Nicely written. I am quoting your blog below:

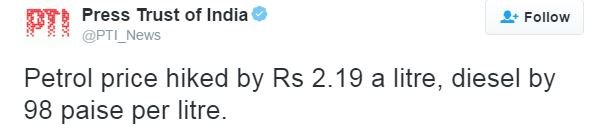

... the government also says we are cutting down on subsidies ... The cost of petrol and diesel is around Rs.25 per ltr ... It would have been a subsidy if the government would have sold it below cost say at Rs.18 per ltr. Hence, this propaganda that government provides subsidy on fuel is completely false.

My View: General Tax payer might think that his money goes into filling the Diesel Tank in a Diesel Car, when it is not. This subsidy stuff is a BIG joke by Govt.

BTW, a barrel of Crude yields 45.4 Lit of Diesel and 72 Lit of Petrol (12 and 19 Gallons per Barrel of Crude). So,

cost per Lit is 59.4 for Diesel and 37.5 for Petrol. Something fishy ???

No way. Last year I posted this (

http://www.theautomotiveindia.com/forums/indian-auto-sector/2383-saga-ever-rising-fuel-prices-india-132.html#post449734)

I am quoting your blog again:

... Increase tax base by getting more working population under income tax net. Currently, less than 4% of the population is paying income taxes...

... Make policies where the rich have to pay higher taxes ...

My View:

Only < 4% pay Income Taxes !!!

![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif)

That is ridiculously low. I checked and found that 3.5 crore people file IT Returns. Lemme use that Calc Bill Gates gave with Win7.

- Taking 1 salaried person per home of 4 people, that covers only 14 Crore.

- A figure of 22% population below poverty means ~ 24.4 Crore poor people (population of 125 Cr).

- Lemme assume, some 25.6 Cr people are into Agri.

- That means 64 Crore (14 + 24.4 + 25.6) people live from Salari, Agri and are poor.

- What about the remaining 61 Crore ??? I will assume, "Big, Medium and Small time Business men, Traders, Shop owners, Self employed etc" fill up this 61 Crore. This could result in 15.25 Crore (61 Cr / 4) IT Returns. So, I would say, expected IT Returns could be around 16 to 20 %

- Let us hope this happens in 10 years from now.

... rich have to pay higher taxes ...

- This has resulted in Black Money and can NEVER be a solution. How can we penalise a Brilliant mind generating riches (for self) and creating Job opportunity to pay more Taxes.

- Better is to put a uniform Tax Slab for ALL and ensure transactions above certain amount happen thro' Credit/Debit Cards or Cheque or On-line. Everywhere.

- Ensure Law Enforcers get PLENTY of Salary, so that they take pride in what they do and scoff at Bribery attempts. Political Class should stop using / treating them as their servants.

- Ensure fast track Trials on Black Money.

- Pay Whistle Blowers (of Black Money) Tax-Free 50% of money recovered, keep their IDs confidential. Say, a trader has got Rs. 2 Lacs but has made Bill for 1 Lacs only. Anyone bringing this out, should be given Rs. 50,000/- same day. Remaining 50K goes to Govt. And the guilty is penalised 50% of what he hid, leaving only Rs. 50K in his hand. He might be tempted to declare Rs 2 Lacs, pay the Tax and keep his Profit with him instead of suffering instant Loss. Day after day

![Laugh [lol] [lol]](https://www.theautomotiveindia.com/forums/images/smilies/Laugh.gif)

See how Black becomes White Money.

My 2 looong cents

![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif)

PS: You guys still awake ???

![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif) That is ridiculously low. I checked and found that 3.5 crore people file IT Returns. Lemme use that Calc Bill Gates gave with Win7.

That is ridiculously low. I checked and found that 3.5 crore people file IT Returns. Lemme use that Calc Bill Gates gave with Win7.![Laugh [lol] [lol]](https://www.theautomotiveindia.com/forums/images/smilies/Laugh.gif)

![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif)

![Frustration [frustration] [frustration]](https://www.theautomotiveindia.com/forums/images/smilies/Frustration.gif)