Mumbai, November 9, 2017: Tata Motors Ltd today declared Consolidated Financial Results for the Quarter and Half Year ended September 30, 2017 – as per Ind-AS

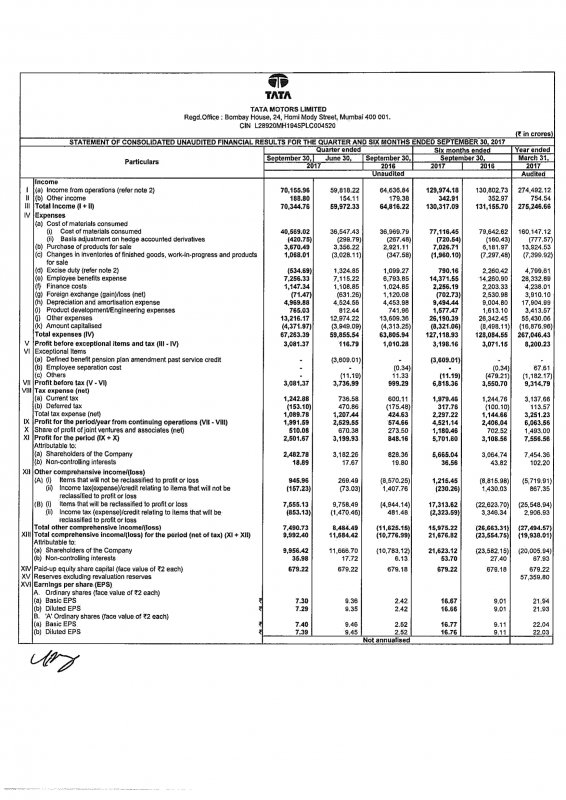

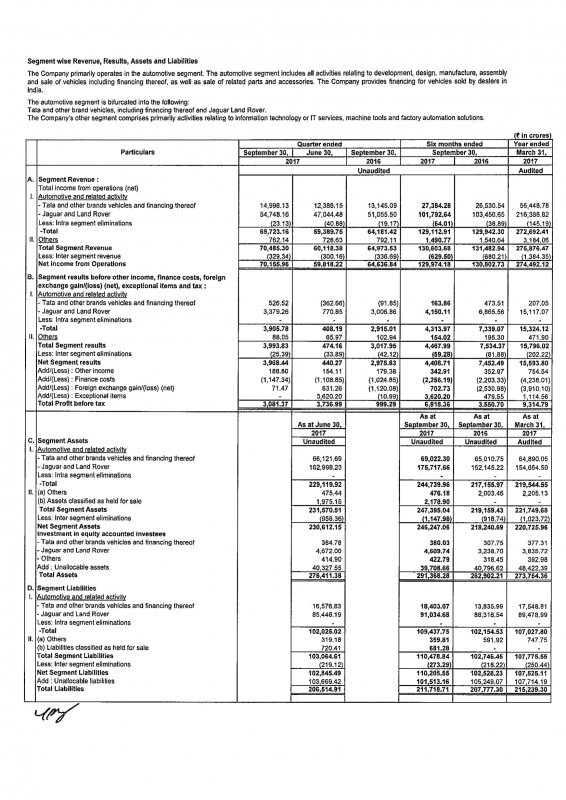

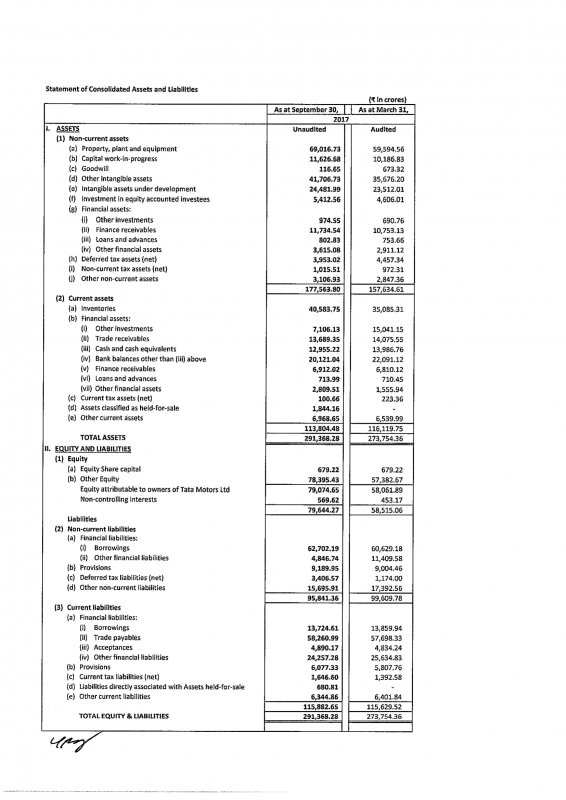

Consolidated Results- For the Quarter ended September 30, 2017

Tata Motors reported Consolidated Revenue (net of excise) of ₹70,156 crores in Q2FY18 as against ₹63,577 crores for the corresponding quarter last year, though lower by ₹ 2,393 crores due to translation impact from GBP to INR.

Consolidated Profit before tax for the quarter was ₹ 3,081 crores, against ₹ 999 crores for the corresponding quarter last year. Consolidated Profit after tax (post profit / loss in respect of joint ventures and associated companies) for the quarter was ₹ 2,502 crores against ₹ 848 crores for the corresponding quarter last year, though lower by ₹ 112 crores due to translation impact from GBP to INR.

Consolidated Results- For the Half Year ended September 30, 2017

Tata Motors reported Consolidated Revenue of ₹ 128,807 crores in H1FY18 against ₹ 128,692 crores for the corresponding period last year. The Consolidated Profit before tax (before exceptional item) was ₹3,198 crores against ₹3,071 crores for the corresponding period last year. Post the exceptional items, the Consolidated Profit before and after tax (post profit / loss in respect of associated companies) for H1FY18 was ₹6,818 crores and ₹5,702 crores, respectively, as against ₹3,551 crores and ₹3,109 crores, for the corresponding period last year.

Tata Motors Standalone Results*- For the Quarter and Half Year ended September 30, 2017

The sales (including exports) of commercial and passenger vehicles stood at 152,979 units in Q2FY18, a growth of 13.8%, as compared to Q2FY17, with an impressive growth across segments - 28% in MHCV, 35% in ILCV, 38% in SCV and pick-ups. The passenger vehicles grew by 14.4% versus the corresponding quarter last year.

The revenues (net of excise) for Q2FY18 stood at ₹ 13,400 crores, as compared to ₹ 10,311 crores for the corresponding quarter last year, a growth of 30%. Operating profit (EBITDA) for Q2FY18 was ₹ 971 crores versus ₹ 336 crores for Q2FY17, a growth of 189%, with operating margin for Q2FY18 at 7.2%. Loss before and after tax for the quarter was at ₹ 266 crores and ₹ 295 crores, against loss before and after tax of ₹ 609 crores and ₹ 631 crores, respectively, for the corresponding quarter last year.

For the half year ended September 30, 2017, the revenue was ₹ 22,607 crores against ₹ 20,704 crores for the corresponding period last year, a growth of 9%. Loss before tax for H1FY18 was ₹ 733 crores against ₹ 571 crores for the corresponding period last year. Loss after tax for H1FY18 was ₹ 762 crores as against ₹ 605 crores for the corresponding period last year.

In order to accelerate the growth momentum and to bring the business back to profitability, Tata Motors took the transformation journey to the next level with business turnaround as an immediate priority. With Q1 performance below expectations, Tata Motors witnessed a month-on-month growth in sales and market share in Q2 outperforming the industry and reaching highest sales in Sep’17 in PV since November 2012 and in CV since June 2014.

The Commercial Vehicles business market share grew by 1.7% (Y-o-Y) and 3.9% (Q-o-Q) on the back of newly launched products, increased acceptance of SCR technology, improved stakeholders’ engagement and aggressive market activation, well complemented at back end by steep ramp-up of production. Positive market sentiments post the GST regime, government funding in infrastructure development and restrictions on overloading with a higher demand of high tonnage vehicles contributed to the growth story.

In Passenger Vehicles business, new products like Tiago, Tigor and Hexa continue to drive sales momentum. Tata Nexon, the newly launched compact SUV has received overwhelming response from the market and added to the positive excitement.

Mr. Guenter Butschek, MD & CEO Tata Motors, said, “After a challenging first quarter, Tata Motors has demonstrated impressive results with month-on-month growth in sales and market share, enabled by a slew of new product launches and customer centric initiatives. With our turnaround plan in full action, we are seeing encouraging results and we will continue to drive sustainable profitable growth to meet our future aspirations.”

Jaguar Land Rover Automotive PLC - (figures as per IFRS)

Second-quarter retail sales rise 5% to 149,690 units year-on-year

Strong customer demand for Range Rover Velar and other new models

Revenues rise 11.5% to £6.3 billion,

Pre-tax profits increase 38% to £385 million

Higher sales and profits reflect the continued ramp-up of new models such as the Range Rover Velar, Land Rover Discovery, Jaguar XF Sportbrake, Jaguar F-PACE and, in China, the Jaguar XFL. Retail sales grew 5.1% to 149,690, with increases in China (27.4%) and the US (5.1%) offsetting lower sales in the UK and Europe. The EBITDA margin was 11.8% and EBIT margin was 5.2% in the quarter.

Dr Ralf Speth, Jaguar Land Rover Chief Executive Officer, said: “We have delivered solid growth in quarterly profit and revenues amid rising demand for our award-winning products. Although we are facing headwinds and uncertainty in some markets, Jaguar Land Rover is well positioned to deliver further global expansion.”

As part of the company’s ongoing product offensive, manufacturing expansion and new technology programme, Jaguar Land Rover’s investment spending was more than £1 billion in the second quarter. Investment spending for the full year is expected to exceed £4 billion.

Dr Ralf Speth concluded: "Our expanding product portfolio continues to excite and surprise; coming this next quarter customers have the all-new Jaguar E-PACE and new plug-in hybrid Range Rover and Range Rover Sport to look forward to as well as a key new model from our China joint venture. Looking ahead to the rest of the year, we will continue to focus on our strategic objective of achieving profitable, sustainable growth and will continue to adapt and innovate in the current challenging market conditions.”

For the half year ended September 30, 2017:

Retail sales were 287,153 units

Revenues were £11.9 billion

Pre- tax profit was £980 million (including one time of £437 million relating to changes made to pension plans in Q1 FY 18)

Tata Daewoo Commercial Vehicles Co. Ltd - (figures as per Korean GAAP)

In Q2FY18, Tata Daewoo Commercial Vehicles Co. Ltd. registered net revenues of KRW 230.8 billion (approx. ₹1,315 crores), a decline of 3% versus the corresponding quarter last year and recorded a net profit of KRW 13.2 billion (approx. ₹75 crores), a 75% jump versus Q2 FY17.

For H1FY18, net revenues were KRW 484.0 billion (approx. ₹2,759 crores), a decline of 4% versus the corresponding period last year and net profit was KRW 30.8 billion (approx. ₹176 crores), a 49% jump versus H1FY17

The Financial Results for the quarter ended September 30, 2017, are enclosed.

![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif) May the homegrown major rise further and reach its deserving place,ie in top 3.

May the homegrown major rise further and reach its deserving place,ie in top 3.![Clap [clap] [clap]](https://www.theautomotiveindia.com/forums/images/smilies/Clap.gif)