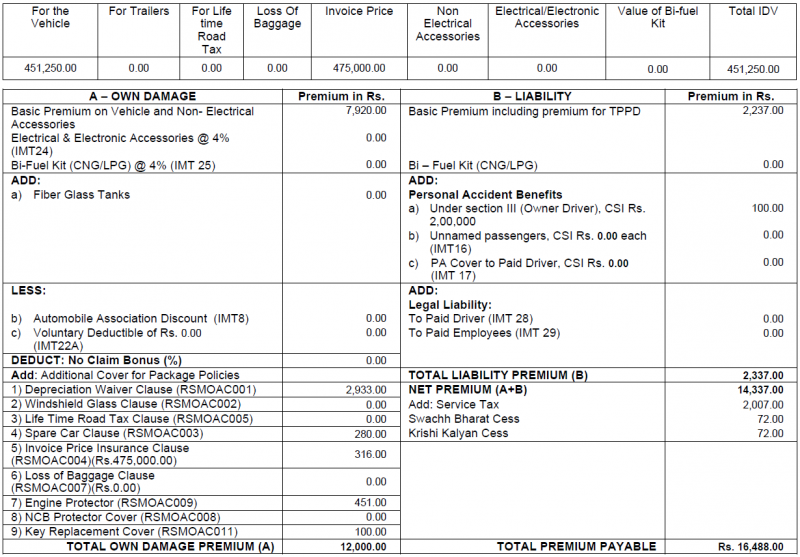

got the pics from computer itself

Attachments

-

121.7 KB Views: 141

-

514.4 KB Views: 131

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

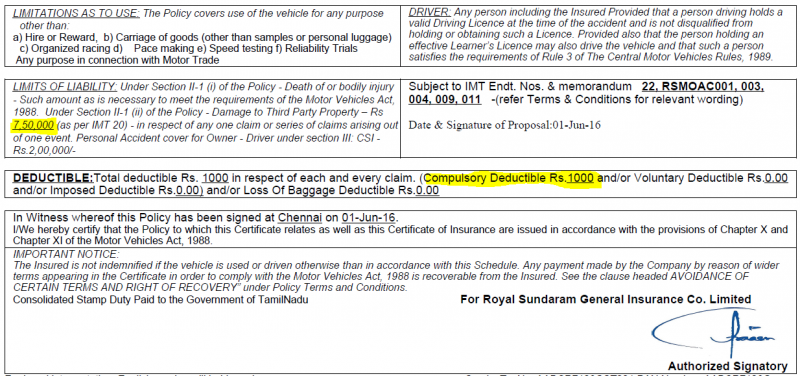

![Laugh [lol] [lol]](https://www.theautomotiveindia.com/forums/images/smilies/Laugh.gif) Yes. Mandatory deductible is Rs. 1000 but for my recent renewals, I remember seperately opting for another Rs. 1000 as voluntary deductible which reduced my insurance premium a bit. Need to check the papers once again though.

Yes. Mandatory deductible is Rs. 1000 but for my recent renewals, I remember seperately opting for another Rs. 1000 as voluntary deductible which reduced my insurance premium a bit. Need to check the papers once again though.![Clap [clap] [clap]](https://www.theautomotiveindia.com/forums/images/smilies/Clap.gif)

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

![Clap [clap] [clap]](https://www.theautomotiveindia.com/forums/images/smilies/Clap.gif)