Mahindra & Mahindra: The Story Of “Rise”

- Thread Starter raj_5004

- Start date

Mahindra and Mahindra Ranked No. 2 on '2021 India's Best Companies to Work For' List by Great Place to Work Institute

Mumbai, Maharashtra, India

Mahindra & Mahindra Ltd. one of India’s largest automotive company and World’s largest tractor company by volume, announced today that it has been Ranked No.2 in “India’s Best Companies To Work For 2021” by the Great Place to Work Institute®.

What makes Mahindra and Mahindra Auto and Farm Equipment sector an organization that is one of India’s Best Companies to Work for - according to the GPTW® Institute Certificate citation - is inspiring trust among the employees, instilling pride in them, creating an environment that promotes camaraderie and fairness, and delivering a great workplace experience for all the employees.

Commenting on leading the list, Rajesh Jejurikar - Executive Director, Auto and Farm Sectors, M&M Ltd. said, “Mahindra is honoured to be consistently ranked as one of ‘India’s Best Companies to Work for’ for over a decade now. In difficult challenging times that the pandemic has posed, being ranked at a number 2 position is a monumental achievement. It is possible because of our associates who give their best every day. It is also a strong testament of our ‘People First’ philosophy, a key driver for our signature ‘Mahindra experience’ that makes us a high-performance and high culture organization.”

In 2021, 850 organizations across several industries representing 24 lakhs employee voices across India were evaluated by the Great Place to Work® Institute. The Institute’s methodology is considered the ‘Gold Standard’ for defining great workplaces across business, academia, and government organizations. The list recognises workplaces with high performance and high culture people and management policies and practices that is based on employee experiences survey results.

Log onto GPTW® website to know more about this year’s winners.

About Mahindra

Founded in 1945, the Mahindra Group is one of the largest and most admired multinational federation of companies with 260,000 employees in over 100 countries. It enjoys a leadership position in farm equipment, utility vehicles, information technology and financial services in India and is the world’s largest tractor company by volume. It has a strong presence in renewable energy, agriculture, logistics, hospitality and real estate.

The Mahindra Group has a clear focus on leading ESG globally, enabling rural prosperity and enhancing urban living, with a goal to drive positive change in the lives of communities and stakeholders to enable them to Rise.

Learn more about Mahindra on www.mahindra.com/Twitter and Facebook: @MahindraRise/For updates subscribe to www.mahindra.com/news-room.

In 2021, 850 organizations across several industries representing 24 lakhs employee voices across India were evaluated by the Great Place to Work® Institute. The Institute’s methodology is considered the ‘Gold Standard’ for defining great workplaces across business, academia, and government organizations. The list recognises workplaces with high performance and high culture people and management policies and practices that is based on employee experiences survey results.

Log onto GPTW® website to know more about this year’s winners.

About Mahindra

Founded in 1945, the Mahindra Group is one of the largest and most admired multinational federation of companies with 260,000 employees in over 100 countries. It enjoys a leadership position in farm equipment, utility vehicles, information technology and financial services in India and is the world’s largest tractor company by volume. It has a strong presence in renewable energy, agriculture, logistics, hospitality and real estate.

The Mahindra Group has a clear focus on leading ESG globally, enabling rural prosperity and enhancing urban living, with a goal to drive positive change in the lives of communities and stakeholders to enable them to Rise.

Learn more about Mahindra on www.mahindra.com/Twitter and Facebook: @MahindraRise/For updates subscribe to www.mahindra.com/news-room.

Akash

Mahindra has extended the warranty program (Shield) by 2 Years for Bolero Power+ and Scorpio customers. Sharing more details from Press Release.

Mahindra & Mahindra Ltd. has recently extended its warranty program (Shield) by 2 years for two of its highest selling models, Bolero Power+ and Scorpio. Through this industry-leading warranty proposition, customers can now enjoy uninterrupted warranty period of 7 years for the Bolero Power+(coverage of 1,50,000 km) and Scorpio (coverage of 1,70,000 km). In addition to ensuring a longer worry-free ownership period, the extended Shield warranty period is provided to bolster the confidence of owners on reliability of their vehicles, allowing them to enjoy owning them for a longer time.

Mahindra offers Shield as an in-house warranty program that ensures faster coverage approval and claim settlement. As a part of this program the customers are benefited with:

a. Coverage of mechanical or electrical failures including (but not limited to): Engine Parts, Transmission System, Cooling System, Steering System, Fuel System, Suspension, Electrical System (factory-fitted).

b. Flexibility in terms of transfer of ownership

c. Higher resale value

d. Convenience of one-time payment. Customers can also avail facility of easy EMIs.

Customers can stay connected with Mahindra’s ‘With You Hamesha’ on Twitter for the latest updates, news on after-sales offerings, digital features and technical tips on its handle @18002096006. For maximum convenience, customers can download Mahindra’s best rated - With You Hamesha app.

Mahindra offers Shield as an in-house warranty program that ensures faster coverage approval and claim settlement. As a part of this program the customers are benefited with:

a. Coverage of mechanical or electrical failures including (but not limited to): Engine Parts, Transmission System, Cooling System, Steering System, Fuel System, Suspension, Electrical System (factory-fitted).

b. Flexibility in terms of transfer of ownership

c. Higher resale value

d. Convenience of one-time payment. Customers can also avail facility of easy EMIs.

Customers can stay connected with Mahindra’s ‘With You Hamesha’ on Twitter for the latest updates, news on after-sales offerings, digital features and technical tips on its handle @18002096006. For maximum convenience, customers can download Mahindra’s best rated - With You Hamesha app.

350Z

Mahindra Electric And Tractor, CVs To Get New Logo – Patent Leaks

Mahindra recently introduced its new logo for its SUV portfolio which was launched along with the new XUV700 in September. This logo will eventually trickle down to every SUV in Mahindra’s lineup in the coming future. Apart from this, the homegrown automaker has filed trademarks for two more logos.

The two new logos will cater to two different segments of Mahindra & Mahindra’s automotive arm. One of these logos is very similar to the ‘Twin Peaks’ revealed earlier this year for the SUV range. The main difference here is that in this logo, the right-angled triangles overlap with each other through their bases.

Read

Mahindra recently introduced its new logo for its SUV portfolio which was launched along with the new XUV700 in September. This logo will eventually trickle down to every SUV in Mahindra’s lineup in the coming future. Apart from this, the homegrown automaker has filed trademarks for two more logos.

The two new logos will cater to two different segments of Mahindra & Mahindra’s automotive arm. One of these logos is very similar to the ‘Twin Peaks’ revealed earlier this year for the SUV range. The main difference here is that in this logo, the right-angled triangles overlap with each other through their bases.

Read

Mahindra Finance Launches Vehicle Leasing & Subscription Brand 'Quiklyz'

Mahindra & Mahindra Financial Services Limited (Mahindra Finance/ MMFSL), part of the Mahindra Group, today launched its leasing and subscription business ‘Quiklyz’. This venture is a new-age digital platform for vehicle leasing and subscription, that aims to provide great convenience, flexibility and choice to customers across cities. Mahindra Finance sees this as a great opportunity to create value for its stakeholders with a profitable business model and build a strong balance sheet out of emerging opportunities in this adjacent business vertical.

Mahindra & Mahindra Financial Services Limited (Mahindra Finance/ MMFSL), part of the Mahindra Group, today launched its leasing and subscription business ‘Quiklyz’. This venture is a new-age digital platform for vehicle leasing and subscription, that aims to provide great convenience, flexibility and choice to customers across cities. Mahindra Finance sees this as a great opportunity to create value for its stakeholders with a profitable business model and build a strong balance sheet out of emerging opportunities in this adjacent business vertical.

Quiklyz is the first-of-its-kind digital journey on car usership with which the customer can access a brand-new car without all the hassles of car ownership. Quiklyz will take care of registration, insurance, scheduled and unscheduled maintenance, roadside assistance etc.

In the initial phase, Quiklyz will launch its services in metro cities like Bengaluru, Chennai, Delhi, Gurugram, Hyderabad, Mumbai, Noida, Pune, and will further expand it to other cities across India, including tier-II cities, covering 30 locations over the next one year. Quiklyz is also in discussions with several automotive OEMs and will announce partnerships with them on Leasing and subscription shortly.

Quiklyz will be available for both corporate (B2B) and retail (B2C) customers. Under the B2B segment, the Company aims to offer services to corporates and fleet operators, while in B2C segment it will target customers with millennial mindset. It will cover vehicles across all major auto OEMs, with wide range of choice in terms of vehicle models, variants and colors.

Speaking on the new business launch, Ramesh Iyer, Vice-Chairman & Managing Director, Mahindra Finance said, “Car leasing and subscription is a lucrative and fast-growing business in India. We aim to achieve a book size of Rs 10,000 crore in a span of 3-5 years. Leasing is seeing significant traction in the last mile mobility space especially with EVs, something our business module will also focus on. With leasing being a relatively new concept for Indian retail consumer, we wanted Mahindra Finance to be at the forefront of this module facilitating millennials and new age corporates alike for hassle free ownership of vehicle”.

Raul Rebello, Chief Operating Officer-Core Business, Mahindra Finance mentioned, “The leasing and subscription module in India is currently at a nascent stage and we at Mahindra Finance would be pioneer in this segment. Coupled with the multi-faceted advantages accruing from the Mahindra Group companies, our spread and reach pan India would be an advantage as we expand our coverage. Iam confident that our customers, individuals and corporates alike would be very encouraged with our customized and unique packages on offer”.

Turra Mohammed, SVP & Business Head – Quiklyz said, “The customers are looking at flexibility in vehicle ownership and with Quiklyz we will provide convenient way of owing a vehicle. Leasing currently accounts for 10% of corporate registered vehicles; and we expect it to grow to 20-25% share in the next 5 yrs. In the Retail – B2C segment, subscription could account for 3-5% of car sales in next 3-5 years. We will leverage Mahindra Group’s extensive network to expand Quiklyz to 30 cities within a year”.

Quiklyz will leverage Mahindra Finance’s expertise as India’s Leading NBFC as well as #1 NBFC in Car Financing driven by a passionate base of 7.3 million customers as well as an extensive reach of 1,380+ branches pan India.

The Quiklyz value proposition will offer the individual multi-faceted benefits including:

Source

In the initial phase, Quiklyz will launch its services in metro cities like Bengaluru, Chennai, Delhi, Gurugram, Hyderabad, Mumbai, Noida, Pune, and will further expand it to other cities across India, including tier-II cities, covering 30 locations over the next one year. Quiklyz is also in discussions with several automotive OEMs and will announce partnerships with them on Leasing and subscription shortly.

Quiklyz will be available for both corporate (B2B) and retail (B2C) customers. Under the B2B segment, the Company aims to offer services to corporates and fleet operators, while in B2C segment it will target customers with millennial mindset. It will cover vehicles across all major auto OEMs, with wide range of choice in terms of vehicle models, variants and colors.

Speaking on the new business launch, Ramesh Iyer, Vice-Chairman & Managing Director, Mahindra Finance said, “Car leasing and subscription is a lucrative and fast-growing business in India. We aim to achieve a book size of Rs 10,000 crore in a span of 3-5 years. Leasing is seeing significant traction in the last mile mobility space especially with EVs, something our business module will also focus on. With leasing being a relatively new concept for Indian retail consumer, we wanted Mahindra Finance to be at the forefront of this module facilitating millennials and new age corporates alike for hassle free ownership of vehicle”.

Raul Rebello, Chief Operating Officer-Core Business, Mahindra Finance mentioned, “The leasing and subscription module in India is currently at a nascent stage and we at Mahindra Finance would be pioneer in this segment. Coupled with the multi-faceted advantages accruing from the Mahindra Group companies, our spread and reach pan India would be an advantage as we expand our coverage. Iam confident that our customers, individuals and corporates alike would be very encouraged with our customized and unique packages on offer”.

Turra Mohammed, SVP & Business Head – Quiklyz said, “The customers are looking at flexibility in vehicle ownership and with Quiklyz we will provide convenient way of owing a vehicle. Leasing currently accounts for 10% of corporate registered vehicles; and we expect it to grow to 20-25% share in the next 5 yrs. In the Retail – B2C segment, subscription could account for 3-5% of car sales in next 3-5 years. We will leverage Mahindra Group’s extensive network to expand Quiklyz to 30 cities within a year”.

Quiklyz will leverage Mahindra Finance’s expertise as India’s Leading NBFC as well as #1 NBFC in Car Financing driven by a passionate base of 7.3 million customers as well as an extensive reach of 1,380+ branches pan India.

The Quiklyz value proposition will offer the individual multi-faceted benefits including:

- Zero Down Payment and lower monthly outflow vs. Loan

- No uncertainty on vehicle maintenance costs, resale price etc. with a fixed monthly fee

- White number plate & RC book in individual’s name

- No resale or maintenance hassles

- Wide range of options for customer at end of tenure - Return/Extend/Buy/Upgrade

Source

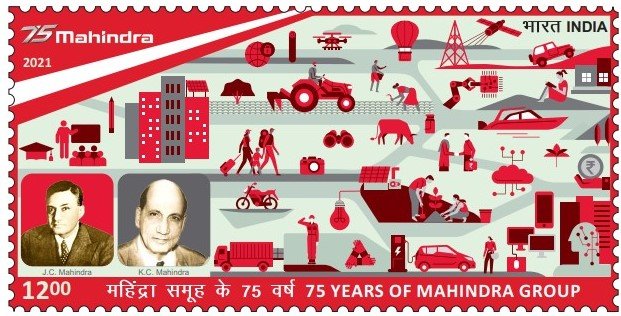

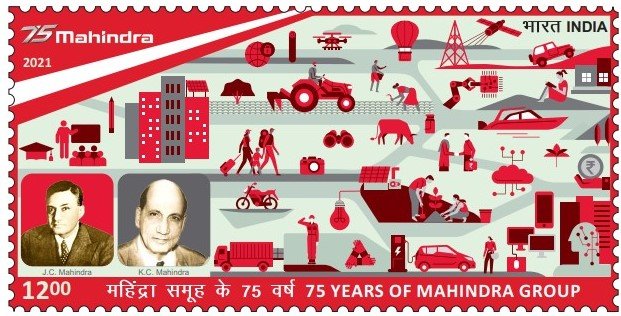

Department of Posts has released commemorative postage stamp to mark 75 years of the Mahindra Group.

Press Release:

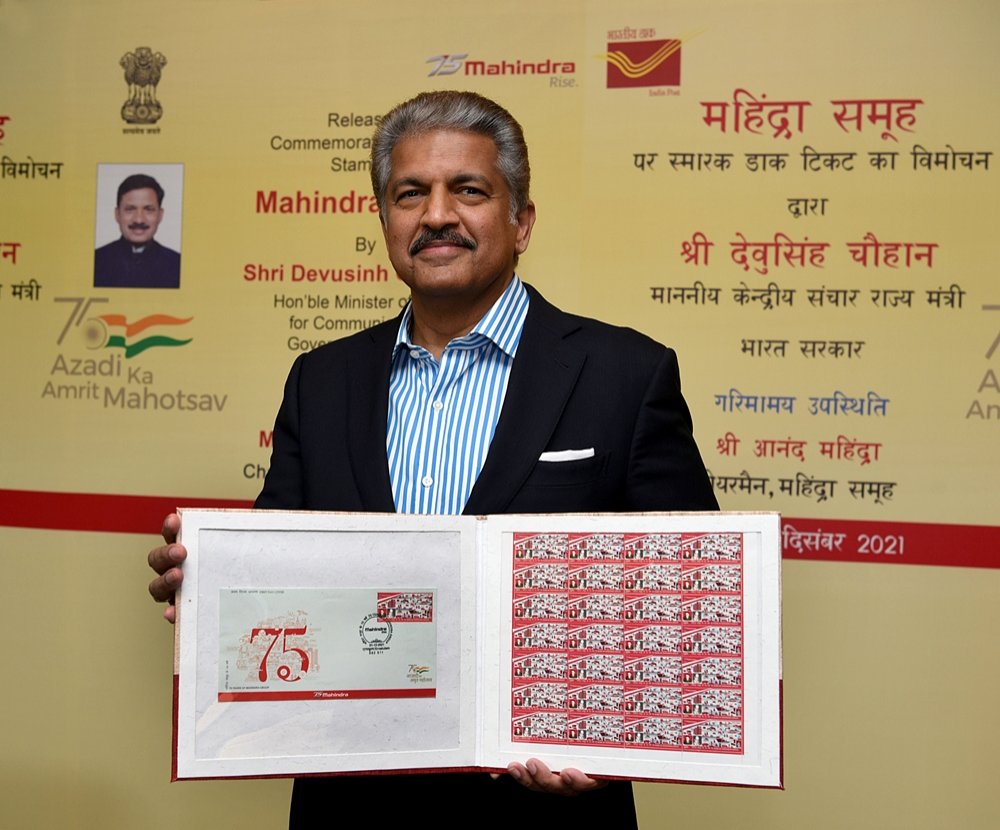

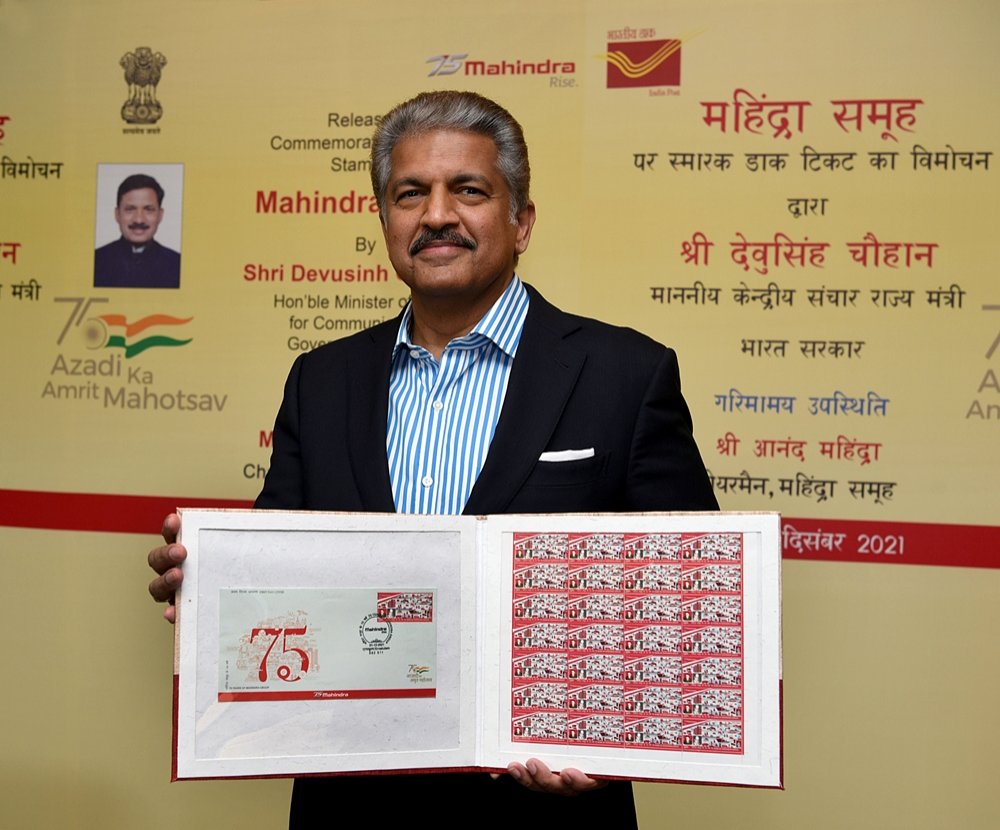

A special Commemorative Postage Stamp to mark the 75th anniversary of Mahindra Group was released by Devusinh Chauhan, the Hon’ble Minister of State for Communications along with Anand Mahindra, Chairman, Mahindra Group in the presence of officials from the Department of Post and colleagues from the Mahindra Group.

Speaking on the occasion, Shri Devusinh Chauhan, Hon’ble Minister of State for Communications said, “Over the last 75 years, the Mahindra Group through its various businesses in farming, automotive, finance, IT & telecommunications has contributed significantly towards the growth and development of our nation. The Government of India under the visionary and dynamic leadership of the Hon’ble Prime Minister, Shri Narendra Modi has taken several initiatives during last 7 years, which have immensely benefited Indian industries and businesses and unleashed their true potential. Among the most notable of them is “Atma Nirbhar Bharat”, which supports homegrown products, industries and businesses. I am happy to state that Mahindra Group is a fine example of Atma Nirbhar Bharat, which is worth emulating and encouraging for all. I can assure you that the support of Modi Government, through its proactive policies, will continue in aforesaid areas. I congratulate the Mahindra Group for their extraordinary and sustained success. I also wish them all the best for their future initiatives.”

Remarking on the Group’s journey, Anand Mahindra, Chairman, Mahindra Group said, “We at the Mahindra Group are truly honoured to have this commemorative postage stamp issued on our 75th anniversary and are thankful to the Department of Posts and honourable minister for this acknowledgment. Commencing its journey as a steel-trading venture seven decades ago, Mahindra was founded with a vision of being a firm imbued with a national purpose and a new outlook. Since then, Mahindra Group has steadily evolved into a global brand, spanning nations and industries. We are very proud of our legacy and are humbled by the opportunities we have had along the way to contribute to the rise of our nation. As we take the next steps in our journey, we are committed to driving growth and prosperity. I take this opportunity to thank all associates, partners and stakeholders for their contributions in our efforts towards helping people Rise.”

The commemorative stamp design features the founders of the Group- JC and KC Mahindra and is inspired by miniature art and uses a modern graphical style to illustrate the various facets of the Group. A closer look at the stamp reveals the various business and life centric activities of the Mahindra Group. In the release function a First Day Cover (FDC) and an Information Brochure were also unveiled.

The Commemorative Postage Stamp, FDC and Information Brochure would be available for sale at Philatelic Bureaux situated in every corner of the country as well as can be ordered online via e-post office. (Visit ePost Office :: Home Page).

Speaking on the occasion, Shri Devusinh Chauhan, Hon’ble Minister of State for Communications said, “Over the last 75 years, the Mahindra Group through its various businesses in farming, automotive, finance, IT & telecommunications has contributed significantly towards the growth and development of our nation. The Government of India under the visionary and dynamic leadership of the Hon’ble Prime Minister, Shri Narendra Modi has taken several initiatives during last 7 years, which have immensely benefited Indian industries and businesses and unleashed their true potential. Among the most notable of them is “Atma Nirbhar Bharat”, which supports homegrown products, industries and businesses. I am happy to state that Mahindra Group is a fine example of Atma Nirbhar Bharat, which is worth emulating and encouraging for all. I can assure you that the support of Modi Government, through its proactive policies, will continue in aforesaid areas. I congratulate the Mahindra Group for their extraordinary and sustained success. I also wish them all the best for their future initiatives.”

Remarking on the Group’s journey, Anand Mahindra, Chairman, Mahindra Group said, “We at the Mahindra Group are truly honoured to have this commemorative postage stamp issued on our 75th anniversary and are thankful to the Department of Posts and honourable minister for this acknowledgment. Commencing its journey as a steel-trading venture seven decades ago, Mahindra was founded with a vision of being a firm imbued with a national purpose and a new outlook. Since then, Mahindra Group has steadily evolved into a global brand, spanning nations and industries. We are very proud of our legacy and are humbled by the opportunities we have had along the way to contribute to the rise of our nation. As we take the next steps in our journey, we are committed to driving growth and prosperity. I take this opportunity to thank all associates, partners and stakeholders for their contributions in our efforts towards helping people Rise.”

The commemorative stamp design features the founders of the Group- JC and KC Mahindra and is inspired by miniature art and uses a modern graphical style to illustrate the various facets of the Group. A closer look at the stamp reveals the various business and life centric activities of the Mahindra Group. In the release function a First Day Cover (FDC) and an Information Brochure were also unveiled.

The Commemorative Postage Stamp, FDC and Information Brochure would be available for sale at Philatelic Bureaux situated in every corner of the country as well as can be ordered online via e-post office. (Visit ePost Office :: Home Page).

350Z

Mahindra Introduces "Get Highest Mileage or Give Truck Back" Guarantee For Its Entire BS6 Truck Range

Mahindra Truck and Bus (MTB) division, the commercial vehicle arm of Mahindra Group, today announced launching its "Get Highest Mileage or Give Truck Back" guarantee scheme for its entire BS6 truck range. Under this guarantee programme, the company claims that its BS6 range of heavy, intermediate, and light commercial vehicles will offer the highest mileage compared to any other truck in their respective class. And if the vehicles fail to offer best-in-class mileage, customers can return the vehicle. The mileage guarantee will be applicable on models like - Blazo X HCV, Furio ICV, and LCV models like Furio7 and Jayo.

Read

Mahindra Truck and Bus (MTB) division, the commercial vehicle arm of Mahindra Group, today announced launching its "Get Highest Mileage or Give Truck Back" guarantee scheme for its entire BS6 truck range. Under this guarantee programme, the company claims that its BS6 range of heavy, intermediate, and light commercial vehicles will offer the highest mileage compared to any other truck in their respective class. And if the vehicles fail to offer best-in-class mileage, customers can return the vehicle. The mileage guarantee will be applicable on models like - Blazo X HCV, Furio ICV, and LCV models like Furio7 and Jayo.

Read

2021 Rank 4 : Mahindra Model Wise Sales - 2021

read more:

2021 Rank 4 : Mahindra Model Wise Sales 2021 -Statistics -Autohead.in

- Mahindra with over 2L vehicles sales emerges as no 4 OEM.

- It grew by close to 50% over previous year or over by 65K volumes over previous period

- Indian OEM also managed to improve the market share by 0.95% to 6.57% in 2021

- Company though being the pioneer in mass EV segment lost the way albiet decent offering in eVerito and E2O in past. We hope 2022 will bring Mahindra back into the EV business.

- Mahindra is SUV player with all its model bearing the SUV body styles save the eVerito which is notchback.

read more:

2021 Rank 4 : Mahindra Model Wise Sales 2021 -Statistics -Autohead.in

Mahindra has collaborated with Google Cloud to underpin group-wide digitization strategy under Mahindra Digital Engine and accelerate adoption of data and artificial intelligence.

Press Release:

The Mahindra Group and Google Cloud today announced a new collaboration that will power the Group’s digital transformation strategy and fuel its next phase of business growth.

Mahindra Group’s Digital, Data and Cloud Center of Excellence, referred to as Mahindra Digital Engine (MDE), will use Google Cloud’s secure and reliable infrastructure and advanced data analytics technology to drive innovation across the Group’s multiple business units, including its core operations, its customer-facing channels, and its employee experience. The partnership will also embed an agile culture within MDE that will foster innovation, embrace change, and build capabilities by cultivating the right talent.

“A digital mindset is front and center in every aspect of the Mahindra Group. We are building for the future with advanced cloud-based technologies and data-driven strategies to speed decision making and maximize synergies across our business. By utilizing Google Cloud’s best-in-class infrastructure and data capabilities, we can innovate faster for competitive differentiation, advance our enterprise sustainability goals, and strengthen our talent pool by attracting the best tech talent in the industry,” said Mohit Kapoor, Group Chief Technology Officer, The Mahindra Group.

Mahindra is advancing its unified data cloud strategy with Google Cloud. First, the Group will migrate its business-critical applications, including SAP S/4HANA, from its on-premises data centers to Google Cloud under the RISE with SAP program, as well as its data warehouse and data lake. This will enable teams across the Group to gain a deeper understanding of customers’ demands and preferences than was available previously. Further, this shift will help in anticipating trends and consumer sentiments to accelerate product innovation and drive a personalized customer experience via new digital platforms; as well as simplify complex data management, lower the total cost of ownership, and improve security and governance.

Working with the cleanest cloud in the industry also advances Mahindra Group’s sustainability goals. The Group plans to fully migrate off its on-premises infrastructure over the next two to three years.

The Group will also tap the engineering prowess and the best practices of Google Cloud’s Site Reliability Engineering (SRE) and Dev SecOps practices, driving in-house talent to continue to scale their technical capabilities to meet the needs of its ever-expanding business.

Commenting on the announcement, Bikram Bedi, Managing Director, Google Cloud India, said, “As Mahindra Group’s trusted innovation partner, we are leveraging our expertise to help the Group bring its enterprise and consumer ecosystems closer together. Our multi-faceted, multi-year collaboration with Mahindra is a great example of the value we bring to customers and our unique ability to help them accelerate their digital transformation strategies, drive sustained business impact, and unlock long-term competitive advantage.”

Mahindra Group’s Digital, Data and Cloud Center of Excellence, referred to as Mahindra Digital Engine (MDE), will use Google Cloud’s secure and reliable infrastructure and advanced data analytics technology to drive innovation across the Group’s multiple business units, including its core operations, its customer-facing channels, and its employee experience. The partnership will also embed an agile culture within MDE that will foster innovation, embrace change, and build capabilities by cultivating the right talent.

“A digital mindset is front and center in every aspect of the Mahindra Group. We are building for the future with advanced cloud-based technologies and data-driven strategies to speed decision making and maximize synergies across our business. By utilizing Google Cloud’s best-in-class infrastructure and data capabilities, we can innovate faster for competitive differentiation, advance our enterprise sustainability goals, and strengthen our talent pool by attracting the best tech talent in the industry,” said Mohit Kapoor, Group Chief Technology Officer, The Mahindra Group.

Mahindra is advancing its unified data cloud strategy with Google Cloud. First, the Group will migrate its business-critical applications, including SAP S/4HANA, from its on-premises data centers to Google Cloud under the RISE with SAP program, as well as its data warehouse and data lake. This will enable teams across the Group to gain a deeper understanding of customers’ demands and preferences than was available previously. Further, this shift will help in anticipating trends and consumer sentiments to accelerate product innovation and drive a personalized customer experience via new digital platforms; as well as simplify complex data management, lower the total cost of ownership, and improve security and governance.

Working with the cleanest cloud in the industry also advances Mahindra Group’s sustainability goals. The Group plans to fully migrate off its on-premises infrastructure over the next two to three years.

The Group will also tap the engineering prowess and the best practices of Google Cloud’s Site Reliability Engineering (SRE) and Dev SecOps practices, driving in-house talent to continue to scale their technical capabilities to meet the needs of its ever-expanding business.

Commenting on the announcement, Bikram Bedi, Managing Director, Google Cloud India, said, “As Mahindra Group’s trusted innovation partner, we are leveraging our expertise to help the Group bring its enterprise and consumer ecosystems closer together. Our multi-faceted, multi-year collaboration with Mahindra is a great example of the value we bring to customers and our unique ability to help them accelerate their digital transformation strategies, drive sustained business impact, and unlock long-term competitive advantage.”

350Z

Mahindra has showcased its range of EVs at Pune Alternate Fuel Conclave. The vehicles displayed include: Treo Auto, Treo Zor Delivery Van, Treo Tipper, e-Alfa Mini Tipper and Atom Quadricycle.

Press Release:

Mahindra Electric Mobility Limited, part of the Mahindra Group, is showcasing its wide range of electric vehicles at the Pune Alternate Fuel Conclave with the display of Treo auto, Treo Zor Delivery Van, Treo Tipper variant, e Alfa Mini Tipper variant, and Atom quadricycle - the new age electric urban mobility solution for smart India’s last mile connectivity needs. Mahindra is the No.1 player in electric 3-wheeler category with a 73.4% market share*. The Mahindra range of electric 3-wheelers are the preferred choice of customers across India.

This is the first time that the Atom, the only electric quadricycle in India, is being showcased post the 2020 Auto Expo. Atom is designed to appeal to a new India and will change the face of last mile connectivity. It offers a combination of clean, comfortable, and smart attributes. Powered by Mahindra’s latest electric drive system, Atom has a spacious interior. Further, the monocoque body offers a safe enclosure for occupants. Atom also comes equipped with telematics connectivity for effective fleet management. The launch of Atom is scheduled in this financial year.

The Maharashtra State Environment & Tourism Minister Shri. Aaditya Thackeray said, Pune is an auto hub and therefore, an ideal venue for the conclave. The conclave is jointly organised by the Maharashtra Industrial Development Corporation (MIDC), Maharashtra Pollution Control Board (MPCB) and the Mahratta Chamber of Commerce Industries and Agriculture (MCCIA). The organisers have facilitated having an RTO booth to ensure hassle-free registration of vehicles, and also bank kiosks to provide easy financing options.

Along with the Atom, the Mahindra e Alfa Mini Tipper will also be showcased to the public for the first time. The vehicle is based on the successful and rugged e Alfa Mini platform. The vehicle is unique in the way that it has a partition split for the wet as well as the dry garbage. It offers a GPS tracking system and a gradeability of 7 degrees. The tipping angle is 40 degrees. The e Alfa Mini Tipper also comes with a peak power of 1.5 kW and has a driving range of 80 km in a single charge. It offers a loading capacity of 310 kg.

Another 3-wheeler EV that is making its public debut is the Mahindra Treo Tipper. This Lithium-ion 3-wheeler is based on the popular Mahindra Treo platform and has a payload of 578 kg, without the waste bin. The Treo Tipper also boasts the best-in-industry power and torque of 8 kW & 42 Nm respectively. The charging time is just 3 hour and 50 minutes for a full charge. A 3-year, 80,000 km warranty is also being offered.

Speaking about the event, Suman Mishra, CEO of Mahindra Electric Mobility Limited said, “Mahindra provides the widest choice of products to its customers. We are the number one electric automaker in the country and the Pune Alternate Fuel Conclave 2022 provides a great platform to not only showcase technologically advanced vehicles but also allows customers to experience them firsthand.”

*As per FY ’22 SIAM data for electric three wheelers

This is the first time that the Atom, the only electric quadricycle in India, is being showcased post the 2020 Auto Expo. Atom is designed to appeal to a new India and will change the face of last mile connectivity. It offers a combination of clean, comfortable, and smart attributes. Powered by Mahindra’s latest electric drive system, Atom has a spacious interior. Further, the monocoque body offers a safe enclosure for occupants. Atom also comes equipped with telematics connectivity for effective fleet management. The launch of Atom is scheduled in this financial year.

The Maharashtra State Environment & Tourism Minister Shri. Aaditya Thackeray said, Pune is an auto hub and therefore, an ideal venue for the conclave. The conclave is jointly organised by the Maharashtra Industrial Development Corporation (MIDC), Maharashtra Pollution Control Board (MPCB) and the Mahratta Chamber of Commerce Industries and Agriculture (MCCIA). The organisers have facilitated having an RTO booth to ensure hassle-free registration of vehicles, and also bank kiosks to provide easy financing options.

Along with the Atom, the Mahindra e Alfa Mini Tipper will also be showcased to the public for the first time. The vehicle is based on the successful and rugged e Alfa Mini platform. The vehicle is unique in the way that it has a partition split for the wet as well as the dry garbage. It offers a GPS tracking system and a gradeability of 7 degrees. The tipping angle is 40 degrees. The e Alfa Mini Tipper also comes with a peak power of 1.5 kW and has a driving range of 80 km in a single charge. It offers a loading capacity of 310 kg.

Another 3-wheeler EV that is making its public debut is the Mahindra Treo Tipper. This Lithium-ion 3-wheeler is based on the popular Mahindra Treo platform and has a payload of 578 kg, without the waste bin. The Treo Tipper also boasts the best-in-industry power and torque of 8 kW & 42 Nm respectively. The charging time is just 3 hour and 50 minutes for a full charge. A 3-year, 80,000 km warranty is also being offered.

Speaking about the event, Suman Mishra, CEO of Mahindra Electric Mobility Limited said, “Mahindra provides the widest choice of products to its customers. We are the number one electric automaker in the country and the Pune Alternate Fuel Conclave 2022 provides a great platform to not only showcase technologically advanced vehicles but also allows customers to experience them firsthand.”

*As per FY ’22 SIAM data for electric three wheelers

350Z

Mahindra to invest Rs 10,000 crore for EV Manufacturing Plant in Pune

Mahindra & Mahindra Ltd. has announced that their investment of Rs. 10,000 Crore for electric vehicles has been approved under the Maharashtra Government’s industrial promotion scheme for Electric Vehicles.

The company, through its subsidiary, will make investments of approx Rs 10,000 Crore over a period of 7-8 years for setting up the manufacturing facility, development, and production of Mahindra’s upcoming Born Electric Vehicles (BEVs), some of which were showcased in Oxfordshire, UK, on August 15th, 2022.

Based on the state-of-the-art INGLO EV Platform, these include the e-SUVs under the iconic brand - XUV with the Twin Peak logo in copper and the allnew electric-only brand called ‘BE’.

“We are delighted with this approval from the Govt. of Maharashtra for setting up our EV Manufacturing Plant in Pune, and investing in what has been our ‘home’ state for over 70 years. We are very thankful to the Govt. of Maharashtra for their continued support. The Government’s focus on ‘ease-of-doing-business’ and progressive policies, together with Mahindra’s investment, will act as a catalyst for Maharashtra to become India’s EV hub, attracting further Indian and Foreign Direct Investment,” said Rajesh Jejurikar, Executive Director, Auto & Farm Sectors, Mahindra & Mahindra Ltd., stated,

////

Mahindra & Mahindra Ltd. has announced that their investment of Rs. 10,000 Crore for electric vehicles has been approved under the Maharashtra Government’s industrial promotion scheme for Electric Vehicles.

The company, through its subsidiary, will make investments of approx Rs 10,000 Crore over a period of 7-8 years for setting up the manufacturing facility, development, and production of Mahindra’s upcoming Born Electric Vehicles (BEVs), some of which were showcased in Oxfordshire, UK, on August 15th, 2022.

Based on the state-of-the-art INGLO EV Platform, these include the e-SUVs under the iconic brand - XUV with the Twin Peak logo in copper and the allnew electric-only brand called ‘BE’.

“We are delighted with this approval from the Govt. of Maharashtra for setting up our EV Manufacturing Plant in Pune, and investing in what has been our ‘home’ state for over 70 years. We are very thankful to the Govt. of Maharashtra for their continued support. The Government’s focus on ‘ease-of-doing-business’ and progressive policies, together with Mahindra’s investment, will act as a catalyst for Maharashtra to become India’s EV hub, attracting further Indian and Foreign Direct Investment,” said Rajesh Jejurikar, Executive Director, Auto & Farm Sectors, Mahindra & Mahindra Ltd., stated,

////

Mahindra delivers 1 lakh XUV700 SUVs in 20 months

Mahindra has delivered one lakh units of the XUV700 SUV in 20 months since its launch. The first 50,000 units were delivered in 12 months, with the remaining handed over in just eight months. This averages to deliveries of around 5,000 units every month.

Read

Mahindra has delivered one lakh units of the XUV700 SUV in 20 months since its launch. The first 50,000 units were delivered in 12 months, with the remaining handed over in just eight months. This averages to deliveries of around 5,000 units every month.

- 50,000 XUV700 units delivered in the first year

- The MX and AX3 variants have a waiting period of 6-8 months

- Manufacturing increased to 8,000 units monthly

Read

More Mahindra SUVs to get ADAS

Advanced Driver Assistance Systems or ADAS is fast gaining acceptance amongst Mahindra SUV buyers. According to the company, a relatively high percentage of its over 1,00,000 XUV700 customers have opted for the system, however, Mahindra isn't saying exactly how many. On the XUV700 ADAS includes lane keep assist, front collision warning, smart pilot assist, automatic emergency braking, adaptive cruise control, high beam assist and traffic sign recognition.

Read

Advanced Driver Assistance Systems or ADAS is fast gaining acceptance amongst Mahindra SUV buyers. According to the company, a relatively high percentage of its over 1,00,000 XUV700 customers have opted for the system, however, Mahindra isn't saying exactly how many. On the XUV700 ADAS includes lane keep assist, front collision warning, smart pilot assist, automatic emergency braking, adaptive cruise control, high beam assist and traffic sign recognition.

- Future Mahindras will get Level 2 Driving Automation

- Scorpio N, XUV300 could get ADAS

- Majority of XUV700 customers have opted for ADAS tech

Read