What a difference one quarter can make," rued Pawan Goenka, president, automotive & farm equipment sector, Mahindra & Mahindra

June saw M&M post its first monthly decline in sales of its UVs in 35 months. Just how serious that drag is, in the short term, is borne out by its August numbers. UV sales of M&M fell 27.5% over August 2012, with every model in its portfolio feeling the pain.

The bad times have hit so suddenly that in the matter of last two to three months, M&M has undertaken several block closures, with its plant remaining shut for almost 10-15 days across plants. The company also had to do away with several hundred contract workers and Goenka said if the tough times continue, more may go.

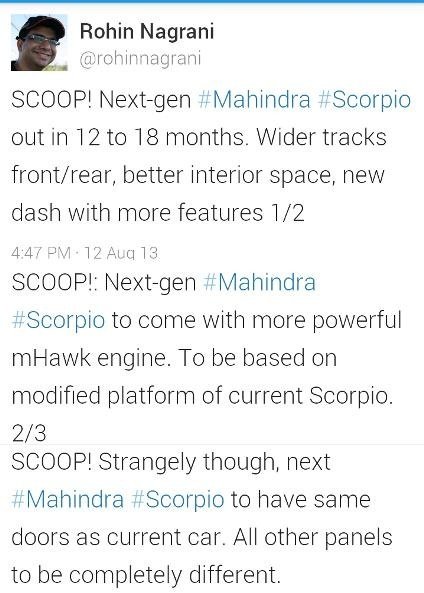

Compounding the worries for Goenka is a picture of rival SUVs in his rear-view mirror that is growing larger by the day. In the seven months to August, its Scorpio was overtaken by Duster, from the stables of its erstwhile partner Renault, as India's bestselling SUV (though the Mahindra vehicle demonstrated its durability by reversing the order in the last two months).

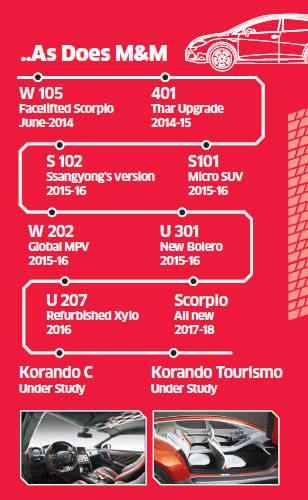

The company arguably faces its biggest challenge yet. Not only the market is falling but the competition has become acute. As many as 15-17 utility vehicles are going to hit the market over the next 3-4 years right from Maruti Suzuki, Hyundai, Ford, Tata Motors amongst others and majority of them targeted at points where M&M is the king.

Ask Goenka about the ensuing competition and he says he is not surprised by the number of new models which are on the anvil; the only thing that has surprised him is the sudden fall in the overall sales numbers in the UV space.

![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif) )front which they are using nowadays on xylo , verito , vibe.

)front which they are using nowadays on xylo , verito , vibe.![Wink [;)] [;)]](https://www.theautomotiveindia.com/forums/images/smilies/Wink.gif) )front which they are using nowadays on xylo , verito , vibe.

)front which they are using nowadays on xylo , verito , vibe.

![Frustration [frustration] [frustration]](https://www.theautomotiveindia.com/forums/images/smilies/Frustration.gif)