Thread Starter

#1

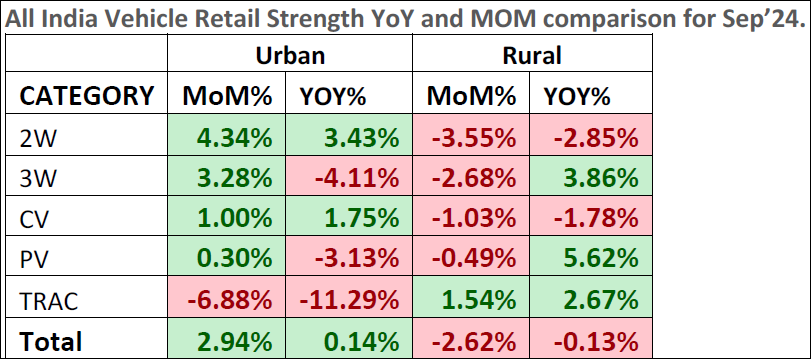

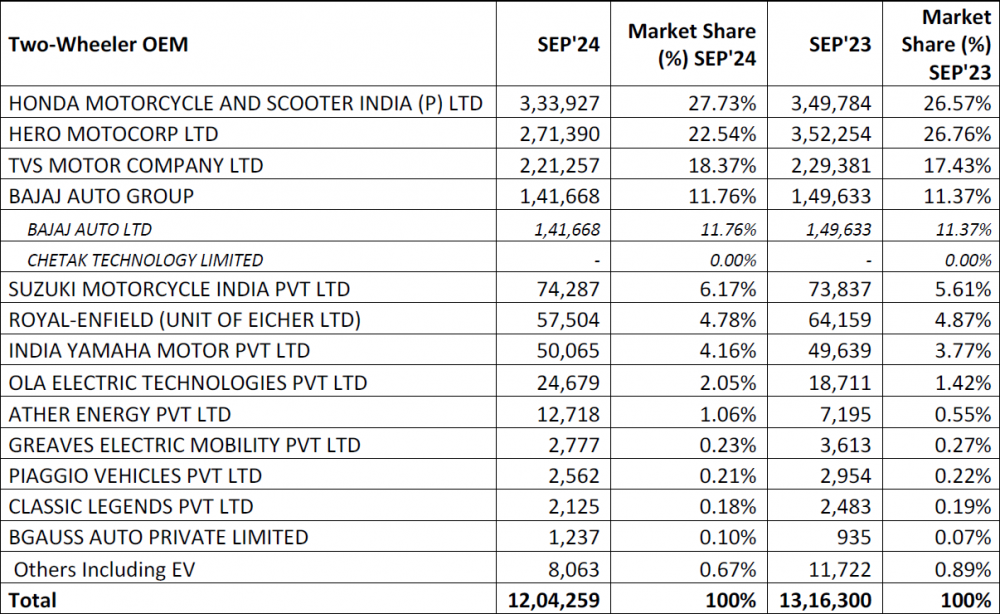

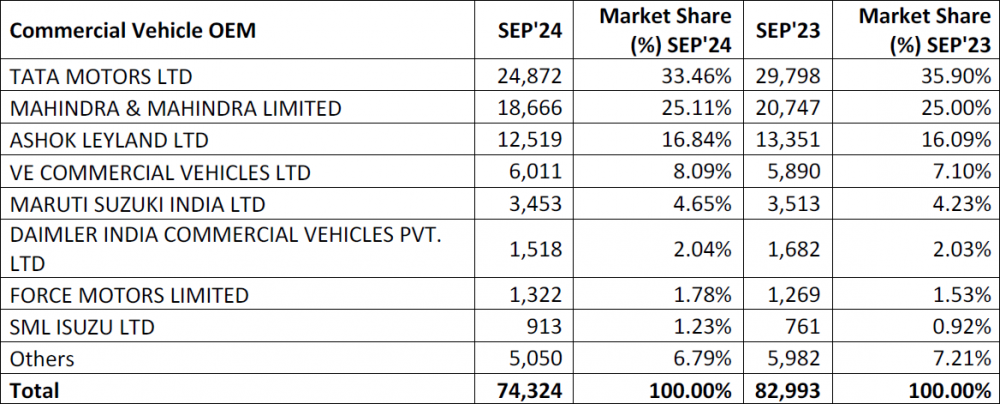

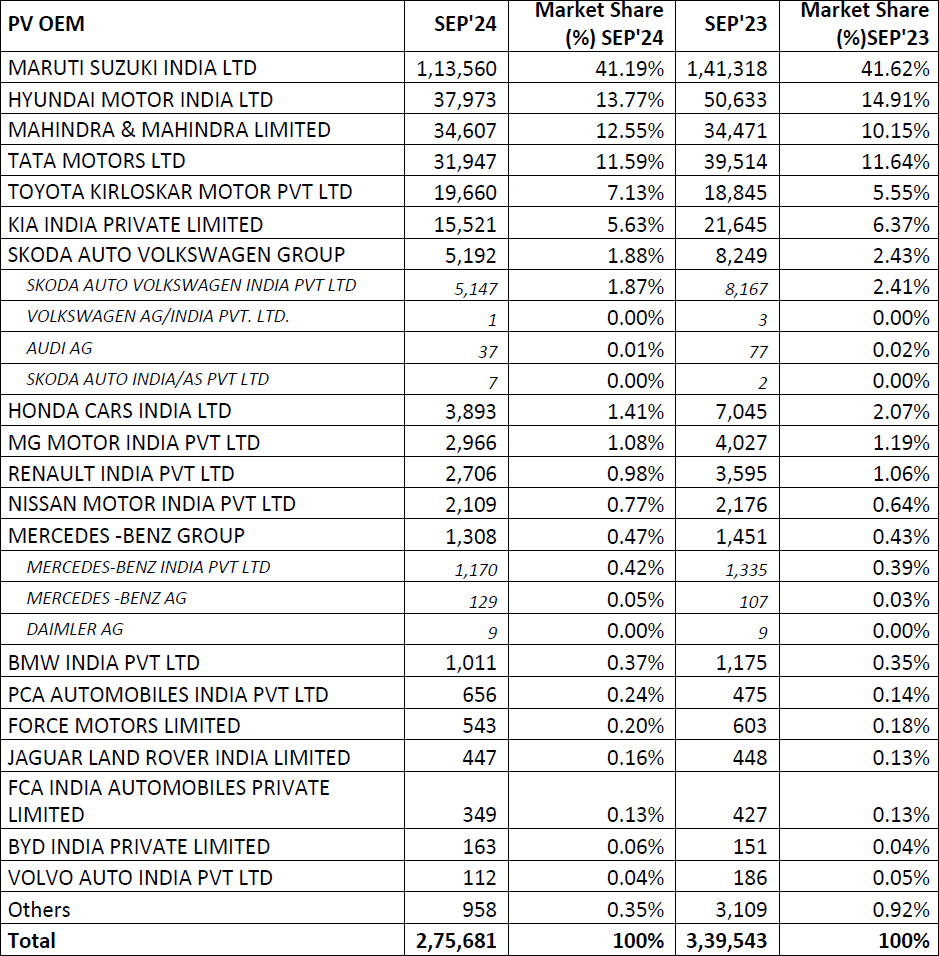

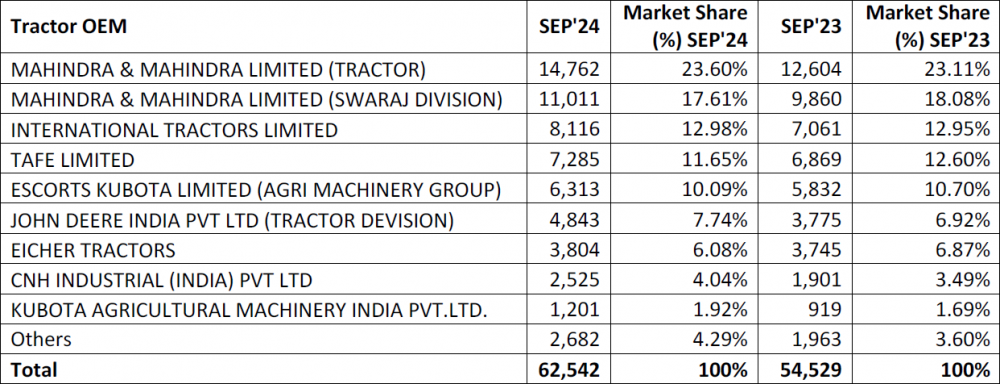

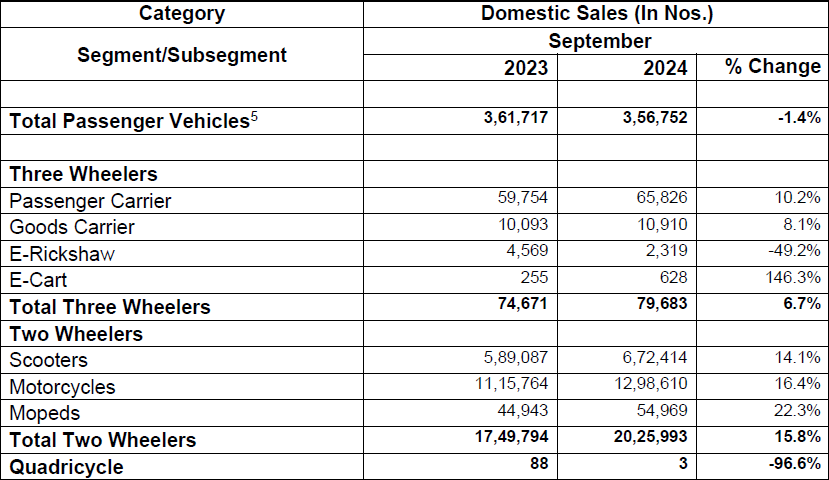

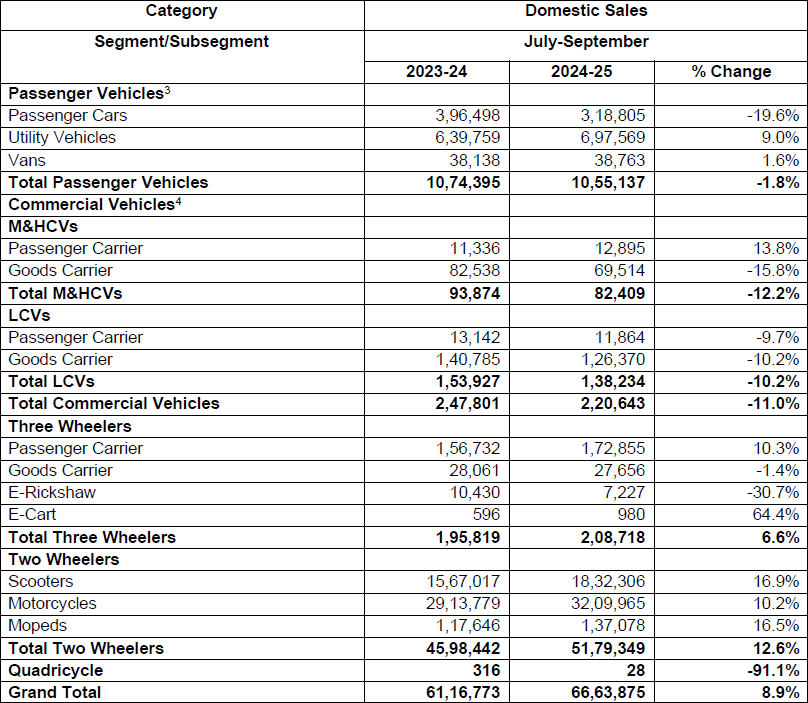

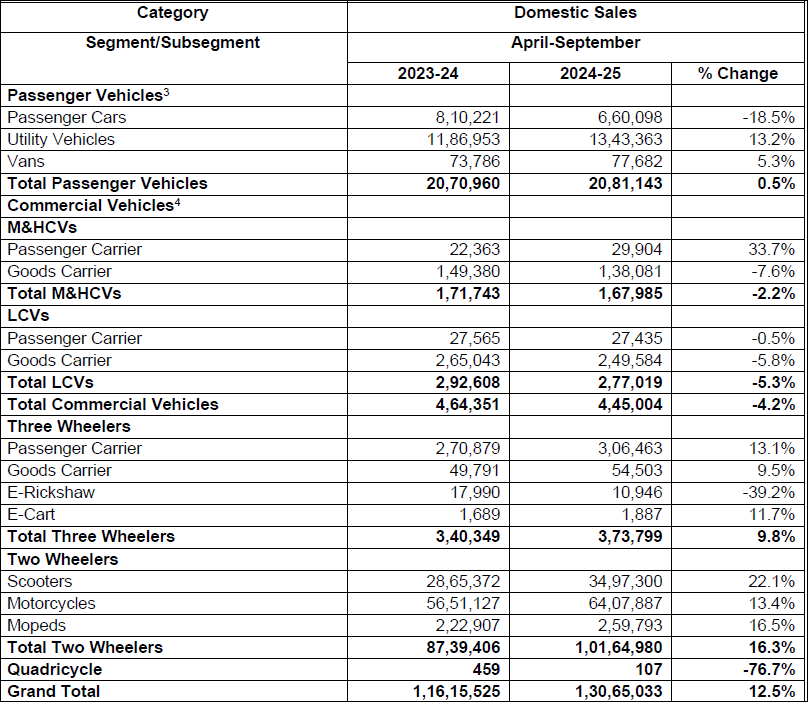

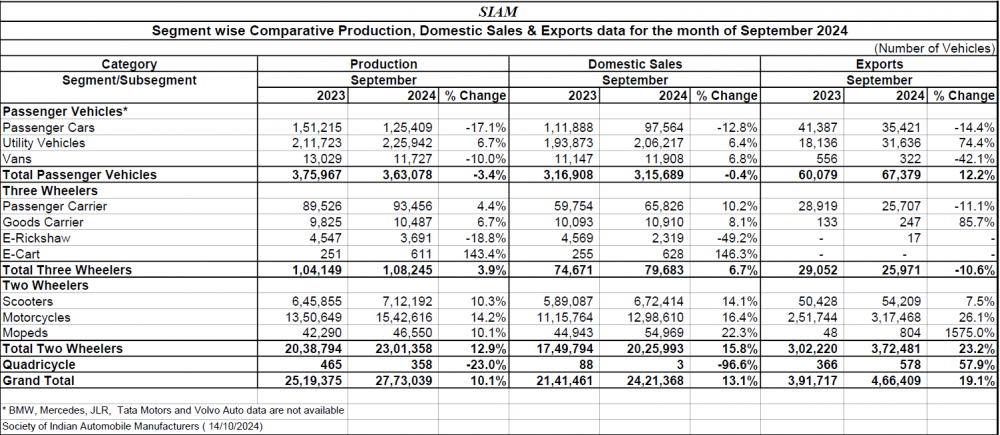

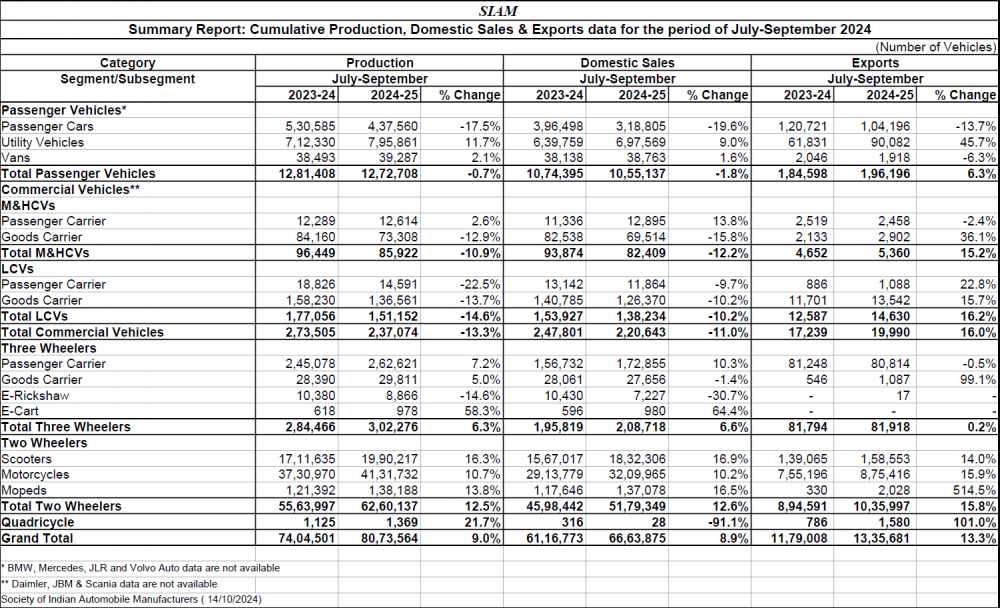

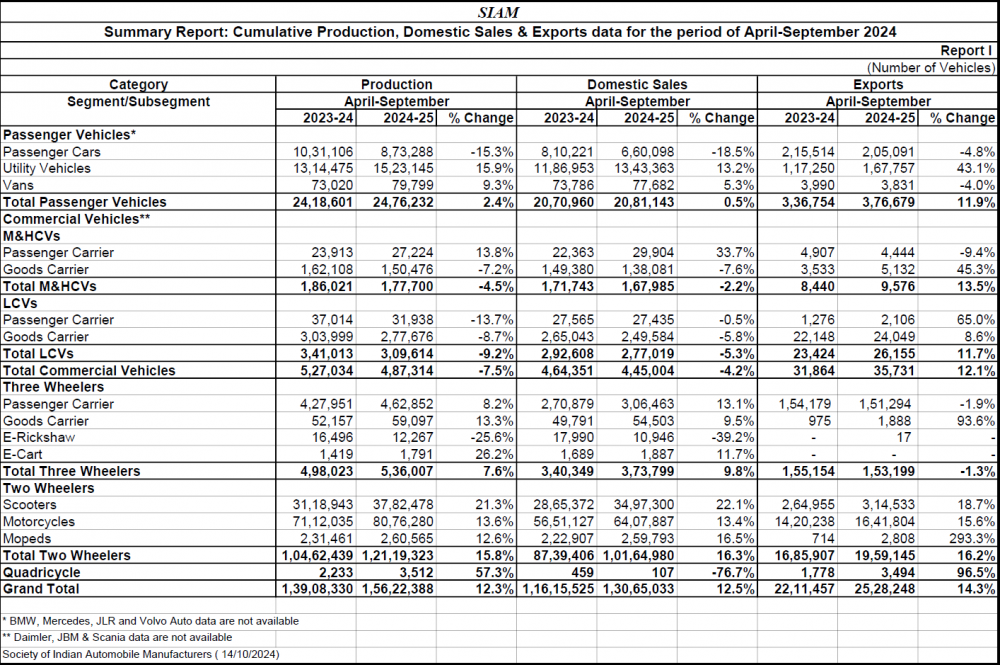

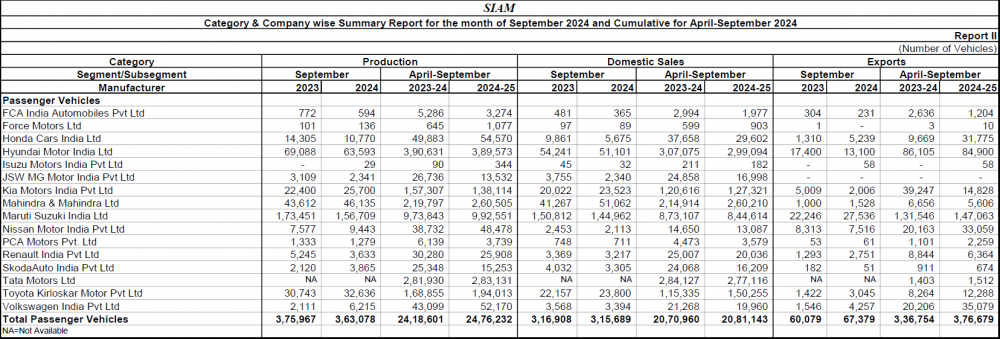

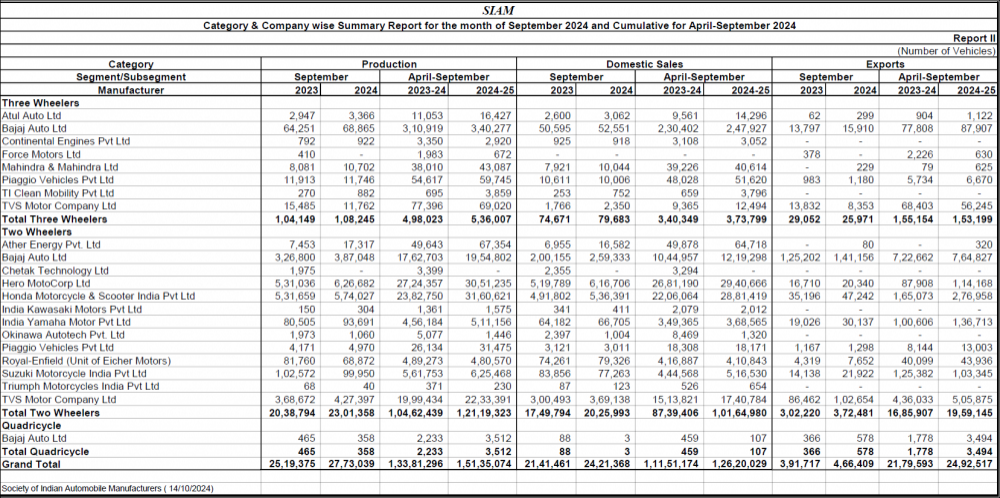

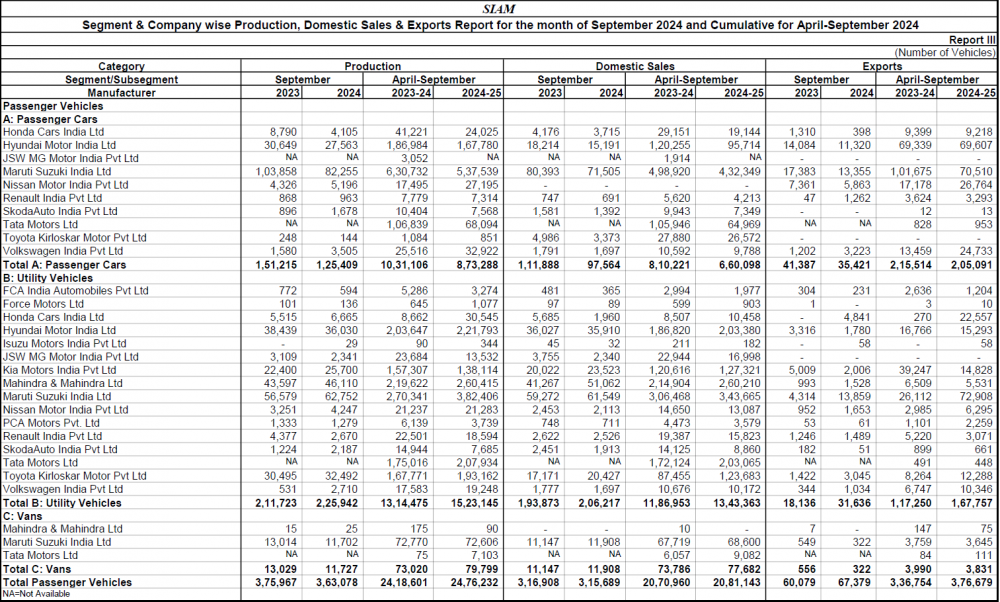

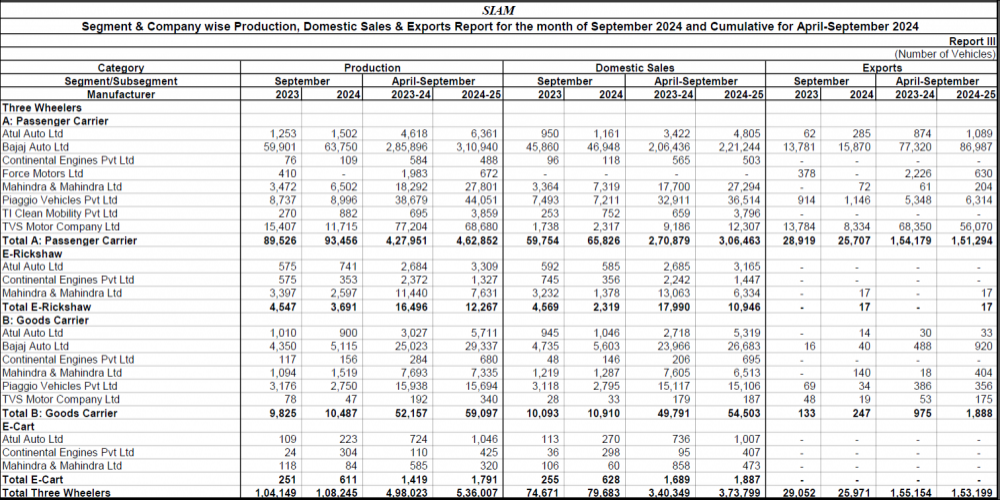

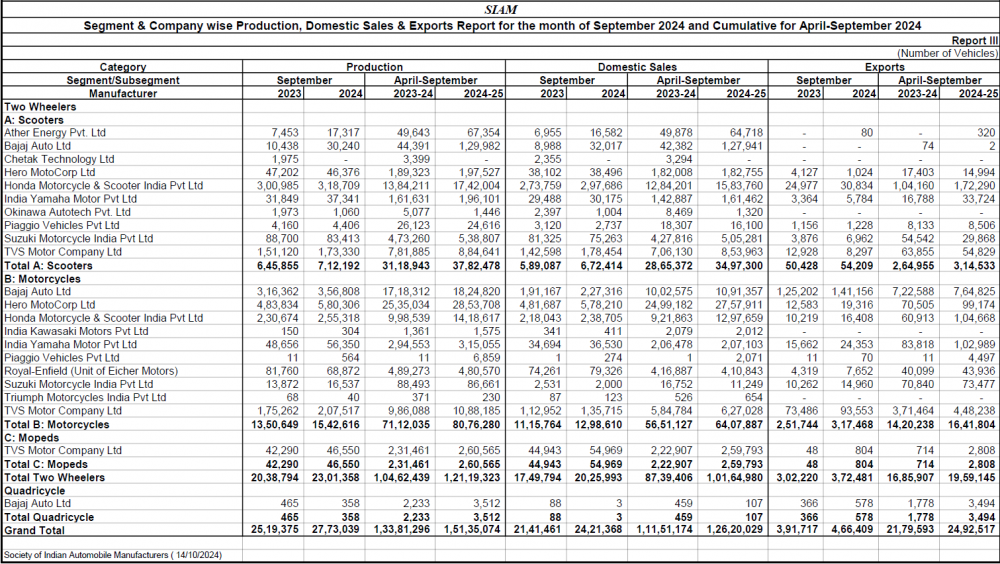

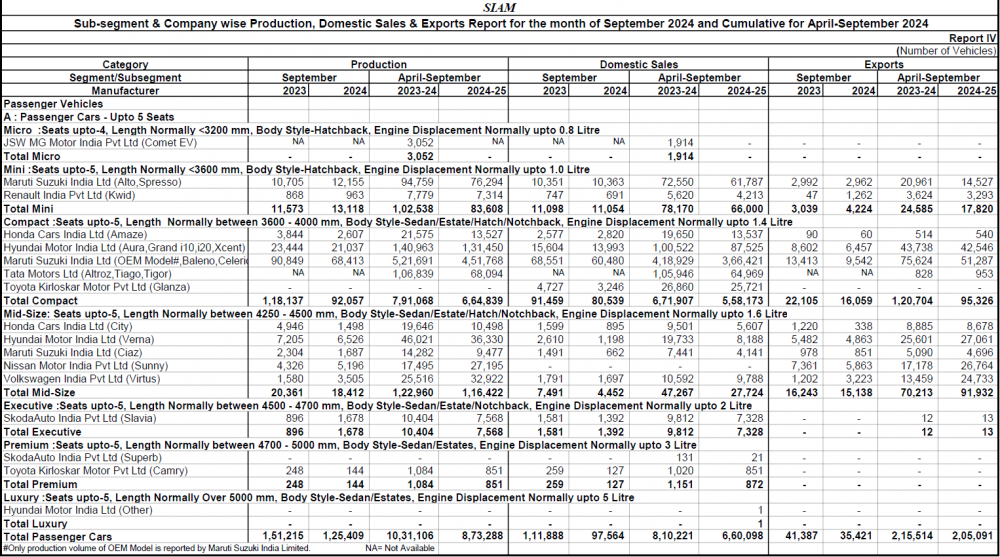

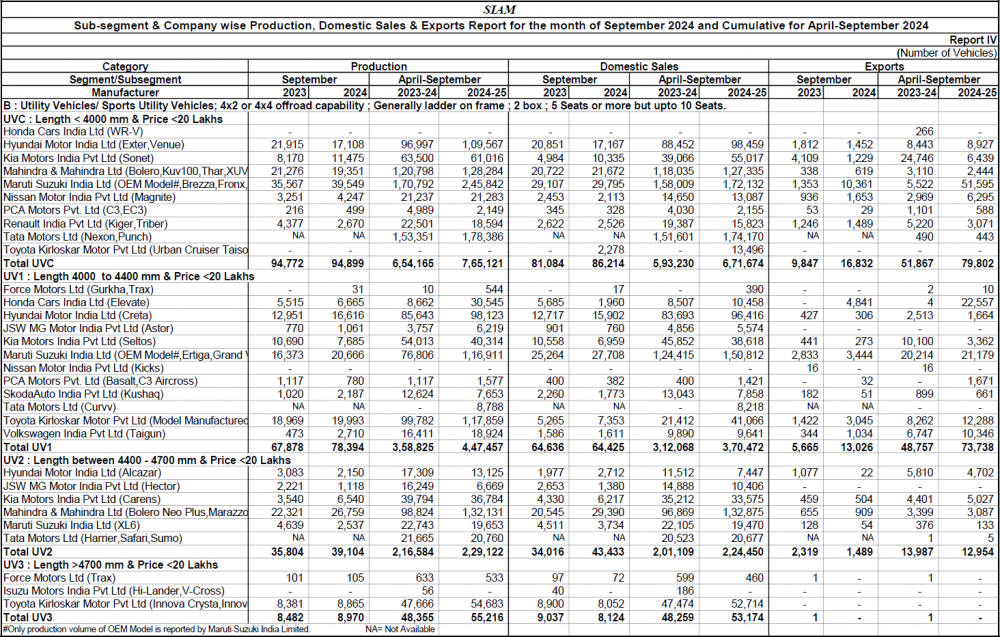

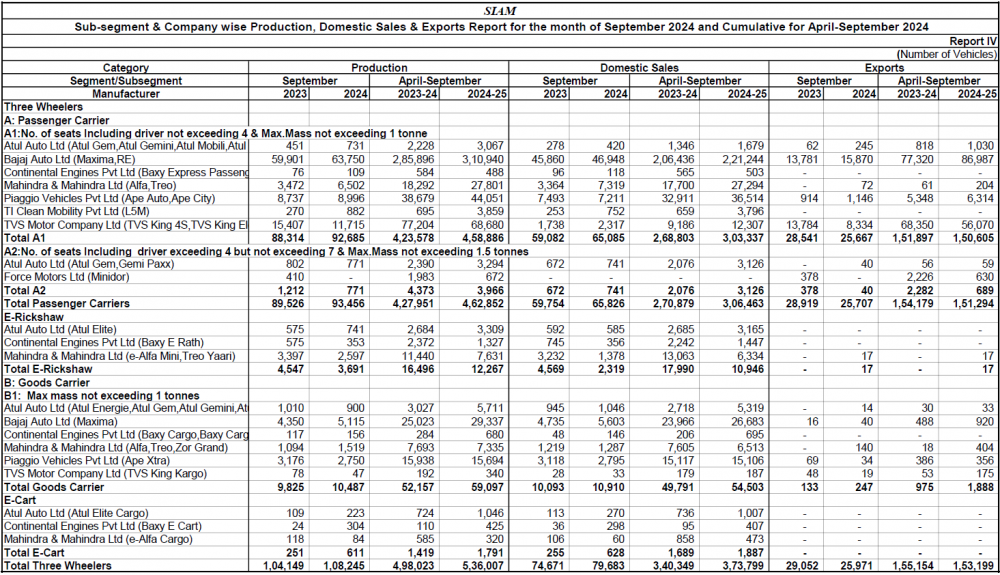

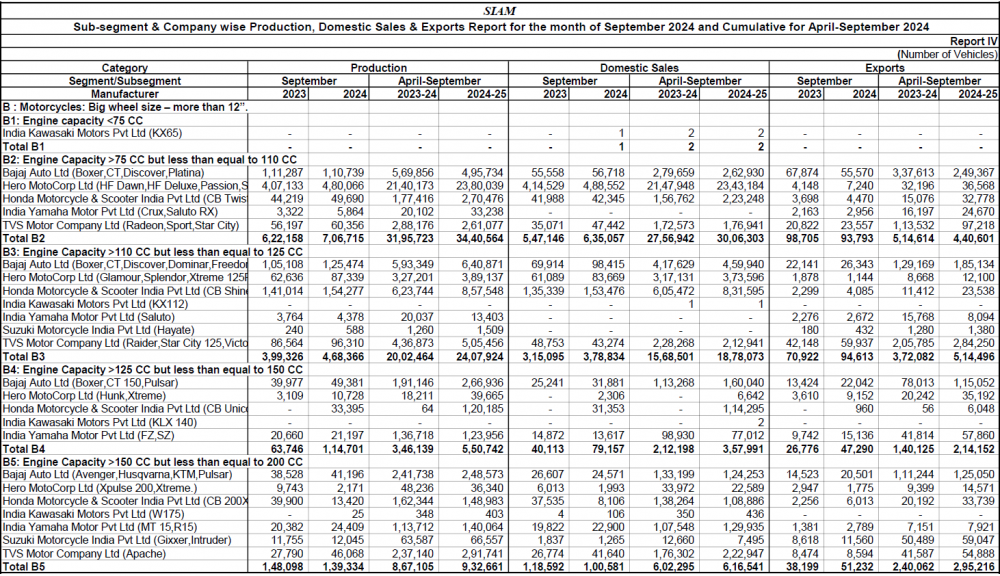

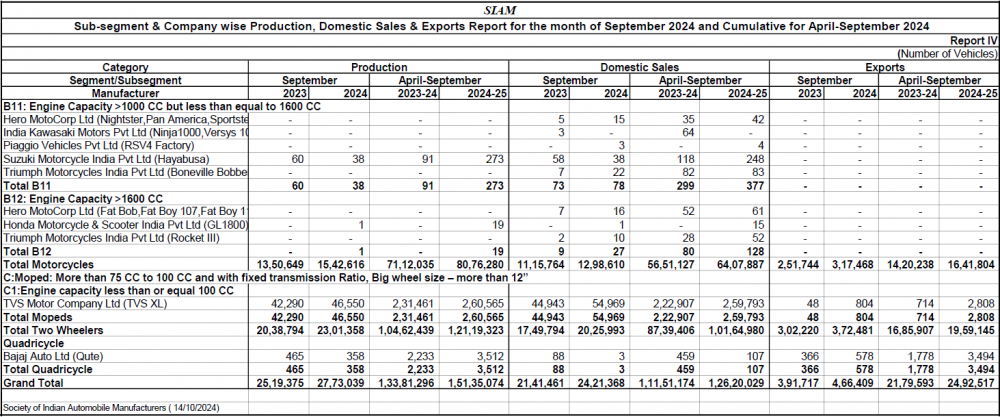

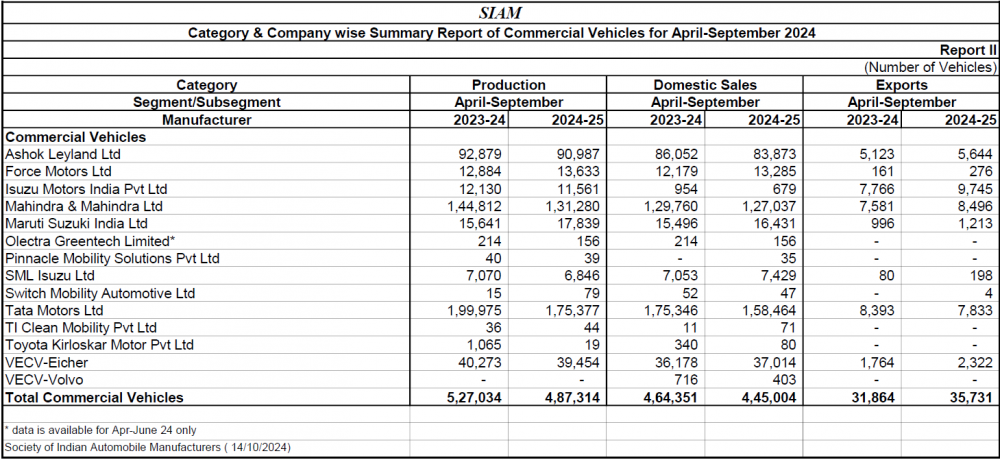

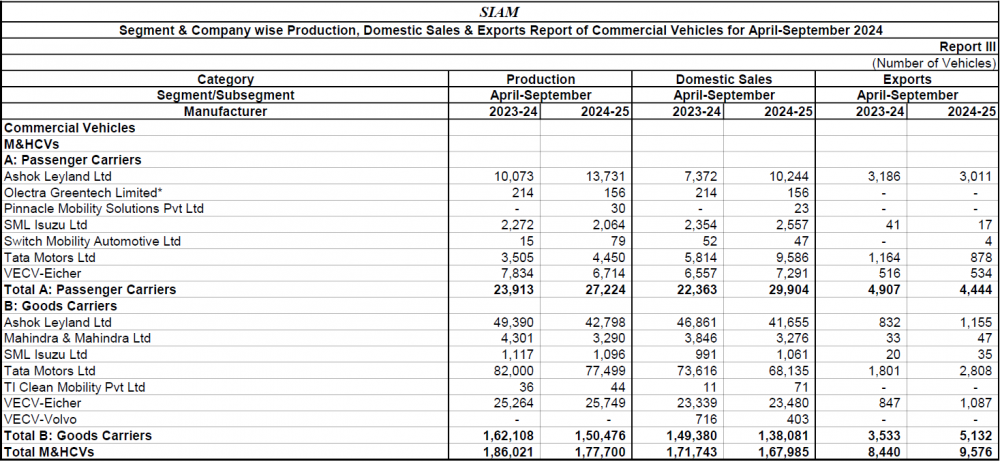

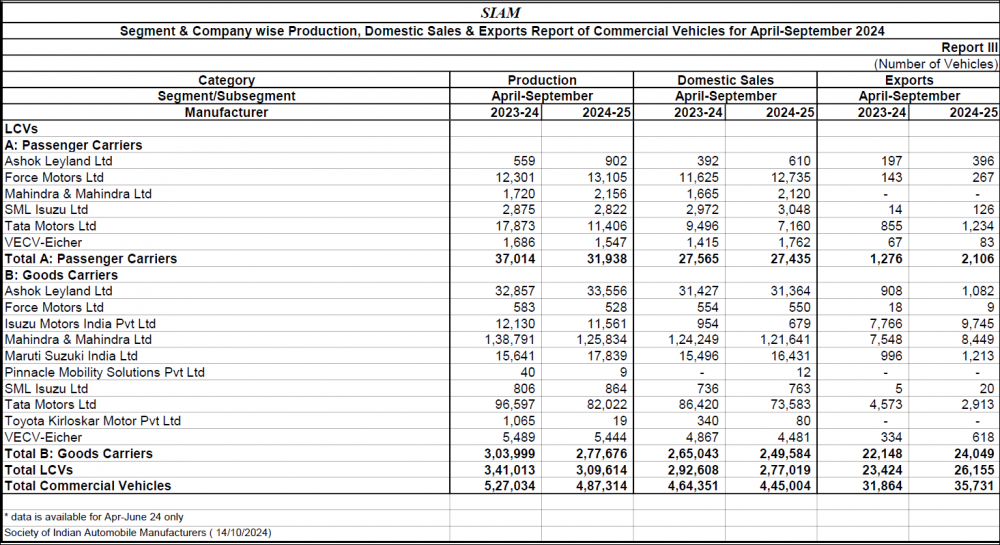

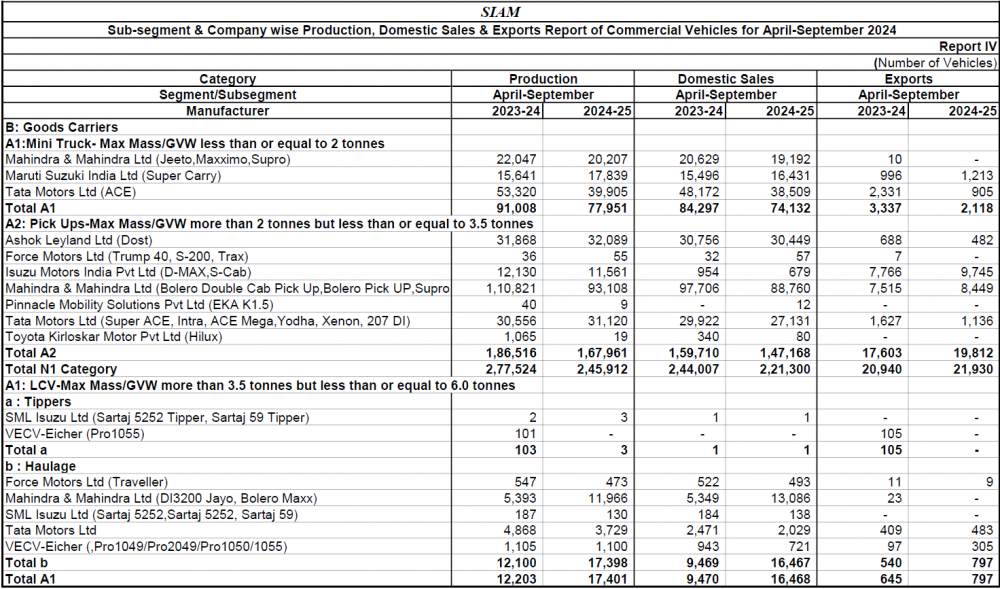

September 2024 Indian Car Sales

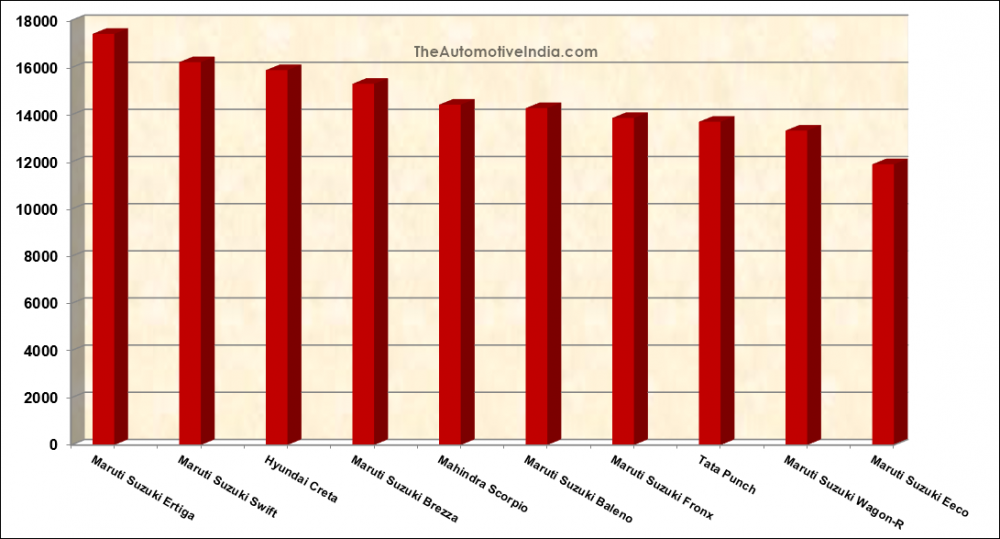

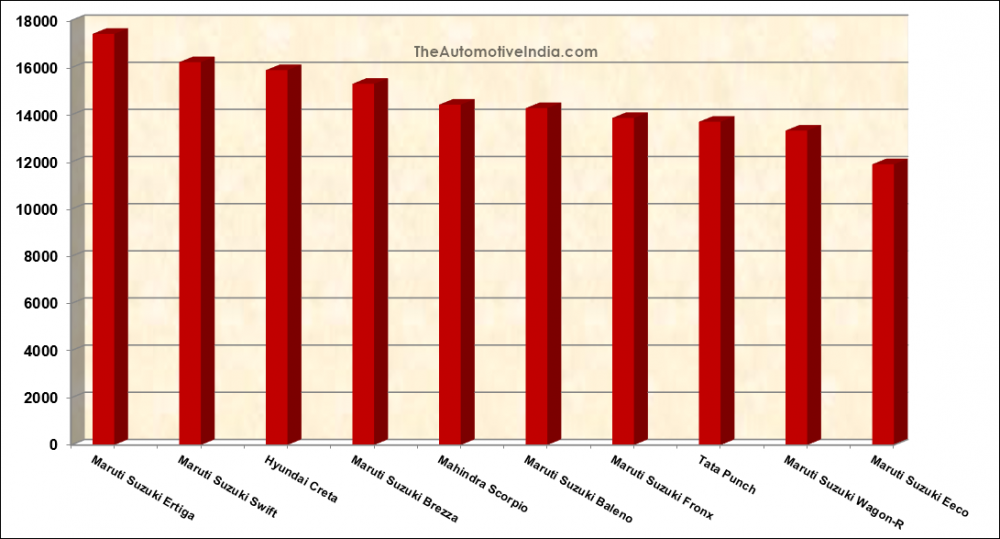

Top 10 Selling Cars: September 2024

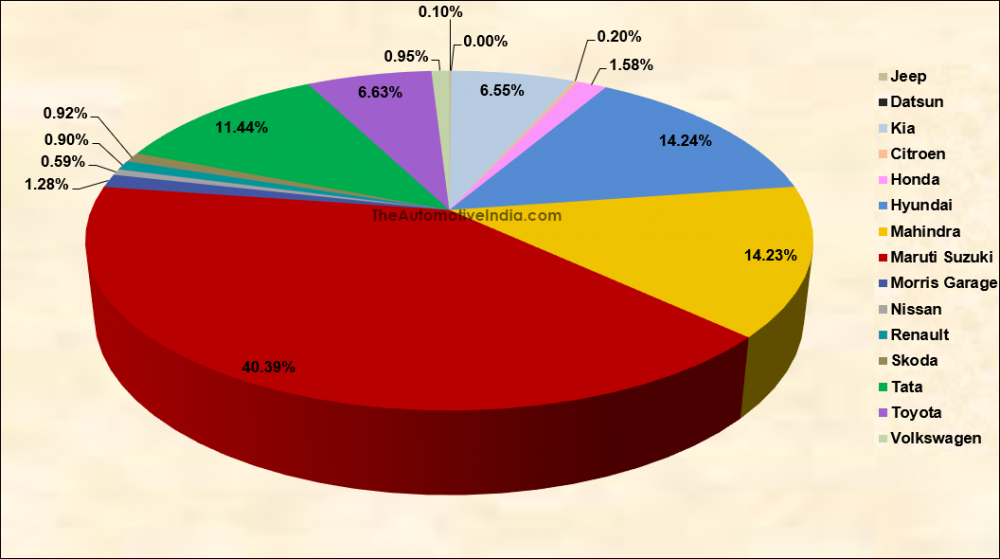

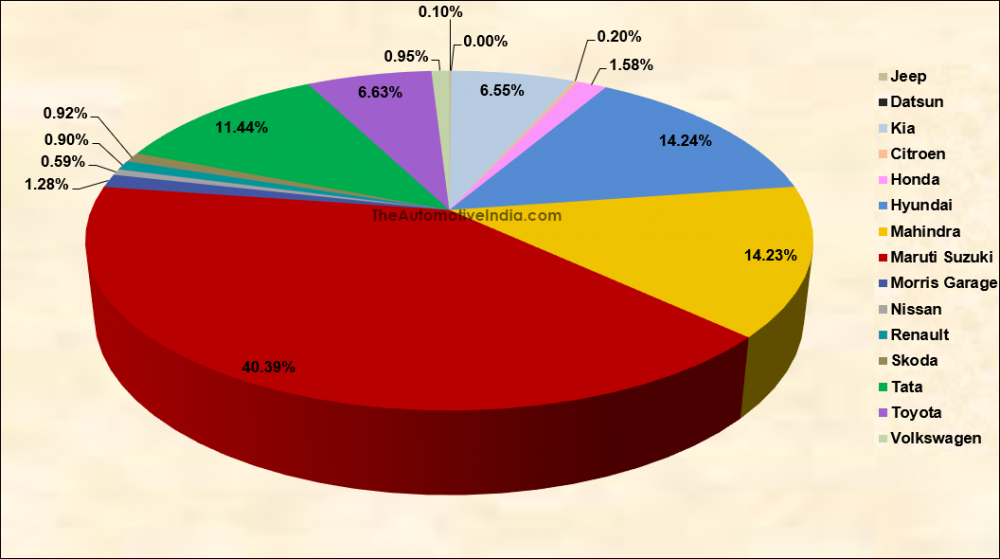

Manufacturers' Market Share: September 2024

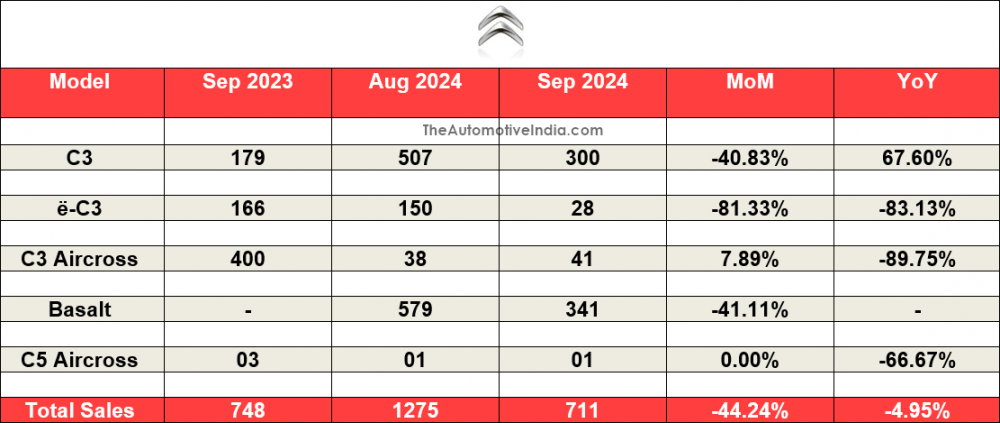

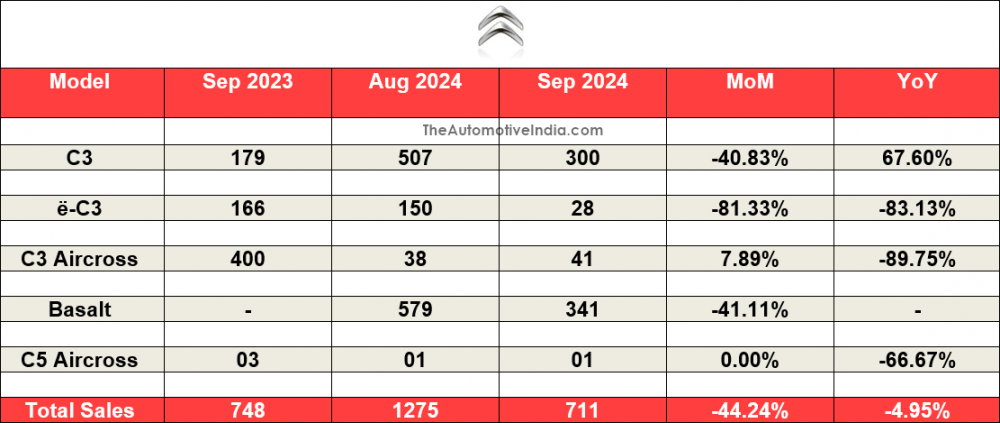

Citroën September 2024 Indian Car Sales

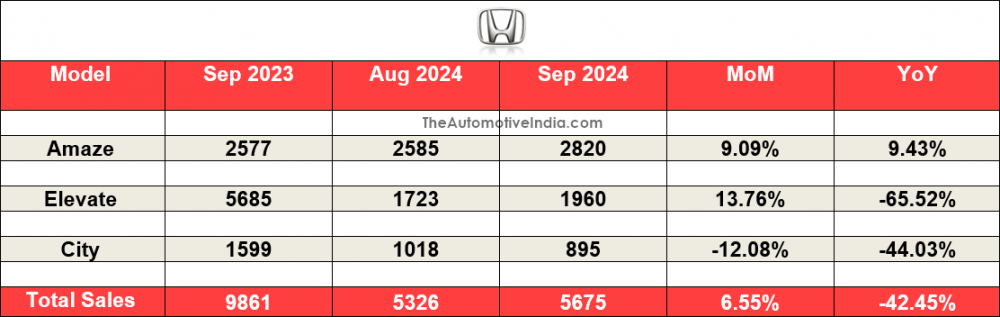

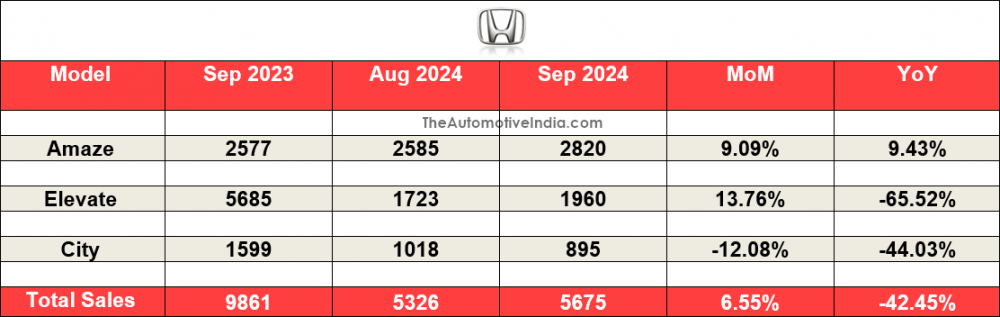

Honda September 2024 Indian Car Sales

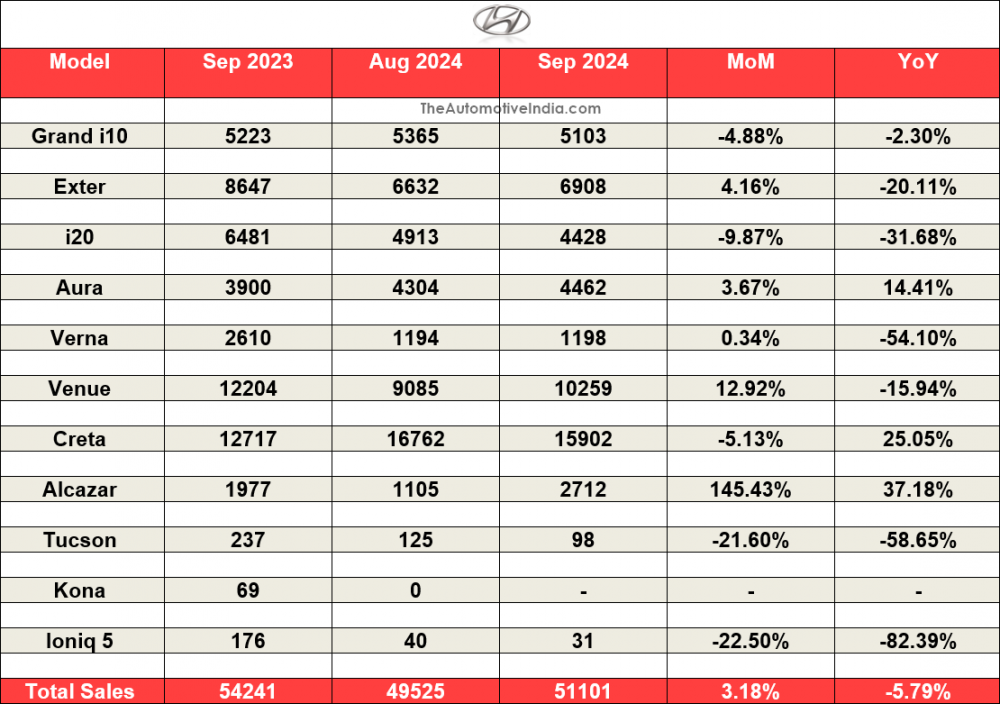

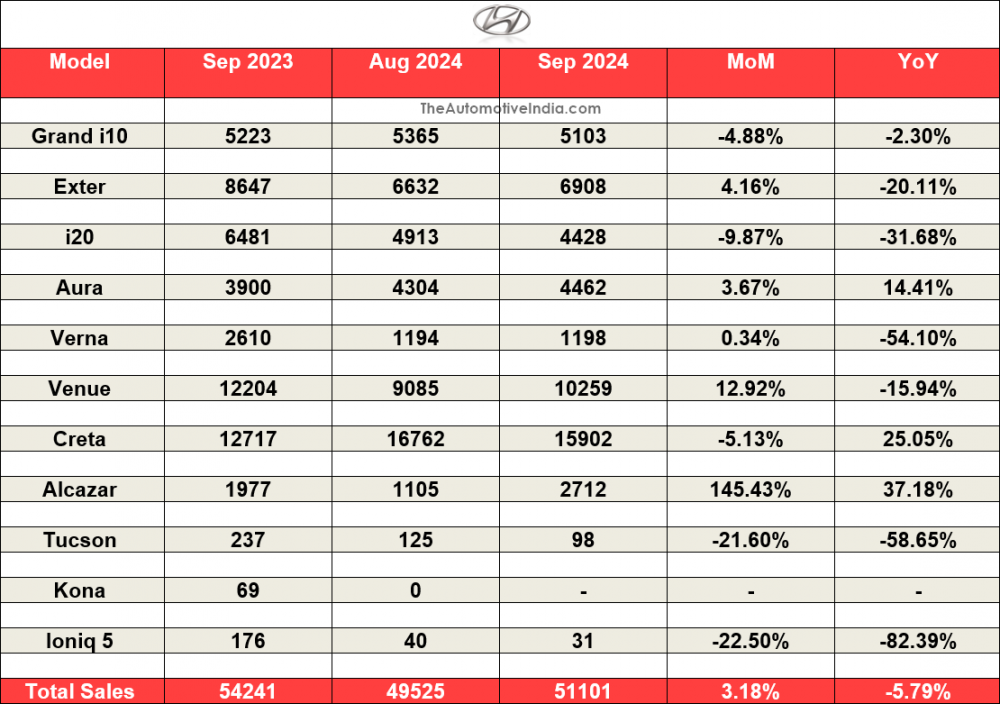

Hyundai September 2024 Indian Car Sales

Jeep September 2024 Indian Car Sales

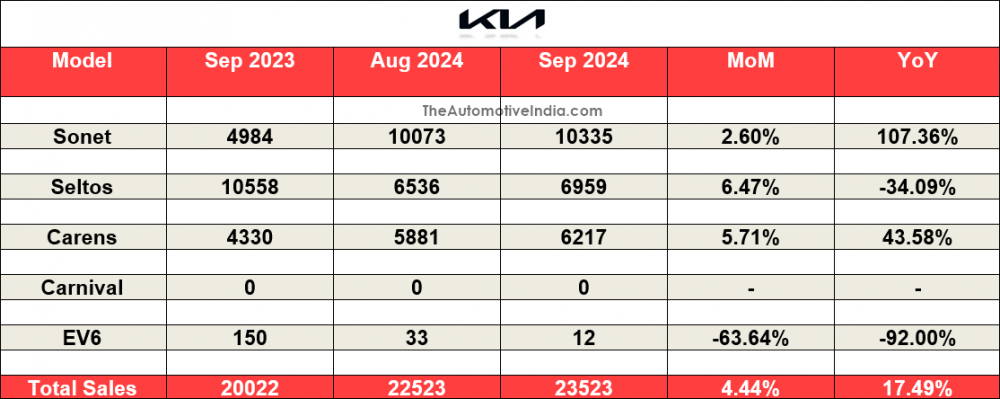

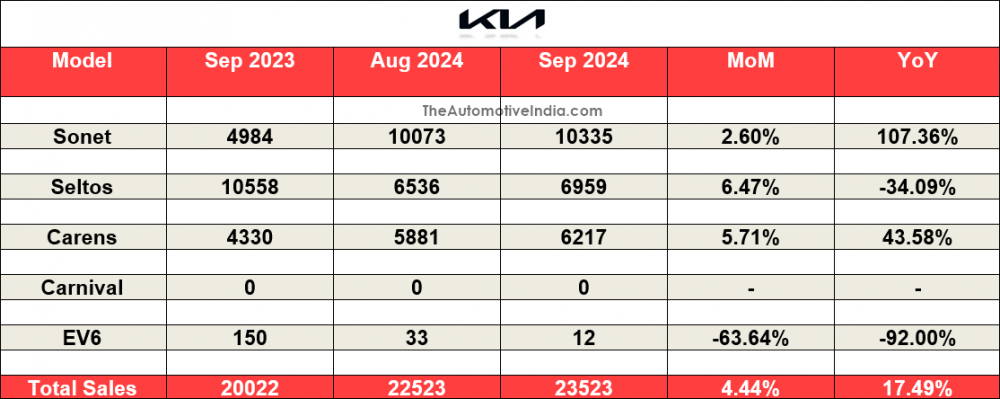

Kia September 2024 Indian Car Sales

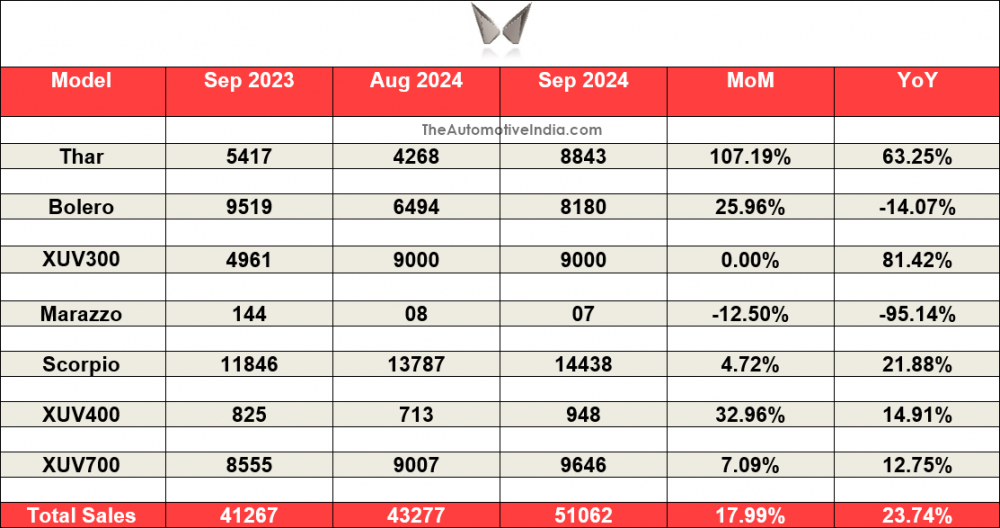

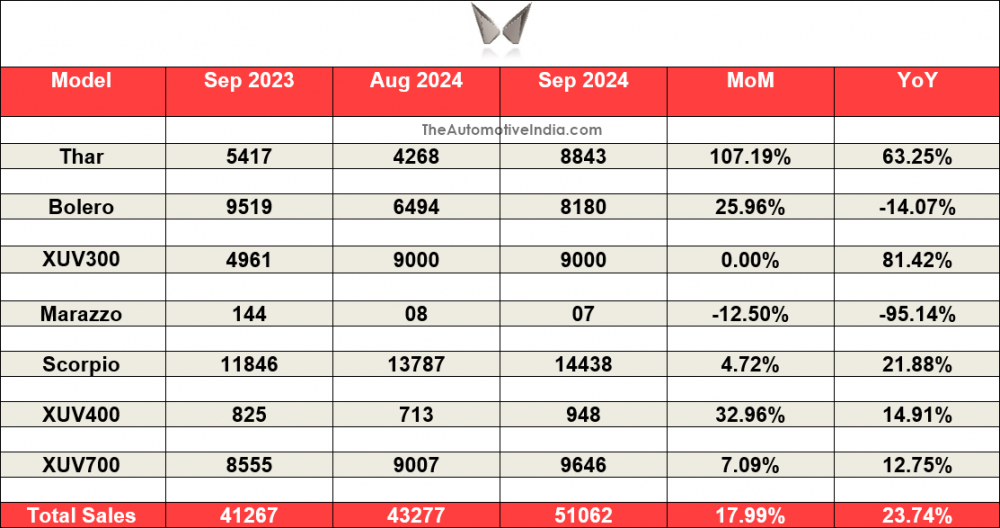

Mahindra September 2024 Indian Car Sales

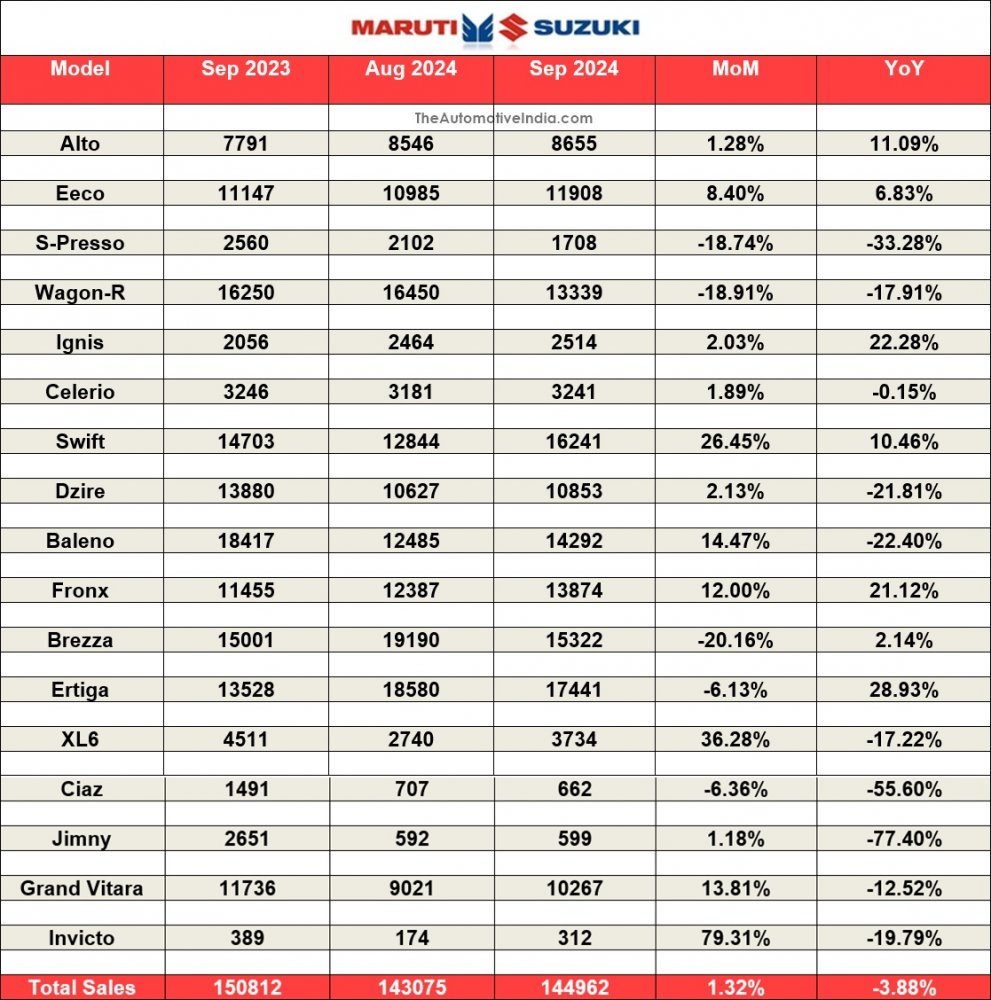

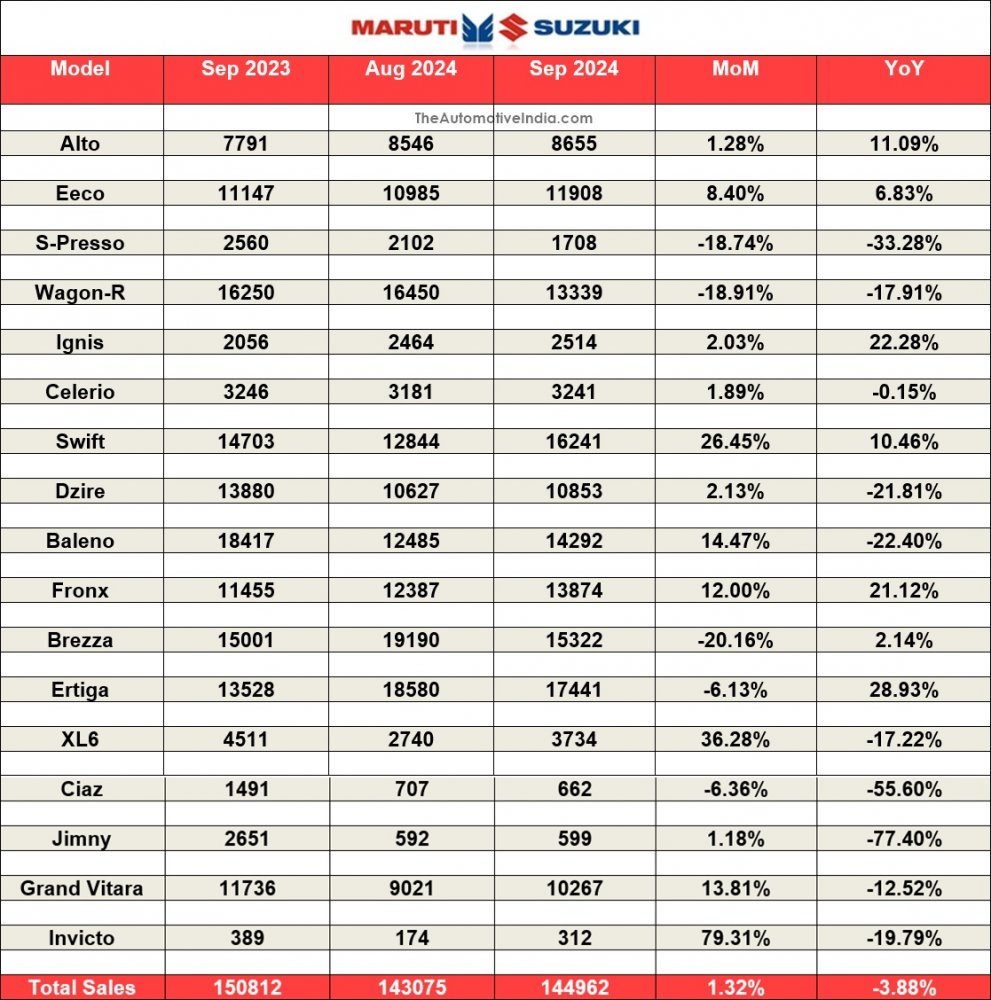

Maruti Suzuki September 2024 Indian Car Sales

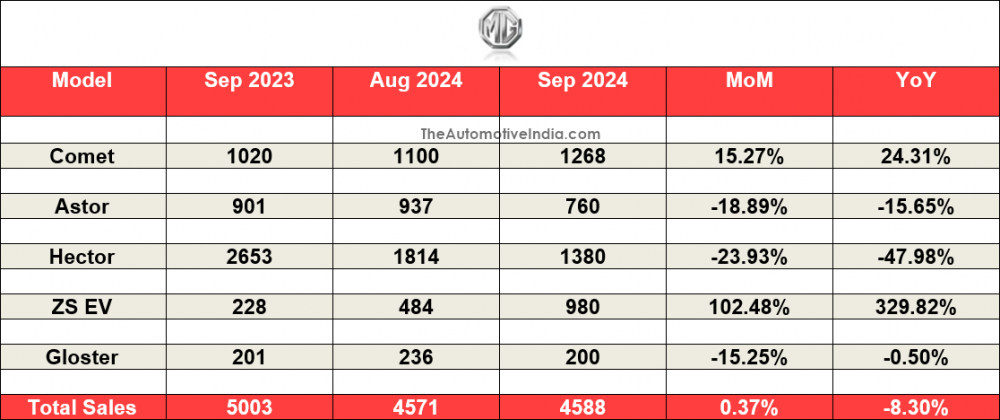

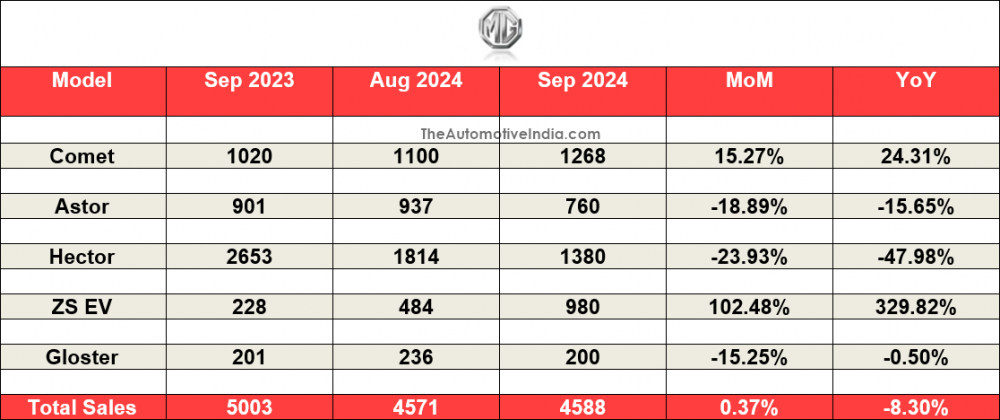

Morris Garages September 2024 Indian Car Sales

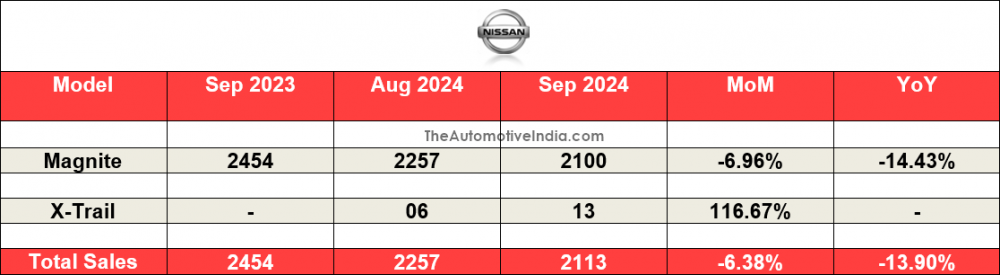

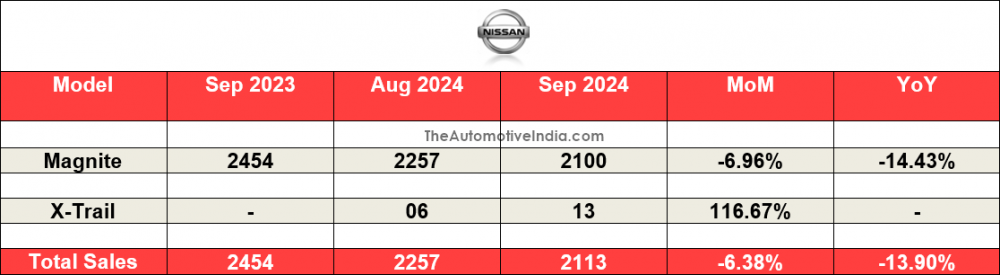

Nissan September 2024 Indian Car Sales

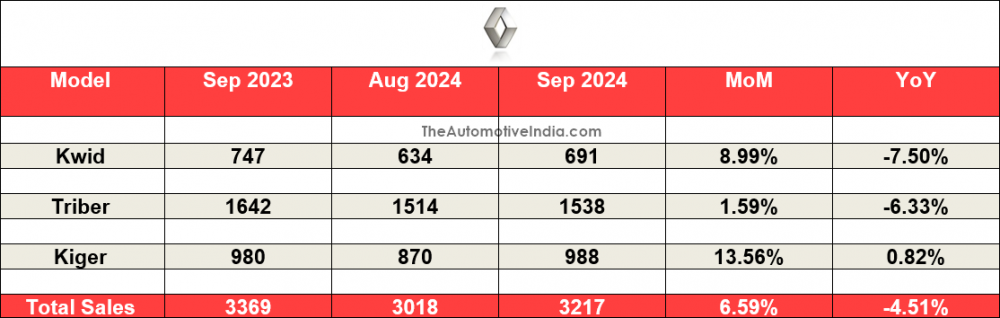

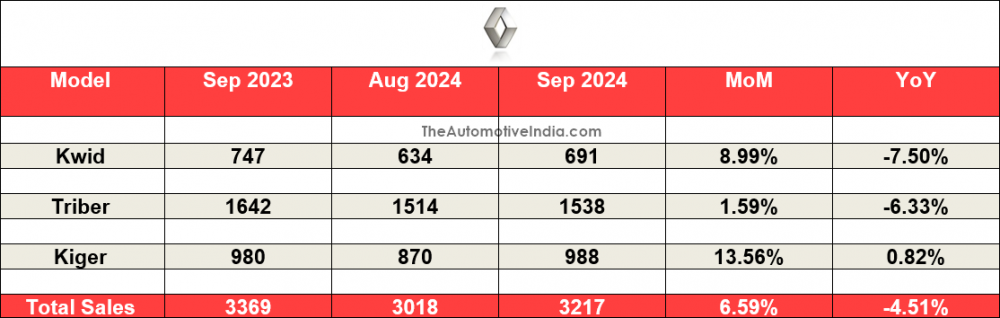

Renault September 2024 Indian Car Sales

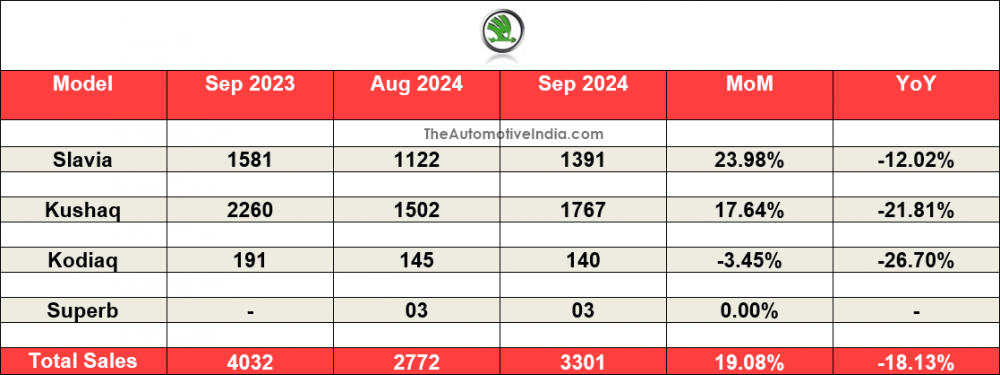

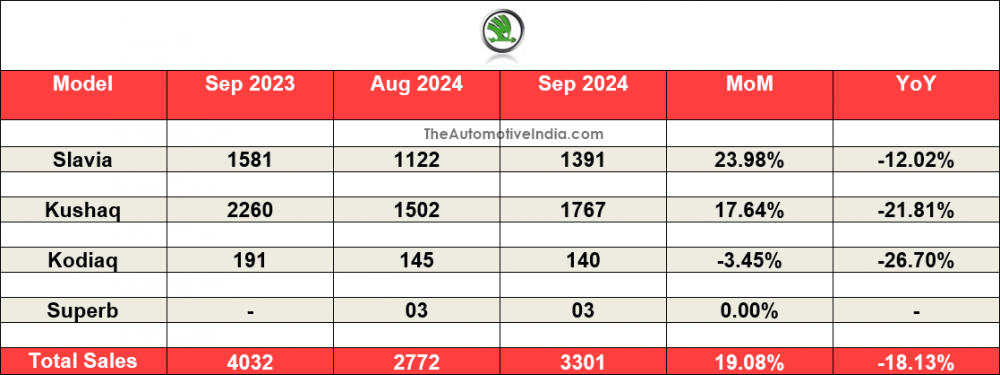

Skoda September 2024 Indian Car Sales

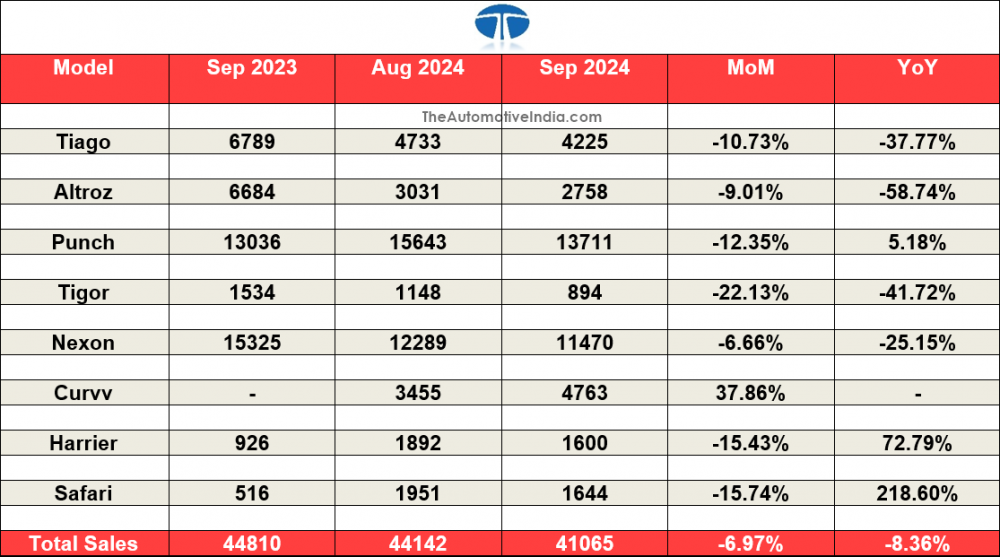

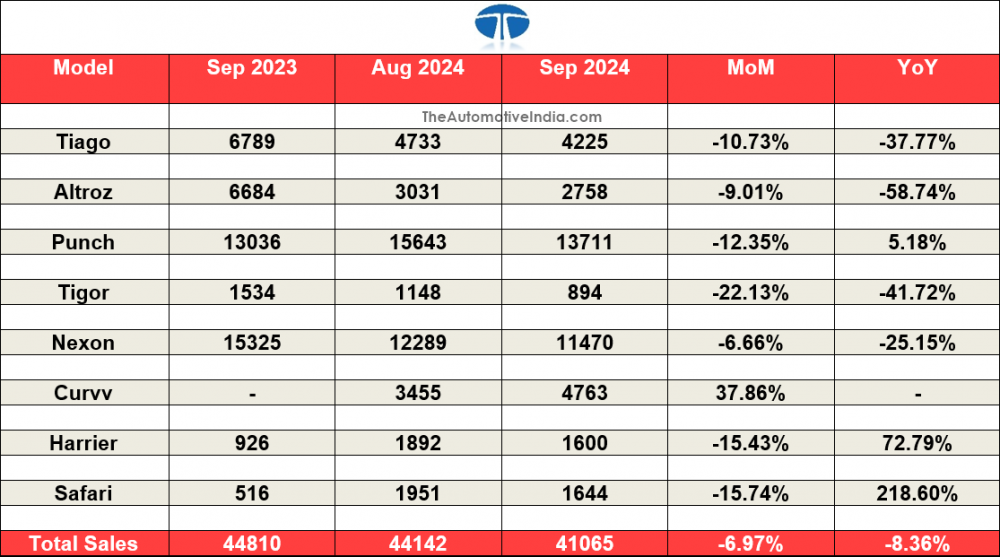

Tata Motors September 2024 Indian Car Sales

Toyota September 2024 Indian Car Sales

.

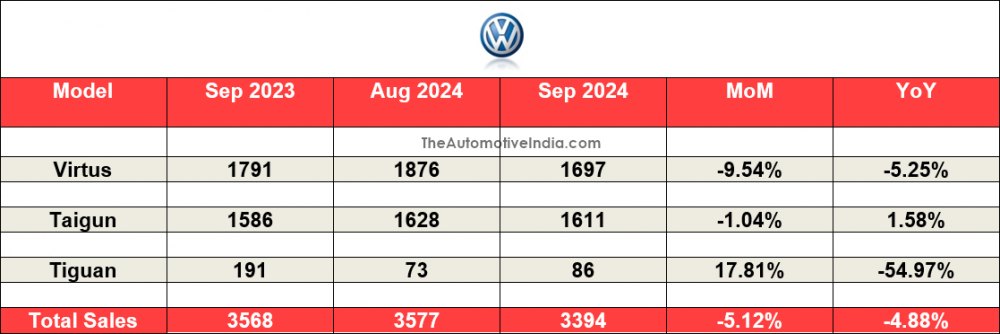

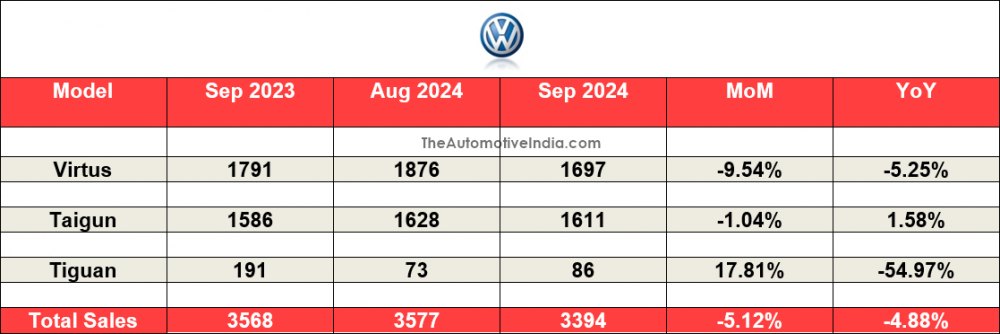

Volkswagen September 2024 Indian Car Sales

Top 10 Selling Cars: September 2024

Manufacturers' Market Share: September 2024

Citroën September 2024 Indian Car Sales

Honda September 2024 Indian Car Sales

Hyundai September 2024 Indian Car Sales

Jeep September 2024 Indian Car Sales

Kia September 2024 Indian Car Sales

Mahindra September 2024 Indian Car Sales

Maruti Suzuki September 2024 Indian Car Sales

Morris Garages September 2024 Indian Car Sales

Nissan September 2024 Indian Car Sales

Renault September 2024 Indian Car Sales

Skoda September 2024 Indian Car Sales

Tata Motors September 2024 Indian Car Sales

Toyota September 2024 Indian Car Sales

.

Volkswagen September 2024 Indian Car Sales

Drive Safe,

350Z