The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for October'24.

October’24 Retails

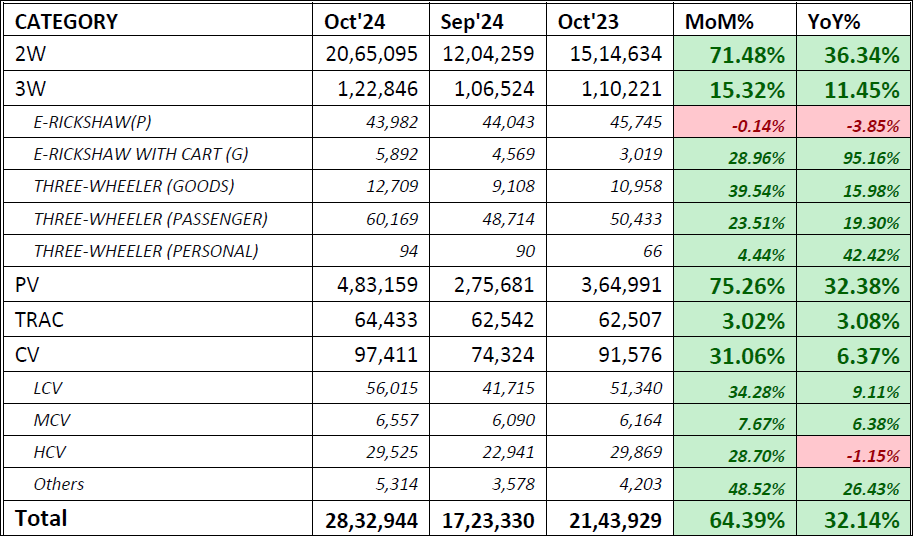

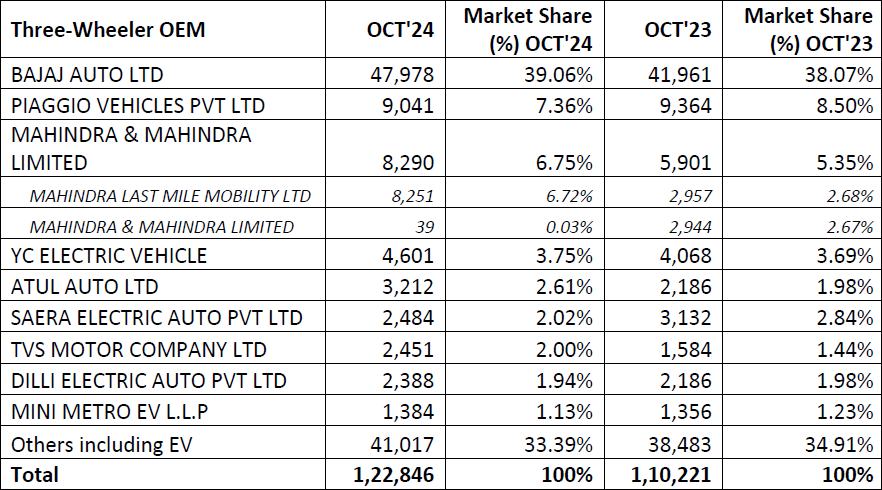

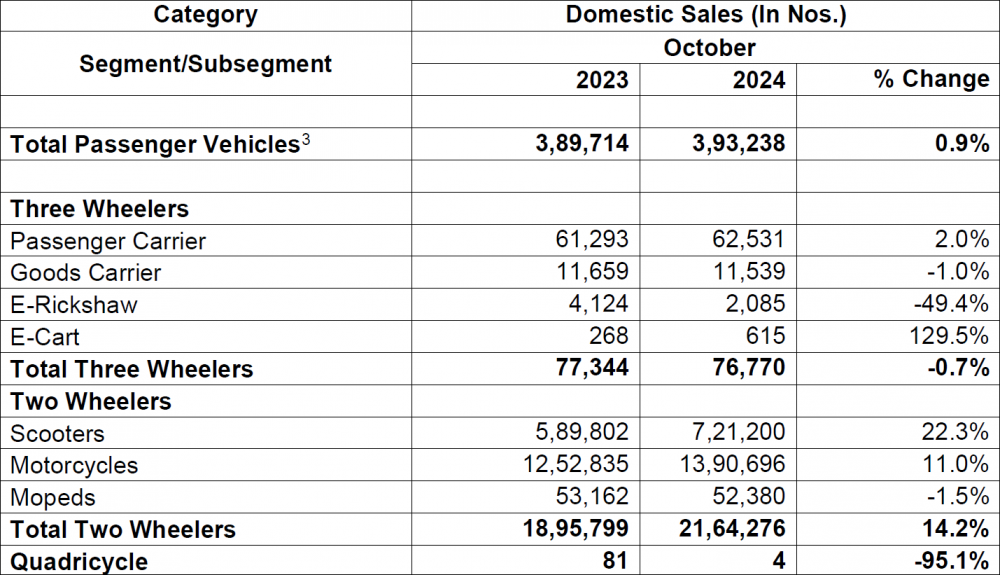

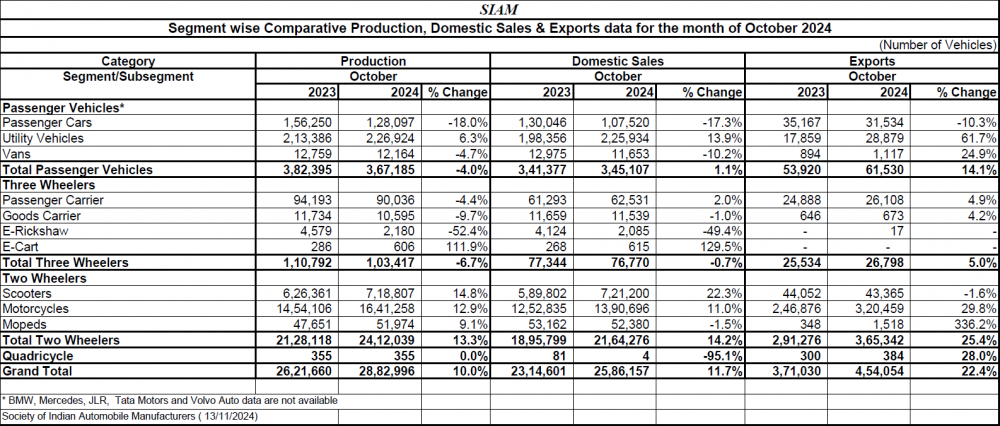

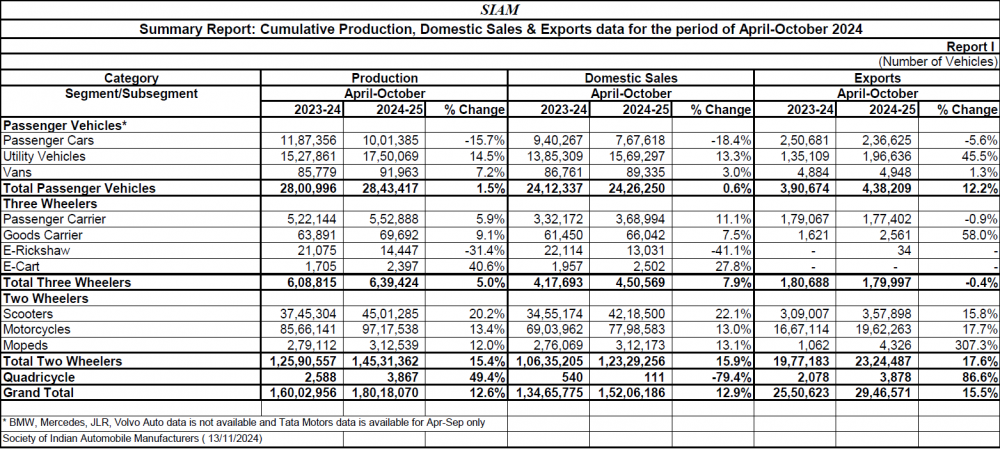

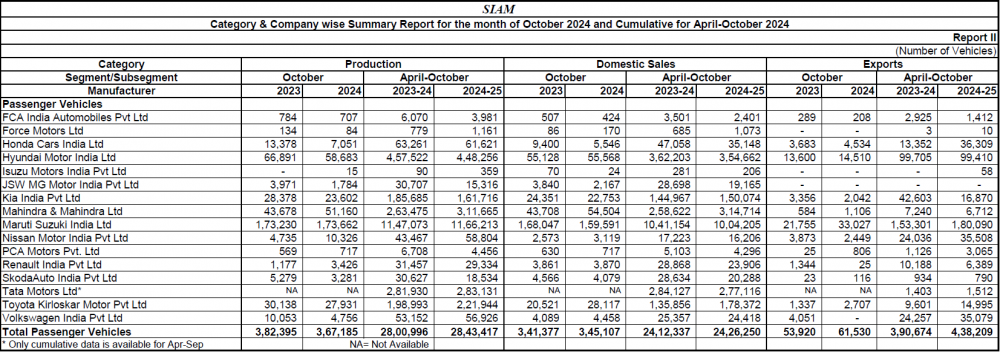

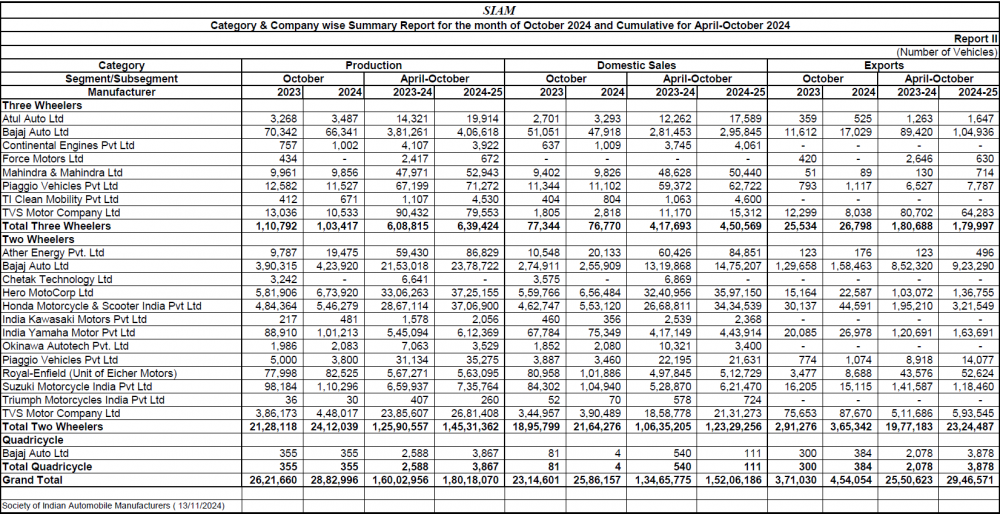

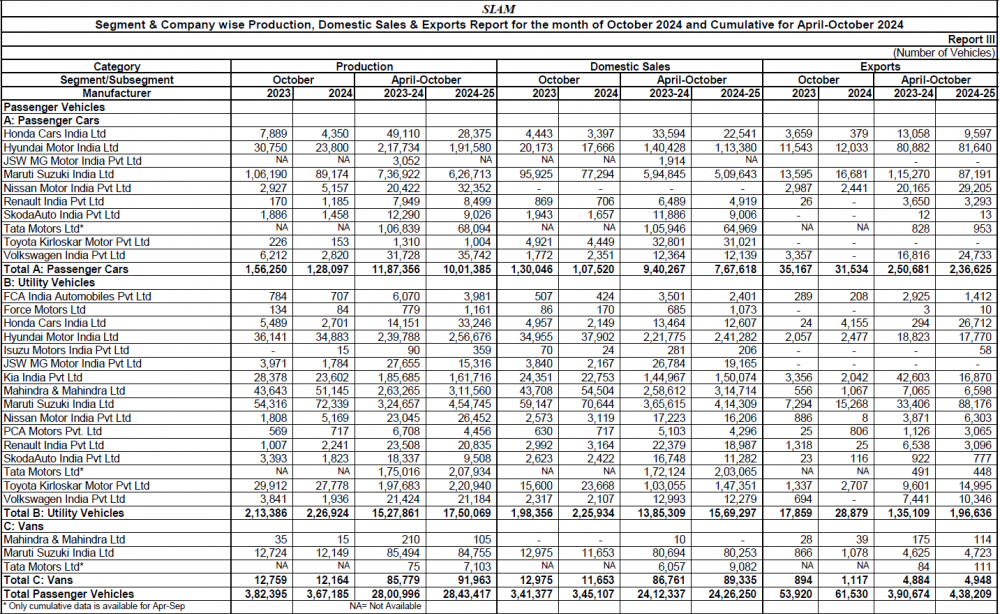

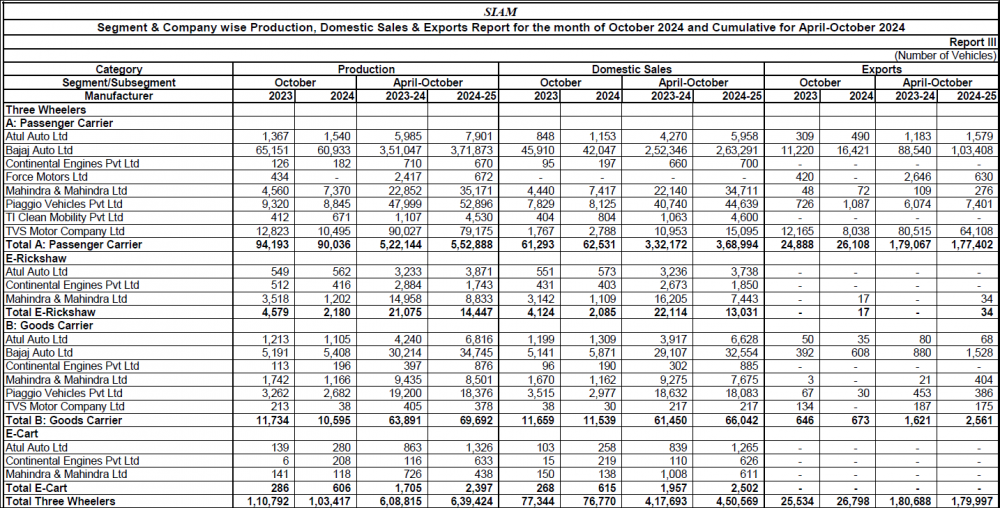

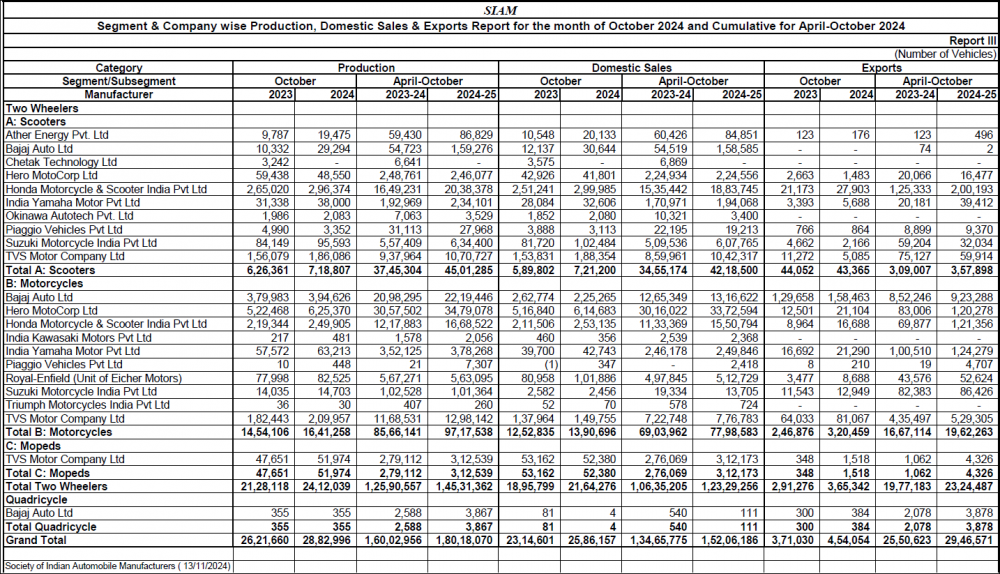

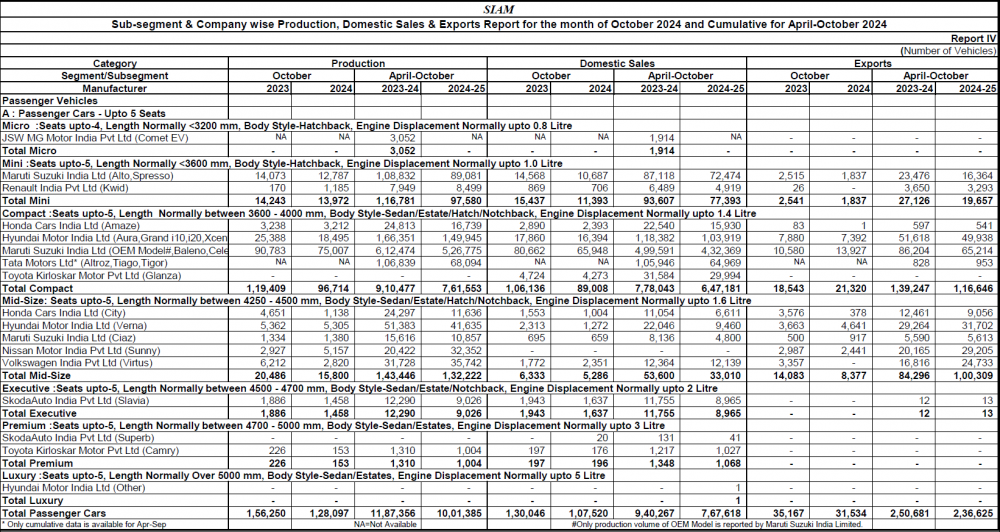

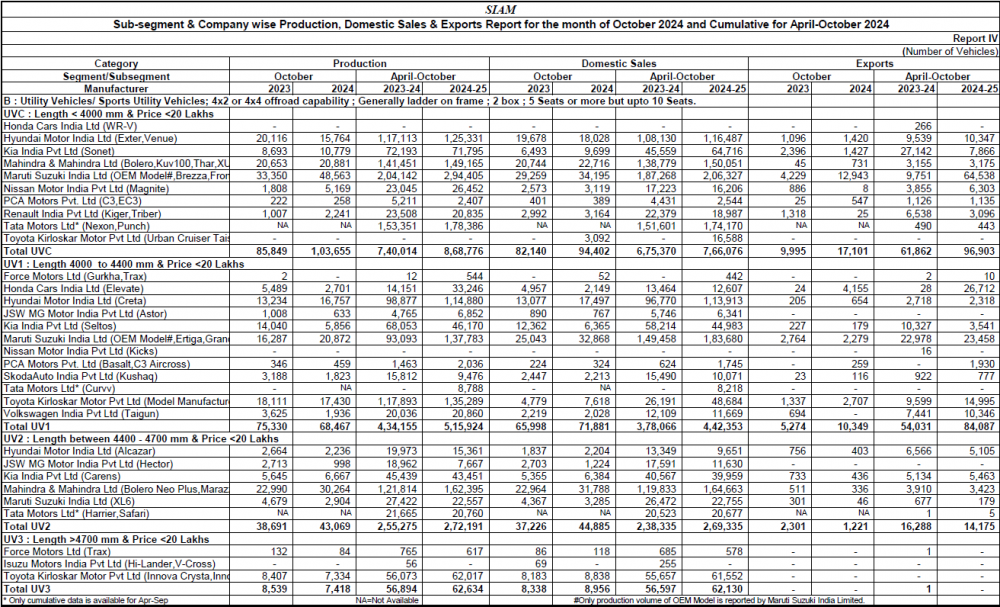

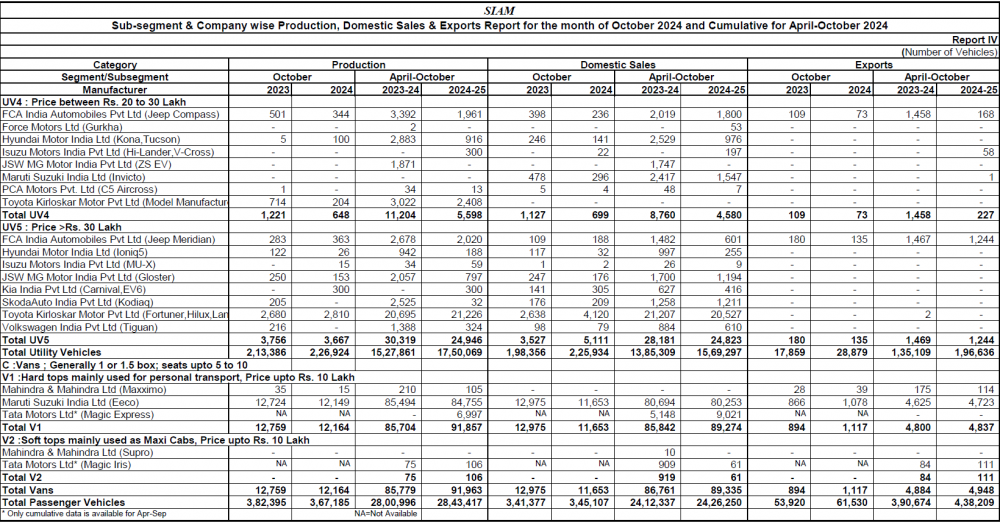

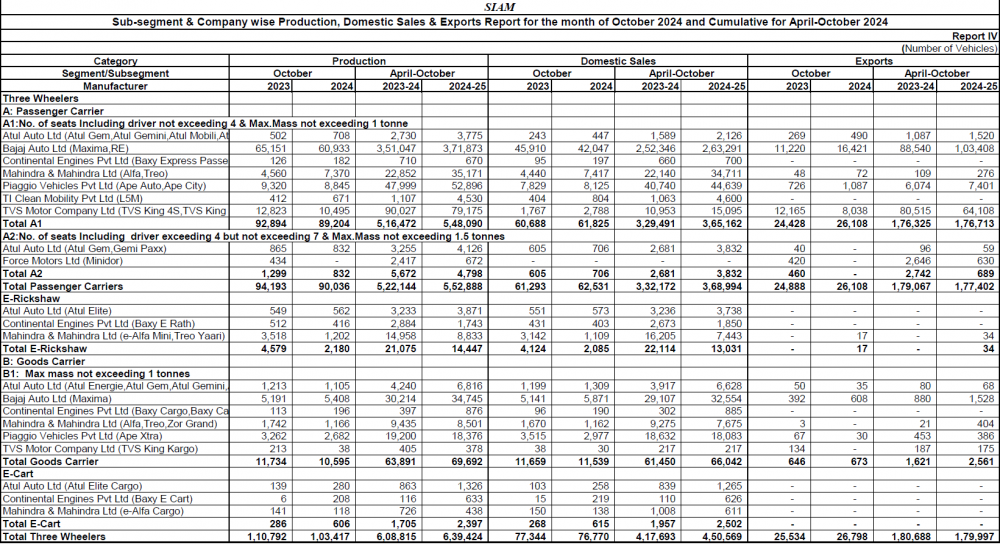

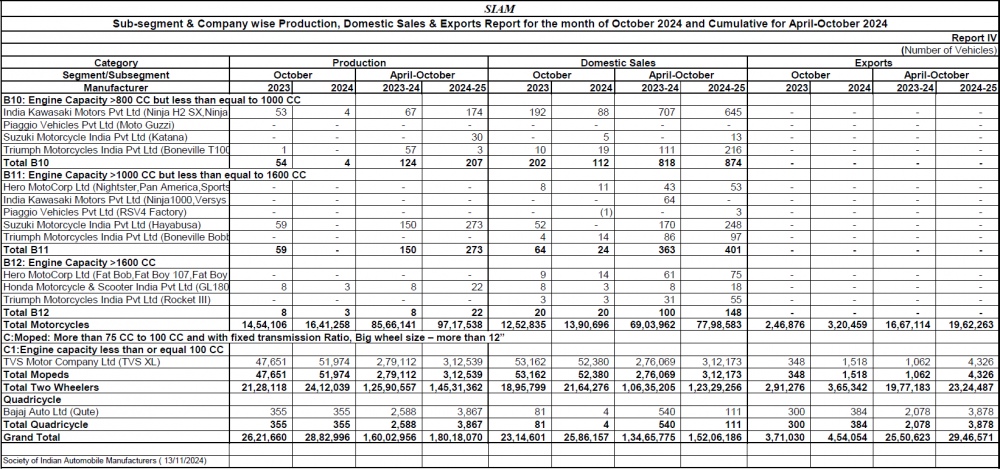

FADA President, Mr. C S Vigneshwar, shared his perspective on the auto retail performance for October 2024: “October 2024 witnessed the convergence of two major festivals, Navratri and Diwali, both occurring in the same month. These festivities traditionally account for 30–35% of total annual auto sales, so the industry's focus was keenly on how October would unfold. With dealers entering this crucial period fully committed and carrying all-time high inventory levels, the month did not disappoint! Overall retail sales grew by 32% YoY and 64% MoM. All categories showed positive growth, with 2W up 36%, 3W up 11%, PV up 32%, Trac up 3% and CV up 6% YoY. The rural market once again played a leading role in driving growth, particularly in the 2W and PV segments. Additionally, the Government of India's announcement of an increase in the Minimum Support Price (MSP) for Rabi crops further boosted market sentiments.

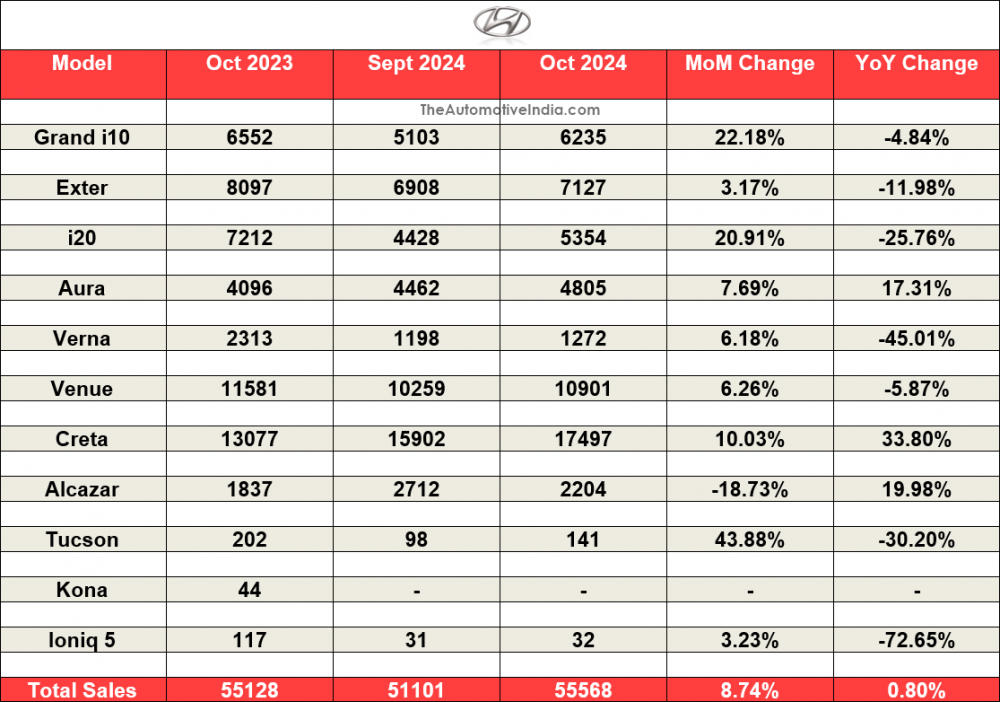

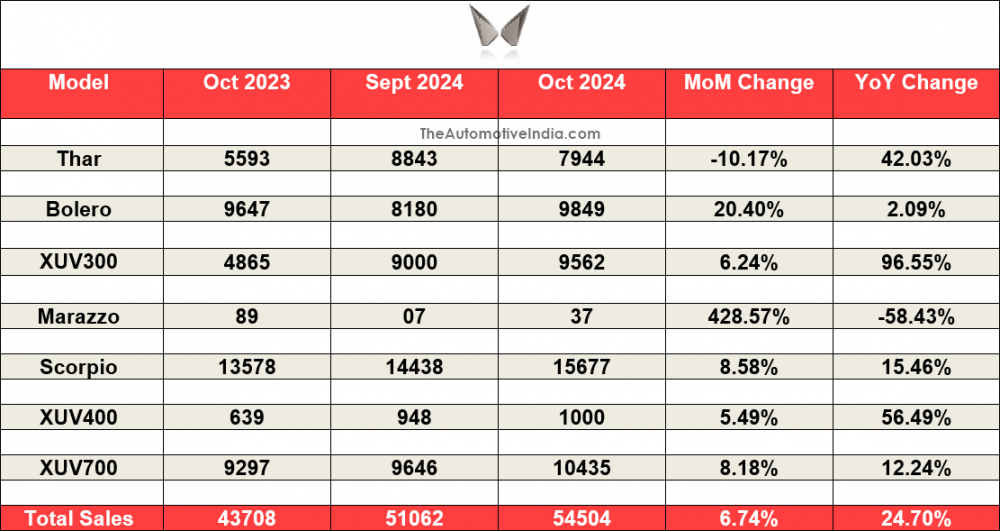

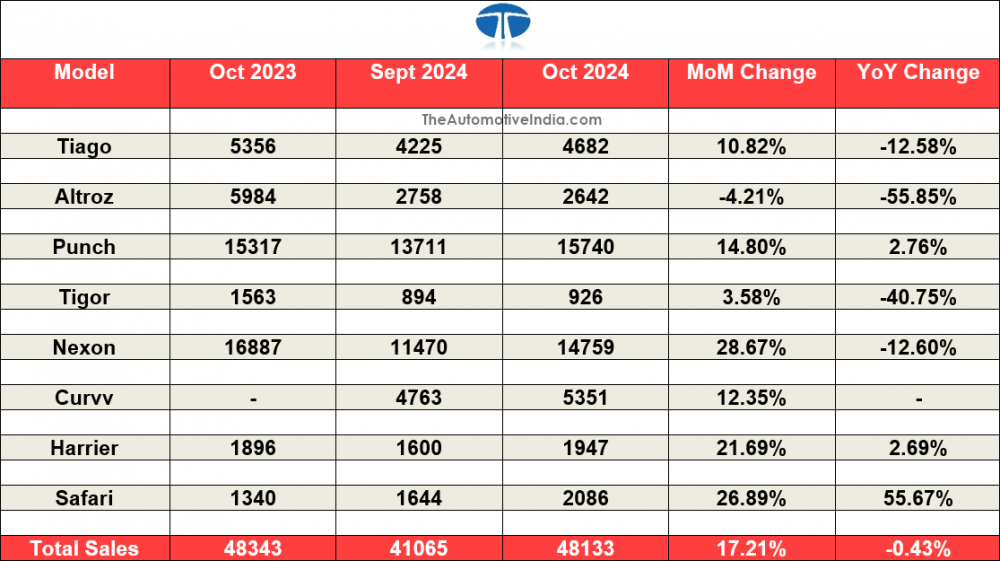

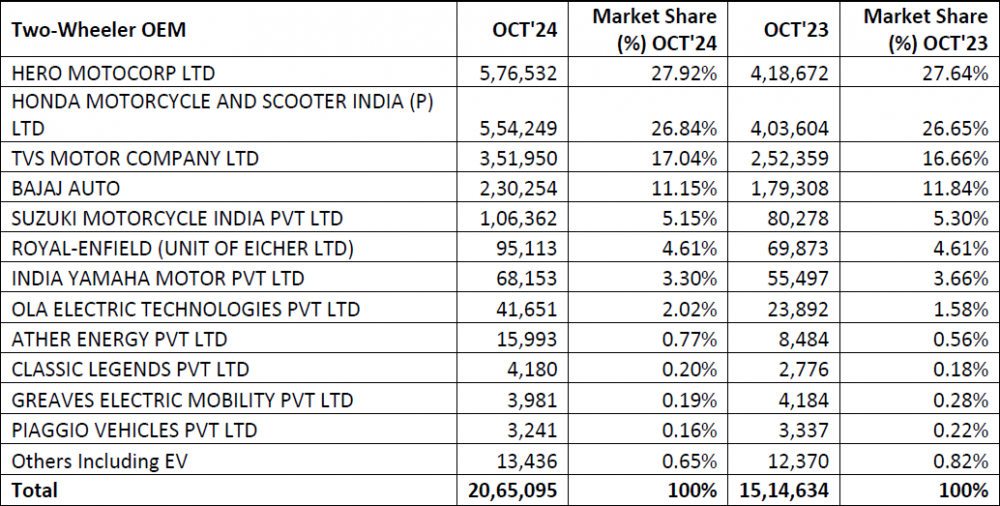

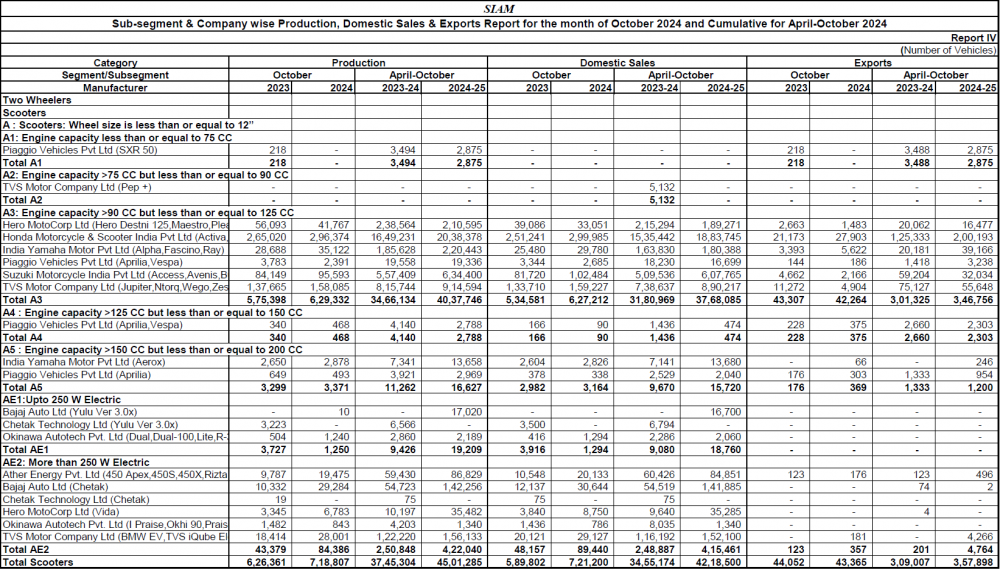

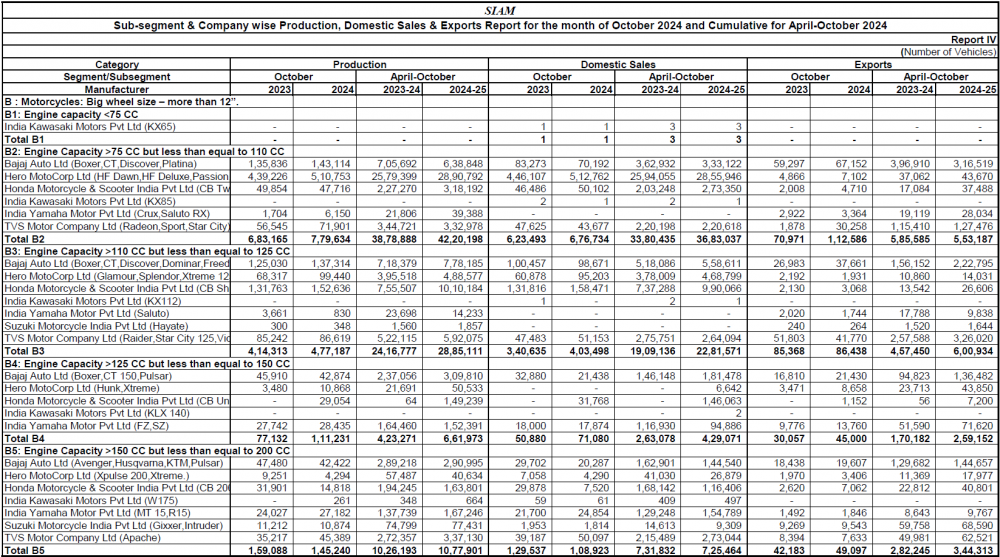

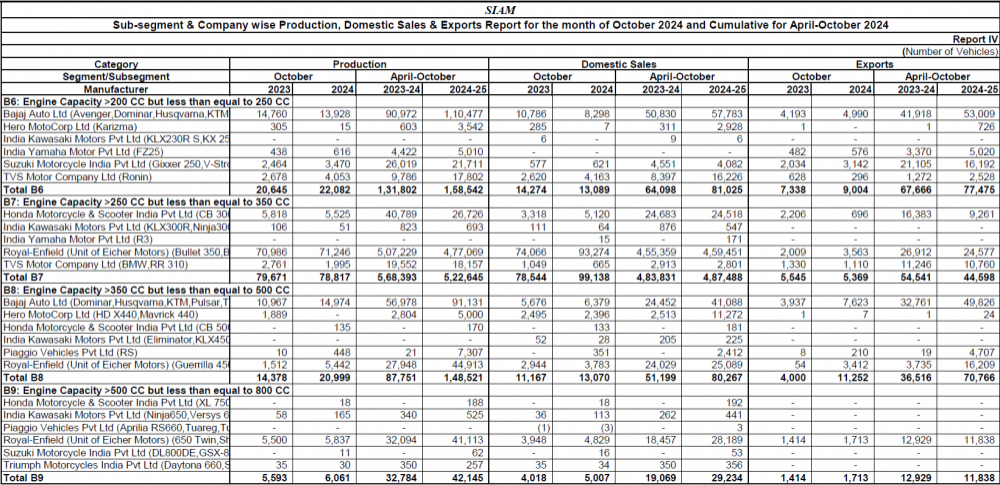

In the 2W segment, sales surged by 36% YoY and an impressive 71% MoM. The coincidence of major festivals in the same month spurred consumer purchasing. Dealers reported that attractive festive schemes, discounts and new model launches significantly stimulated customer interest. Enhanced stock availability and better vehicle supplies from manufacturers enabled dealers to meet the increased demand. Positive rural sentiments, aided by favourable monsoons and crop expectations, also contributed to the strong performance. Overall, the combination of festive celebrations, promotional offers and positive market conditions led to an exceptional month for 2W dealers. The passenger vehicle segment experienced growth of 32% YoY and 75% MoM.

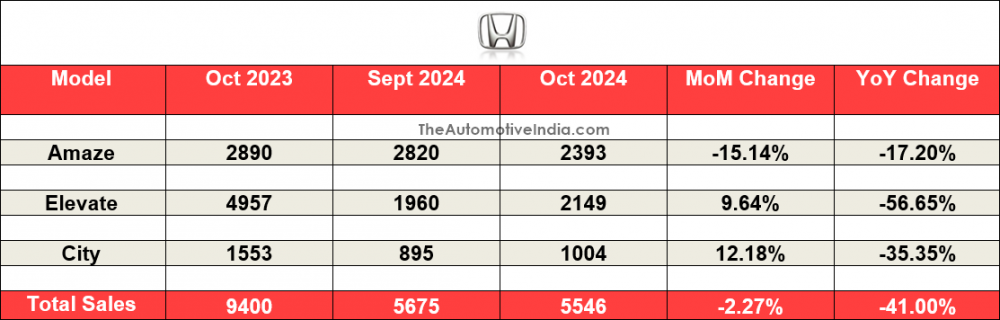

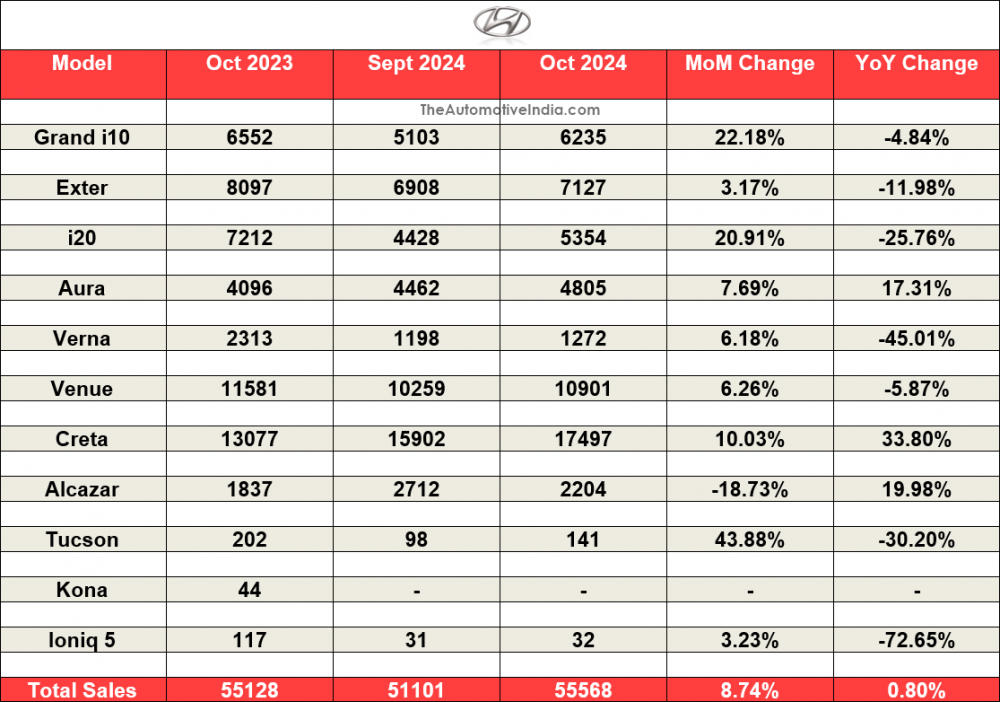

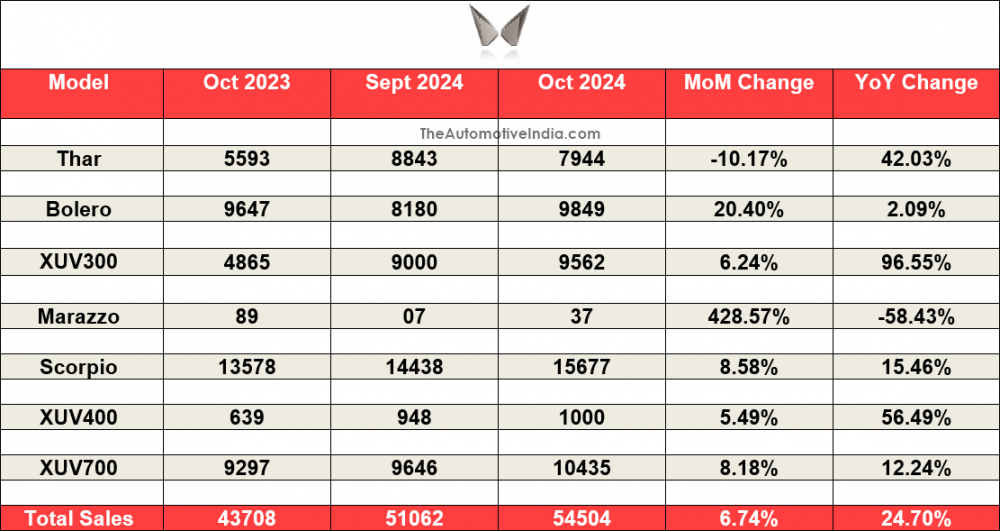

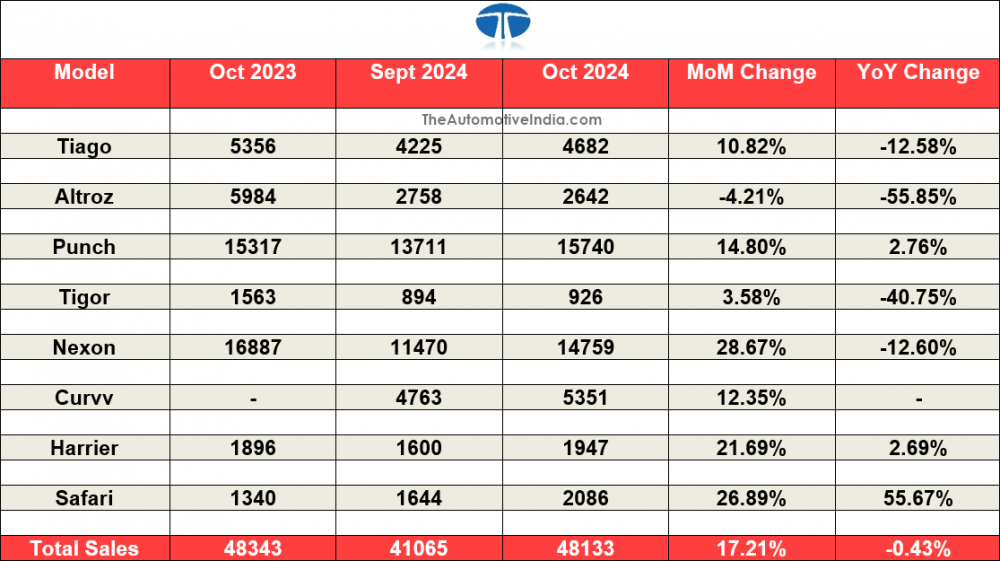

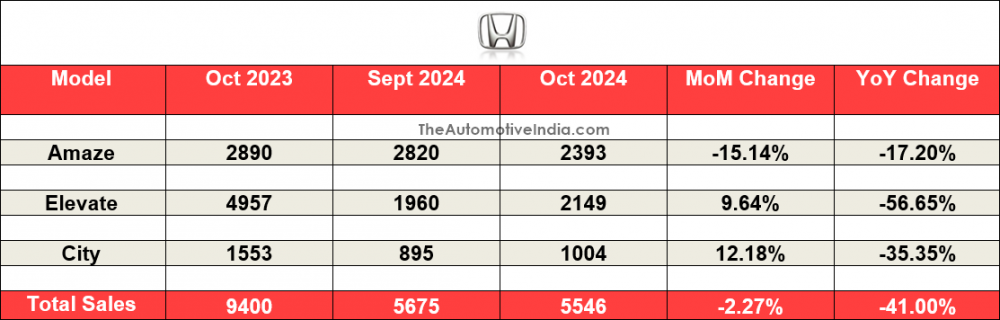

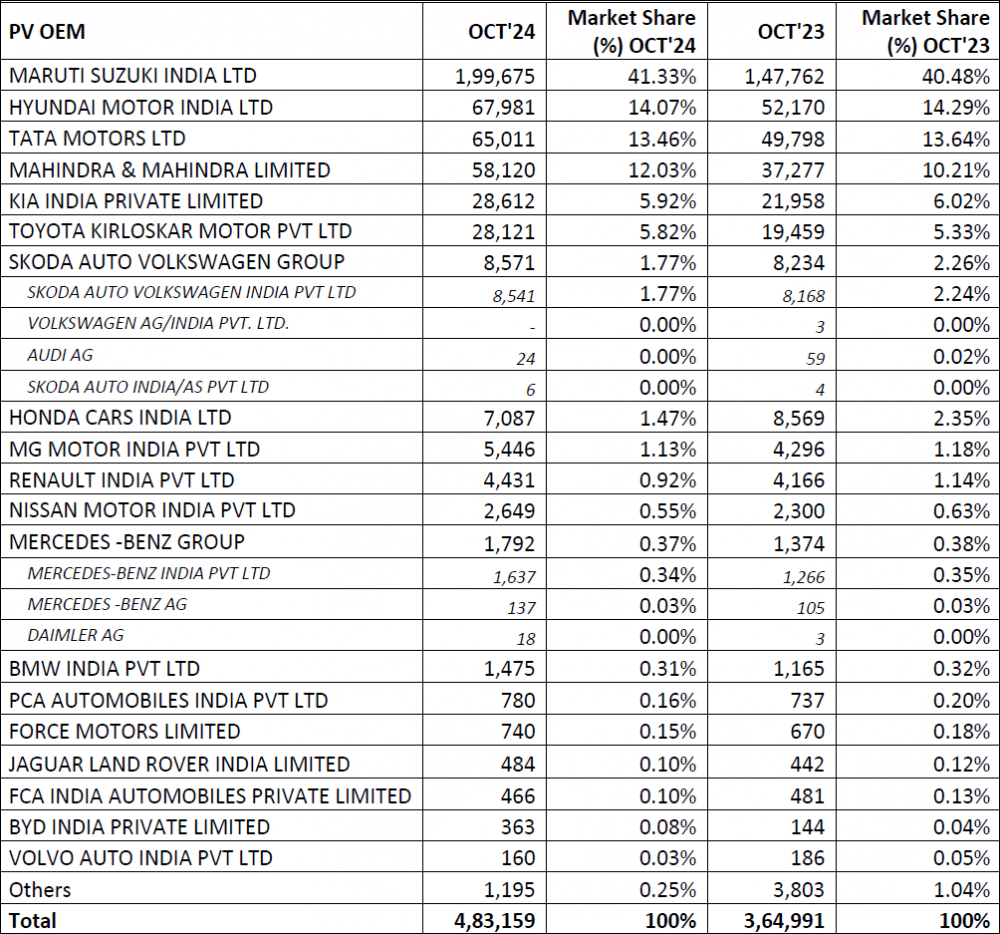

This impressive performance was again driven by the festivals coinciding in October, boosting consumer purchasing. Dealers highlighted that aggressive offers, attractive schemes and new model introductions further stimulated demand. Enhanced vehicle availability and strong market interest, especially for SUVs and new products, also contributed to the exceptional sales. However, despite strong sales, PV OEMs continue to heavily stock dealers, resulting in inventory levels decreasing by only five days, with overall inventory still at a high of 75–80 days. This may thus lead the season of substantial discounts to continue until the end of the calendar year.

The commercial vehicle segment registered a modest 6% YoY growth. Factors contributing to this included supportive agricultural markets and bulk purchases, particularly for container movements. The festive season, featuring both Diwali and Dussehra, also stimulated demand, along with some recovery from September's slowdown due to rains. However, dealers faced challenges such as slow demand, sluggish construction activities, financial issues among customers and increased vehicle prices leading to higher EMIs. Overall, while there were areas of growth, the CV market faced headwinds that tempered its overall performance.”

Near-Term Outlook

Looking ahead, the Indian auto industry is poised for continued robust retail performance through the end of the calendar year. With an estimated 4.8 million weddings scheduled nationwide in November and December 2024, Indian retail is preparing for an unprecedented surge in demand for wedding-related goods and services. Vehicle purchases also traditionally witnesses an uptick during the wedding season, and FADA anticipates that this will translate into strong sales in both, the 2W and PV segments in the near term.

In the 2W category, positive factors such as good crop yields, favorable rural sentiments and the upcoming marriage season are expected to drive demand. In the CV segment, while supportive agricultural markets and continued bulk purchases may contribute positively, dealers remain vigilant due to factors like sluggish construction activities, financial constraints among customers and an anticipated decrease in demand post-festivities. For PV, the marriage season and ongoing promotional offers are expected to sustain demand. Yet, there are apprehensions about potential slowdowns caused by customers postponing purchases in anticipation of better year-end discounts. FADA also urges, PV OEMs to further rationalise supply.

Overall, while the industry is optimistic about near-term growth driven by the wedding season and favourable market conditions, dealers are mindful of potential challenges that could affect sales momentum as the year concludes. The mixed sentiments reflected in the survey highlight the need for strategic planning and cautious optimism as the auto sector navigates the remaining months of the year.

Key Findings from our Online Members Survey

§ Liquidity

o Good 48.35%

o Neutral 38.93%

o Bad 12.72%

§ Sentiment

o Good 50.64%

o Neutral 34.86%

o Bad 14.50%

§ Expectation from November’24

o Flat 39.69%

o Growth 37.15%

o De-growth 23.16%