Thread Starter

#1

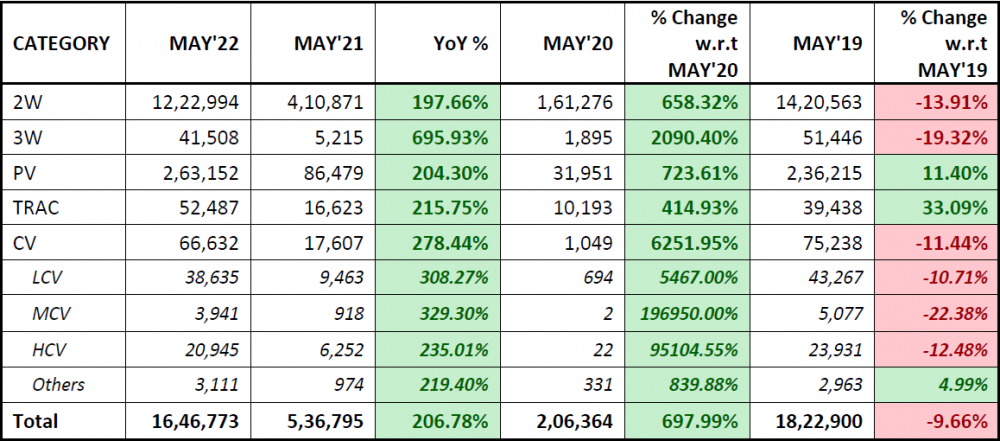

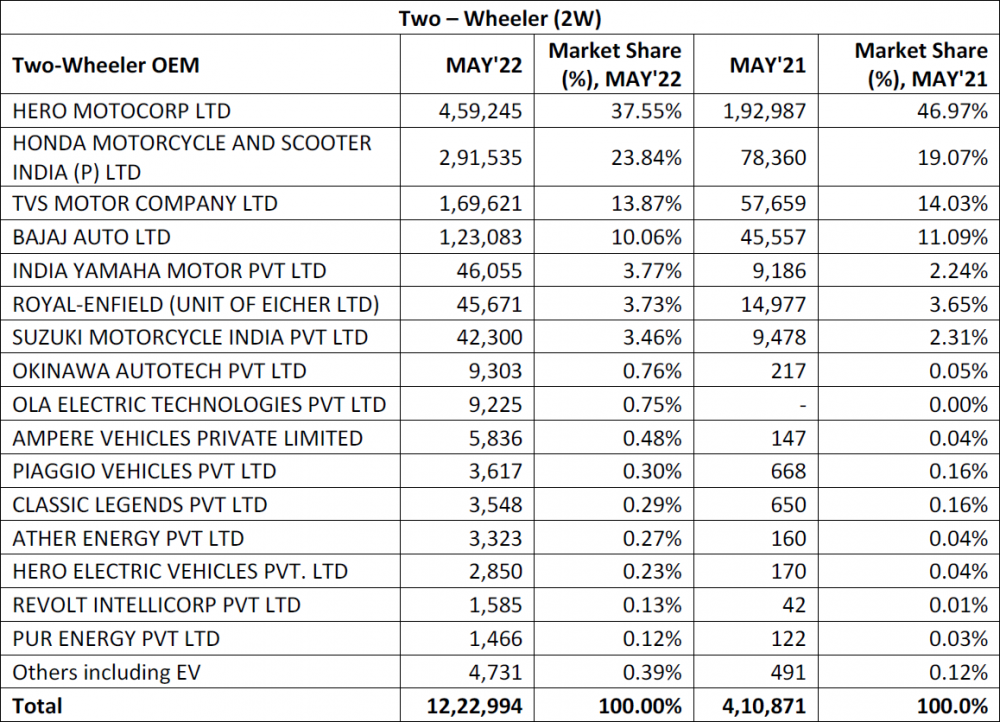

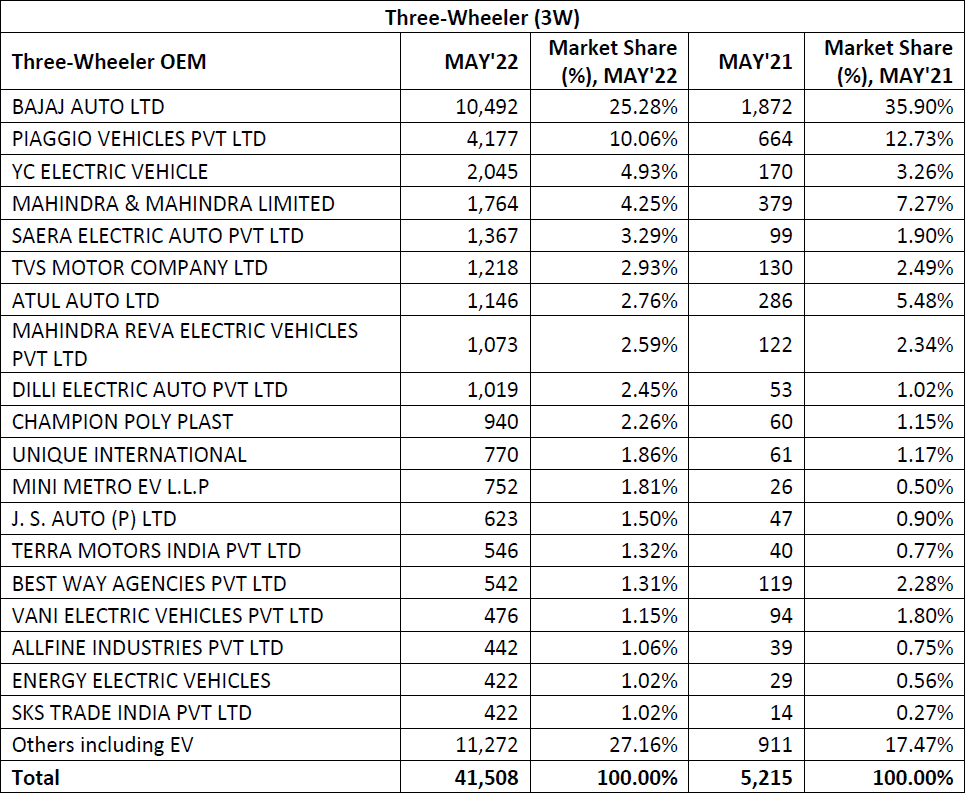

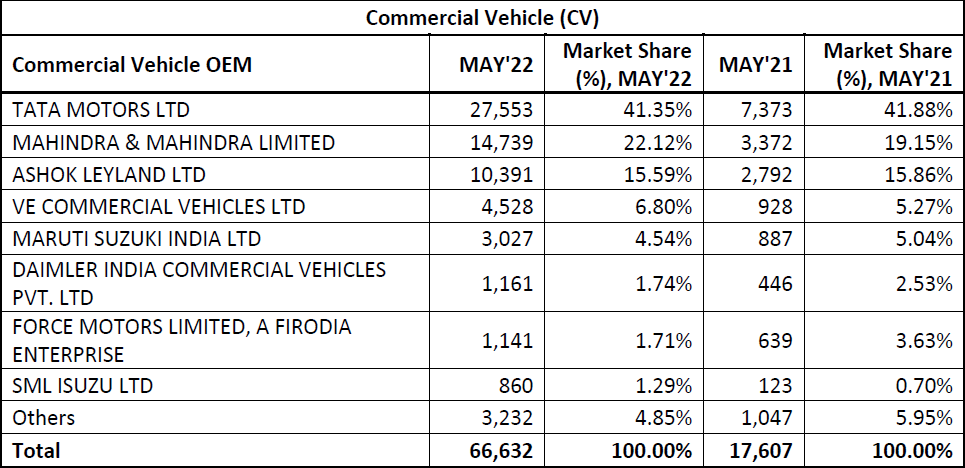

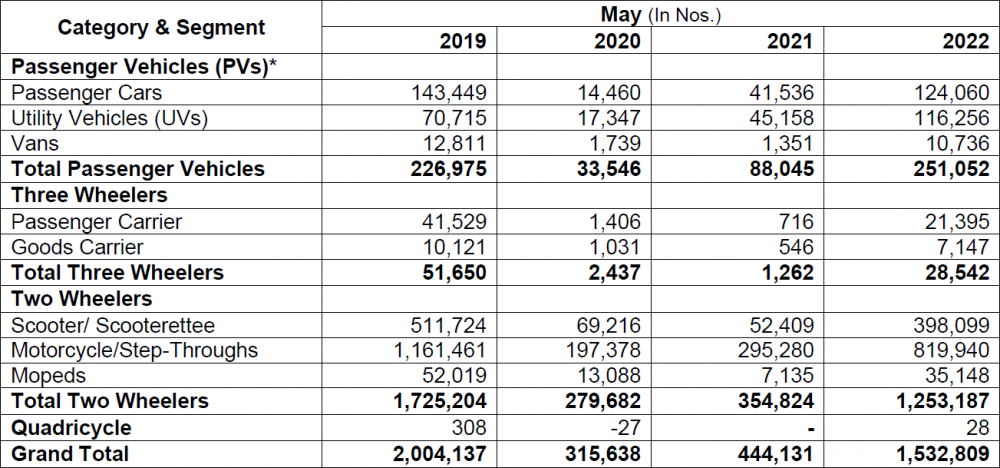

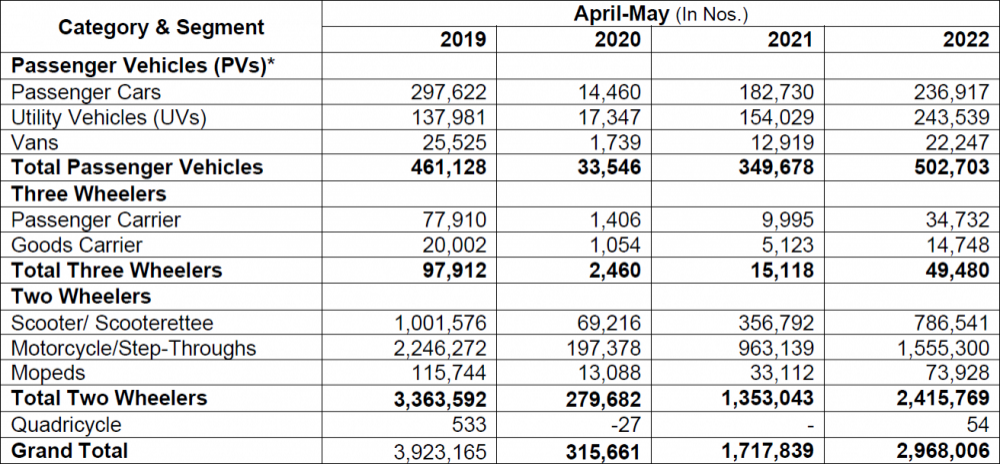

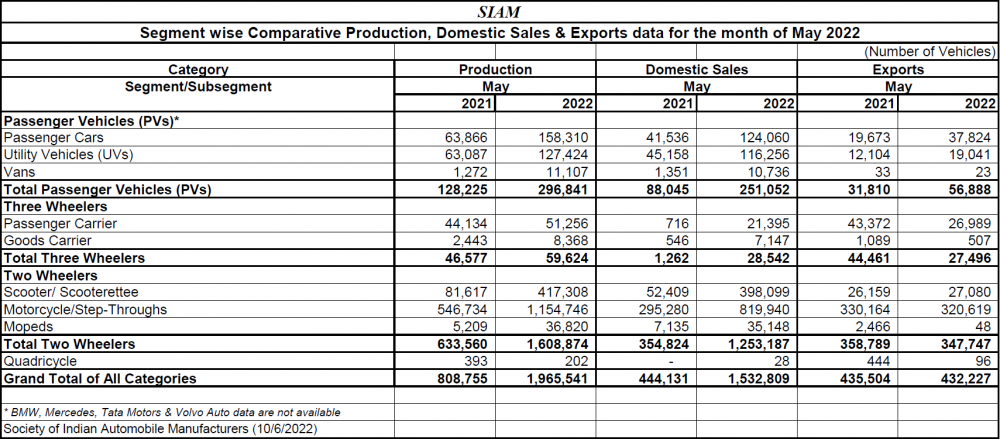

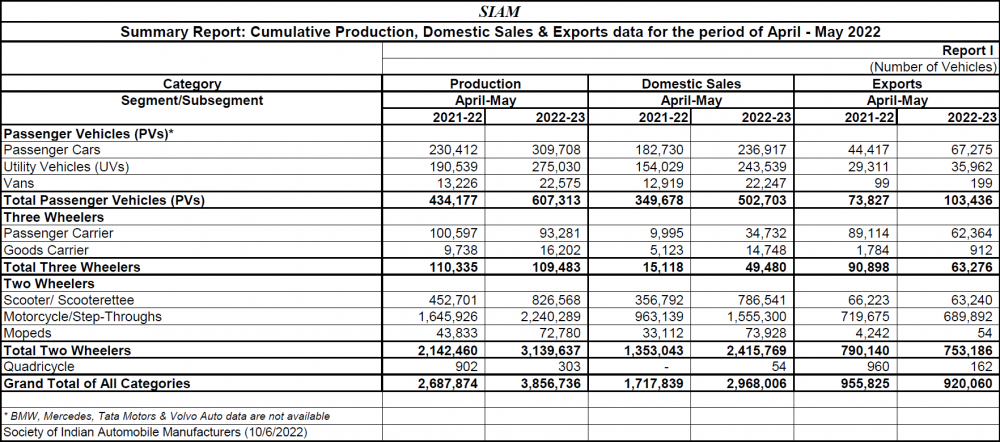

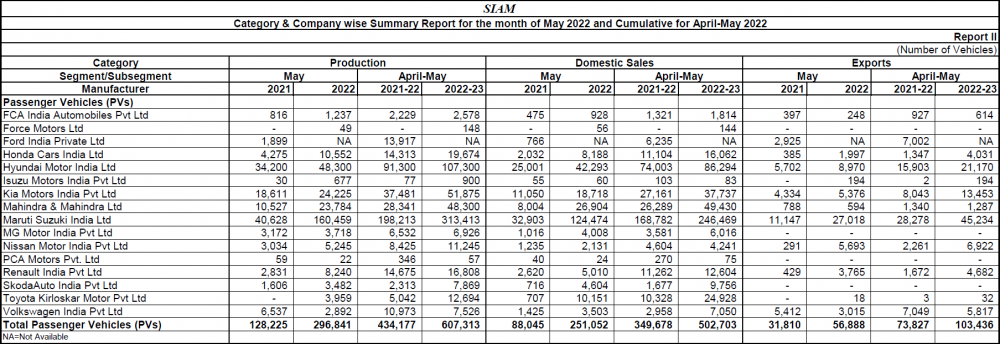

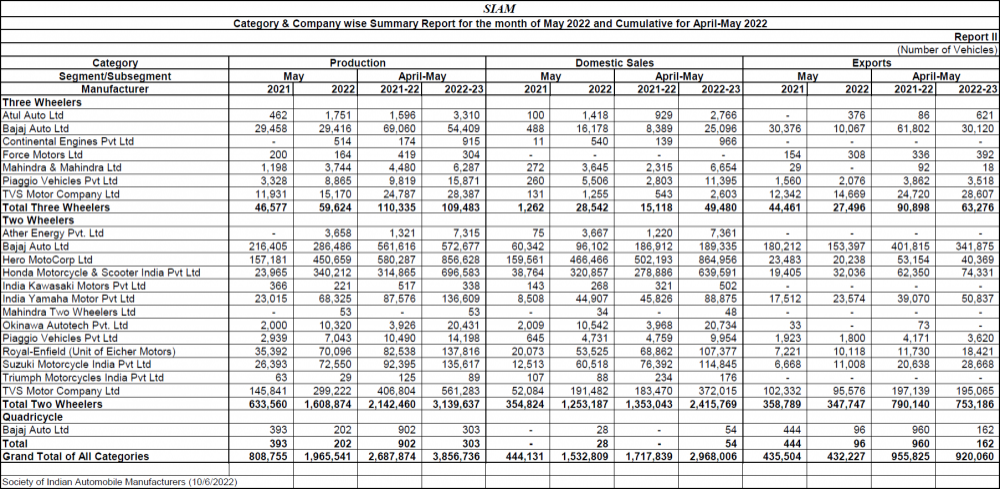

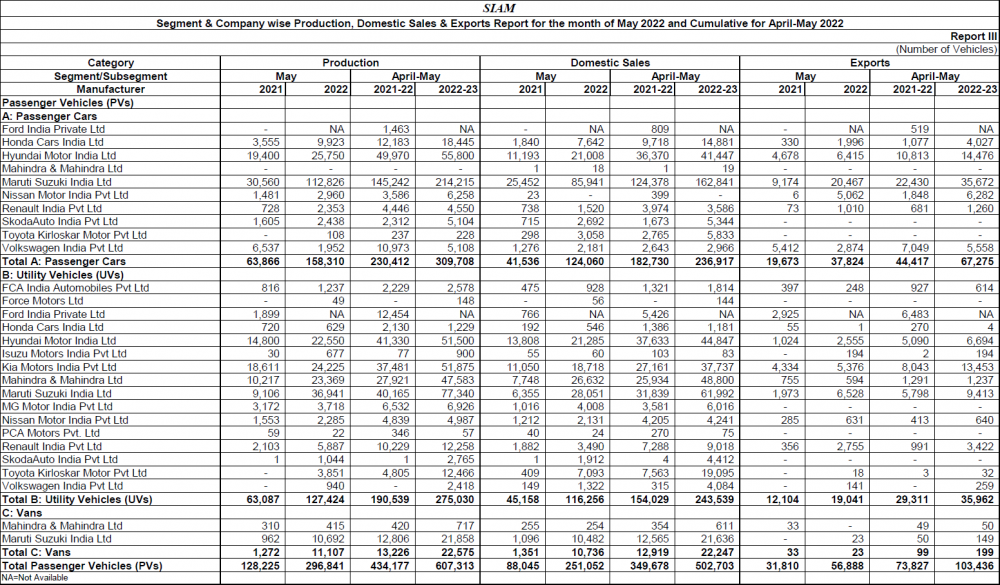

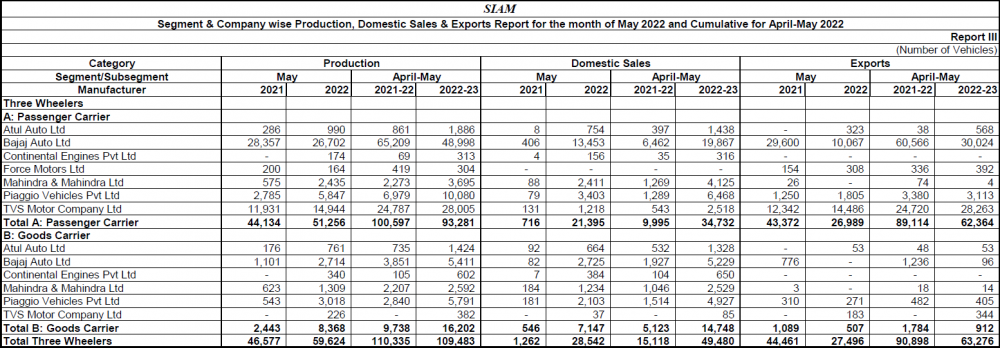

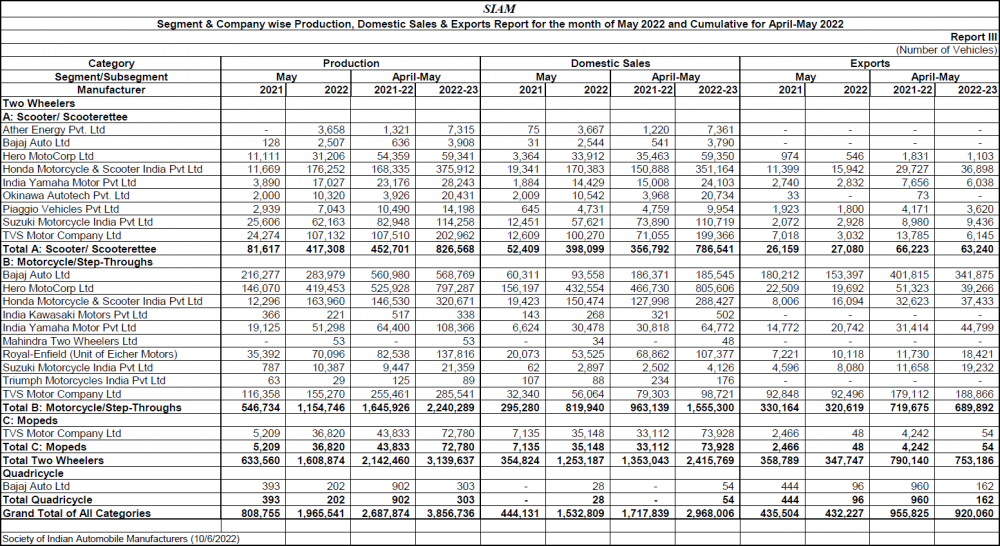

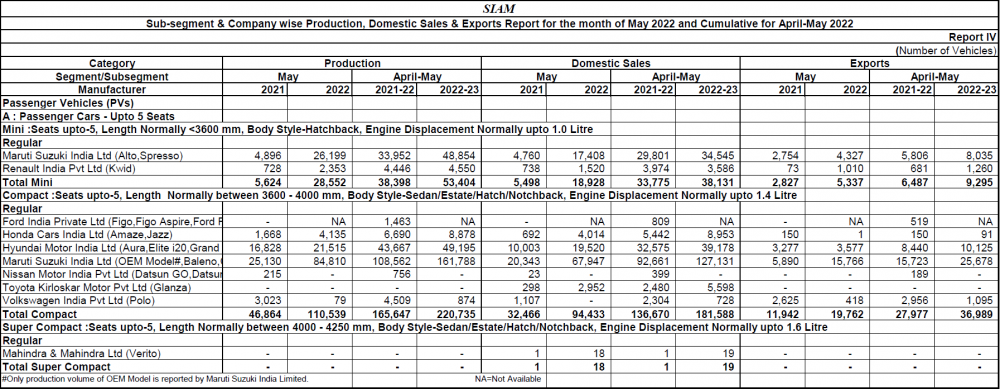

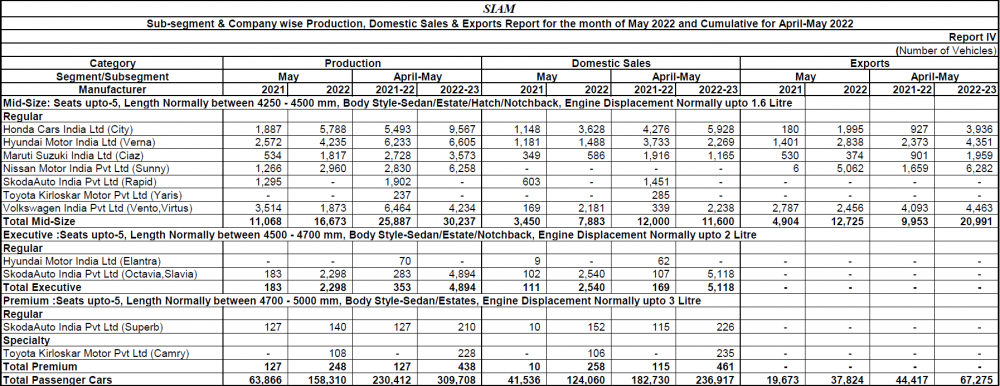

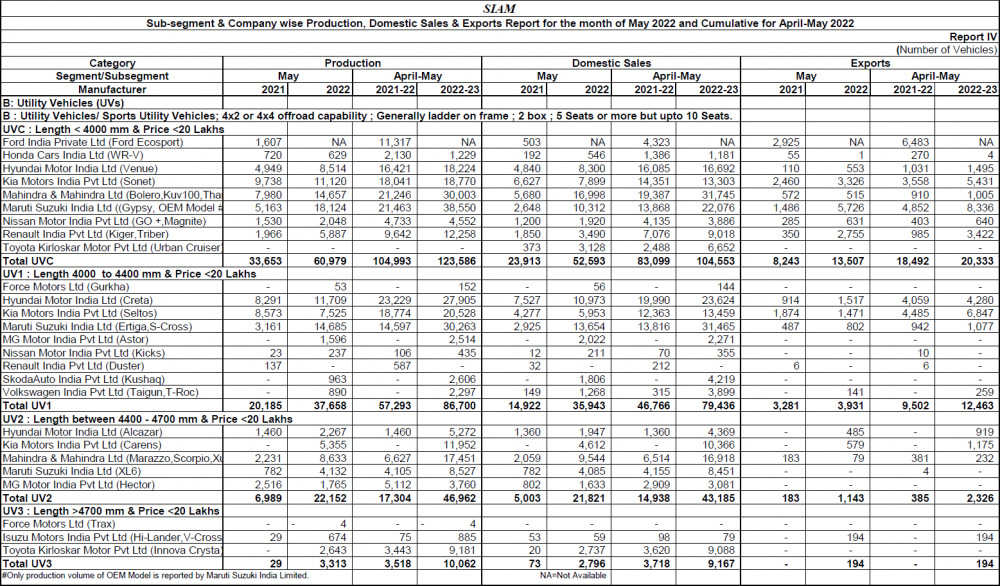

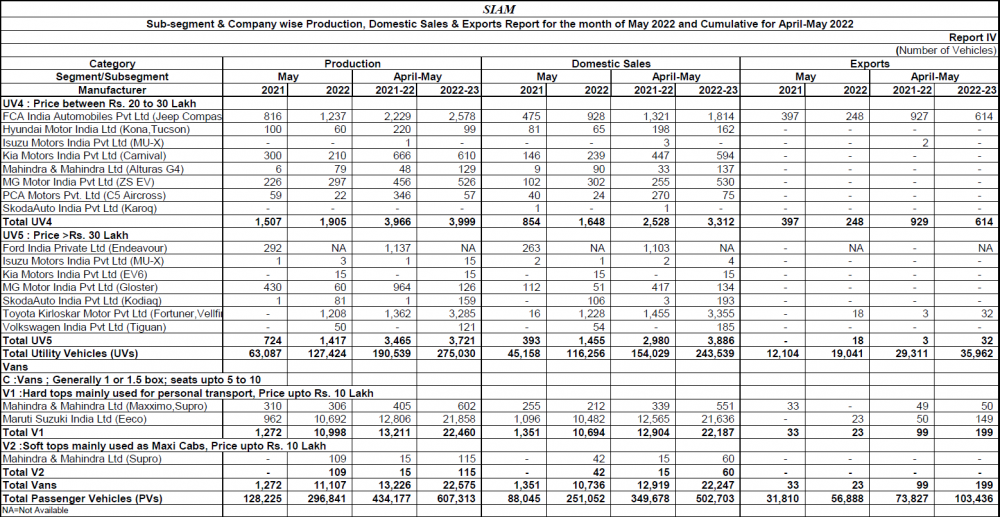

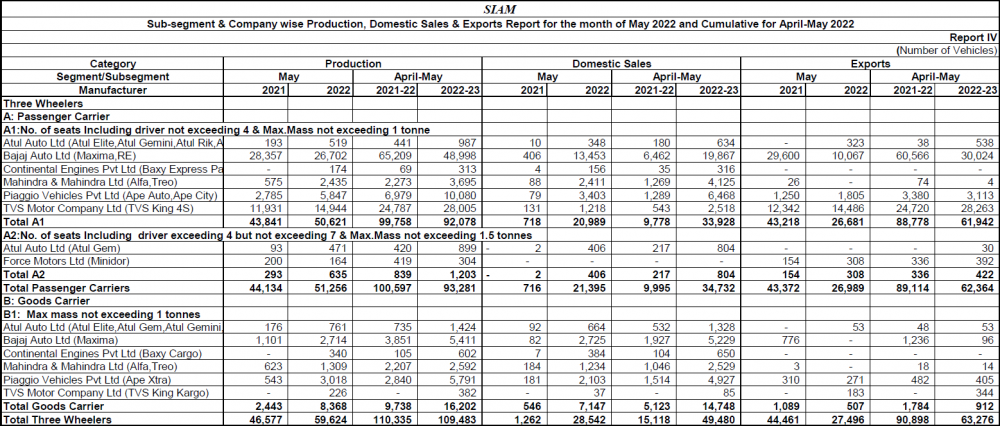

May 2022 Indian Car Sales

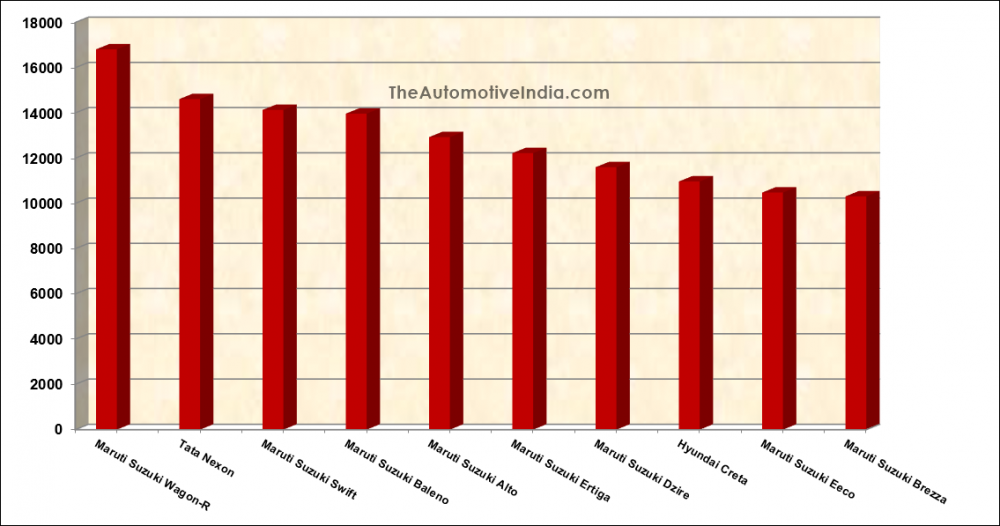

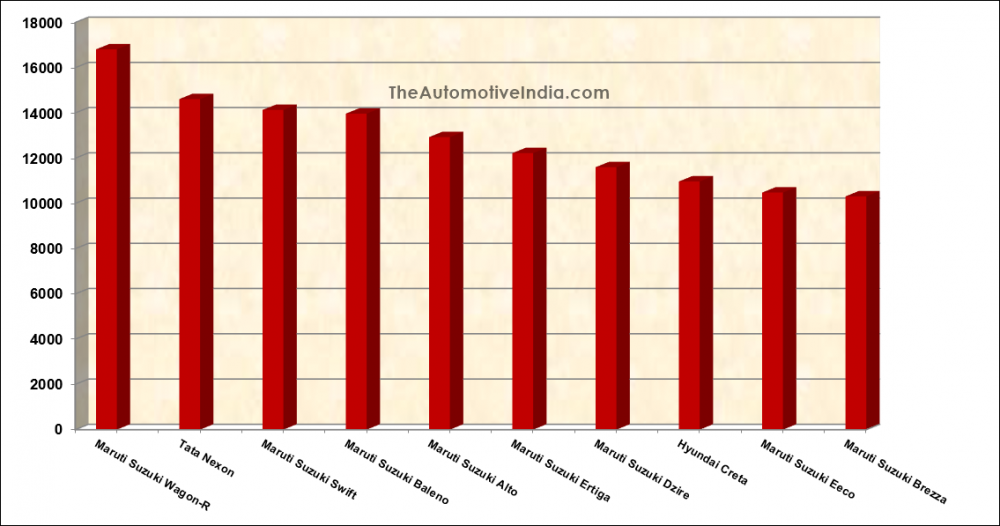

Top 10 Hot Selling Cars: May 2022

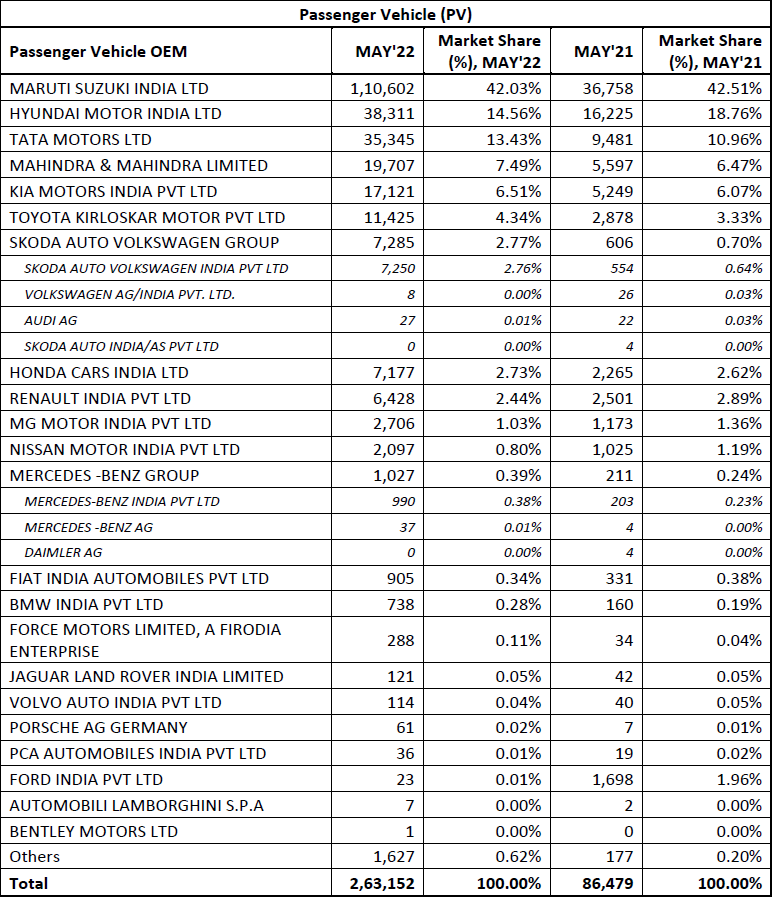

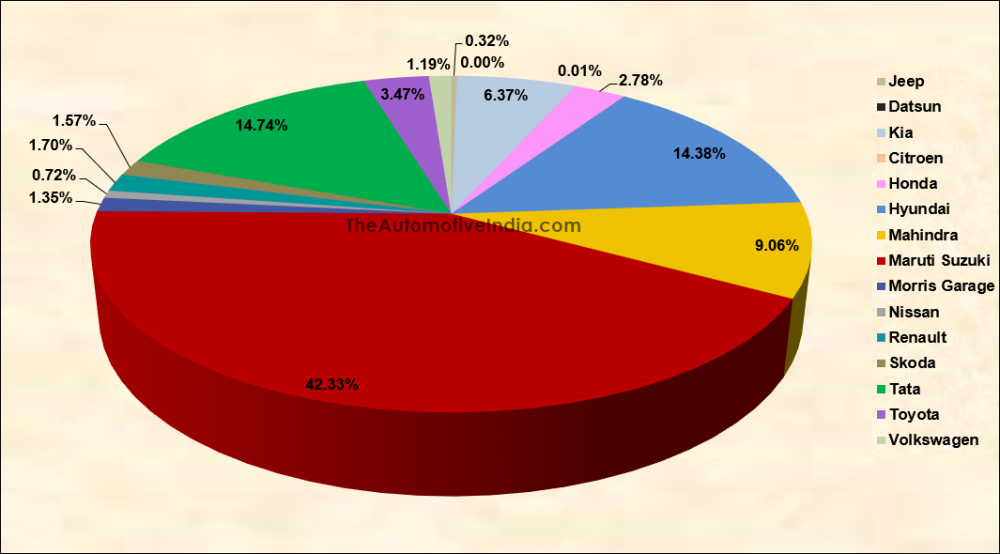

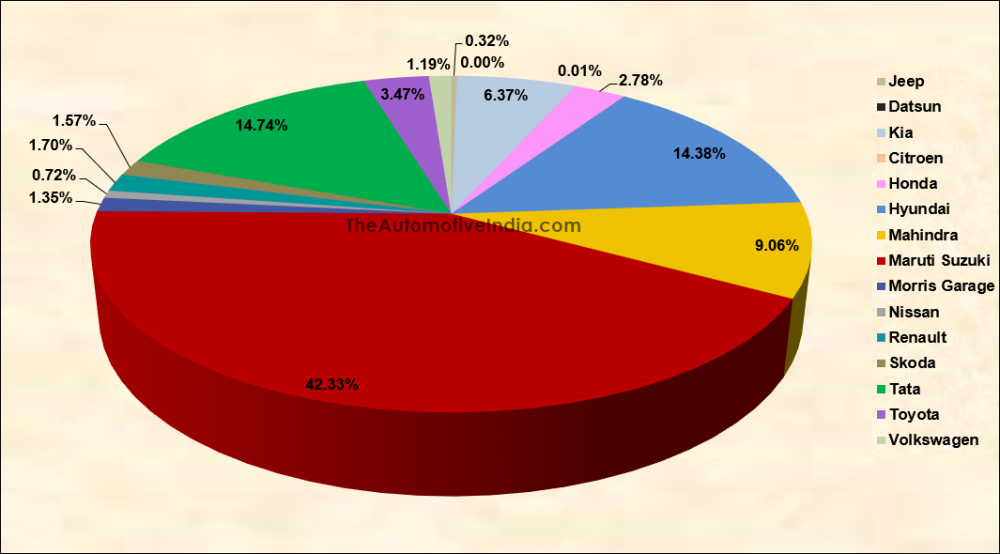

Manufacturer's Market Share: May 2022

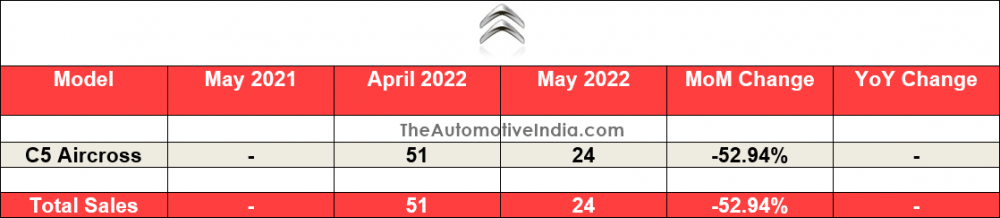

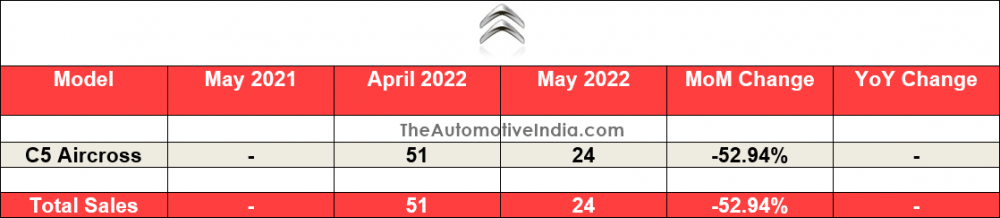

Citroën May 2022 Indian Car Sales

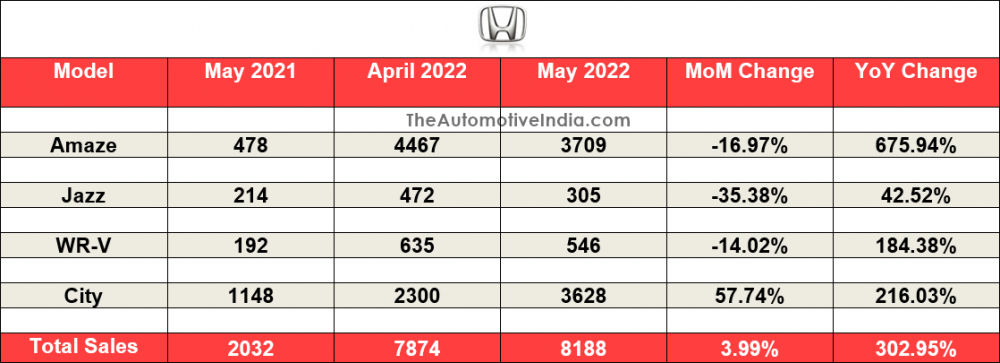

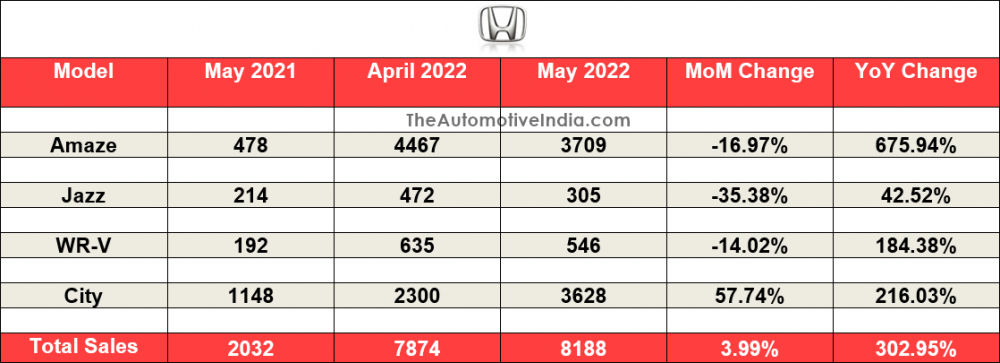

Honda May 2022 Indian Car Sales

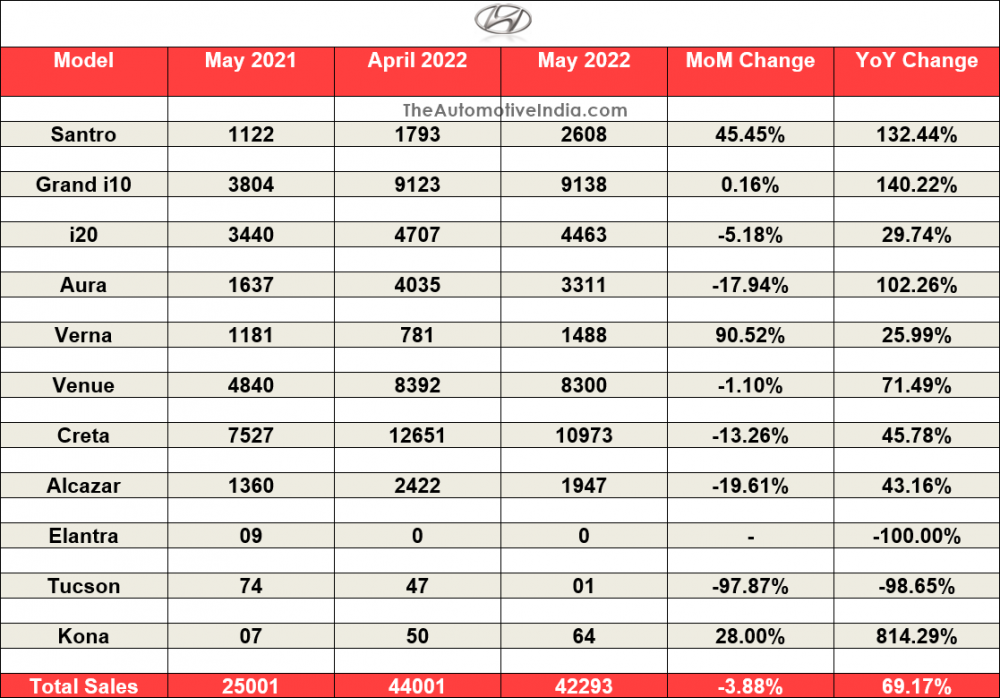

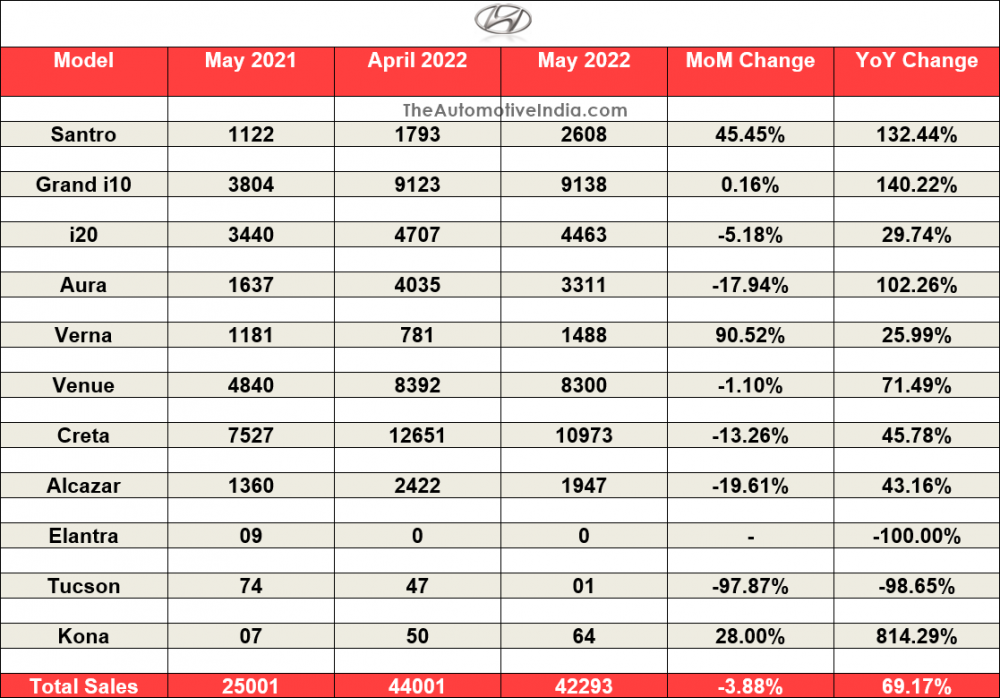

Hyundai May 2022 Indian Car Sales

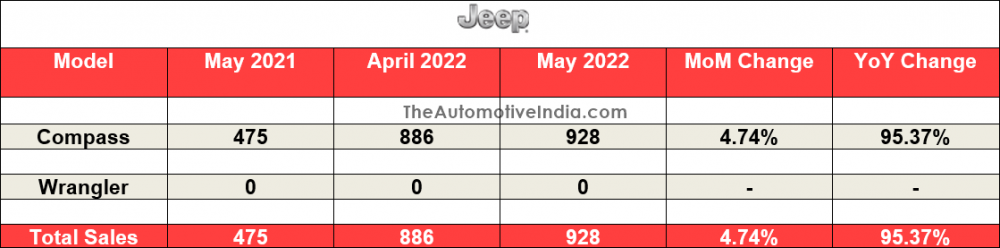

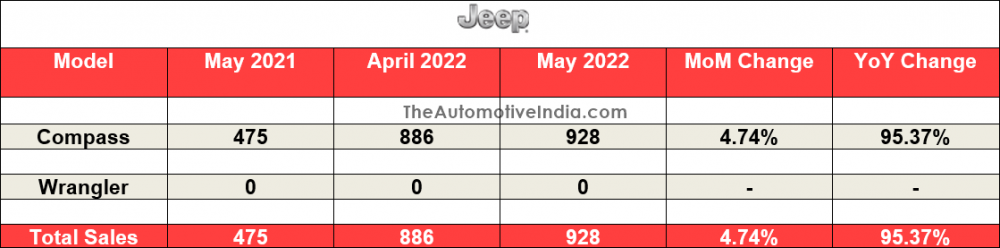

Jeep May 2022 Indian Car Sales

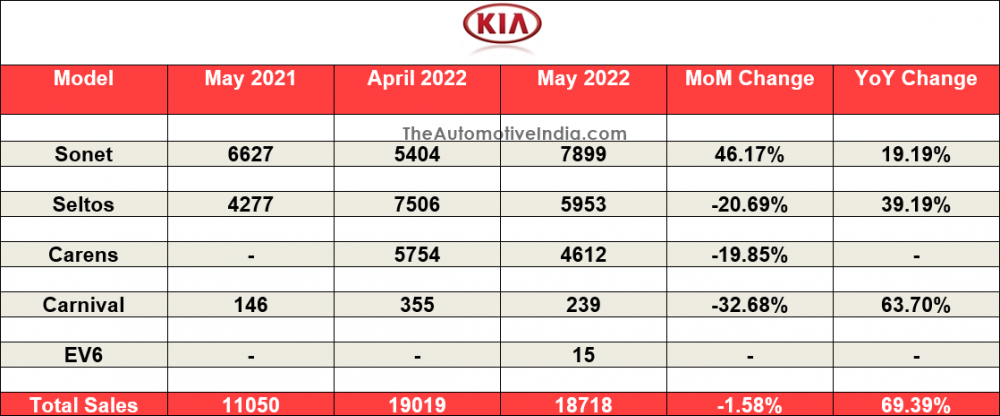

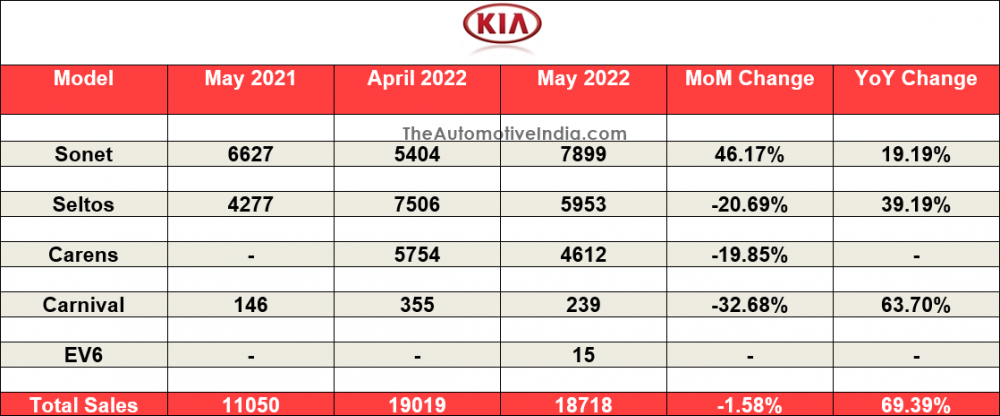

Kia May 2022 Indian Car Sales

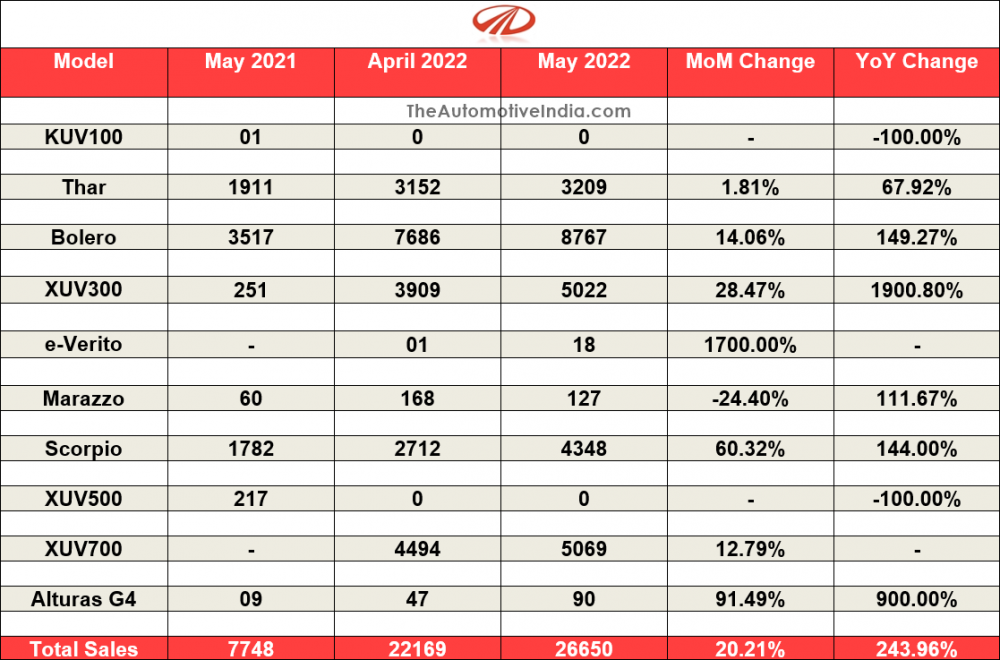

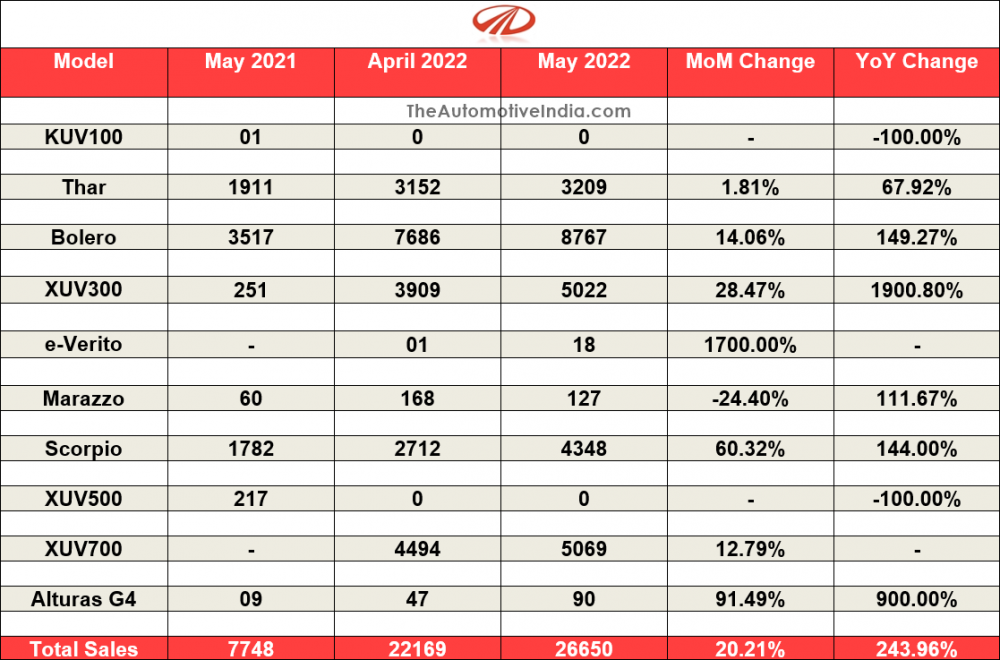

Mahindra May 2022 Indian Car Sales

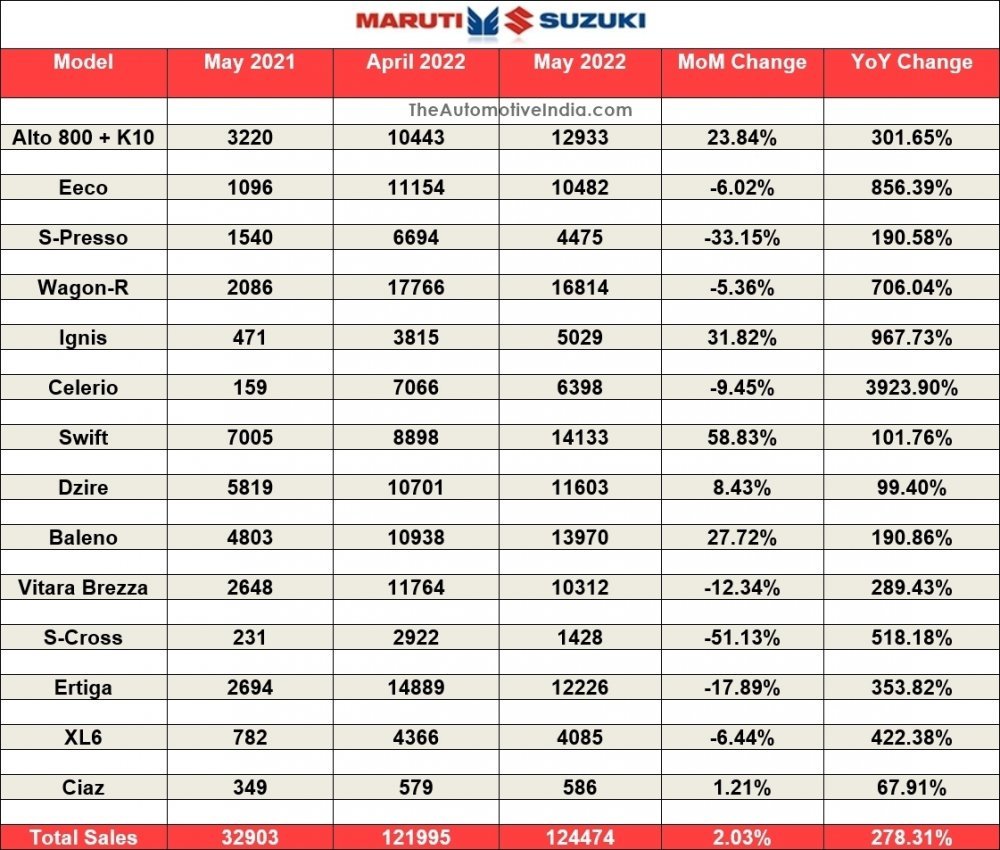

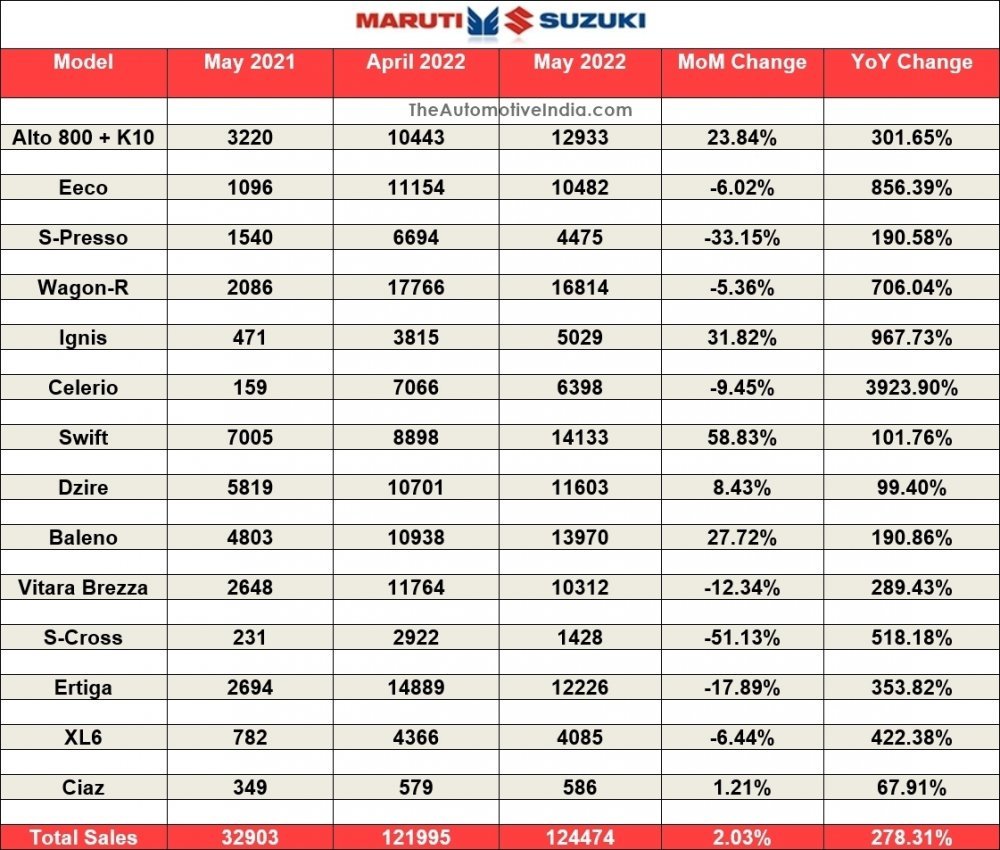

Maruti Suzuki May 2022 Indian Car Sales

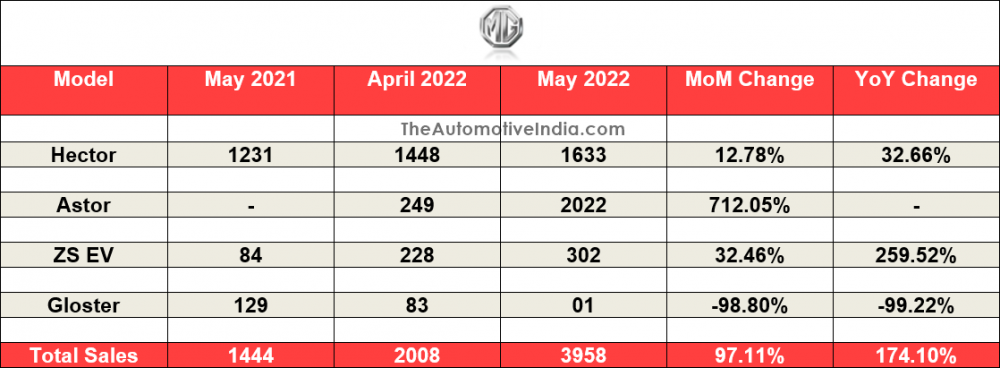

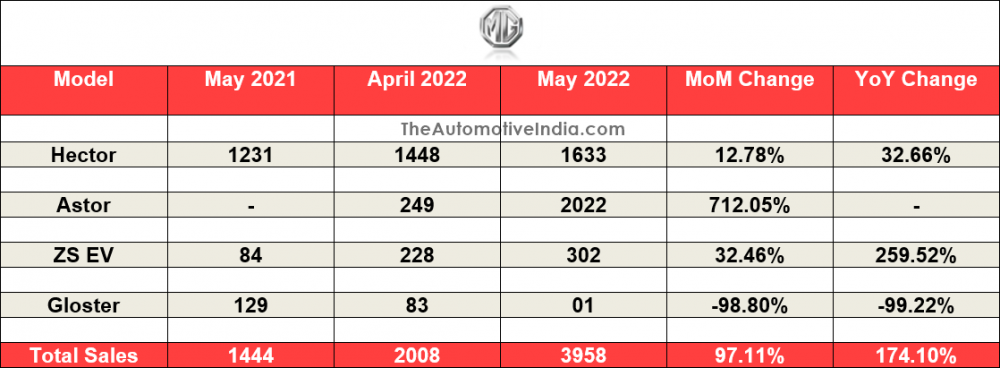

Morris Garages May 2022 Indian Car Sales

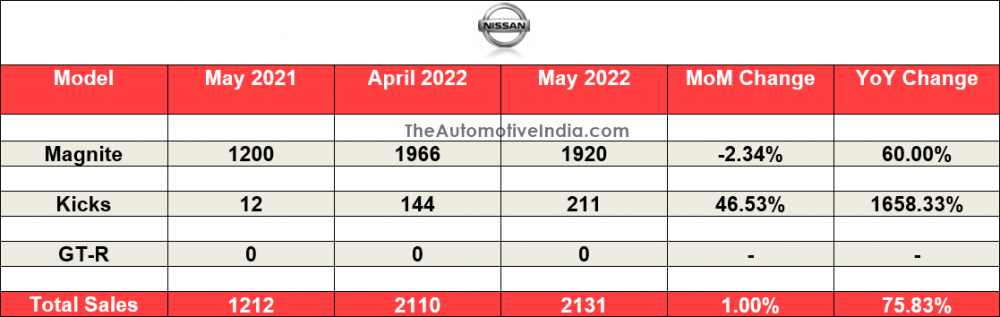

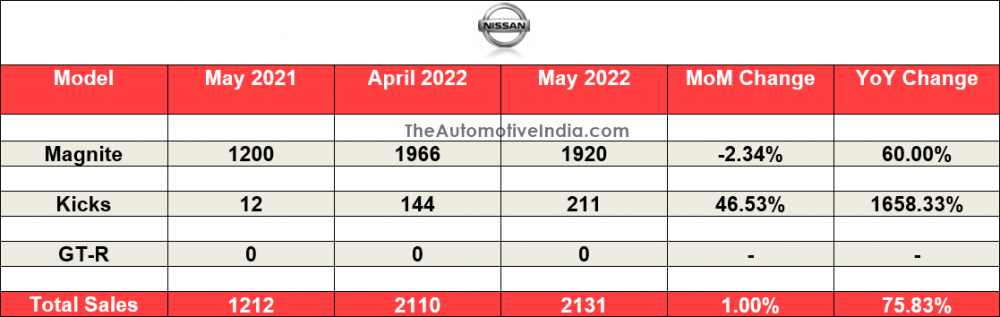

Nissan May 2022 Indian Car Sales

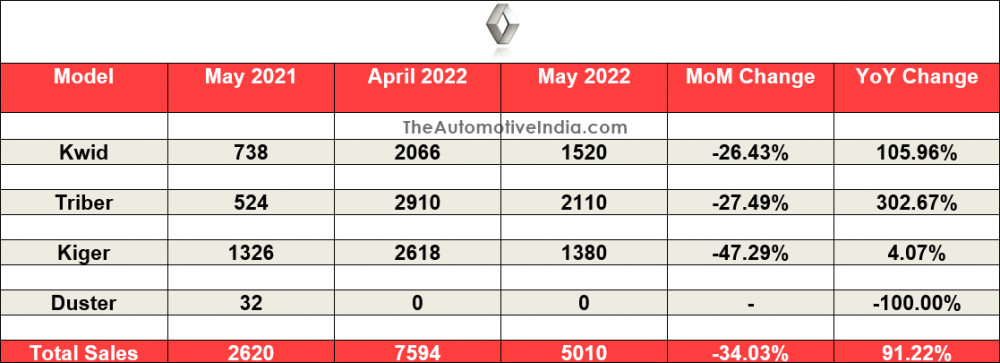

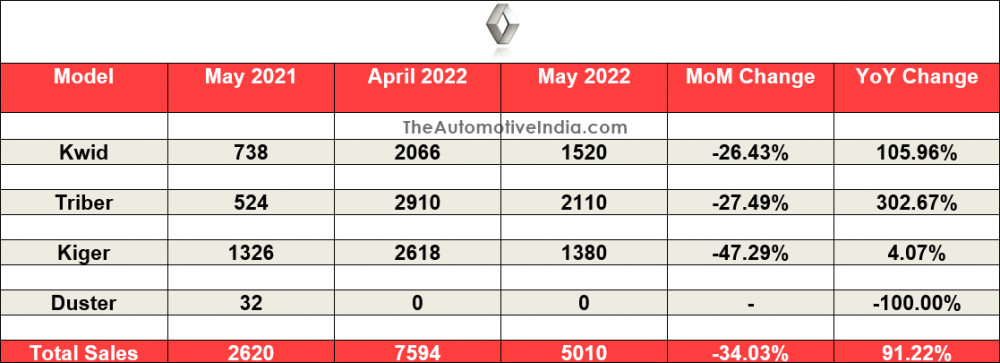

Renault May 2022 Indian Car Sales

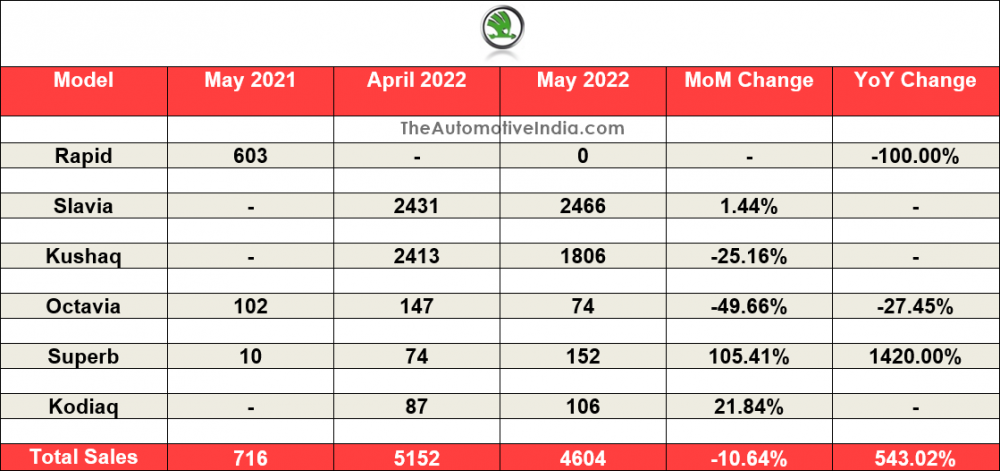

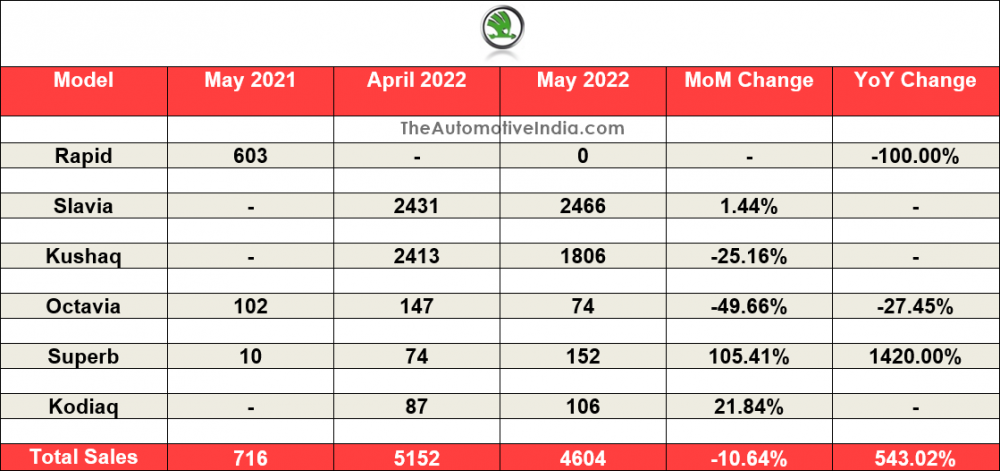

Skoda May 2022 Indian Car Sales

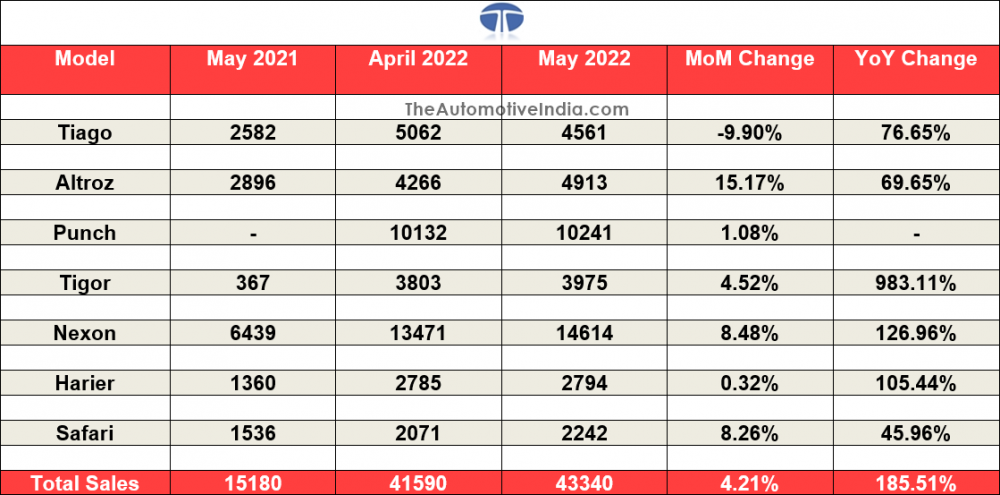

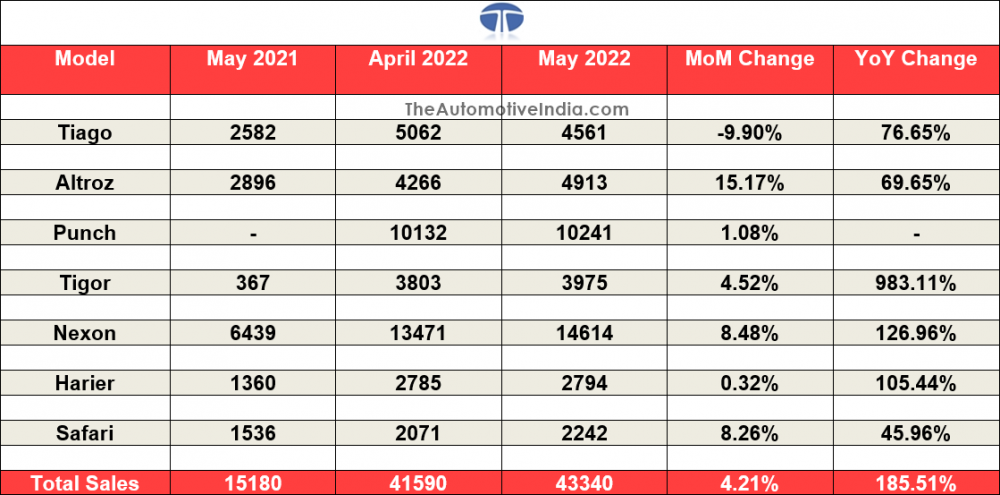

Tata Motors May 2022 Indian Car Sales

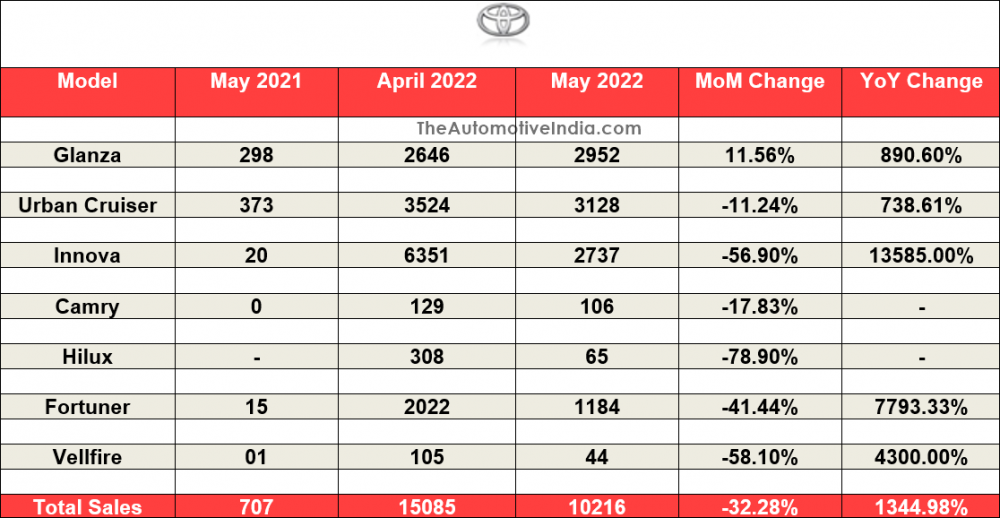

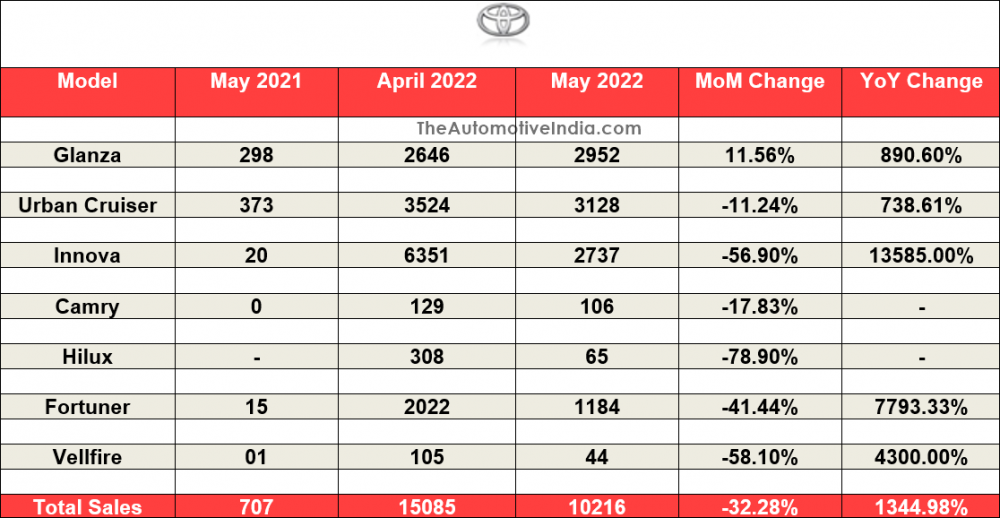

Toyota May 2022 Indian Car Sales

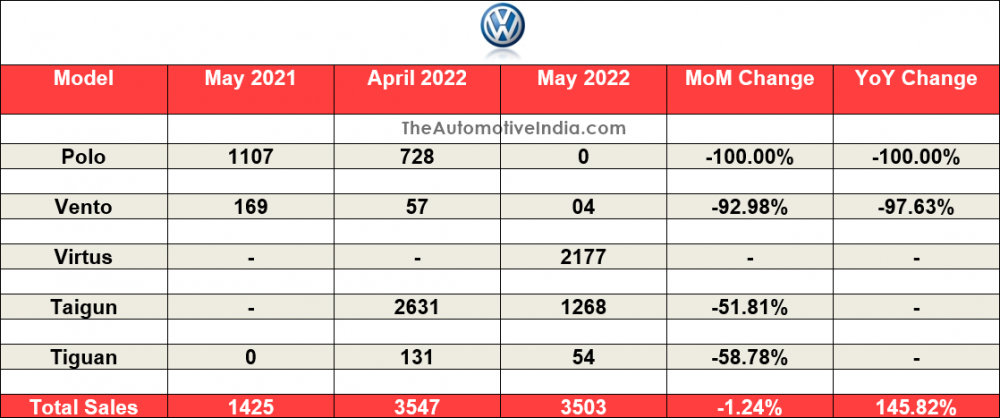

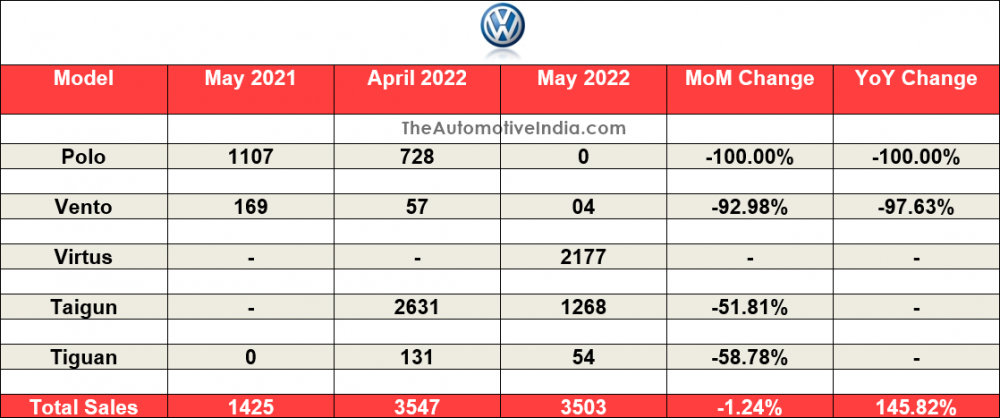

Volkswagen May 2022 Indian Car Sales

Top 10 Hot Selling Cars: May 2022

Manufacturer's Market Share: May 2022

Citroën May 2022 Indian Car Sales

Honda May 2022 Indian Car Sales

Hyundai May 2022 Indian Car Sales

Jeep May 2022 Indian Car Sales

Kia May 2022 Indian Car Sales

Mahindra May 2022 Indian Car Sales

Maruti Suzuki May 2022 Indian Car Sales

Morris Garages May 2022 Indian Car Sales

Nissan May 2022 Indian Car Sales

Renault May 2022 Indian Car Sales

Skoda May 2022 Indian Car Sales

Tata Motors May 2022 Indian Car Sales

Toyota May 2022 Indian Car Sales

Volkswagen May 2022 Indian Car Sales

Drive Safe,

350Z