Key Highlights from FY 2024-25

Overall

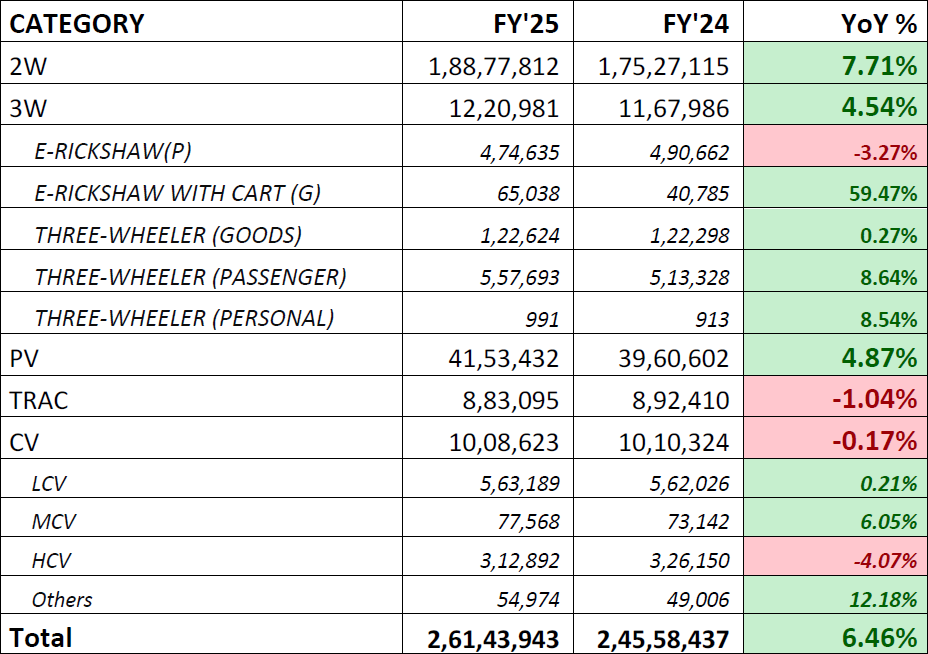

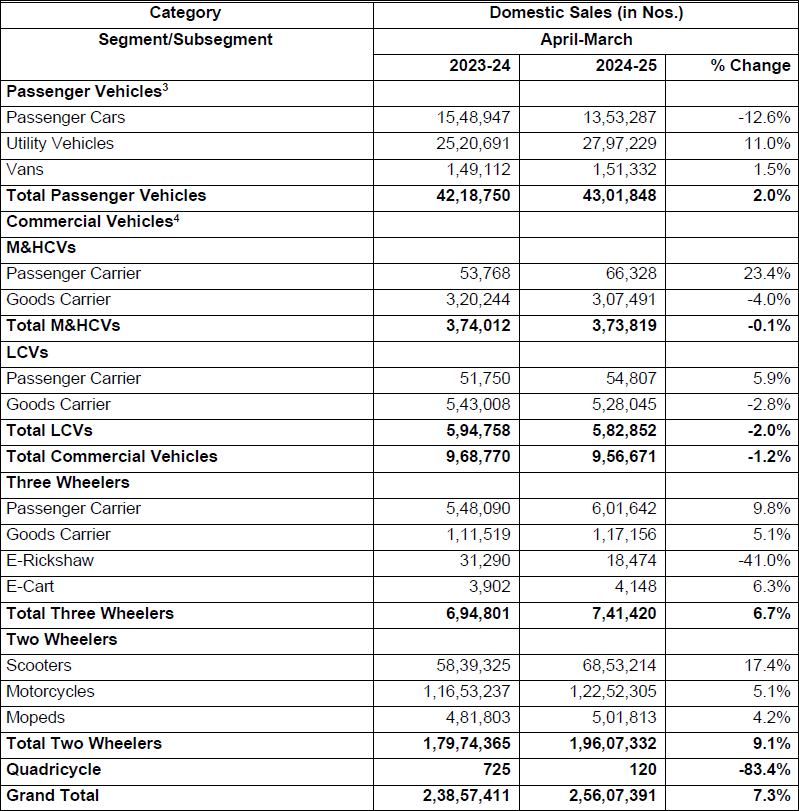

• Industry grew 7.3% in domestic sales, continuing its upward trajectory.

• Exports rose by 19.2%, reflecting strong global demand.

• Performance driven by healthy demand, infrastructure investments, supportive Government policies, and continued emphasis on sustainable mobility.

• Sound economic policies and positive market sentiment helped in maintaining growth.

Segment-wise

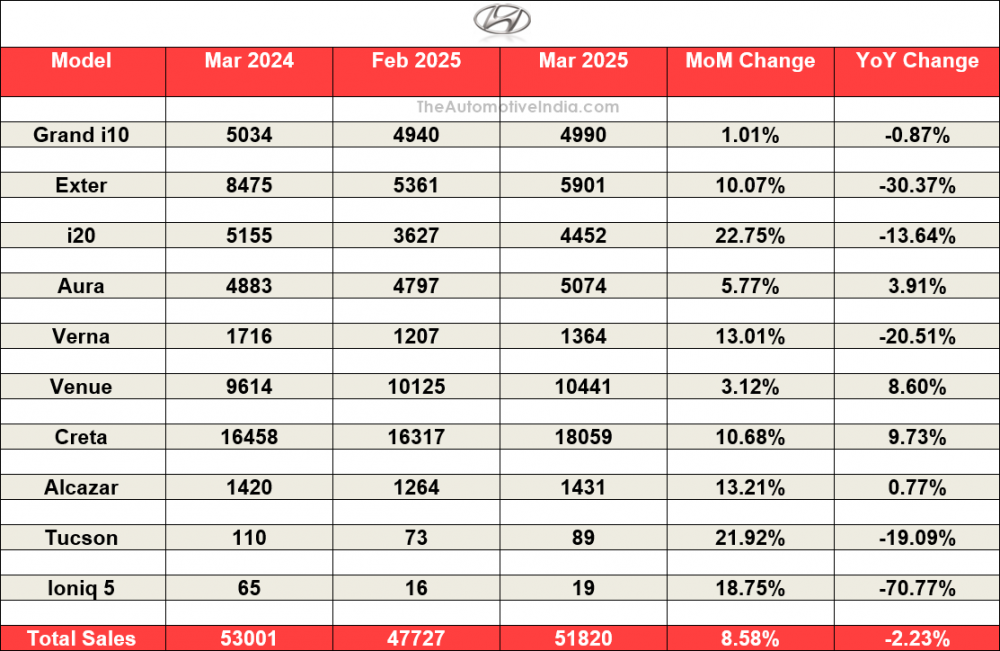

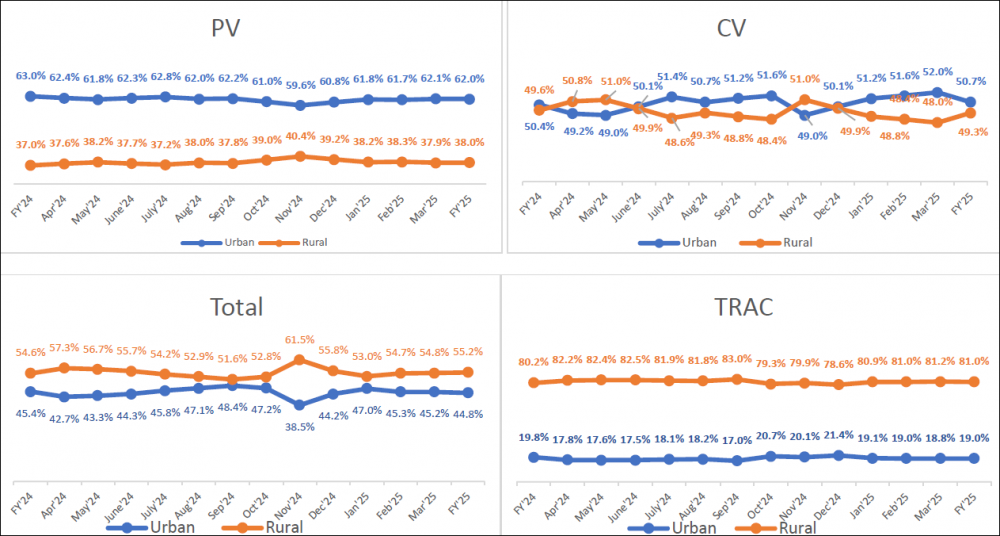

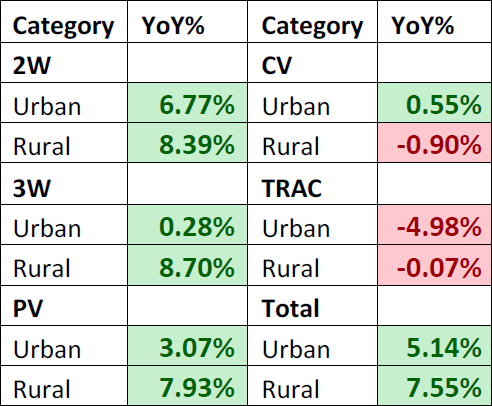

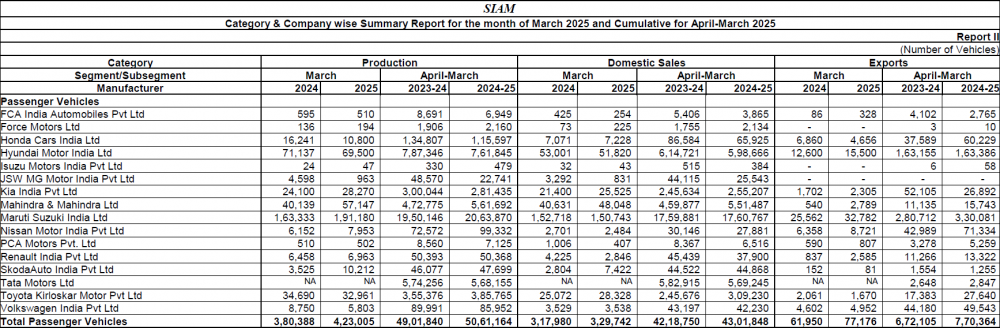

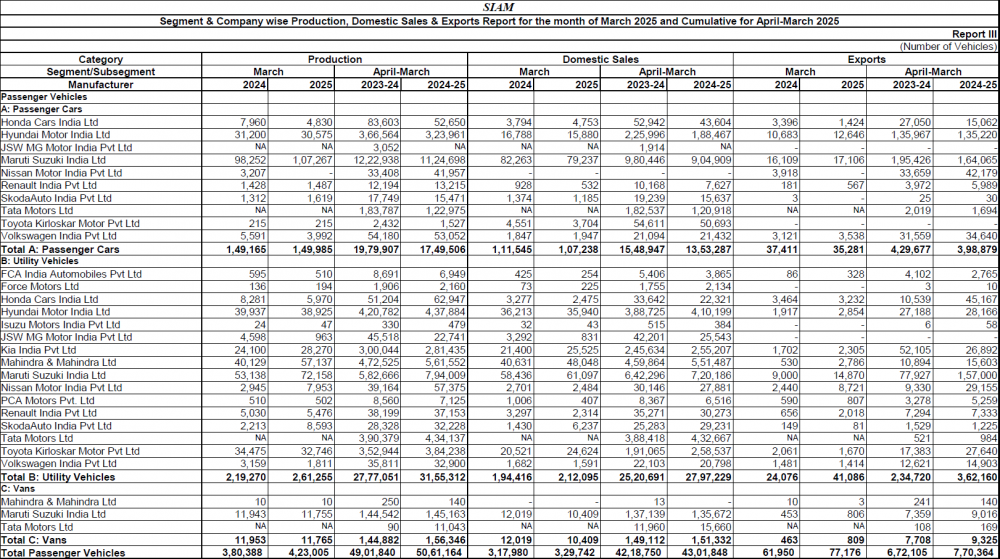

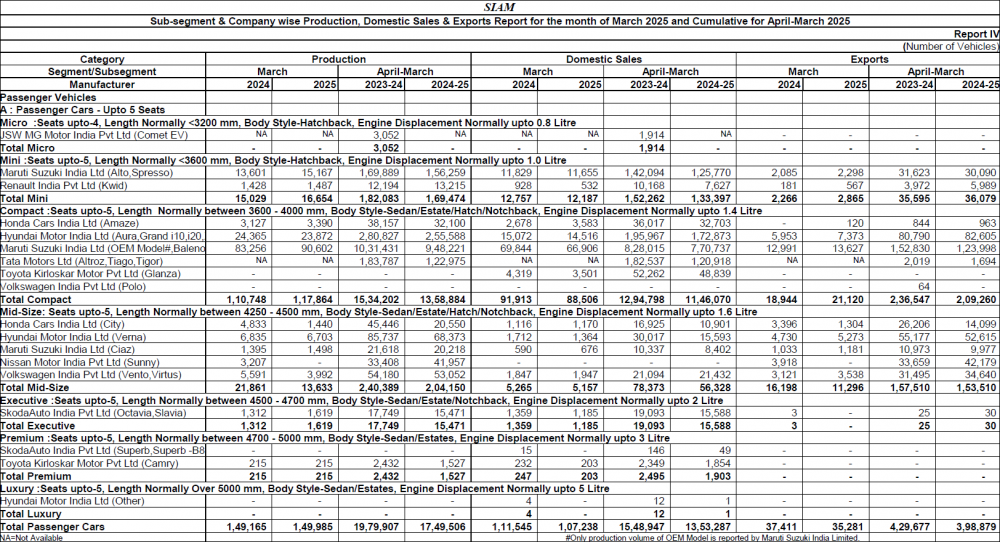

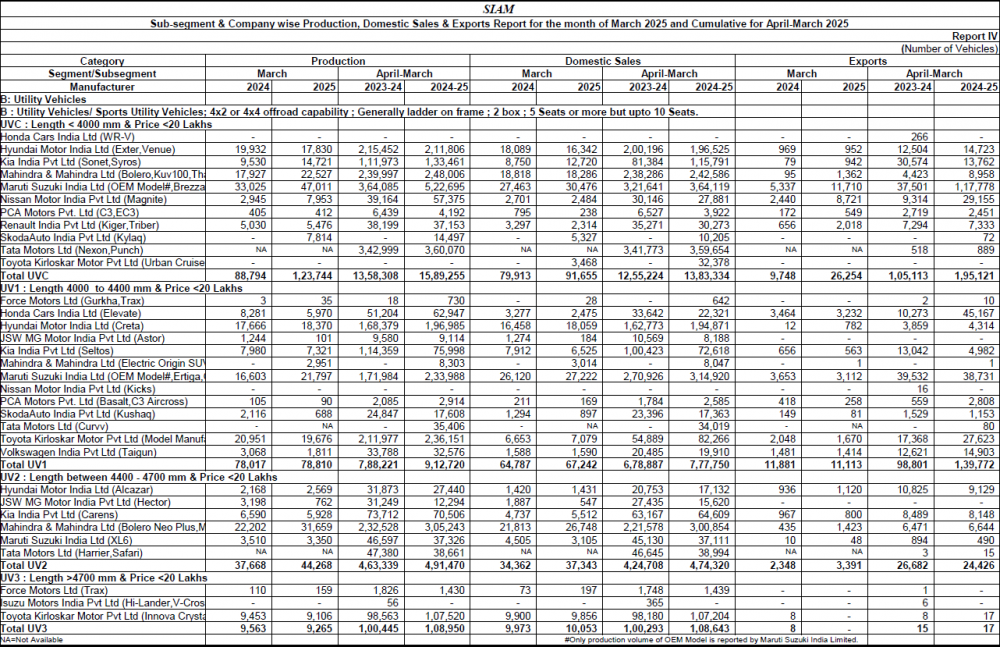

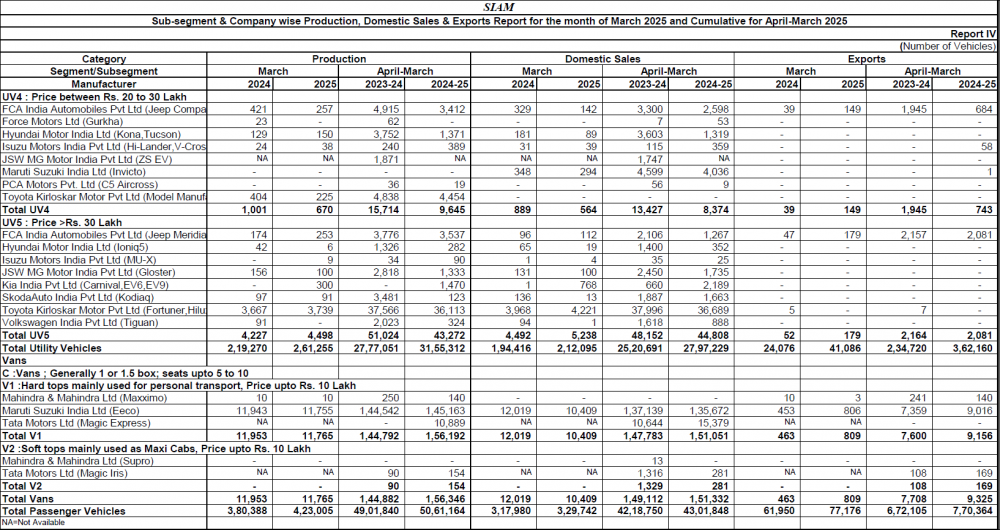

a) Passenger vehicles

• Passenger Vehicles (PV) posted its highest ever sales in FY 2024-25 of 4.3 million units, with a growth of 2% as compared to FY 2023-24.

• High base effect of FY 2023-24 resulted in moderate Growth.

• Utility Vehicles (UVs) continued to drive growth, now contributing 65% of total PV sales compared to about 60% in FY 2023-24.

• New model launches, packed with advanced features and modern design, resonated strongly with consumer aspirations.

• Attractive discounts and promotional offers supported growth momentum and helped sustain volumes.

• Passenger Vehicles also saw their highest ever exports in FY 2024-25 of 0.77 million units registering a growth of 14.6% as compared to FY 2023-24. Growth in exports have been driven by demand of global models being manufactured from India in markets of Latin America and Africa. Some companies have also commenced exporting to Developed markets.

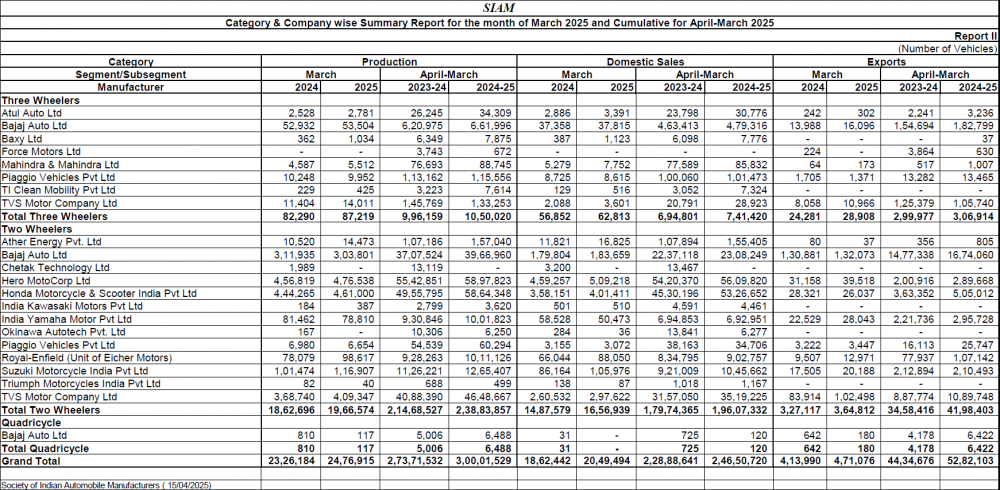

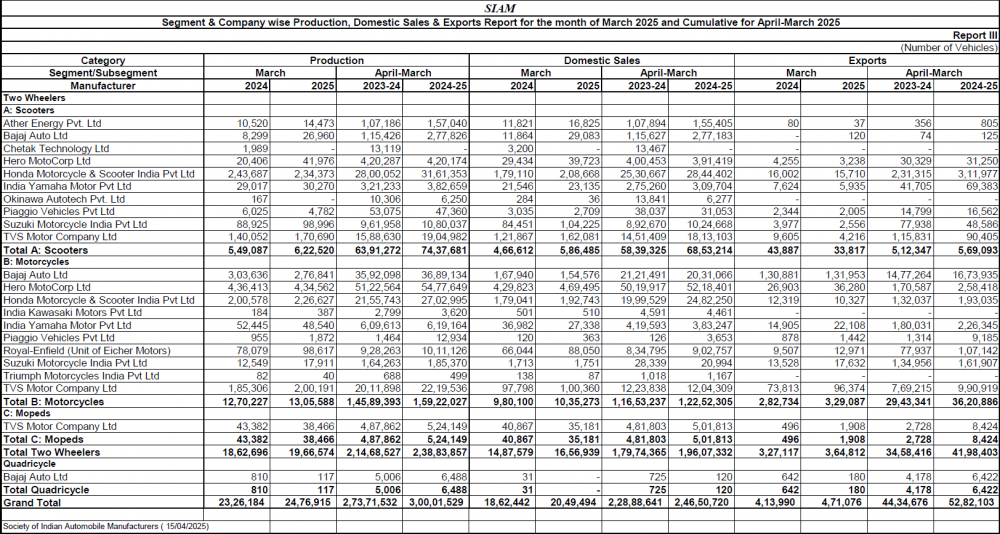

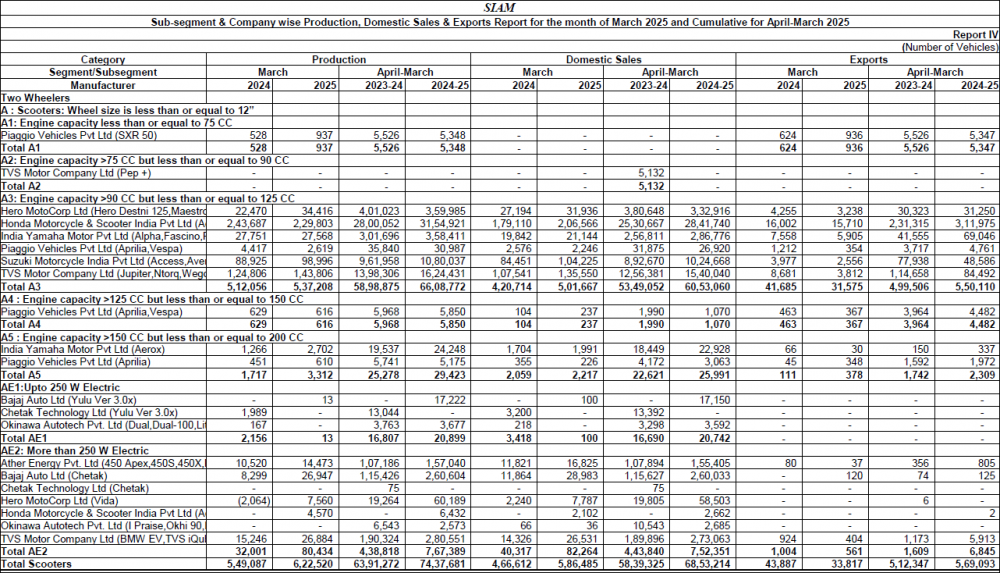

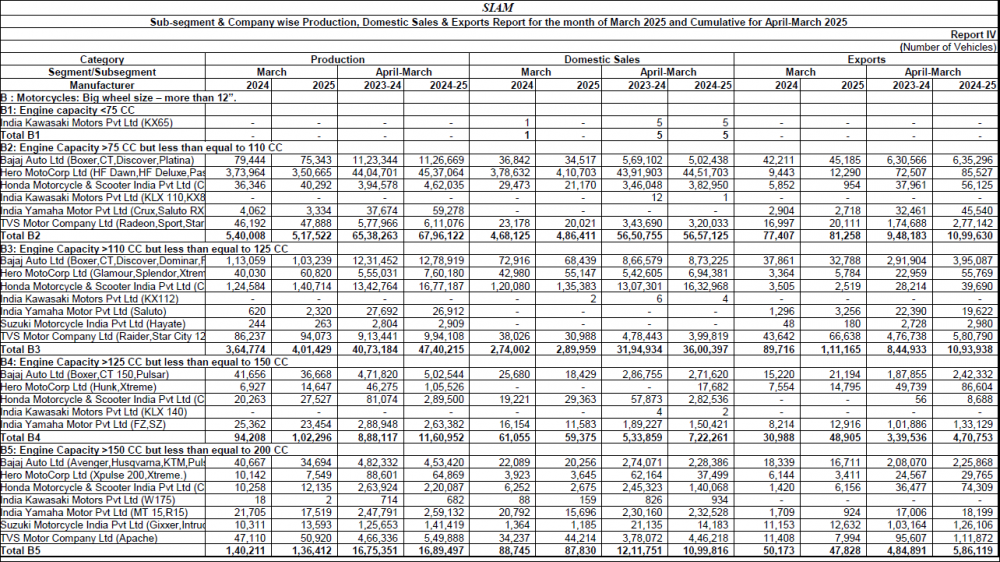

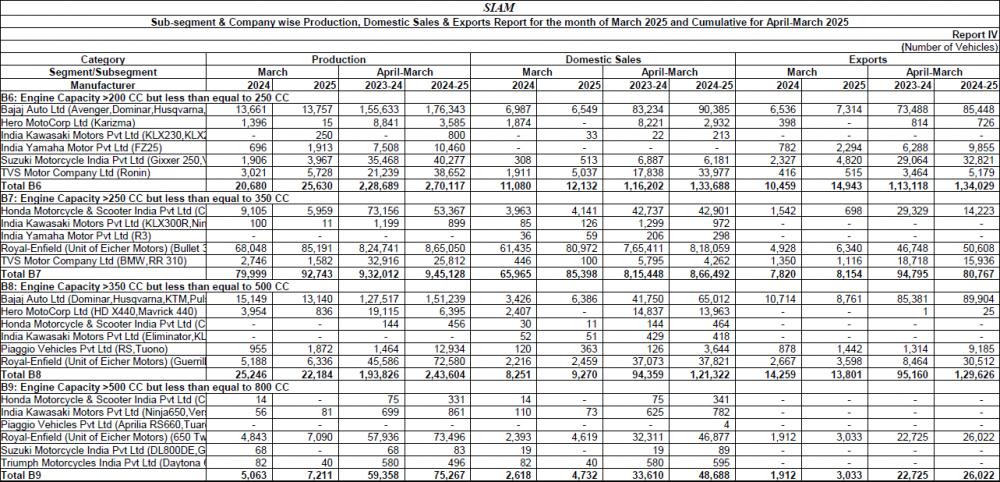

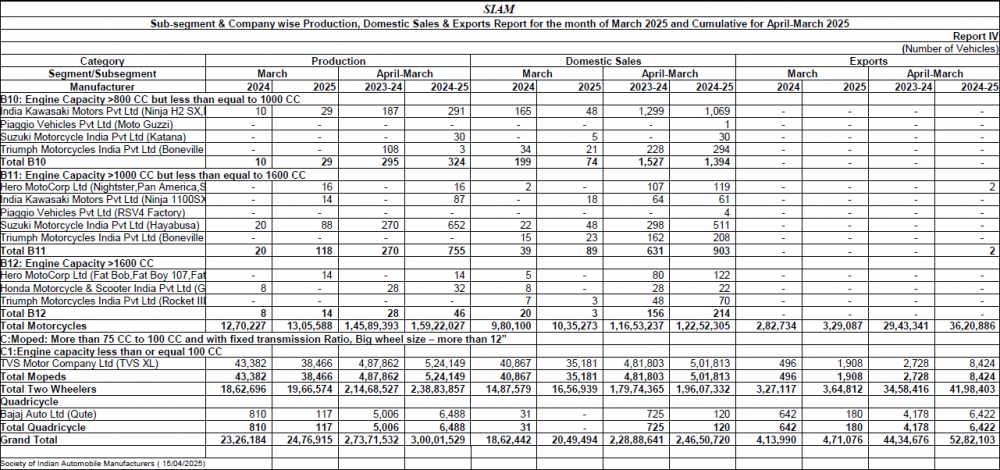

b) Two-Wheelers

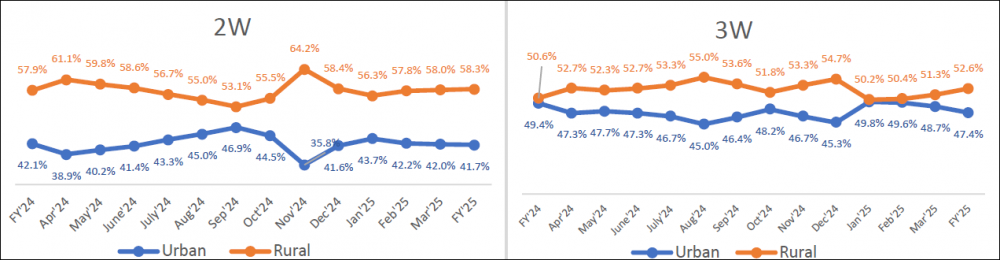

• Two-Wheelers with sales of 19.6 million units registered a good growth momentum of 9.1% in FY 2024-25 over FY 2023-24.

Improved rural demand and resurgence in consumer confidence is helping the segment to recover.

• Growth is led by scooter segment due to improved rural and semi-urban connectivity and availability of newer models with enhanced features.

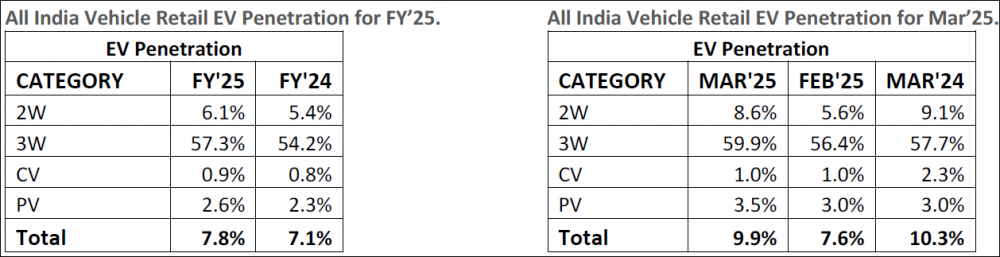

• It is noteworthy that share of EVs in overall Two-Wheelers have crossed 6% in 2024-25.

• In FY 2024-25, Two-Wheeler exports registered a good growth of 21.4% as compared to the previous year with a total of 4.2 million units. New models and new markets have helped in expanding the footprint of Two-Wheeler exports. Further, economic stability in the African region and demand in Latin America has supported this growth.

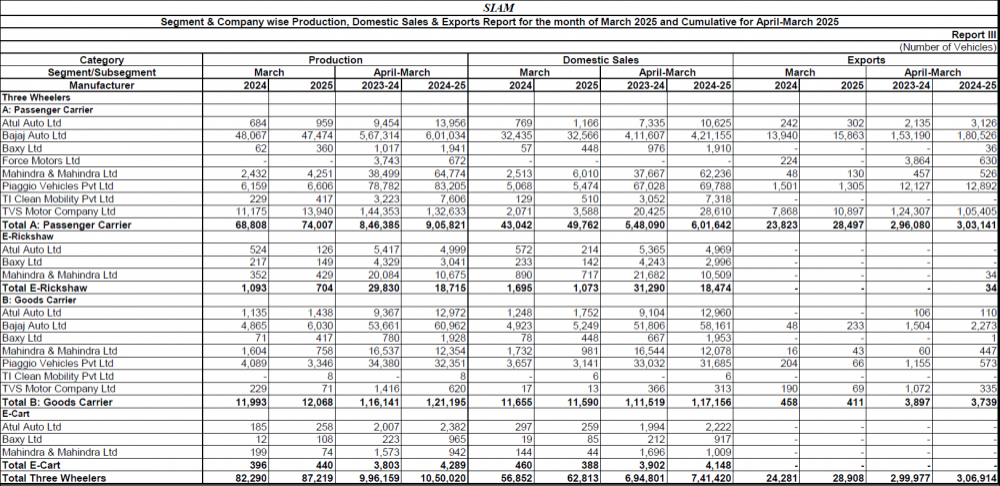

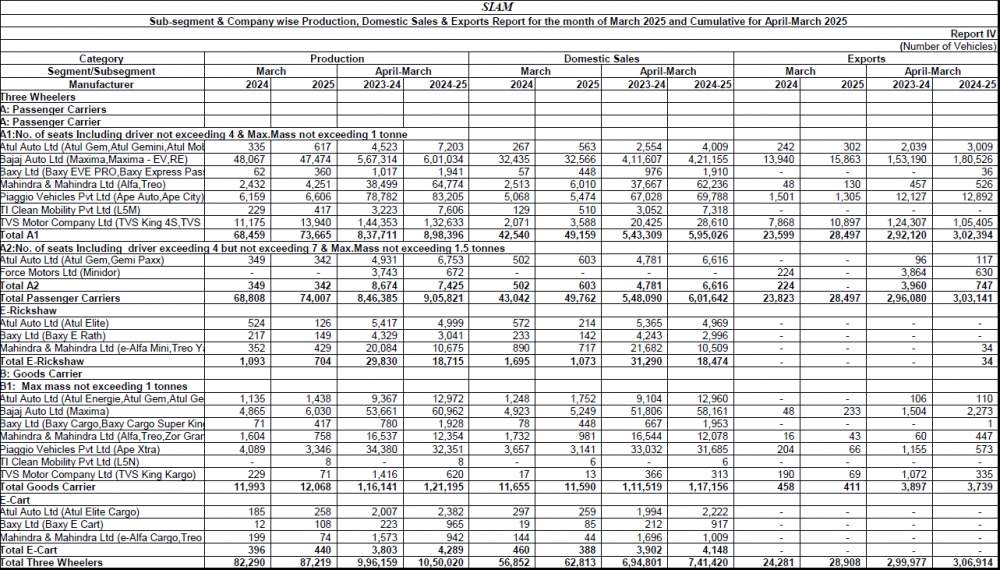

c) Three Wheelers

• Three-Wheelers posted its highest ever sales in FY 2024-25 of 7.4 Lakh Units with a growth of 6.7% as compared to previous year, surpassing the previous peak of FY2019.

• Growth is primarily driven by the demand of Passenger sub-segment.

• Rising demand for last-mile mobility solutions, in urban and semi-urban areas including e-vehicles led to this growth.

• Replacement demand and easier availability of financing has also helped this segment.

• Three-Wheeler exports grew by 2.3% in FY 2024-25 as compared to FY 2023-24 with exports of 3.1 Lakh units.

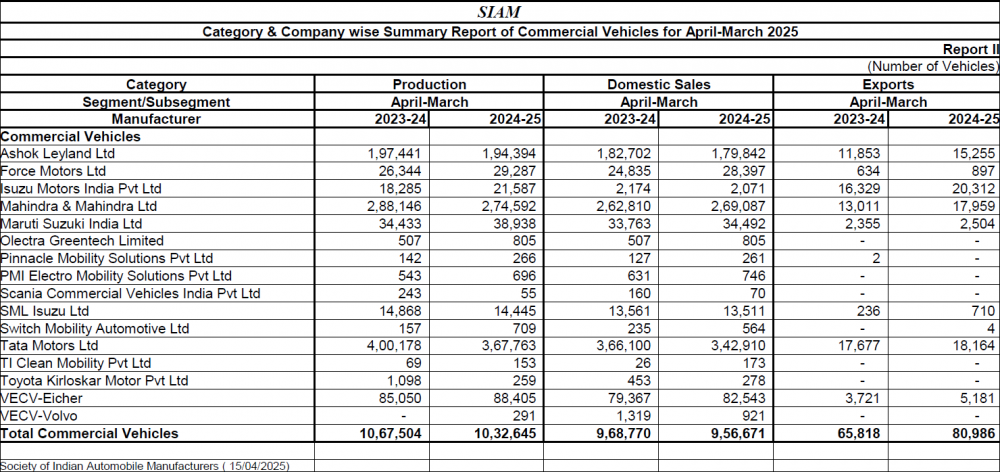

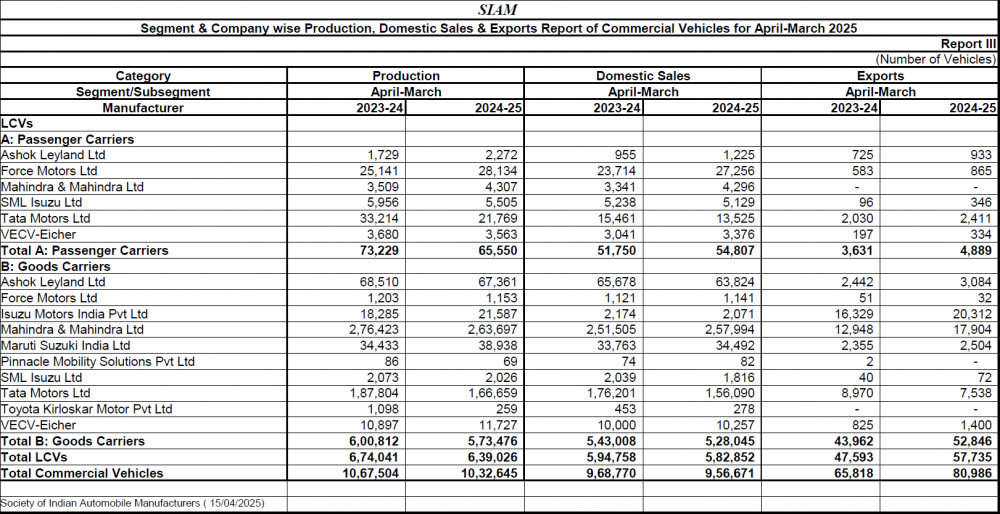

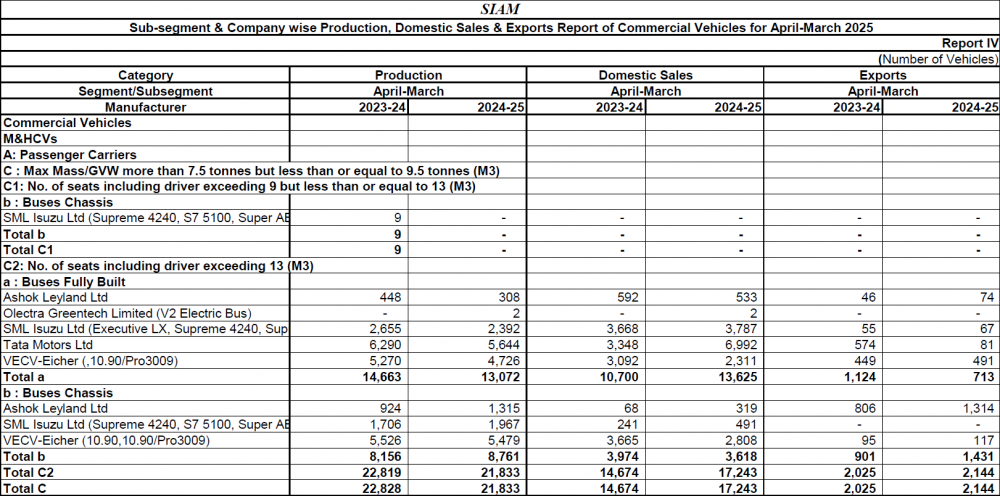

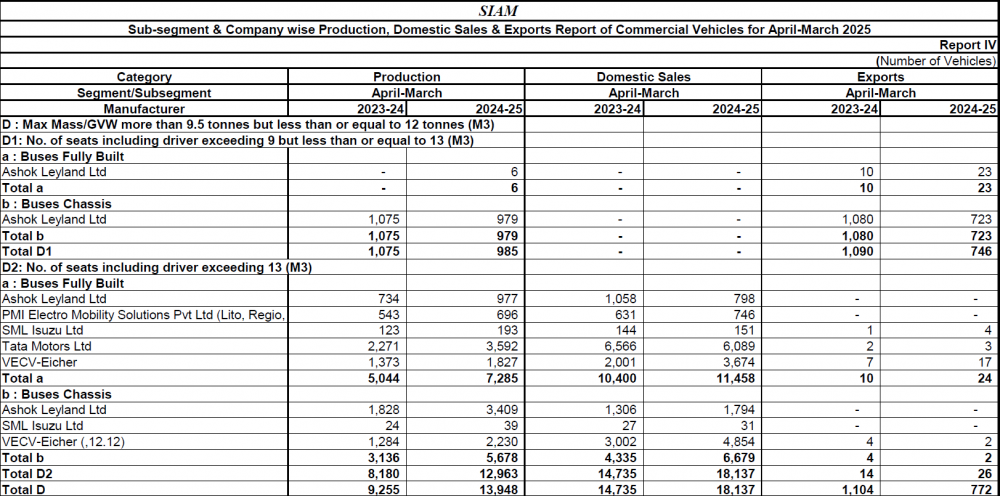

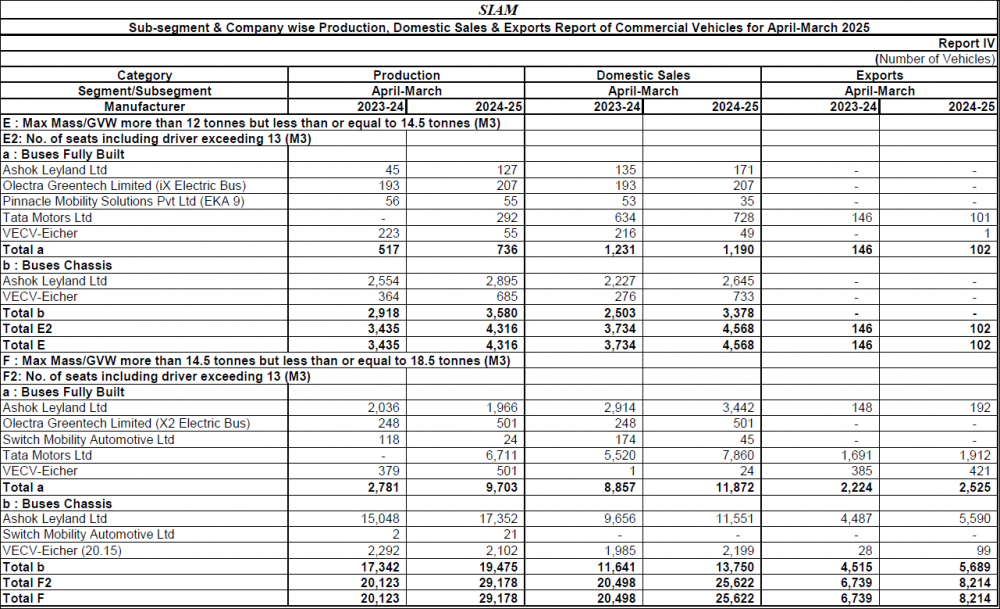

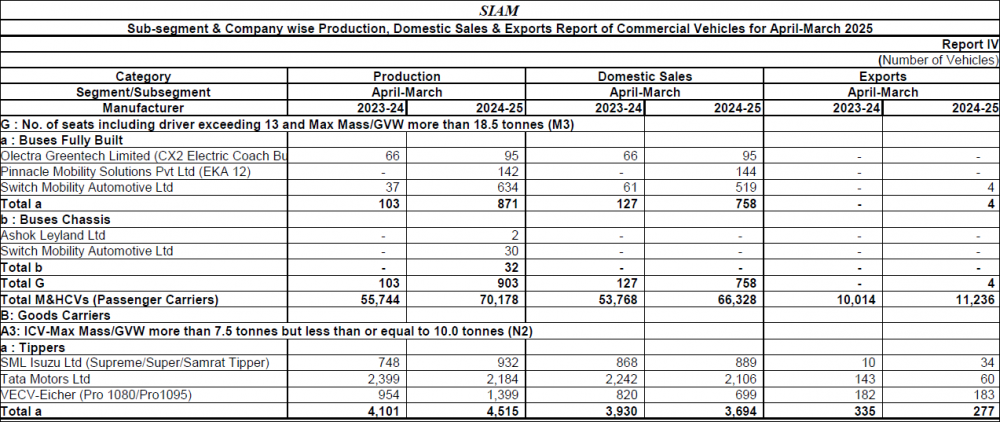

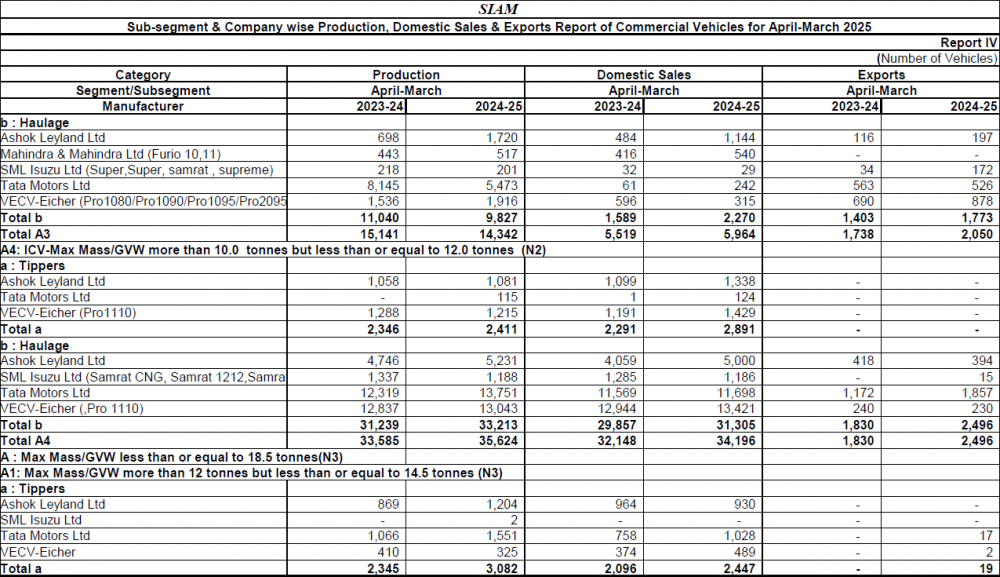

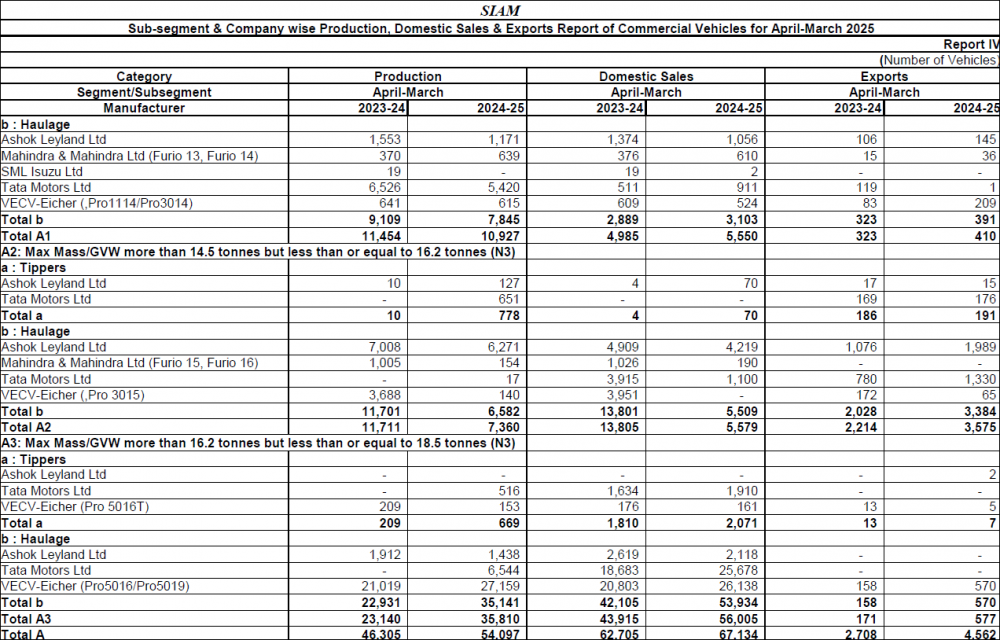

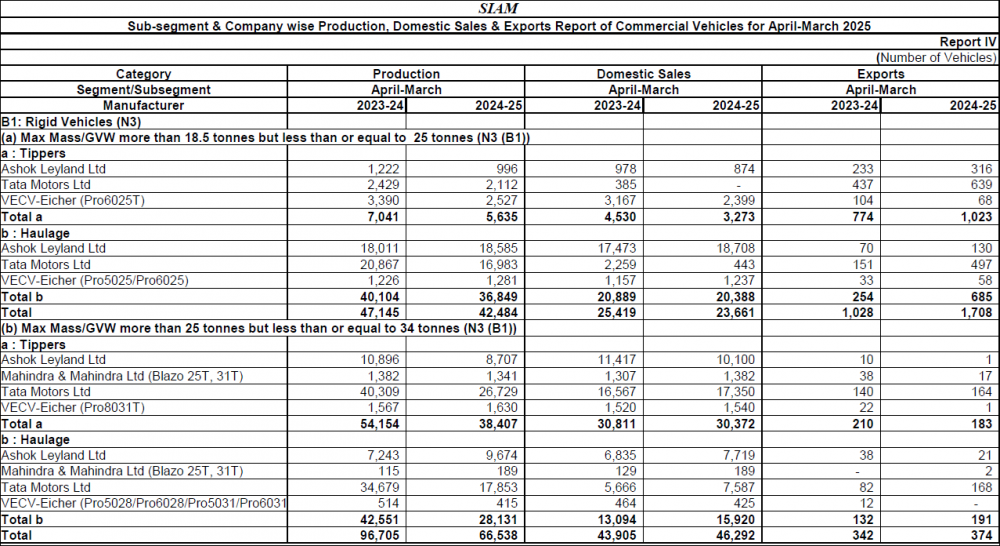

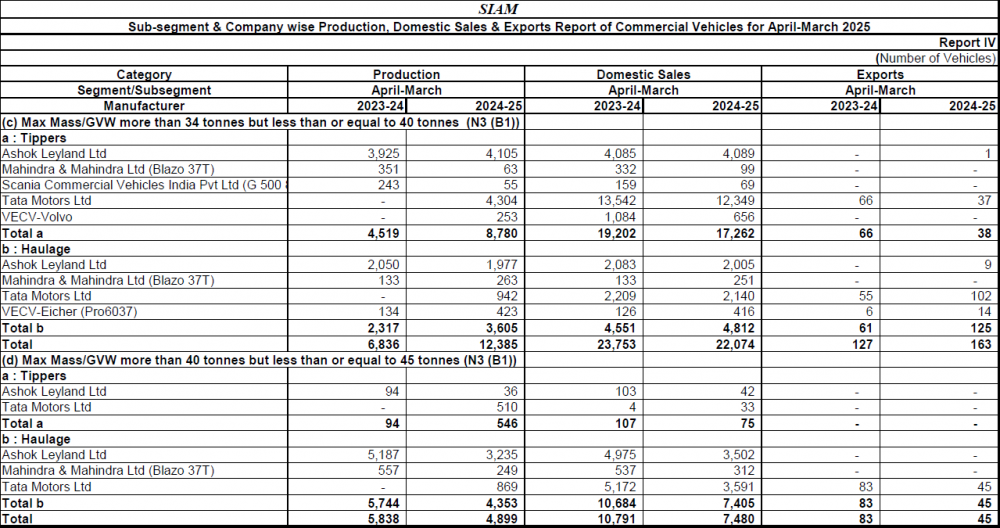

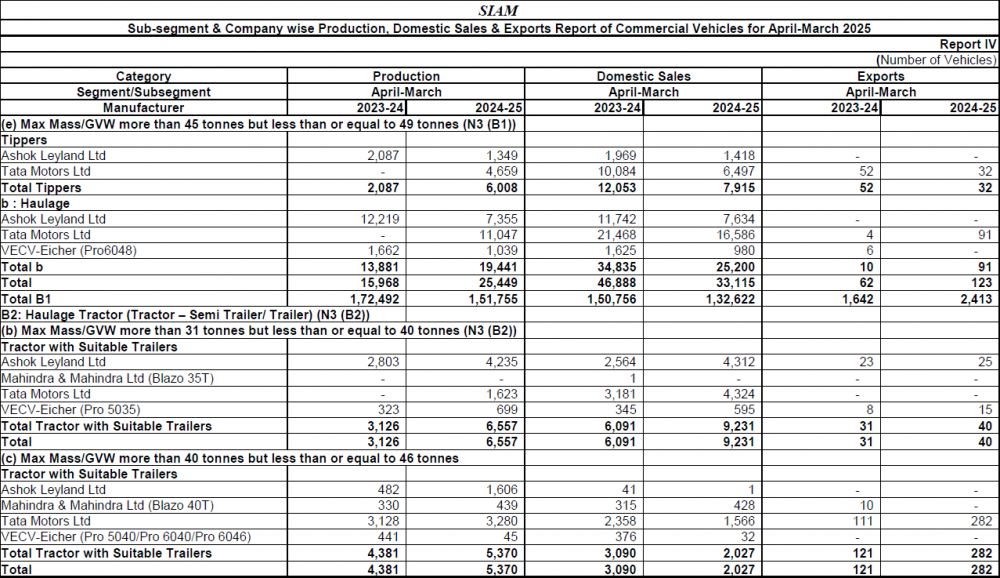

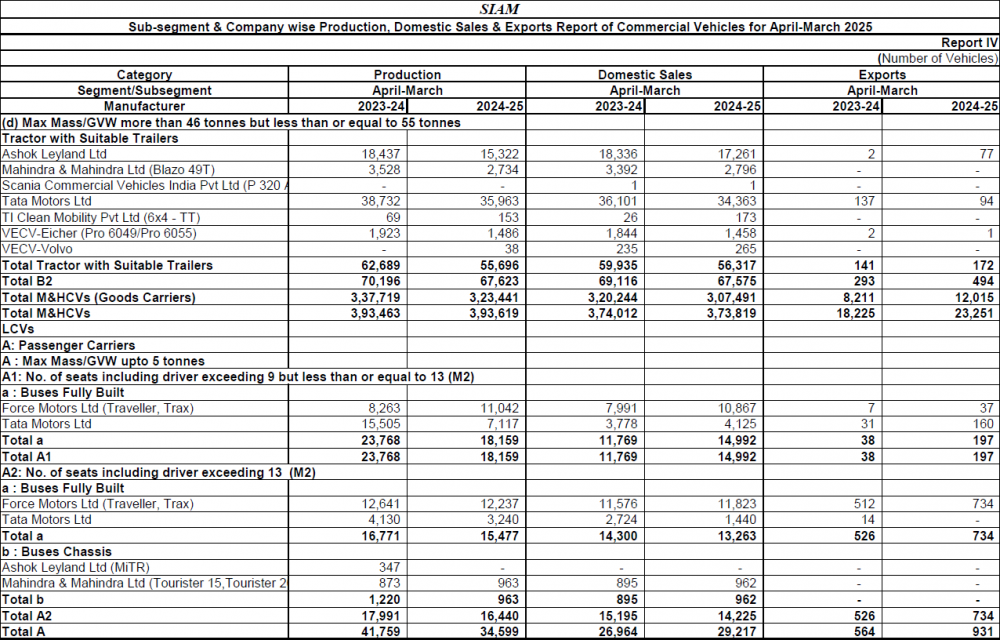

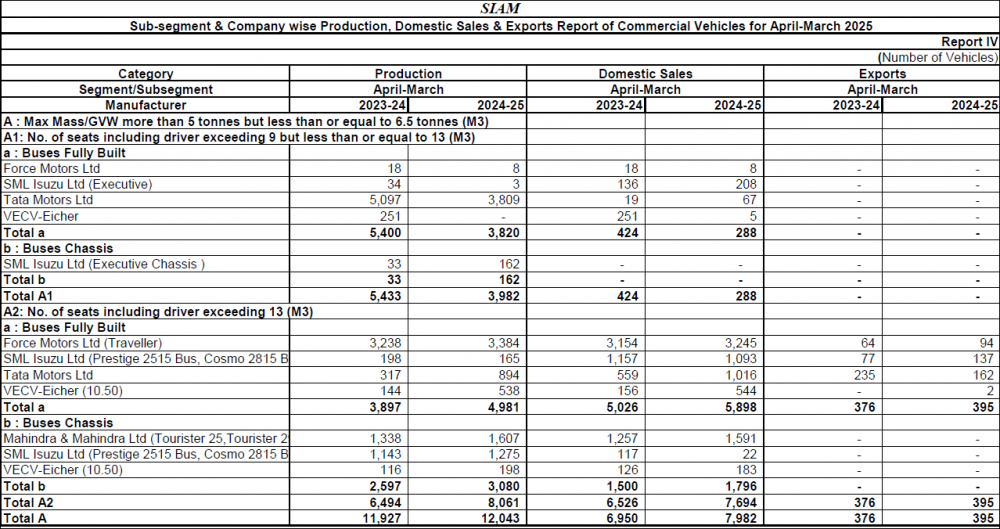

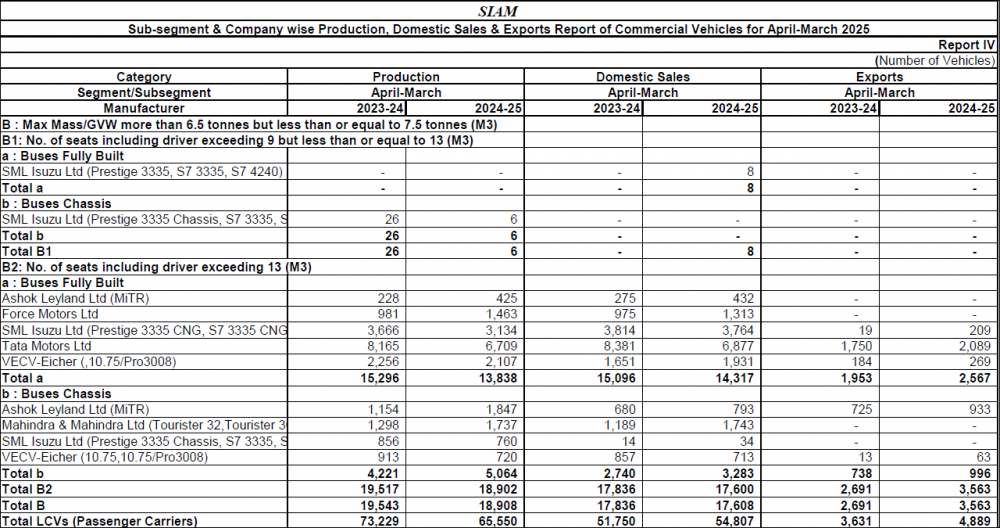

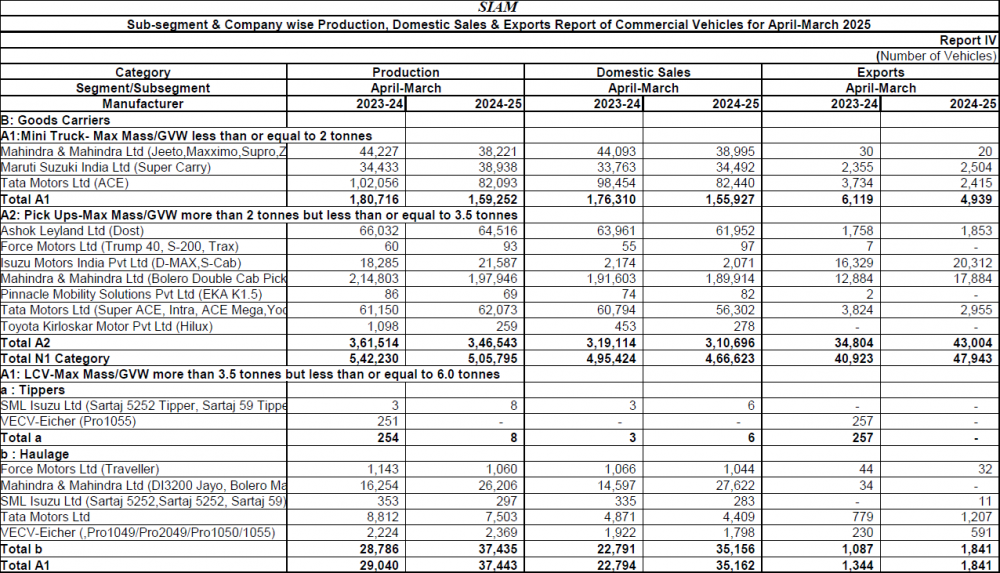

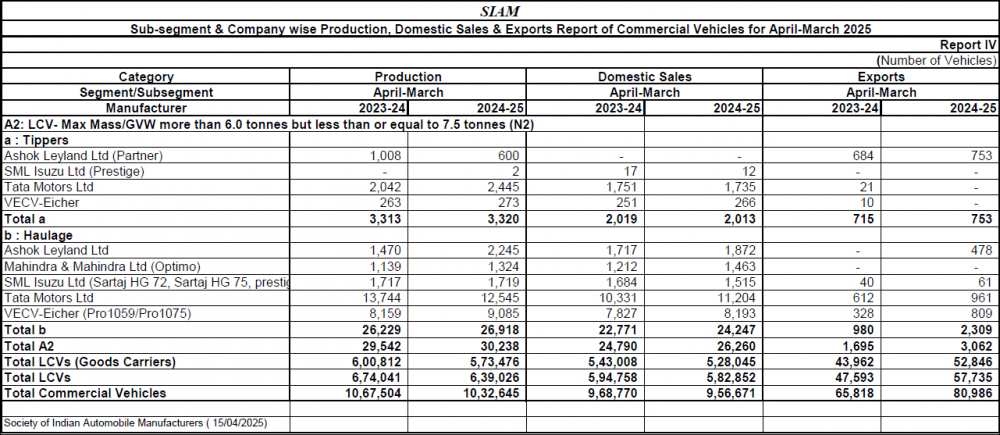

d) Commercial Vehicles

• Commercial Vehicles experienced a slight de-growth of (-) 1.2% in FY 2024-25 compared to previous year. However, last quarter of FY 2024-25 posted a growth of 1.5%.

• Though the overall trucks segment has witnessed a slight de-growth, but the requirement of freight movement has been suitably served with fleets migrating towards higher GVW vehicles. The expanding highways and expressway network is playing a crucial role in reducing logistics costs, enhancing regional connectivity which is auguring well with the performance of this segment.

• However, the infrastructure development has helped in driving sales of buses for inter-city travels and focus on mass-mobility in intra-city routes has also helped this segment.

• Exports of Commercial Vehicles posted a good growth of 23% in FY 2024-25 as compared to previous year with exports of 0.81 Lakh units.

Growth Outlook for FY 2025-26

• All segments of the industry are expected to continue with the growth momentum in FY 2025–26, building on the robust performance of recent years due to stable macroeconomic conditions, proactive government policies, and Infrastructure spending by the Government.

• A normal monsoon, as currently forecasted for 2025, is expected to support broader economic activity, especially in rural and semi-urban regions, which would be a tailwind for auto sector demand.

• The sector will also benefit from the reforms in the personal income tax announced in the recent Union Budget of 2025-26, which has been followed by two back-to-back rate cuts by RBI. These measures would help in creating demand by increased accessibility of vehicle financing.

• Export demand in key markets of interest, such as Africa and neighbouring countries, is likely to continue as ‘Made in India’ vehicles are gaining traction.

• Overall, the Automobile Industry will closely monitor macroeconomic factors and global geopolitics, which will determine the key demand conditions, and supply chain dynamics going forward.

EV Adoption Trends (Source: SIAM Analysis of Vahan Database)

• Total EV registrations in the country reached 1.97 million units in FY 2024-25 compared to 1.68 million units FY 2023-24 posting a growth of 16.9%.

• Electric Passenger Vehicle registrations crossed 1 Lakh units in FY 2024-25 registering a growth of 18.2% as compared to previous year.

• Registration of e-Two Wheelers grew by 21.2% in FY 2024-25 as compared to previous year, with 11.5 Lakh units.

• Registration of all types of e-Three Wheelers grew by 10.5% in FY 2024-25 as compared to FY 2023-24, with registrations of close to 7 Lakh units.

• Recent policy interventions of Government of India including Electric Mobility Promotion Scheme (EMPS) from 1st April 2024 to 30th September 2024, followed by the PM E DRIVE and PM e-Sewa schemes, coupled with EV launches by several manufacturers has provided the necessary momentum for the adoption of electric vehicles in the country.

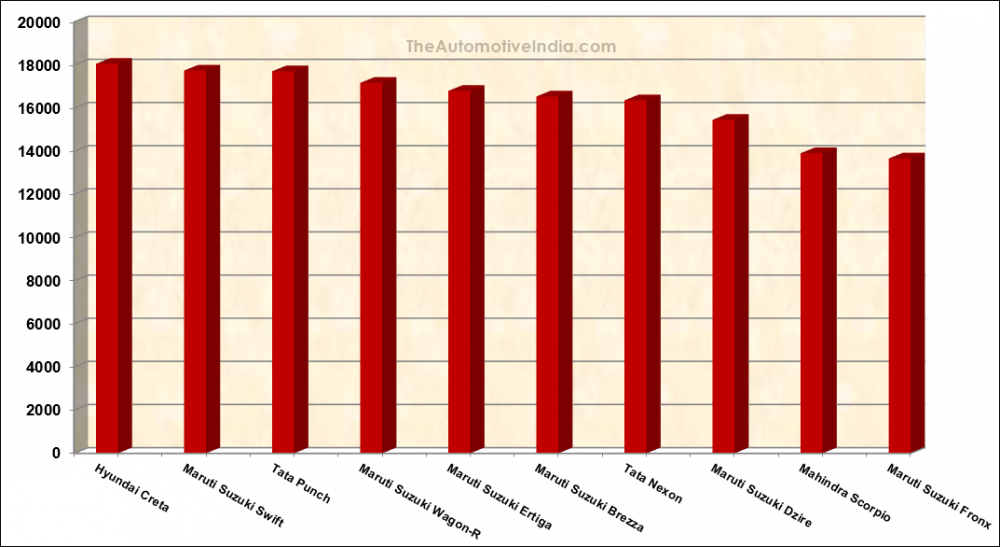

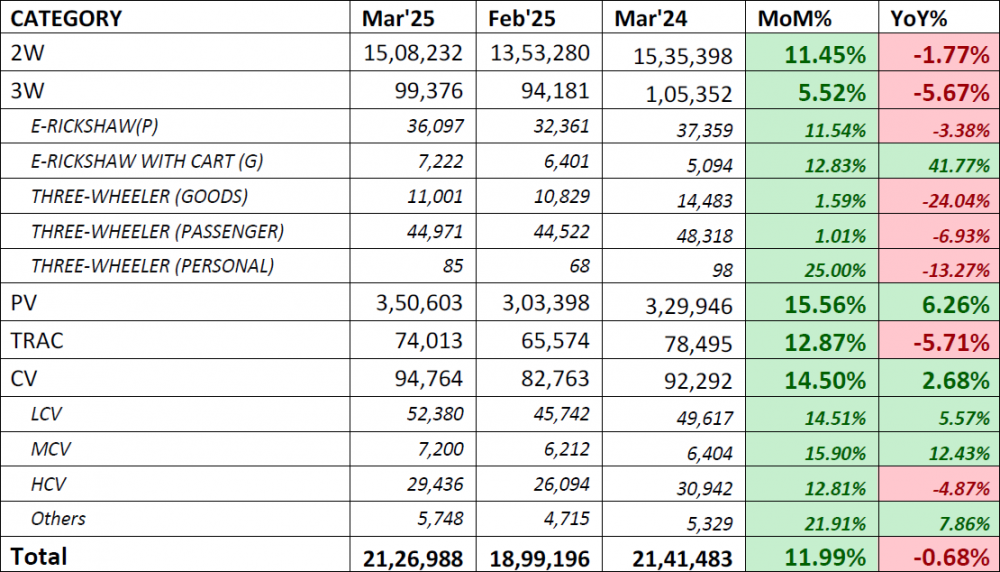

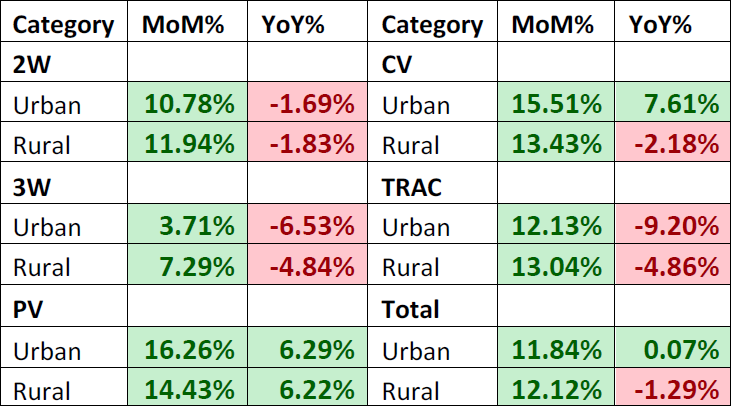

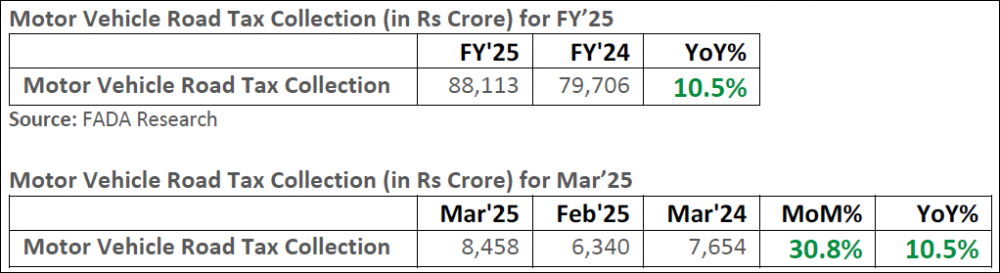

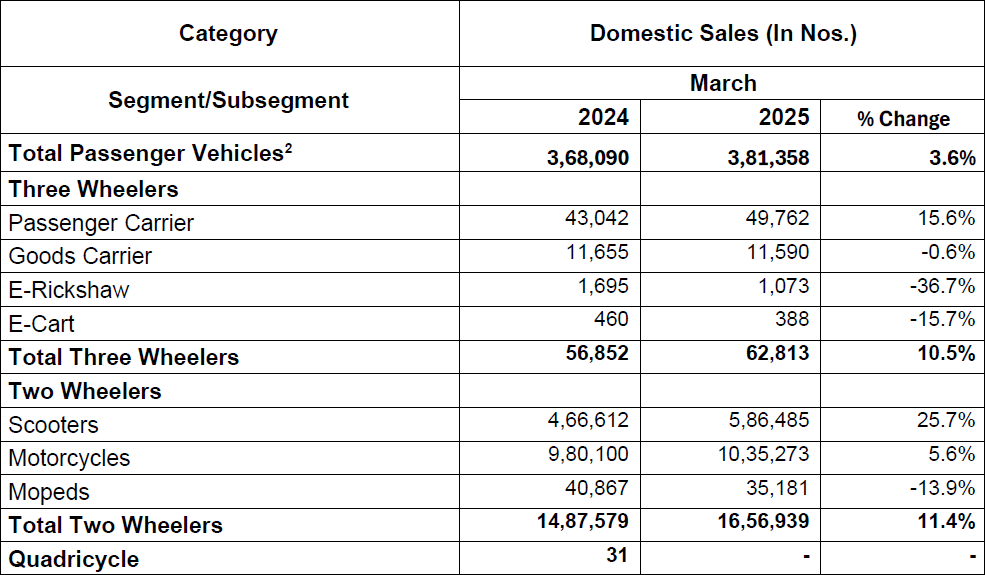

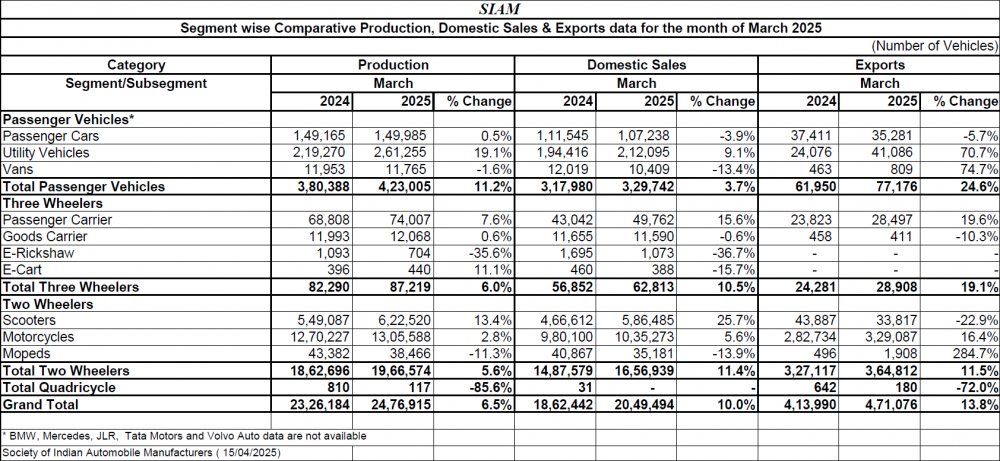

Monthly Performance: March 2025

Production: The total production of Passenger Vehicles1, Three Wheelers, Two Wheelers and Quadricycle in the month of March 2025 was 24,76,915 units

Domestic Sales:

• Passenger Vehicles2 sales were 3,81,358 units in March 2025.

• Three-wheeler sales were 62,813 units in March 2025.

• Two-wheeler sales were 16,56,939 units in March 2025.

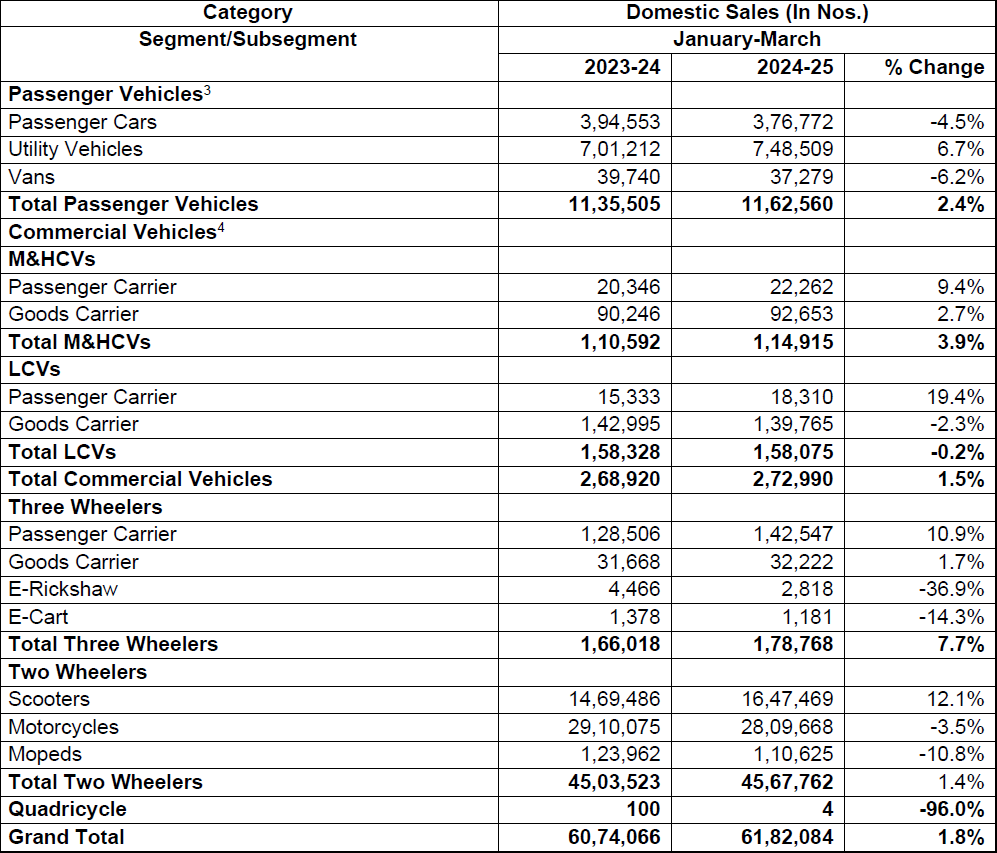

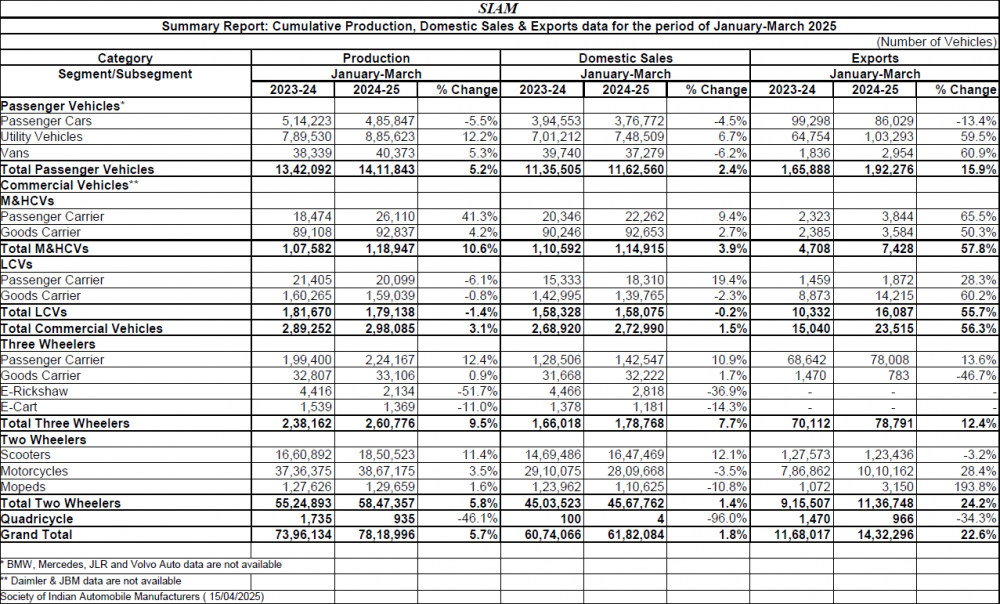

Quarterly Performance: January - March 2025

Production: Total production of Passenger Vehicles3, Commercial Vehicles4, Three Wheelers, Two Wheelers and Quadricycle in January - March 2025 was 78,18,996 units.

Domestic Sales:

• Passenger Vehicles3 sales were 11,62,560 units in January– March 2025.

• Commercial Vehicles4 sales were 2,72,990 units in January – March 2025.

• Three-wheeler sales were 1,78,768 units in January – March 2025.

• Two-wheeler sales were 45,67,762 units in January – March 2025.

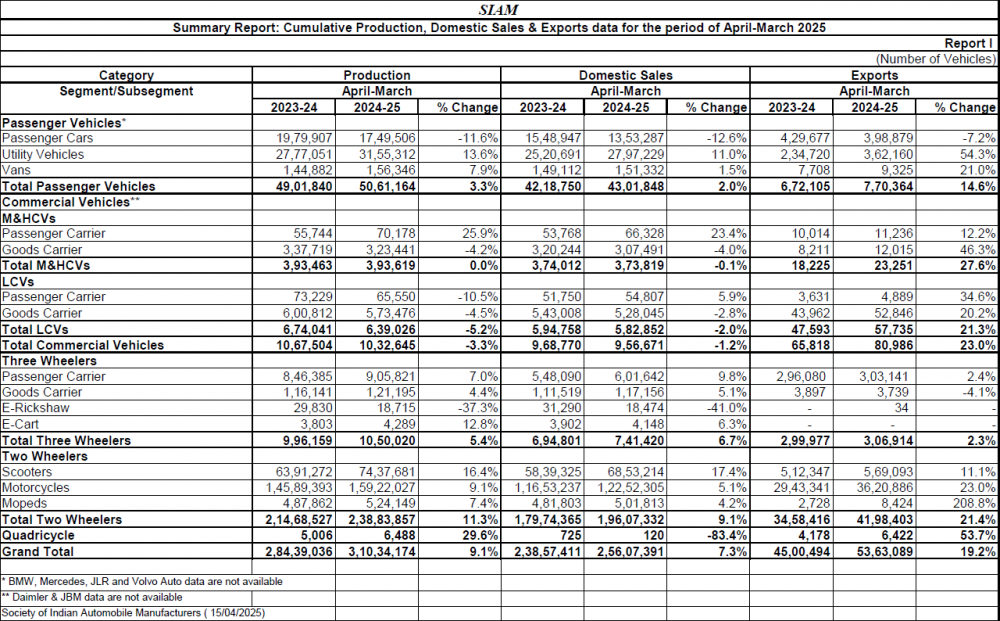

Financial Year Performance: April 2024 - March 2025

Production: Total production of Passenger Vehicles3, Commercial Vehicles4, Three Wheelers, Two Wheelers and Quadricycle in April 2024 - March 2025 was 3,10,34,174 units.

Domestic Sales:

• Passenger Vehicles3 sales were 43,01,848 units in April – March 2025.

• Commercial Vehicles4 sales were 9,56,671 units in April – March 2025.

• Three-wheeler sales were 7,41,420 units in April – March 2025.

• Two-wheeler sales were 1,96,07,332 units in April – March 2025.

Commenting on sales data of 2024-25, Mr Shailesh Chandra, President, SIAM said, “The Indian Automobile Industry continued its steady performance in FY2024–25, driven by healthy demand, infrastructure investments, supportive Government policies, and continued emphasis on sustainable mobility. Passenger Vehicles, Two-Wheelers and Three Wheelers grew in FY 2024-25 compared to FY 2023-24, but growth rates have been varied across segments. Passenger Vehicles and Three-Wheelers witnessed a moderate growth on account of high base effect, but saw the highest ever sales in these categories, while the Two-Wheeler segment registered strong growth in FY2024-25. However, Commercial Vehicles witnessed a slight degrowth in the FY2024-25, though performance in recent months has been comparatively better. On the exports front, good recovery is seen across all segments, particularly Passenger Vehicles and Two-Wheelers reflecting improved global demand and India's growing competitiveness. In FY2024-25, the Government of India introduced the PM E DRIVE scheme and PM e-Sewa schemes which underscores the firm commitment of the Government towards promoting sustainable mobility. Looking ahead, the backdrop of stable policy environment, along with recent measures such as reforms in personal income tax and RBI’s rate cuts, will help in supporting consumer confidence and demand across segments.

Commenting on the performance of 2024-25, Mr Rajesh Menon, Director General, SIAM said, “Sales of Passenger Vehicles has been the highest ever in FY2024-25 of 4.3 million units, with a growth of 2%, compared to the previous year. Sales of Three-Wheelers in FY2024-25 grew by 6.7% as compared to last year, with 7.4 Lakh units, which is again the highest ever in a financial year. Two-Wheelers witnessed a good growth of momentum 9.1% in this financial year, compared to last year, with sales of 19.6 million units while Commercial Vehicles posted a slight de-growth of (-) 1.2% in FY2024-25, compared to last year, with sales of 9.6 Lakh units.”