Thread Starter

#46

Mahindra & Mahindra: The Story Of “Rise”

- Thread Starter raj_5004

- Start date

Re: Mahindra - Rise.

@raj

Since you are mahindra fan and have really great information I have couple of questions for you hope you could share some info .

1) is a w4 model of xuv in the works ? And if yes any idea when it will be launched.

2) any news about a all new Scorpio or refreshed face lifted one ?

Would be wonderful if you could share some insights thanx in advance .

@raj

Since you are mahindra fan and have really great information I have couple of questions for you hope you could share some info .

1) is a w4 model of xuv in the works ? And if yes any idea when it will be launched.

2) any news about a all new Scorpio or refreshed face lifted one ?

Would be wonderful if you could share some insights thanx in advance .

Re: Mahindra - Rise.

Fantastic pics, its porn for automobile lovers..lol

Btw the link seems to be redirecting back to this page..

To see XUV5OO in action, click here.

Btw the link seems to be redirecting back to this page..

Thread Starter

#51

Re: Mahindra - Rise.

Yes, many 2WD Scorpios & Boleros participate.

W4 model is already made. But because of the demand of the W6 & W8, Mahindra is not willing to launch it.

The new Scorpio is still in design stage. Testing has not yet started, so I guess it will take some time.

The link is working fine for me. It takes me to the XUV500 thread.

Thanks buddy.

Just wow.

Those Hawks with 2WD also have participated in the offroading.![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif)

Those Hawks with 2WD also have participated in the offroading.

![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif)

@raj

Since you are mahindra fan and have really great information I have couple of questions for you hope you could share some info .

1) is a w4 model of xuv in the works ? And if yes any idea when it will be launched.

2) any news about a all new Scorpio or refreshed face lifted one ?

Would be wonderful if you could share some insights thanx in advance .

Since you are mahindra fan and have really great information I have couple of questions for you hope you could share some info .

1) is a w4 model of xuv in the works ? And if yes any idea when it will be launched.

2) any news about a all new Scorpio or refreshed face lifted one ?

Would be wonderful if you could share some insights thanx in advance .

The new Scorpio is still in design stage. Testing has not yet started, so I guess it will take some time.

Fantastic pics, its porn for automobile lovers..lol

Btw the link seems to be redirecting back to this page..

Btw the link seems to be redirecting back to this page..

Nice set of pictures Raj,these serious mud-pluggers is motivating me to buy one and roll with them.

loved each and every stance of THAR in action.

The Scorpio looks beaut in those terrains.

loved each and every stance of THAR in action.

The Scorpio looks beaut in those terrains.

Re: Mahindra - Rise.

excellent info Raj. though i dont have Scorpio, it still pleases me to see all the developments. We were about to get the Bolero. But Xylo just couldnt be resisted. Dad clearly said that No TATA only Mahindra. Mahindra is more reliable. sorry not to create arguments but that is what my dad believes. even though he considered Grande, he was always in doubts. But now he is fully satisfied with the Xylo. He says it suits perfectly. Its spacious, VFM, A.S.S has been good, looks fine, delivers superb FE and the best overall package and its hard to match such cars. Mahindra has really developed a lot and also they came in news for Ssangyong take over. God Bless Mahindra for the future!

excellent info Raj. though i dont have Scorpio, it still pleases me to see all the developments. We were about to get the Bolero. But Xylo just couldnt be resisted. Dad clearly said that No TATA only Mahindra. Mahindra is more reliable. sorry not to create arguments but that is what my dad believes. even though he considered Grande, he was always in doubts. But now he is fully satisfied with the Xylo. He says it suits perfectly. Its spacious, VFM, A.S.S has been good, looks fine, delivers superb FE and the best overall package and its hard to match such cars. Mahindra has really developed a lot and also they came in news for Ssangyong take over. God Bless Mahindra for the future!

Re: Mahindra - Rise, Anand Mahindra takes charge as the New Chairman.

Anand Mahindra takes over Keshub Mahindra as the new Chairman by August 8th.

Keshub Mahindra to be the Chairman emeritus of Mahindra .

More info here:

Anand Mahindra takes over as Chairman of M&M

Anand Mahindra takes over Keshub Mahindra as the new Chairman by August 8th.

Keshub Mahindra to be the Chairman emeritus of Mahindra .

More info here:

Anand Mahindra takes over as Chairman of M&M

Thread Starter

#56

Re: Mahindra - Rise.

That's great news. Thanks Mukesh.

I am sure Anand Mahindra will make the company grow by leaps and bounds.

That's great news. Thanks Mukesh.

I am sure Anand Mahindra will make the company grow by leaps and bounds.

Re: Mahindra - Rise, Anand Mahindra takes charge as the New Chairman.

Another nice article on this written by Naazneen Karmali.

Source:

Smooth Succession At Mahindra - Forbes

Anand Mahindra takes over Keshub Mahindra as the new Chairman by August 8th.

Keshub Mahindra to be the Chairman emeritus of Mahindra .

Keshub Mahindra to be the Chairman emeritus of Mahindra .

After nearly five decades at the helm of India’s Mahindra Group, Keshub Mahindra, will be retiring as chairman of flagship Mahindra & Mahindra at the company’s annual shareholders’ meeting in August. In what is a seamless succession, he is handing over charge to his Harvard-educated nephew Anand who turned 57 earlier this month and is currently vice-chairman and managing director. As per the announcement, made following a board meeting Thursday, Keshub, 88, will remain chairman emeritus.

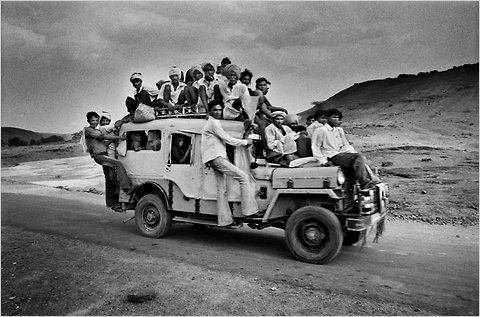

The $15.4 billion (revenues) Mahindra conglomerate best known as the world’s largest tractor-maker by volume and India’s leading producer of sport utility vehicles, was founded in 1945 as a steel trader and later assembled Willys Jeeps. Today. it makes everything from tractors and trucks to two-wheelers and electric cars. It also has interests in information technology, holiday timeshares, aerospace and real estate, businesses largely nurtured by the younger Mahindra.

Keshub, a Wharton alum, joined the group in 1947 and took over as chairman in 1963, becoming one of India’s top industrialists. The Bhopal gas leak tragedy of 1984, cast a shadow over what has otherwise been a stellar career. He was non-executive chairman of Union Carbide India when it occurred and has appealed against his conviction.

Anand’s elevation comes as no surprise as it marks the culmination of an extended grooming process for the penultimate post. (Keshub has three daughters, none of whom work in the group) He joined the family enterprise armed with an undergrad degree in film-making and a Harvard MBA, in 1981 at its steel unit. He rose through the ranks to take charge of running the automaker in 1997 as managing director and additionally as vice chairman in 2003.

With Anand at the helm, this one-time partner of Ford and later Renault, went on to produce the Scorpio, its best-selling SUV, which it developed from scratch with homegrown technology. In 2010, it made a splash with the $463 million acquisition of Korean vehicle maker SsangYong Motor. Last year’s launch of the XUV 500, which Mahindra touts as a ‘global SUV’ was a runaway success. Speaking to Forbes last year prior to its launch, Anand had said he was confident it would succeed as it had passed the all-important “lipstick test”; his wife Anuradha loved the way it looked. In 2011, M&M featured on Forbes Global 2000 list of the largest public companies.

Both uncle and nephew are among India’s wealthiest and featured on Forbes Asia’s India Rich List 2011. Keshub was ranked at No.82 with a net worth of $615 million. Anand was listed higher at No.68 with a bigger fortune of $825 million, thanks to his minority stake in Kotak Mahindra Bank Uday Kotak, the bank’s founder who has since become a billionaire, said ” Anand has vision. He can spur people to think out-of-the-box.”

The imminent appointment of a younger chairman who’s a Jazz and Blues fan , has already heralded an important change in M&M’s board, which until now featured a group of dark suits of a certain vintage. Vishakha Desai, who is stepping down as president and chief executive of New York-based Asia Society in September to take up an assignment with the Guggenheim Foundation, will be joining the board as its first woman director.

The $15.4 billion (revenues) Mahindra conglomerate best known as the world’s largest tractor-maker by volume and India’s leading producer of sport utility vehicles, was founded in 1945 as a steel trader and later assembled Willys Jeeps. Today. it makes everything from tractors and trucks to two-wheelers and electric cars. It also has interests in information technology, holiday timeshares, aerospace and real estate, businesses largely nurtured by the younger Mahindra.

Keshub, a Wharton alum, joined the group in 1947 and took over as chairman in 1963, becoming one of India’s top industrialists. The Bhopal gas leak tragedy of 1984, cast a shadow over what has otherwise been a stellar career. He was non-executive chairman of Union Carbide India when it occurred and has appealed against his conviction.

Anand’s elevation comes as no surprise as it marks the culmination of an extended grooming process for the penultimate post. (Keshub has three daughters, none of whom work in the group) He joined the family enterprise armed with an undergrad degree in film-making and a Harvard MBA, in 1981 at its steel unit. He rose through the ranks to take charge of running the automaker in 1997 as managing director and additionally as vice chairman in 2003.

With Anand at the helm, this one-time partner of Ford and later Renault, went on to produce the Scorpio, its best-selling SUV, which it developed from scratch with homegrown technology. In 2010, it made a splash with the $463 million acquisition of Korean vehicle maker SsangYong Motor. Last year’s launch of the XUV 500, which Mahindra touts as a ‘global SUV’ was a runaway success. Speaking to Forbes last year prior to its launch, Anand had said he was confident it would succeed as it had passed the all-important “lipstick test”; his wife Anuradha loved the way it looked. In 2011, M&M featured on Forbes Global 2000 list of the largest public companies.

Both uncle and nephew are among India’s wealthiest and featured on Forbes Asia’s India Rich List 2011. Keshub was ranked at No.82 with a net worth of $615 million. Anand was listed higher at No.68 with a bigger fortune of $825 million, thanks to his minority stake in Kotak Mahindra Bank Uday Kotak, the bank’s founder who has since become a billionaire, said ” Anand has vision. He can spur people to think out-of-the-box.”

The imminent appointment of a younger chairman who’s a Jazz and Blues fan , has already heralded an important change in M&M’s board, which until now featured a group of dark suits of a certain vintage. Vishakha Desai, who is stepping down as president and chief executive of New York-based Asia Society in September to take up an assignment with the Guggenheim Foundation, will be joining the board as its first woman director.

Smooth Succession At Mahindra - Forbes

Re: Mahindra - Rise.

Country's largest utility vehicle maker Mahindra & Mahindra on Thursday sounded bullish on growth, pegging average sales growth of 10-12 per cent for the fiscal, and said it will launch six new models this fiscal.

"We have a capital allocation of Rs 5,000 crore for the next three fiscals and plan to launch six new models this fiscal," M&M president (automotive business) Pawan Goenka told reporters here during a post-earnings conference call.

However, Goenka did not offer any details on the new models or launch dates.

He also announced an investment of another Rs 2,500 crore in group companies during the next three fiscals.

On the tractor front, however, the company, which is the largest manufacturer of the farm equipment in the country, sounded cautious saying its expects sales growth to halve this fiscal from 10-12 percent forecast earlier, at to 5-6 percent.

M&M, the flagship of the $14.4-billion Mahindra Group, yesterday reported a more-than-expected 44 percent jump in net profit for the March quarter at Rs 874.5 crore on strong volume growth.

Net sales rose to Rs 9,241.28 crore for the quarter as against Rs 6,633.84 crore a year ago.

Consolidated net for the full fiscal rose to Rs 3,126.66 crore, while sales jumped to Rs 58,241.40 crore.

On the much-delayed new plant in the South, Goenka said, the company is in talks with some states but so far it has not finalised the location.

Source:

M&M to launch 6 models in FY13, plans Rs 5,000 crore capex by FY16 - The Economic Times

Country's largest utility vehicle maker Mahindra & Mahindra on Thursday sounded bullish on growth, pegging average sales growth of 10-12 per cent for the fiscal, and said it will launch six new models this fiscal.

"We have a capital allocation of Rs 5,000 crore for the next three fiscals and plan to launch six new models this fiscal," M&M president (automotive business) Pawan Goenka told reporters here during a post-earnings conference call.

However, Goenka did not offer any details on the new models or launch dates.

He also announced an investment of another Rs 2,500 crore in group companies during the next three fiscals.

On the tractor front, however, the company, which is the largest manufacturer of the farm equipment in the country, sounded cautious saying its expects sales growth to halve this fiscal from 10-12 percent forecast earlier, at to 5-6 percent.

M&M, the flagship of the $14.4-billion Mahindra Group, yesterday reported a more-than-expected 44 percent jump in net profit for the March quarter at Rs 874.5 crore on strong volume growth.

Net sales rose to Rs 9,241.28 crore for the quarter as against Rs 6,633.84 crore a year ago.

Consolidated net for the full fiscal rose to Rs 3,126.66 crore, while sales jumped to Rs 58,241.40 crore.

On the much-delayed new plant in the South, Goenka said, the company is in talks with some states but so far it has not finalised the location.

Source:

M&M to launch 6 models in FY13, plans Rs 5,000 crore capex by FY16 - The Economic Times

Re: Mahindra - Rise.

Found an article on Anand Mahindra's plan to establish Mahindra in the developed world,it's a nice read.

How M&M's Anand Mahindra could be India Inc's Tiger Pataudi - The Economic Times

Found an article on Anand Mahindra's plan to establish Mahindra in the developed world,it's a nice read.

In many ways he's attempting to do for India Inc what the late Mansur Ali Khan did for Indian cricket: prove that it is possible to win overseas by leading from the front.

The Nawab of Pataudi transformed a ragtag team in flannels from a bunch of affable but inevitable losers when he led them to a first-ever Test series win on foreign soil, against New Zealand in the late '60s; and a few years later to India's first series triumph against England at home.

For Anand Mahindra who on the penultimate day of May was designated chairman and managing director of automotive and farm equipment maker Mahindra & Mahindra (M&M), the equivalent of winning overseas and against those who couldn't be beaten before involves two imperatives: taking the Mahindra brand to foreign markets, including developed ones, by selling products and services that global customers find acceptable and comparable with what they're accustomed to; and, equally important, indulging Indian consumers with 'world-class' products and services - not quite what they've been accustomed to, but perhaps enviably spied when on an overseas junket.

Going Global

Mahindra isn't the first to sing the 'go global' mantra. A number of Indian promoters, from the late Aditya Birla to the Danis of Asian Paints, set up overseas outposts at a time when the domestic growth story was barely a glimmer in the eye of the most avid India punter.

What's more, going global can mean a number of things to a number of people, getting a chunk of your revenues via exports, a la Reliance Industries; setting up global delivery centres in cost-effective geographies like Uruguay and Mexico, the way the IT services top tier brigade has; and paying top dollar to buy assets in foreign lands, as a clutch of Indian promoters has done.

The Mahindra conglomerate, whose operations span from automotives and IT services to aerospace and financial services, has made many of such 'globalisation' moves. For instance, a couple of group companies supply American companies like Caterpillar, John Deere and GE with components. And in Europe, the group has component manufacturing units, most of them acquired, in Italy, the United Kingdom and Germany.

Making a Mark

The end game for the 57-year-old second-generation Mahindra scion, however, is a far more ambitious one: to take the Mahindra brand overseas and compete with the biggest and the best there. He's made tentative progress on that front. Mahindra tractors are No. 1 in the world, by volume. The electric car Reva is visible on roads in the eurozone. And rugged, reliable and fuel-efficient UVs like the Bolero and the Scorpio find buyers in parts of Latin America, Southeast Asia and Australia.

M&M may never become as large an auto major as, say, a Toyota or a General Motors, but perhaps that's not as important to Mahindra as gaining respect as a maker of world-class products. The XUV500 sports utility vehicle - with best-in-class technology and design, is the most contemporary evidence of that aspiration. But that journey for global esteem has only just begun.

Accepting No Limits

Back home, over the past decade Mahindra has diversified the group's activities into high-growth sectors like leisure and hospitality, financial services, and real estate. And within automotives, he's blueprinted a game plan that no auto major in the world has attempted, to produce virtually everything that moves on wheels and is powered by an engine.

The Nawab of Pataudi transformed a ragtag team in flannels from a bunch of affable but inevitable losers when he led them to a first-ever Test series win on foreign soil, against New Zealand in the late '60s; and a few years later to India's first series triumph against England at home.

For Anand Mahindra who on the penultimate day of May was designated chairman and managing director of automotive and farm equipment maker Mahindra & Mahindra (M&M), the equivalent of winning overseas and against those who couldn't be beaten before involves two imperatives: taking the Mahindra brand to foreign markets, including developed ones, by selling products and services that global customers find acceptable and comparable with what they're accustomed to; and, equally important, indulging Indian consumers with 'world-class' products and services - not quite what they've been accustomed to, but perhaps enviably spied when on an overseas junket.

Going Global

Mahindra isn't the first to sing the 'go global' mantra. A number of Indian promoters, from the late Aditya Birla to the Danis of Asian Paints, set up overseas outposts at a time when the domestic growth story was barely a glimmer in the eye of the most avid India punter.

What's more, going global can mean a number of things to a number of people, getting a chunk of your revenues via exports, a la Reliance Industries; setting up global delivery centres in cost-effective geographies like Uruguay and Mexico, the way the IT services top tier brigade has; and paying top dollar to buy assets in foreign lands, as a clutch of Indian promoters has done.

The Mahindra conglomerate, whose operations span from automotives and IT services to aerospace and financial services, has made many of such 'globalisation' moves. For instance, a couple of group companies supply American companies like Caterpillar, John Deere and GE with components. And in Europe, the group has component manufacturing units, most of them acquired, in Italy, the United Kingdom and Germany.

Making a Mark

The end game for the 57-year-old second-generation Mahindra scion, however, is a far more ambitious one: to take the Mahindra brand overseas and compete with the biggest and the best there. He's made tentative progress on that front. Mahindra tractors are No. 1 in the world, by volume. The electric car Reva is visible on roads in the eurozone. And rugged, reliable and fuel-efficient UVs like the Bolero and the Scorpio find buyers in parts of Latin America, Southeast Asia and Australia.

M&M may never become as large an auto major as, say, a Toyota or a General Motors, but perhaps that's not as important to Mahindra as gaining respect as a maker of world-class products. The XUV500 sports utility vehicle - with best-in-class technology and design, is the most contemporary evidence of that aspiration. But that journey for global esteem has only just begun.

Accepting No Limits

Back home, over the past decade Mahindra has diversified the group's activities into high-growth sectors like leisure and hospitality, financial services, and real estate. And within automotives, he's blueprinted a game plan that no auto major in the world has attempted, to produce virtually everything that moves on wheels and is powered by an engine.

Re: Mahindra - Rise.

I loved every single picture in this thread

its a great achievement by Mahindra

I can now say yes we can make nice Off road vehicles

good one them and Jeep has to be my all time fav car

I loved every single picture in this thread

its a great achievement by Mahindra

I can now say yes we can make nice Off road vehicles

good one them and Jeep has to be my all time fav car