Thread Starter

#1

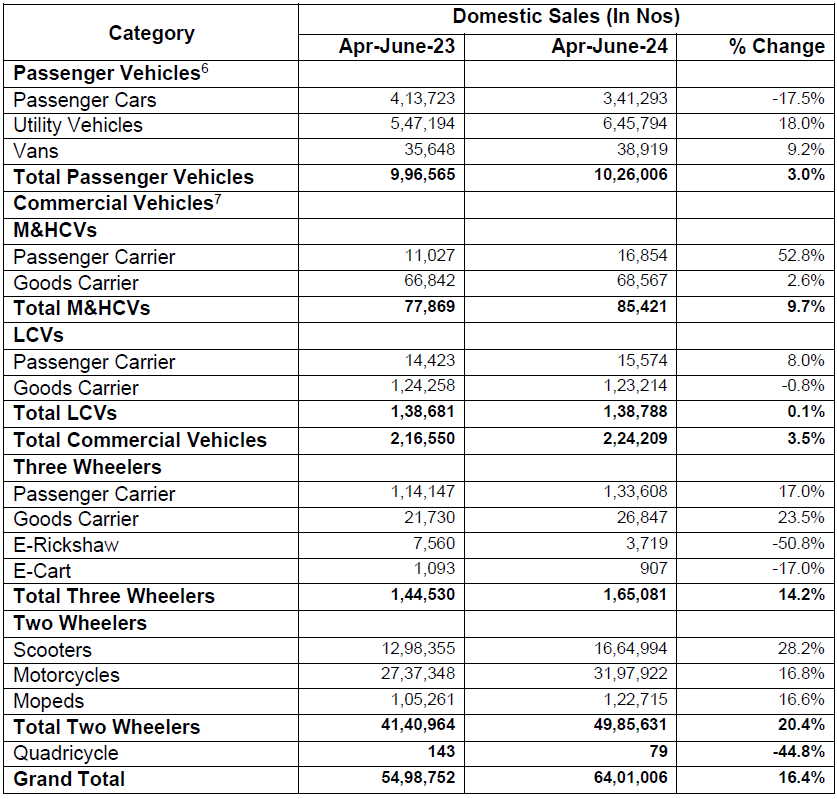

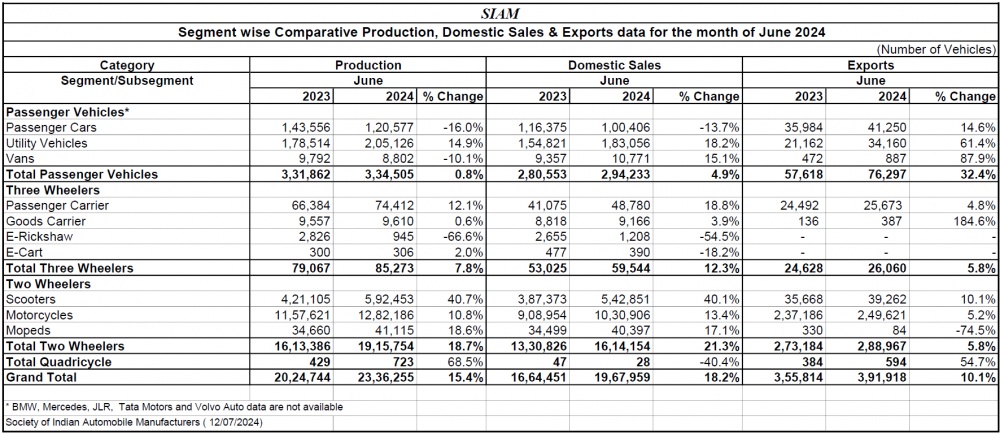

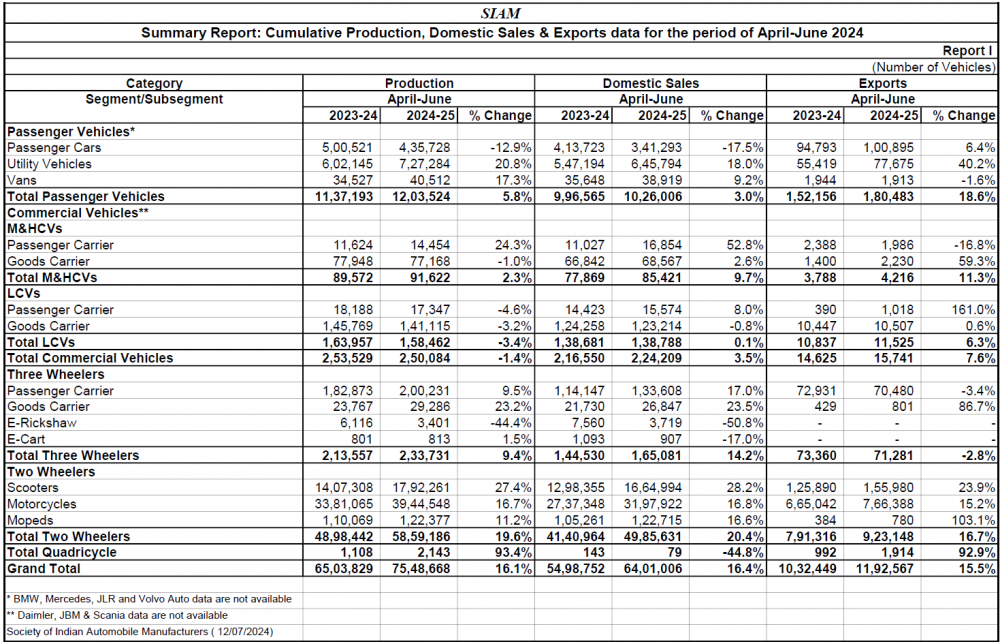

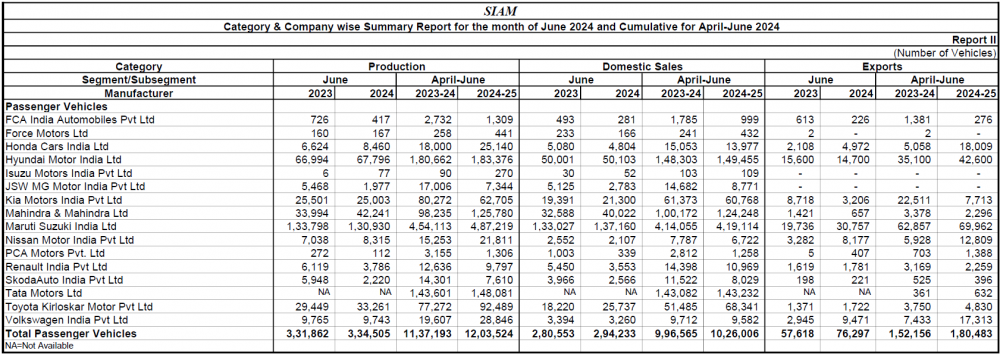

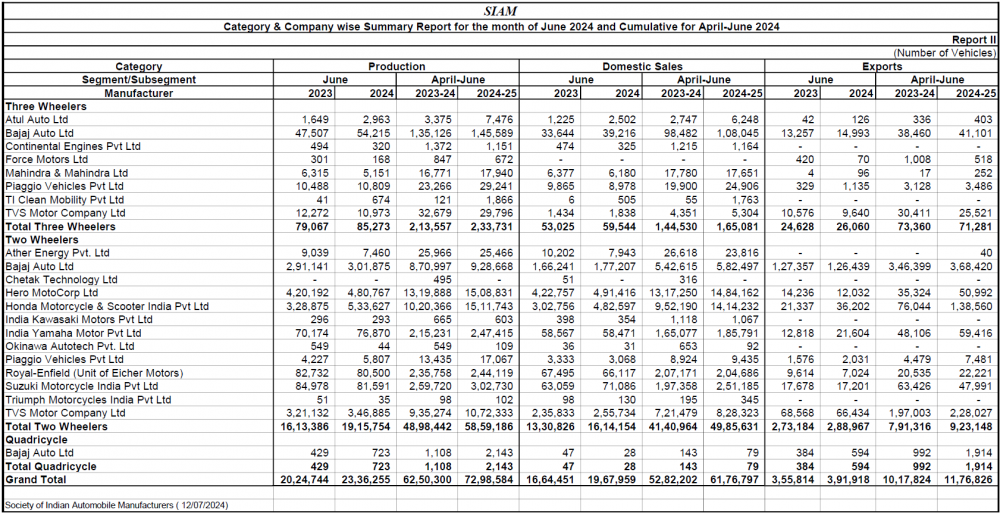

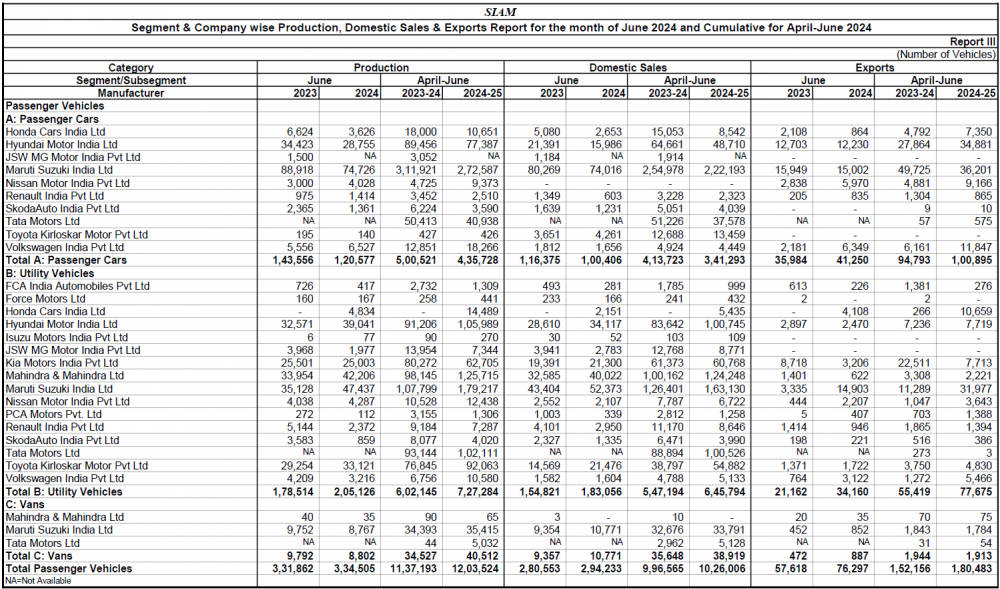

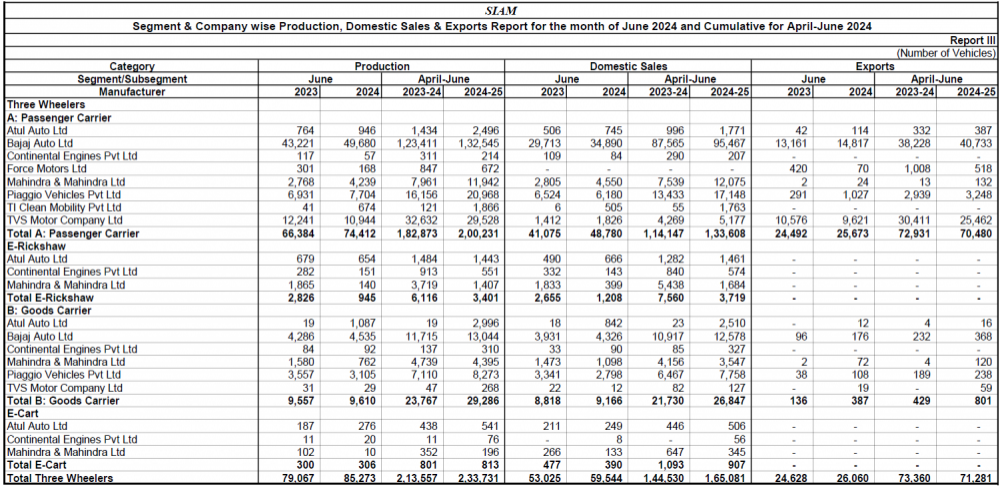

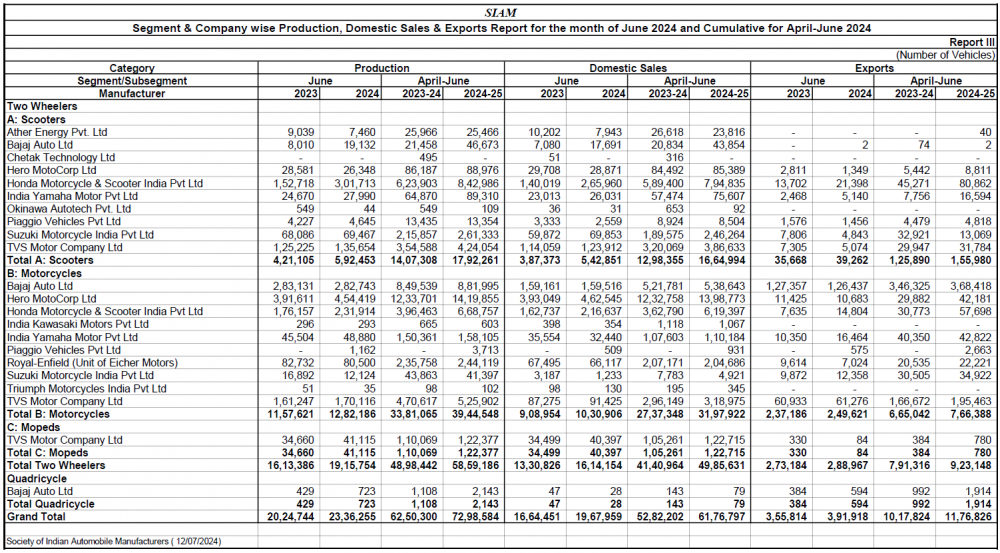

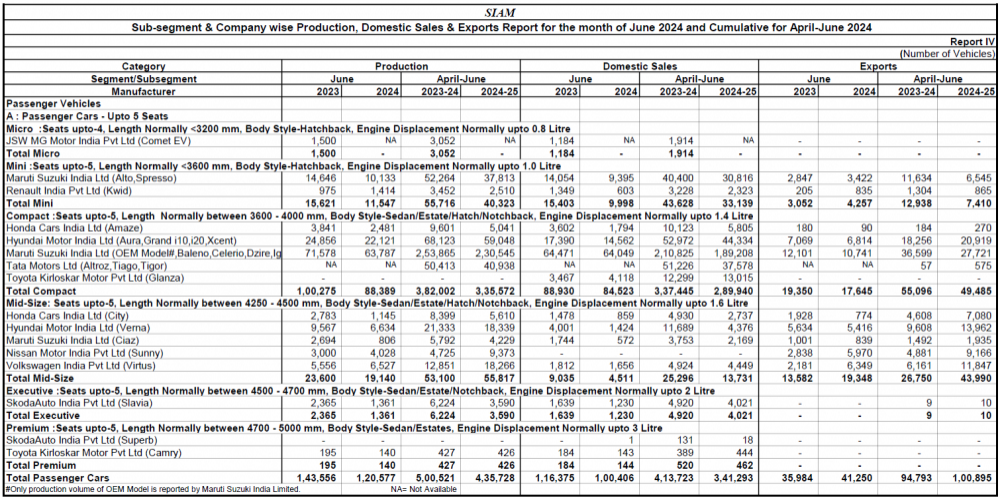

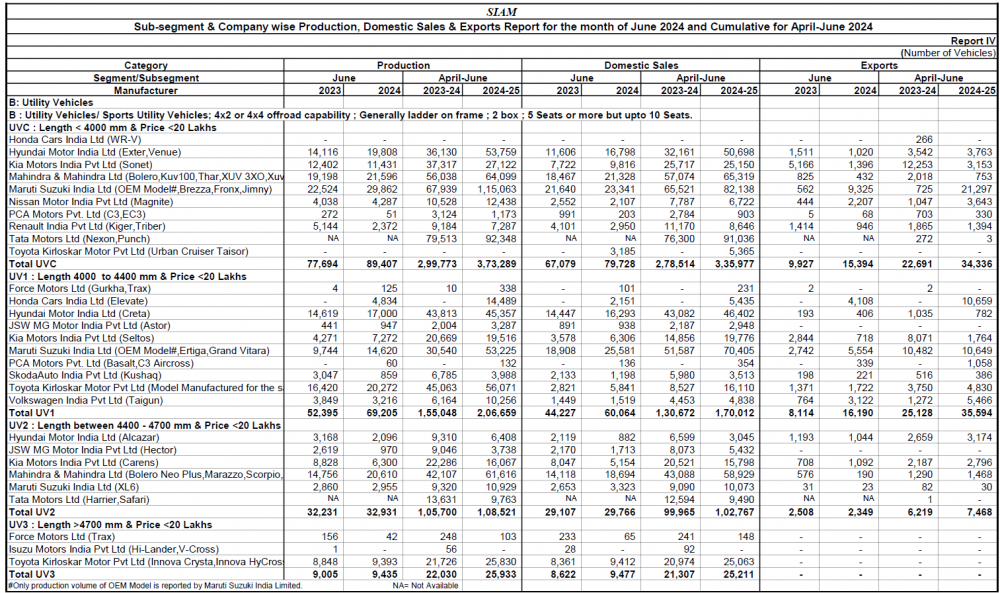

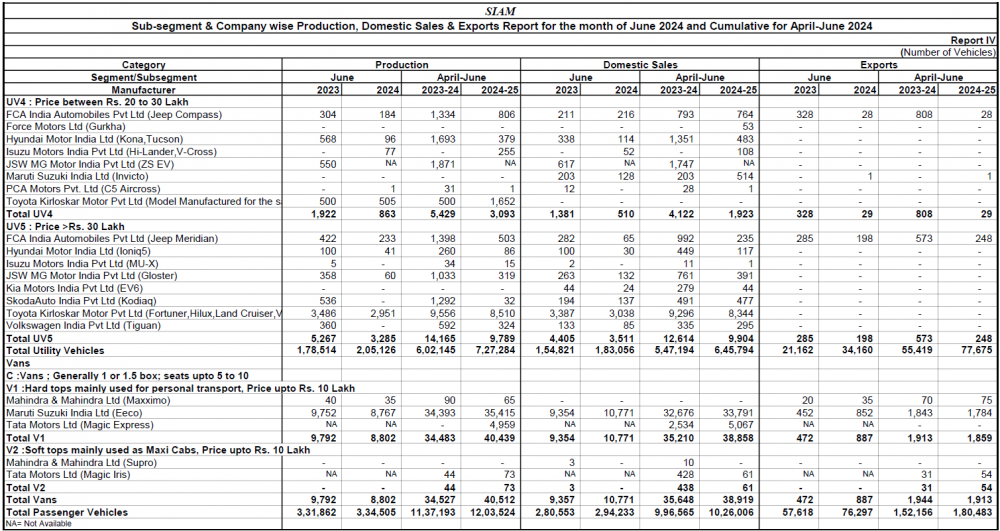

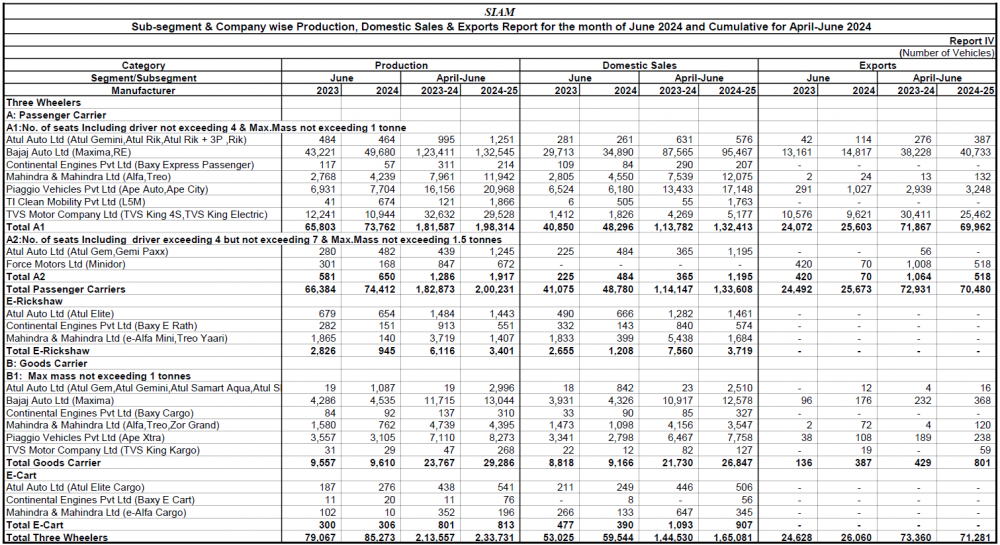

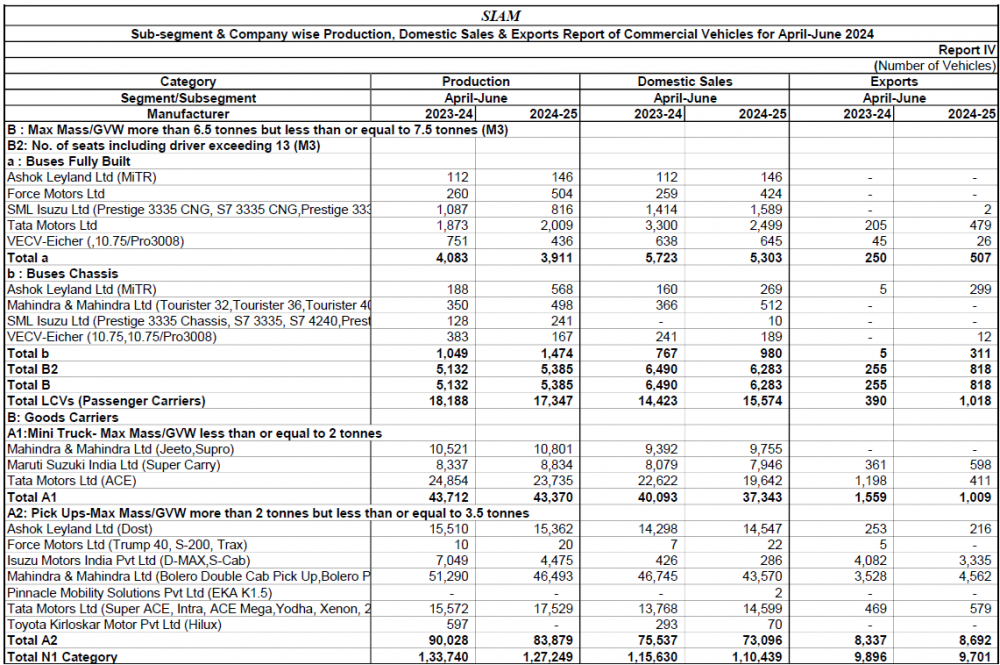

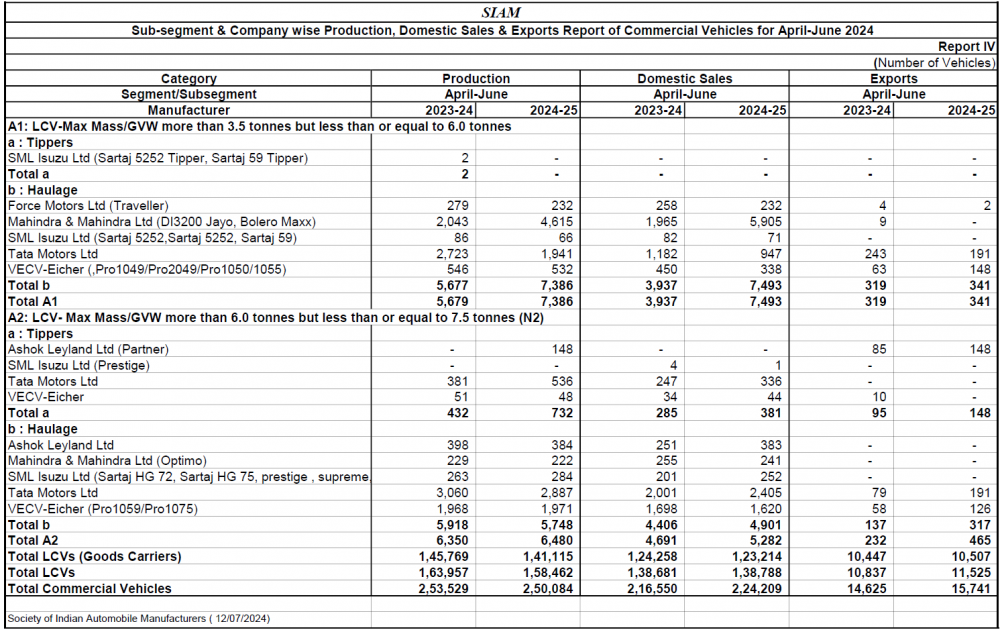

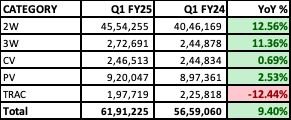

June 2024 Indian Car Sales

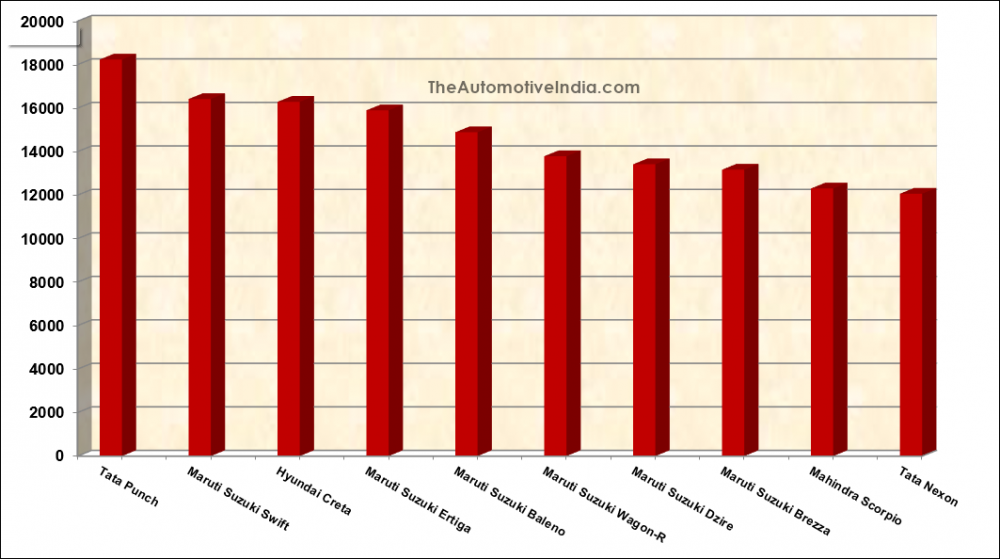

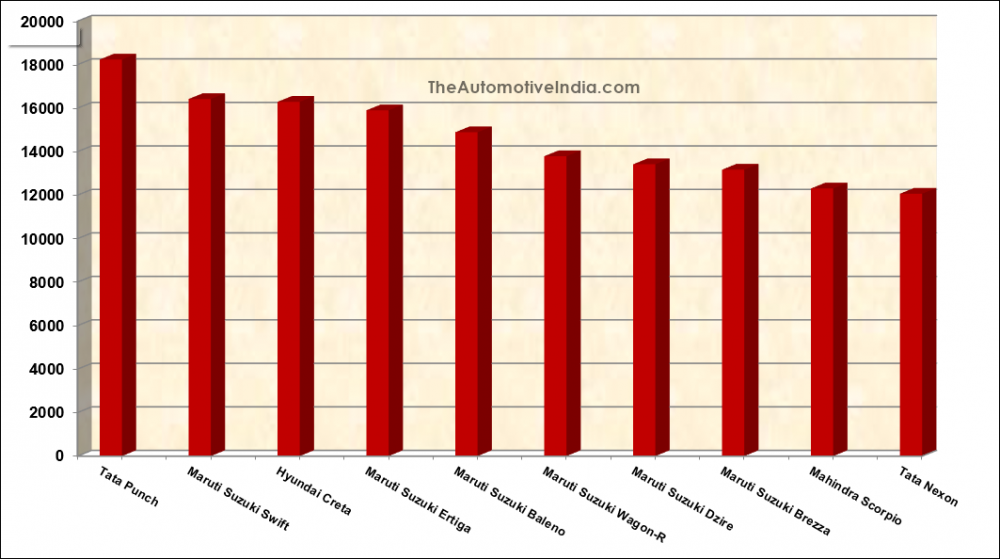

Top 10 Selling Cars: June 2024

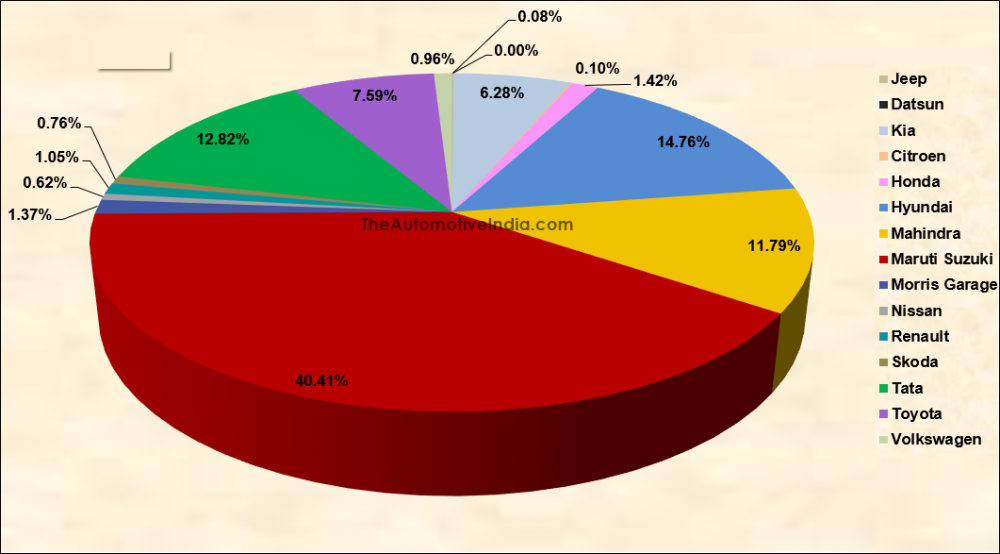

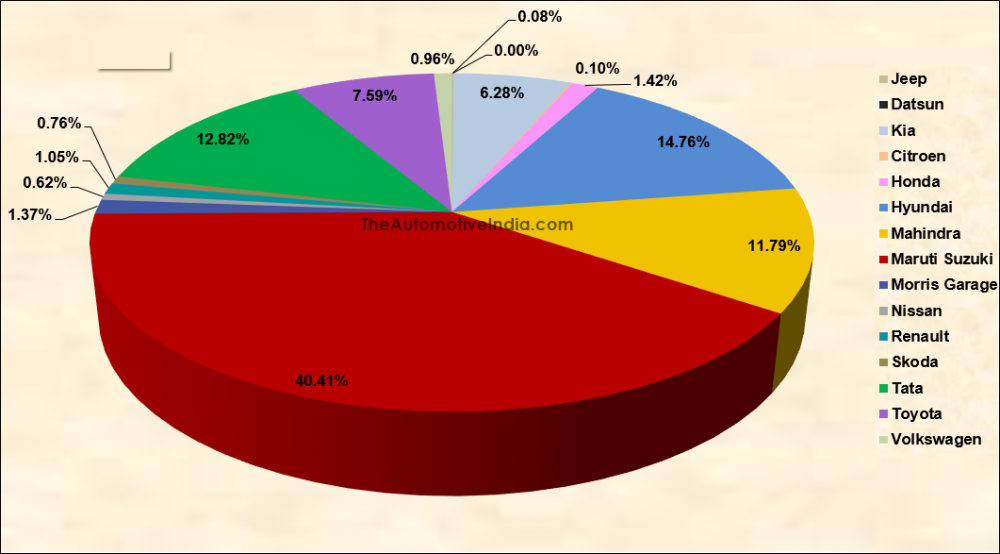

Manufacturers' Market Share: June 2024

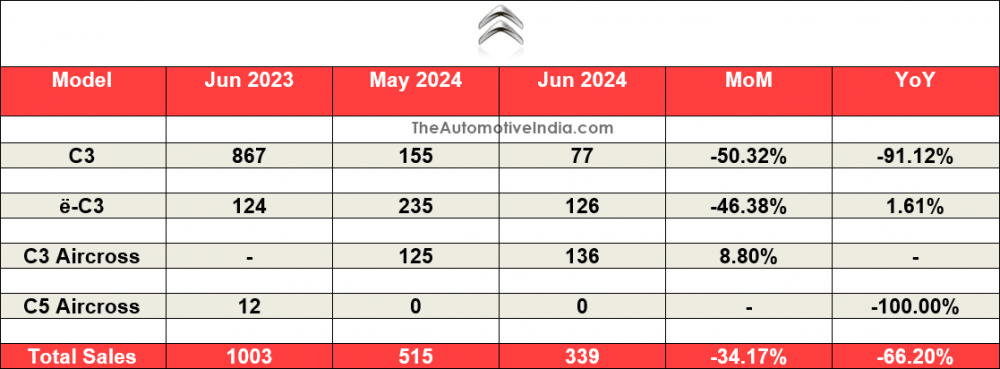

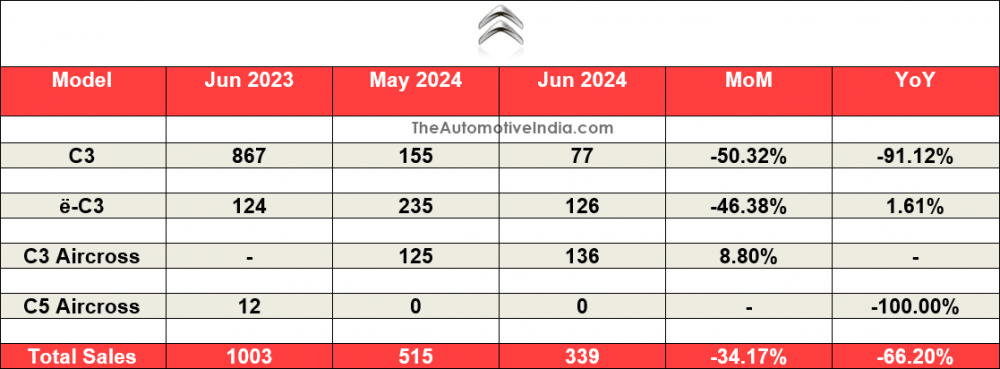

Citroën June 2024 Indian Car Sales

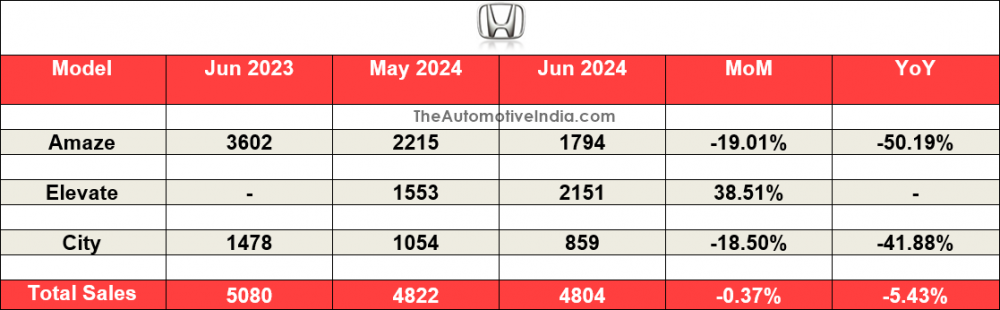

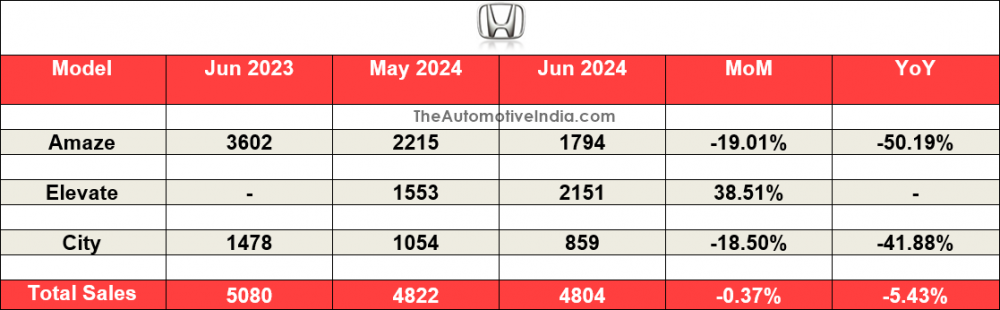

Honda June 2024 Indian Car Sales

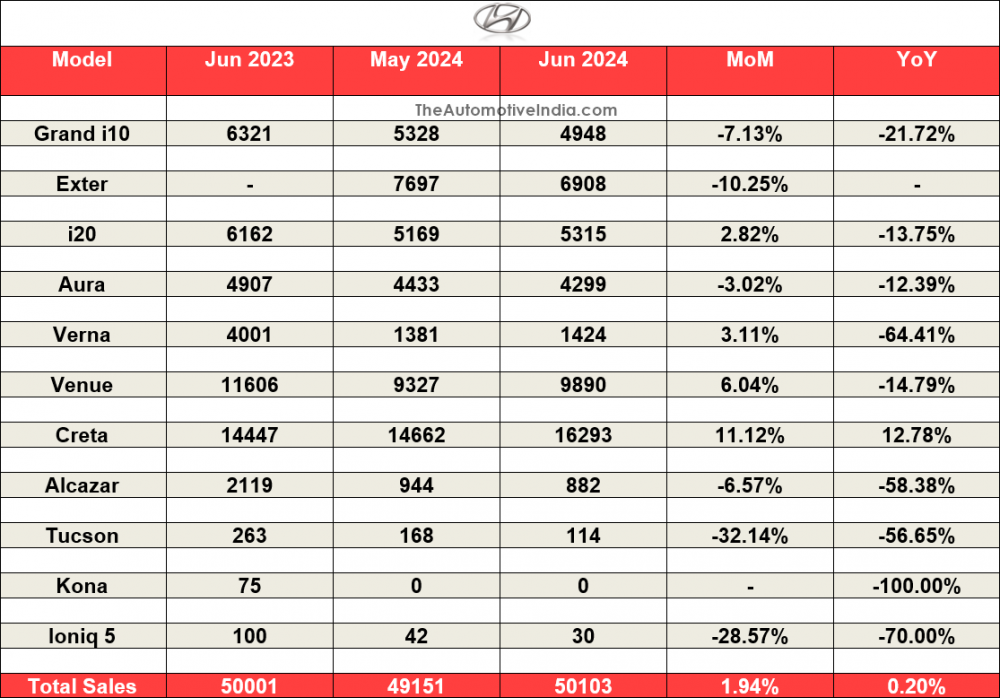

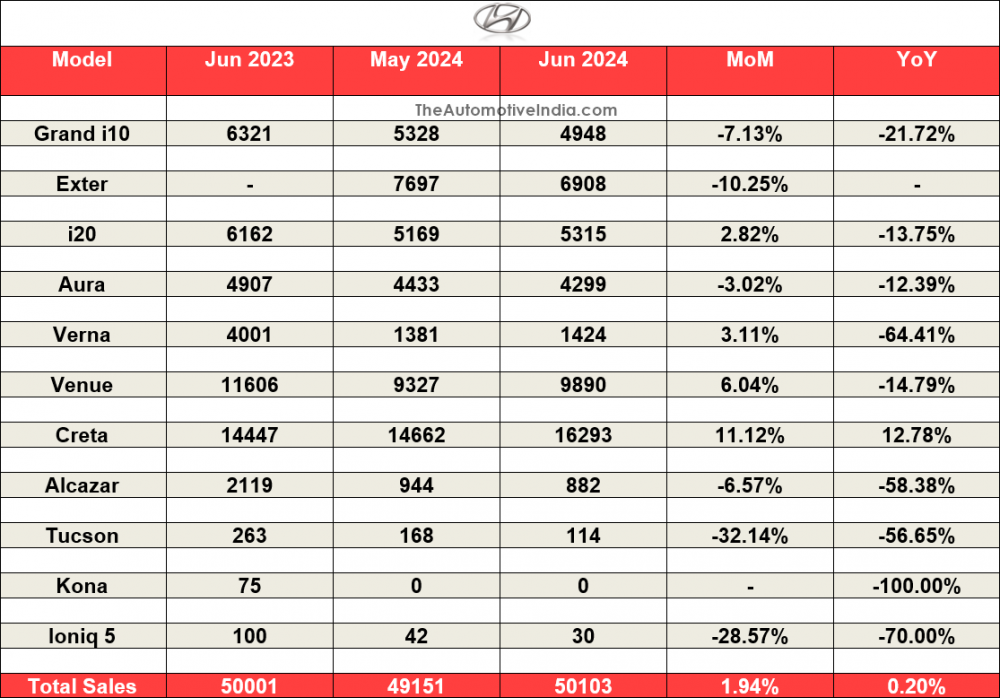

Hyundai June 2024 Indian Car Sales

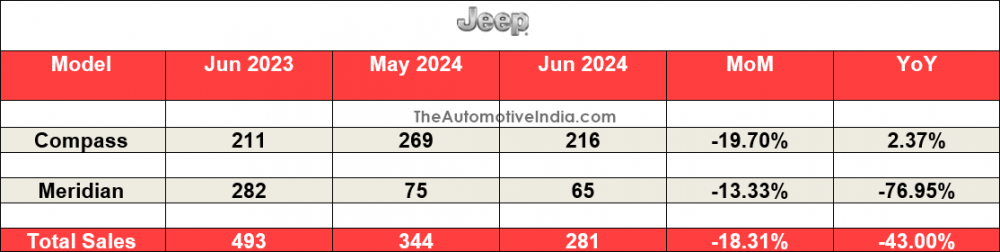

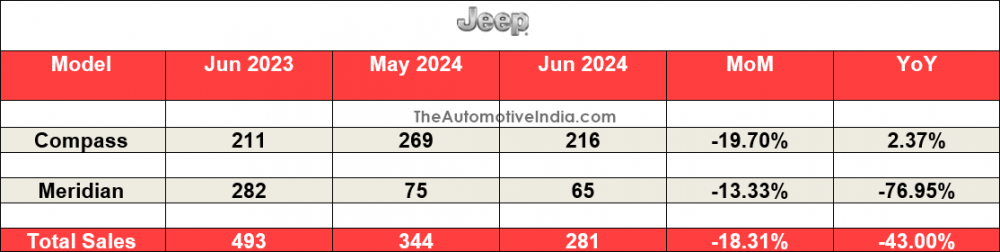

Jeep June 2024 Indian Car Sales

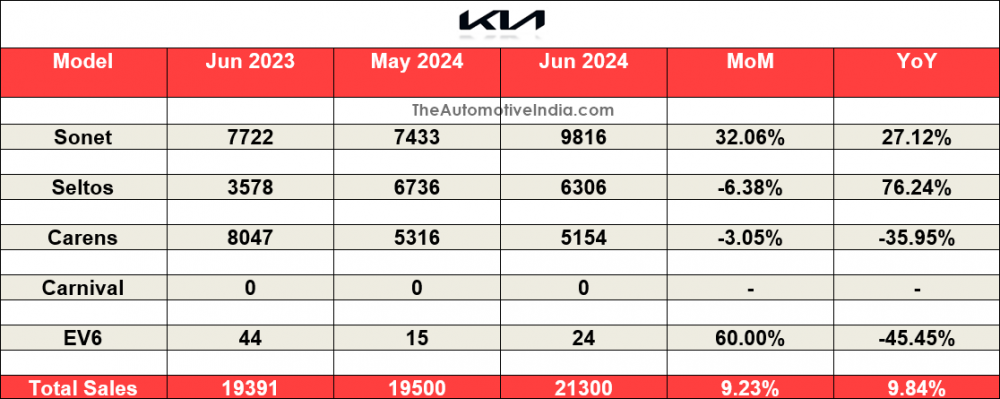

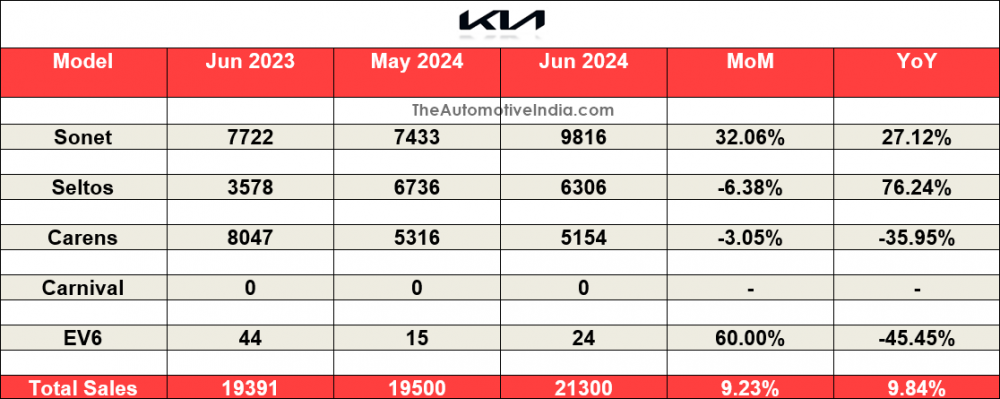

Kia June 2024 Indian Car Sales

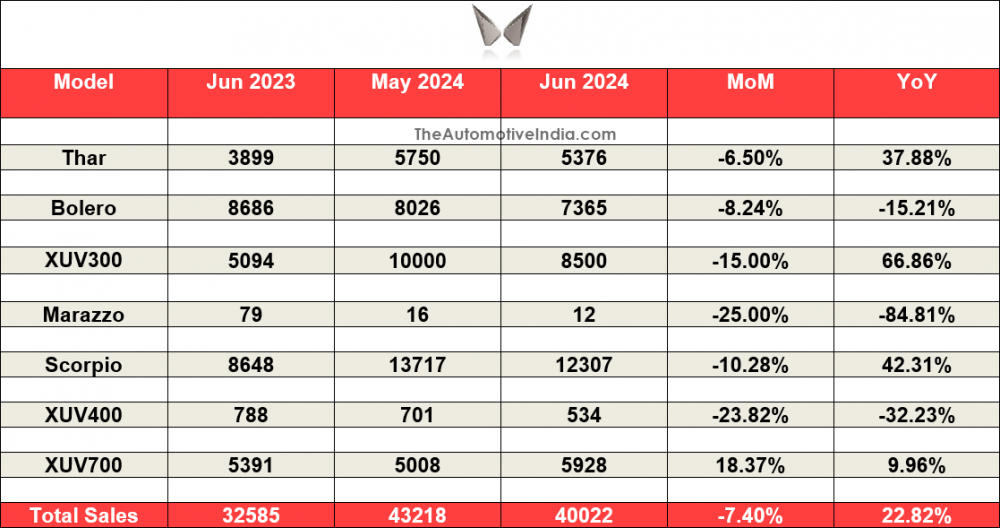

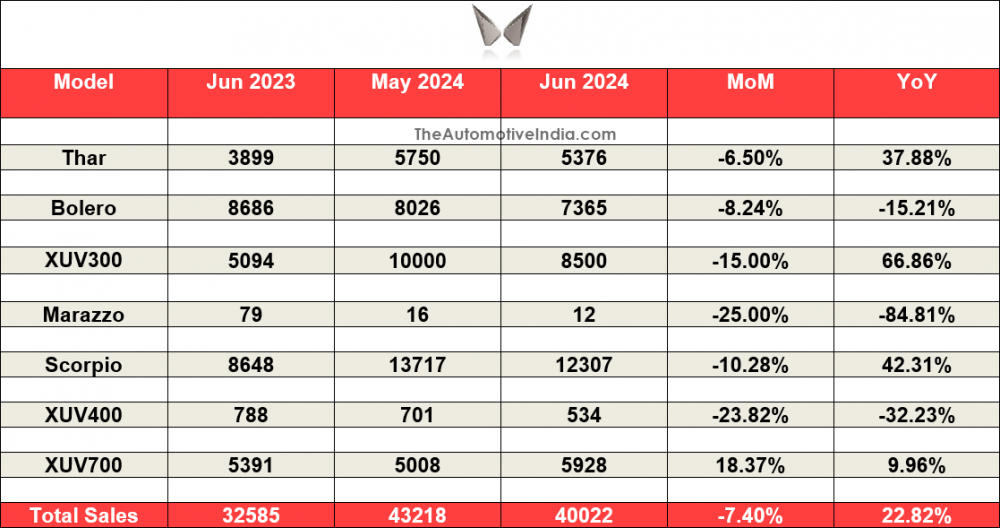

Mahindra June 2024 Indian Car Sales

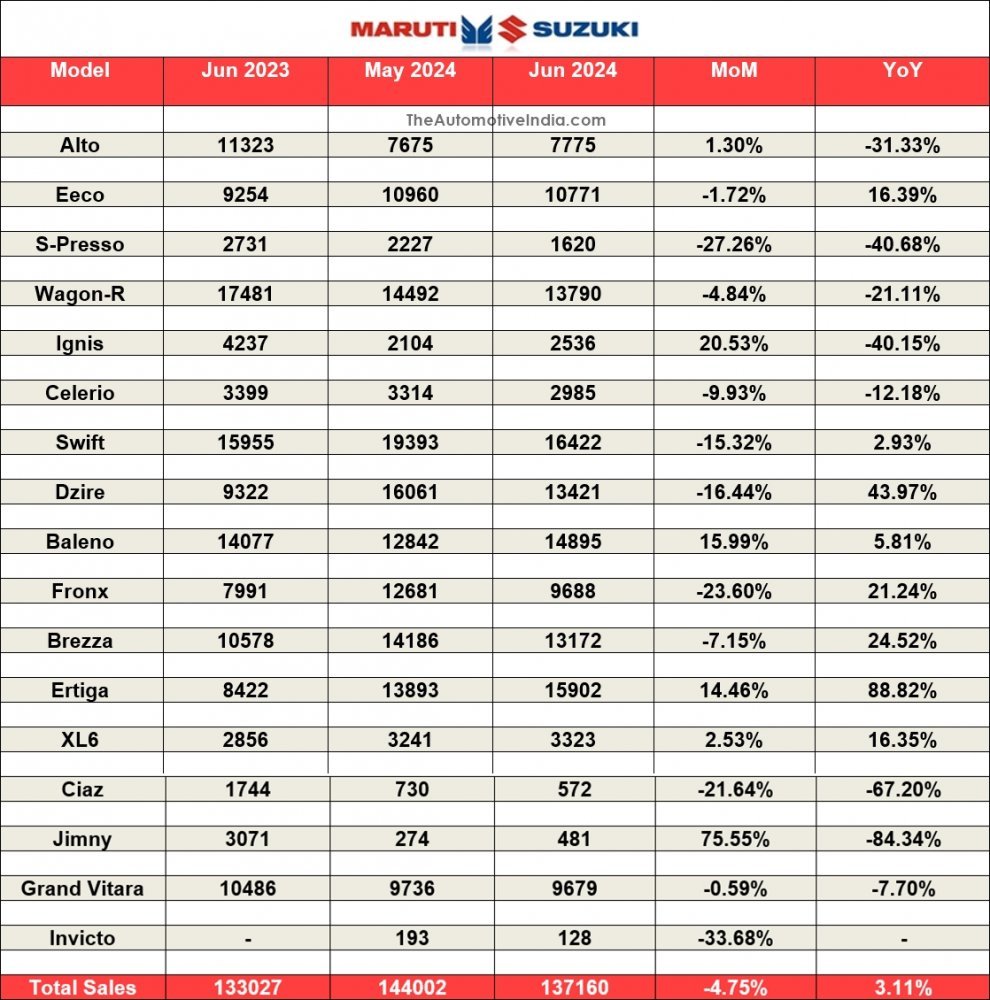

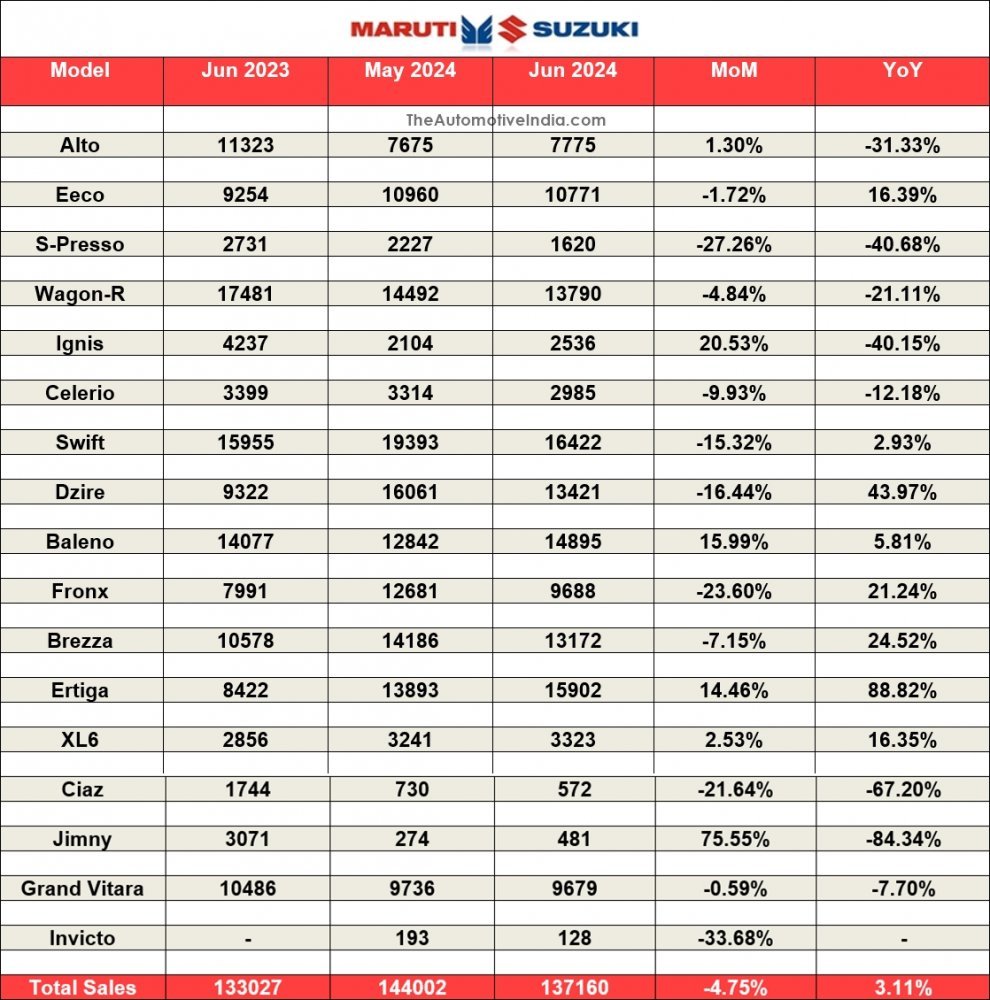

Maruti Suzuki June 2024 Indian Car Sales

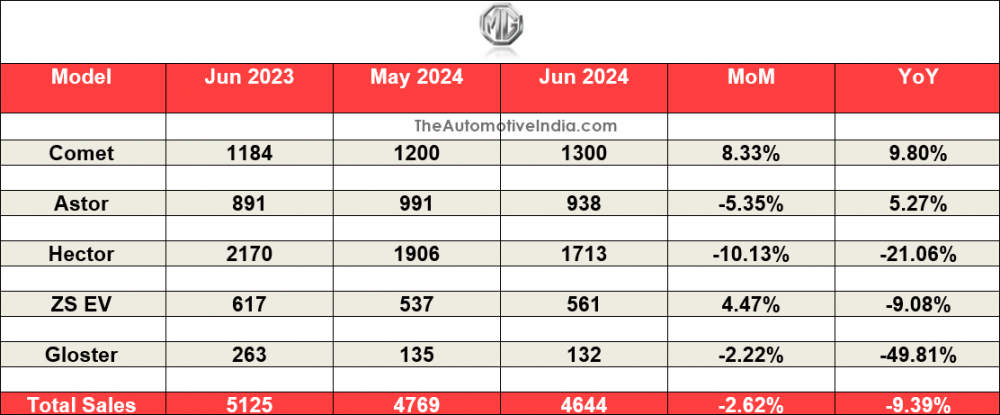

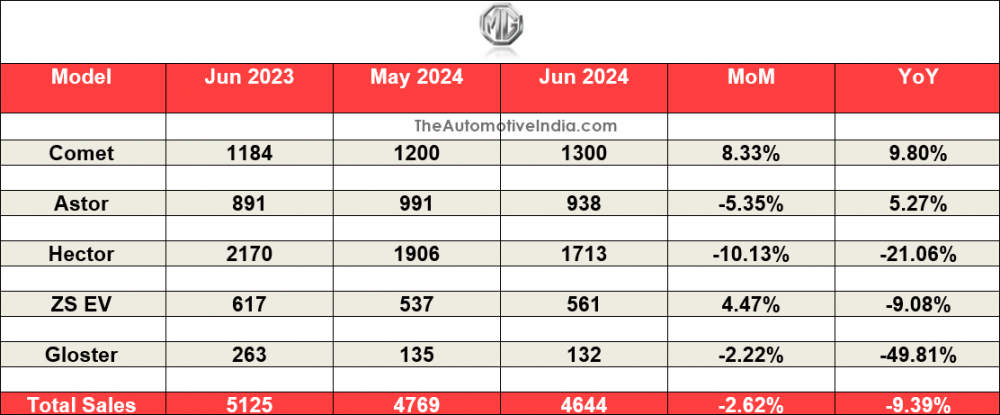

Morris Garages June 2024 Indian Car Sales

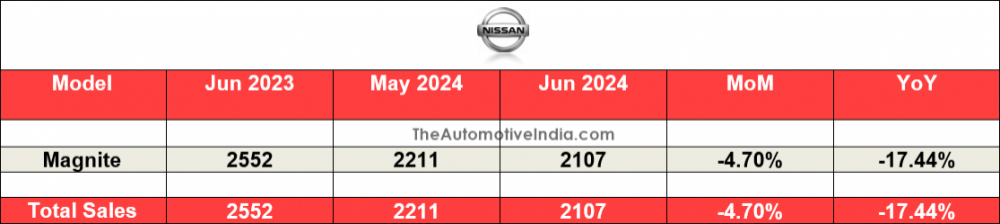

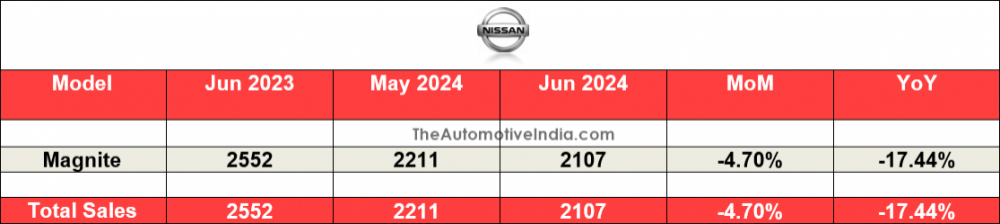

Nissan June 2024 Indian Car Sales

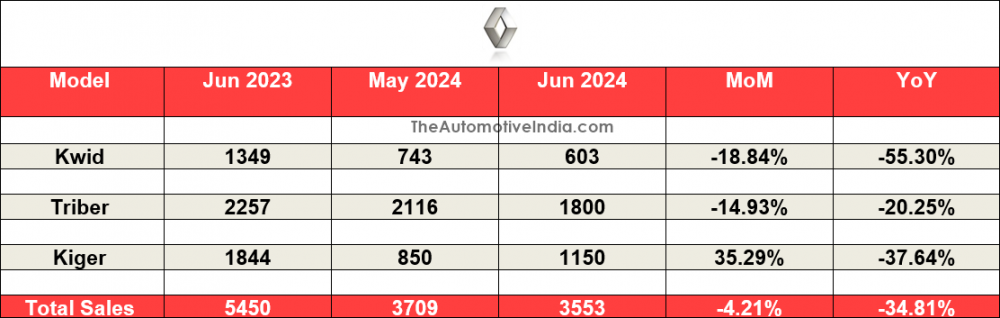

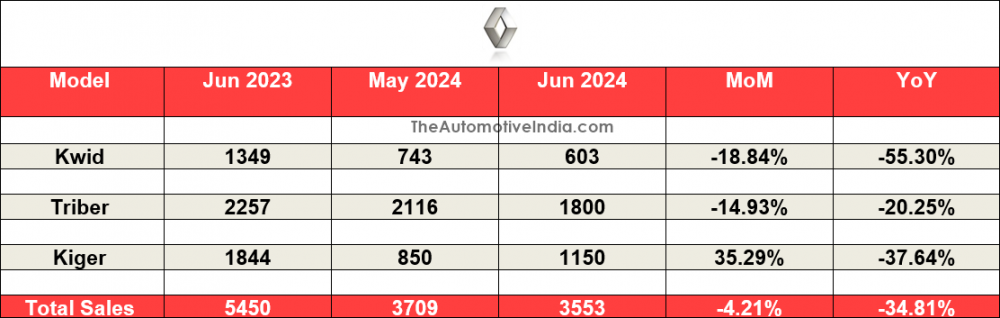

Renault June 2024 Indian Car Sales

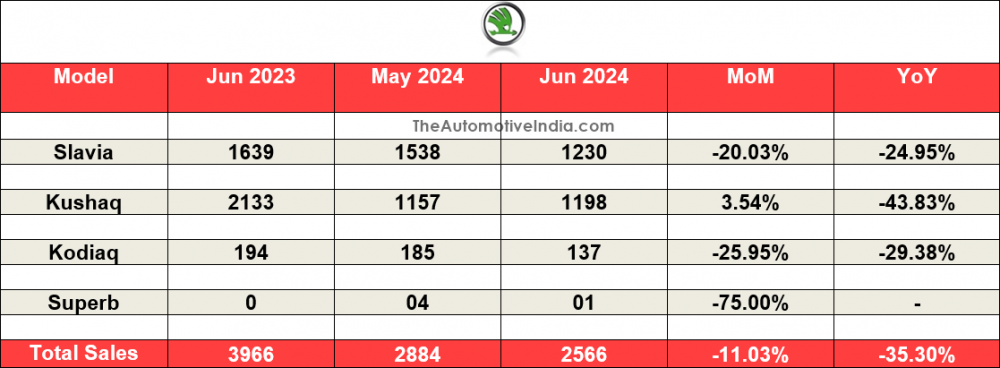

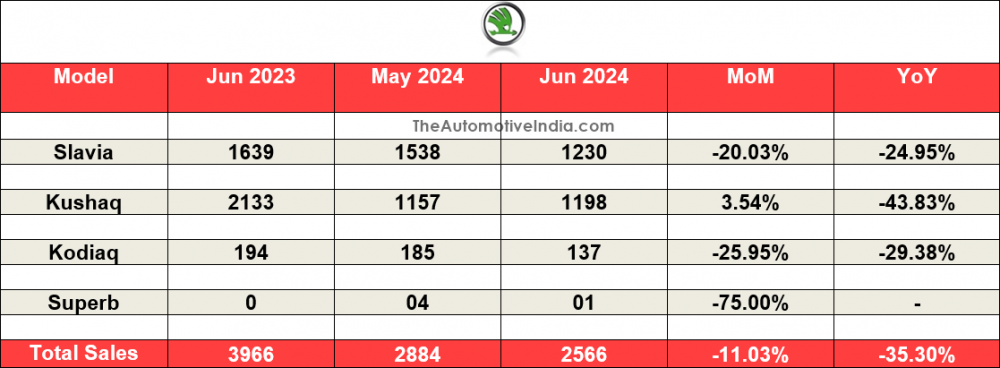

Skoda June 2024 Indian Car Sales

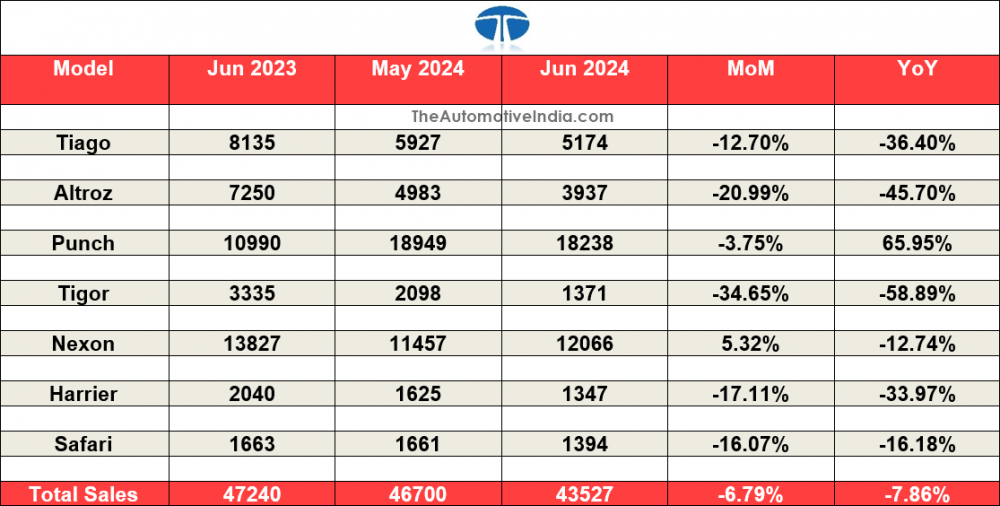

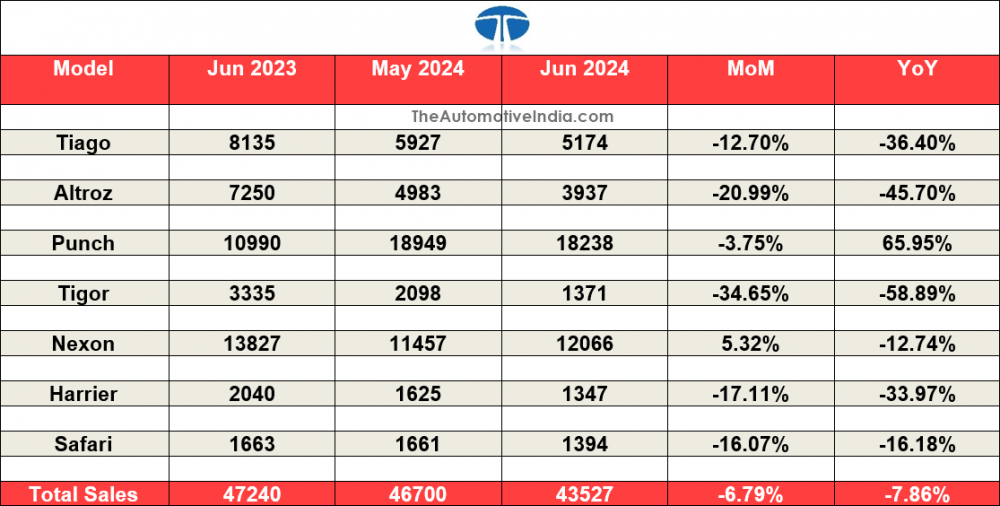

Tata Motors June 2024 Indian Car Sales

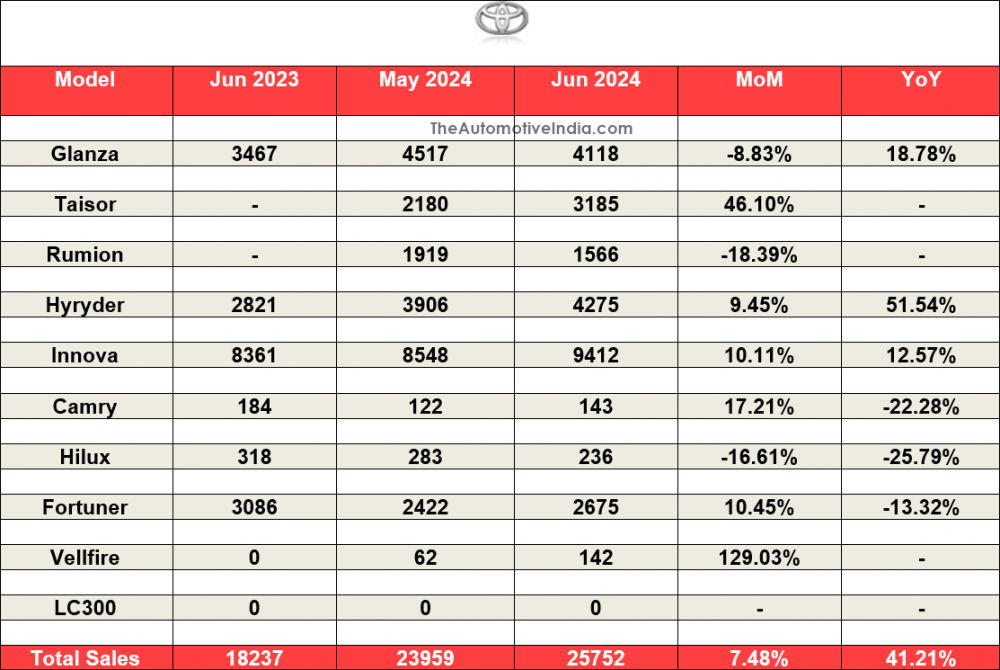

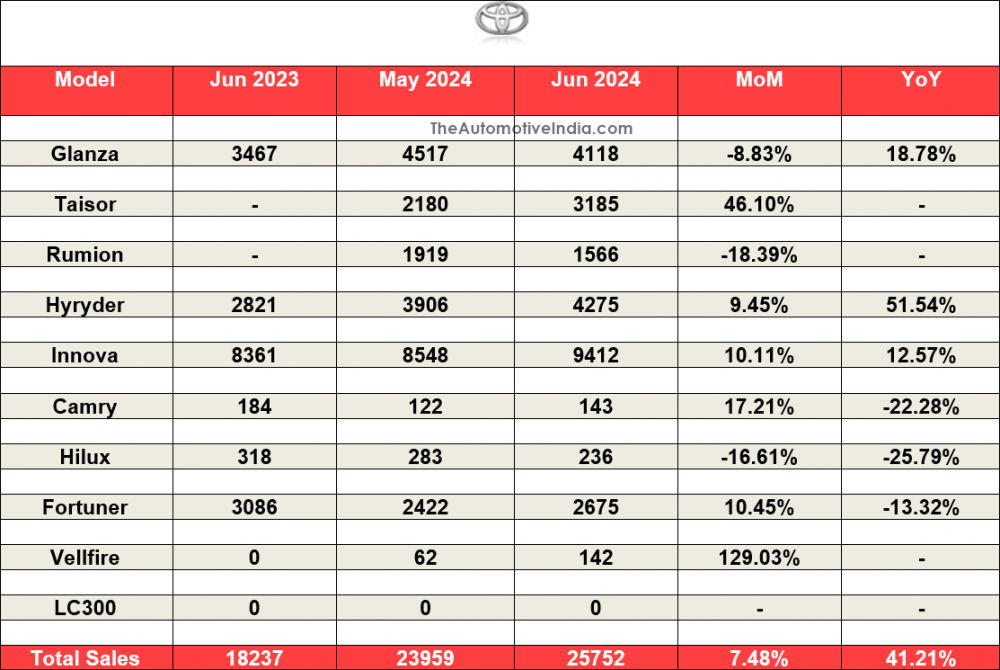

Toyota June 2024 Indian Car Sales

.

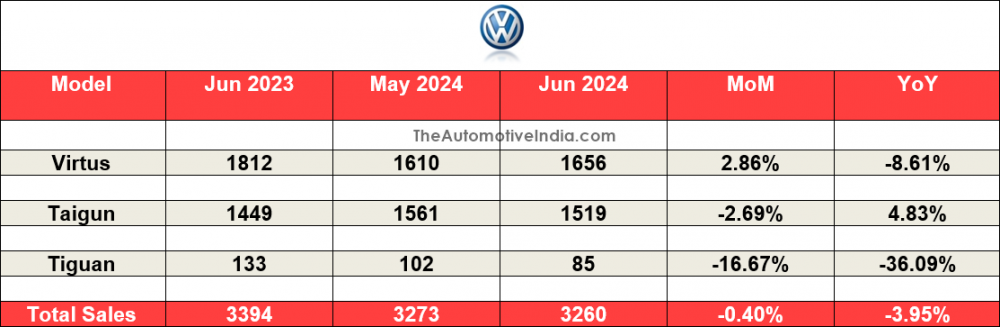

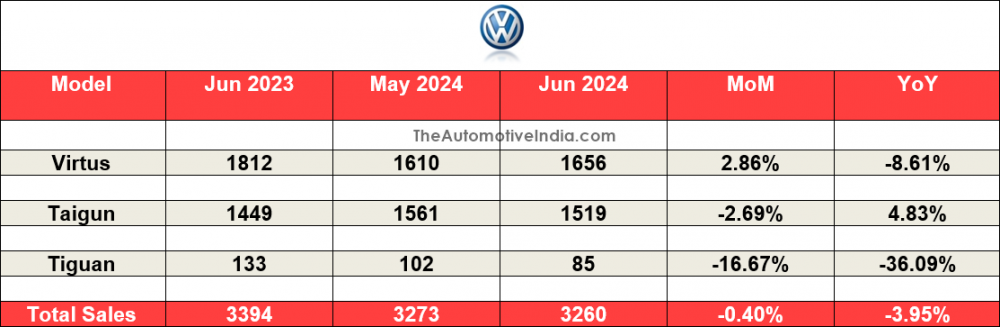

Volkswagen June 2024 Indian Car Sales

Top 10 Selling Cars: June 2024

Manufacturers' Market Share: June 2024

Citroën June 2024 Indian Car Sales

Honda June 2024 Indian Car Sales

Hyundai June 2024 Indian Car Sales

Jeep June 2024 Indian Car Sales

Kia June 2024 Indian Car Sales

Mahindra June 2024 Indian Car Sales

Maruti Suzuki June 2024 Indian Car Sales

Morris Garages June 2024 Indian Car Sales

Nissan June 2024 Indian Car Sales

Renault June 2024 Indian Car Sales

Skoda June 2024 Indian Car Sales

Tata Motors June 2024 Indian Car Sales

Toyota June 2024 Indian Car Sales

.

Volkswagen June 2024 Indian Car Sales

Drive Safe,

350Z