i just checked. even my checkout page says so. have you filled in the details and clicked on pay my order ? just do this, maybe the transaction will be successful.

Guide: Online Shopping Abroad & Customs Formalities

- Thread Starter Dr MUDHAN

- Start date

Thanks allhyundaicars. I shall try out and fill everythng in details. Hope to get successful.

this is strange. i was planning to give my blue leds to a friend. i lifted the boot only to see that 1 smd of the led was not working. my friend rejected it.

got a screw driver to replace with the stock ones , then i saw that only 1 of the other smd was working![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif)

now after checking it once more , both of the led's working fine :|

is this normal for these leds ? stop working and then be fine.

i reported to the seller the same. told him the led's are not working and told him to refund my money since shipping back will not be cost effective.

got a screw driver to replace with the stock ones , then i saw that only 1 of the other smd was working

![Surprise [surprise] [surprise]](https://www.theautomotiveindia.com/forums/images/smilies/Surprise.gif)

now after checking it once more , both of the led's working fine :|

is this normal for these leds ? stop working and then be fine.

i reported to the seller the same. told him the led's are not working and told him to refund my money since shipping back will not be cost effective.

Last edited:

May I know how much you paid for them? Most of these LEDs which are available for cheap prices are not built properly to dissipate heat. As a result when they get hot they tend to fail. As the cost of these LEDs increase better is the quality.

Also check if the seller has provided warranty for them.

Also check if the seller has provided warranty for them.

I paid 7$ for 2 LED bulbs . i don't think heat is the cause of this issue in my case. I removed the bulbs and again saw sometimes it worked and sometimes not.

Attachments

-

196.7 KB Views: 258

Hello Everyone,

I may be visiting to Portland, USA this month end for a around 60 days. I need some suggestion or knowledge sharing regarding buying product from US from local shops or malls. What kind of product should I buy which is not available/costly in INDIA.

I am also interested in knowing thing that how can I avoid/pay less "customs duty" or "tax".

What kind of payment mode is acceptable?

I may be visiting to Portland, USA this month end for a around 60 days. I need some suggestion or knowledge sharing regarding buying product from US from local shops or malls. What kind of product should I buy which is not available/costly in INDIA.

I am also interested in knowing thing that how can I avoid/pay less "customs duty" or "tax".

What kind of payment mode is acceptable?

International Shopping?

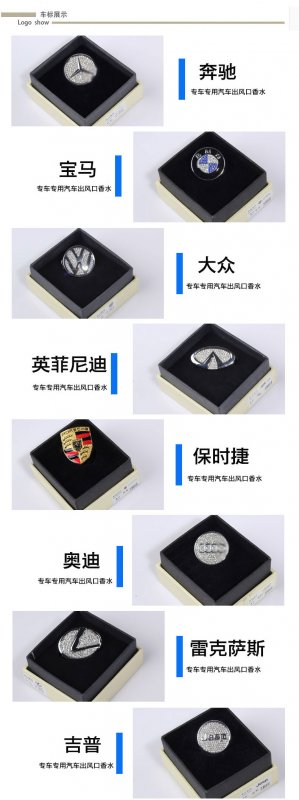

Guys, I find out some car perfume(about 400Rs per item) online, but are not sold by sellers in India, how can I get these stuffs back to India?

Anyone knows how?

Guys, I find out some car perfume(about 400Rs per item) online, but are not sold by sellers in India, how can I get these stuffs back to India?

Anyone knows how?

Attachments

-

189.3 KB Views: 228

-

184.7 KB Views: 233

-

455.8 KB Views: 2,467

Last edited:

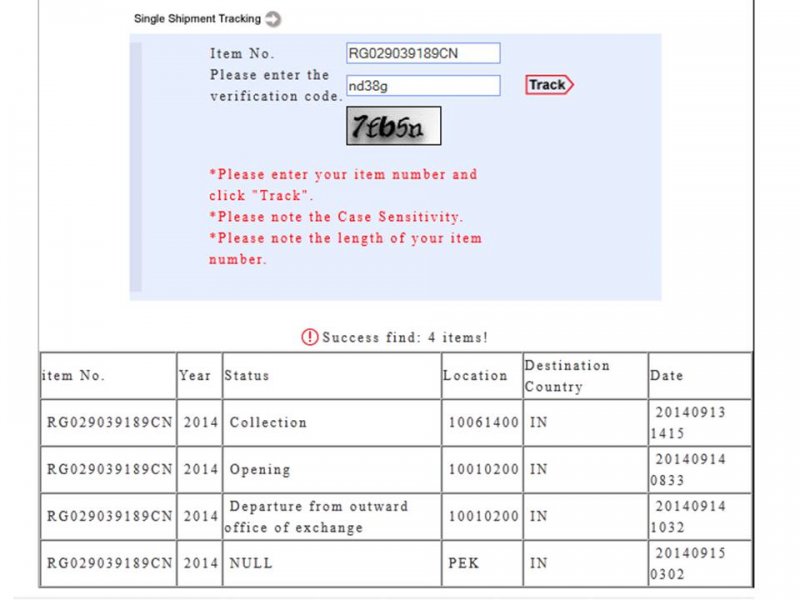

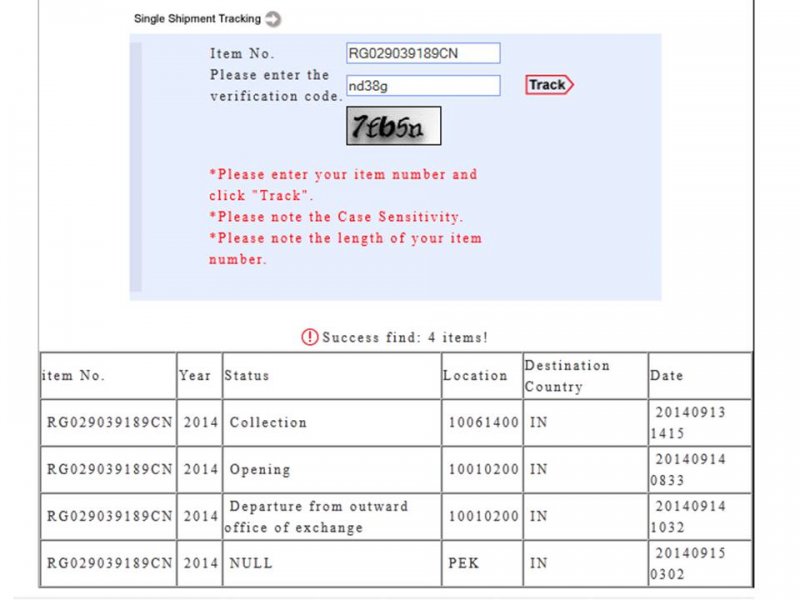

Doctor,

Please pardon my ignorance.

I have ordered a material in Aliexpress.com. Posted the current shipping status. I hope there is no delay in status updation. Is this warrants any activity from my side?

Also I'm planning to go to my hometown for the next one week. If suppose I get the material in the mean time, how to ensure the delivery of the product.

Please pardon my ignorance.

I have ordered a material in Aliexpress.com. Posted the current shipping status. I hope there is no delay in status updation. Is this warrants any activity from my side?

Also I'm planning to go to my hometown for the next one week. If suppose I get the material in the mean time, how to ensure the delivery of the product.

Thread Starter

#56

@gandhi

As on 15/09/2014 your product got cleared at china customs and it is on transit to India and may again take 10 to 15 days more.

Kindly tell your friends / neighbors to receive it . If you know the nearest foreign post office / regular post office, you can even tell the post man to keep it for you. There will not be any problem.

As on 15/09/2014 your product got cleared at china customs and it is on transit to India and may again take 10 to 15 days more.

Kindly tell your friends / neighbors to receive it . If you know the nearest foreign post office / regular post office, you can even tell the post man to keep it for you. There will not be any problem.

Thread Starter

#58

@ GANDHI

You haven’t given the present status report to know where the consignment is lying as on date.

Whatever may be, before the purchase protection ends, we have to open dispute with the seller.

I assume, the assured time is getting over, so first send a letter to the seller that you need a full refund as the same has not been received in wanted time and further, you promise him that the amount will be returned immediately in case you receive the item later.

Most of the sellers will respond and agree. Some seller may extend purchase protection for 15 days more, by making a request to you.

This will create a record and help AE to dispose the dispute at our favor at last.

If the time is very short say 1 or 2 days, proceed straight to dispute. If it is an item with battery or electronic one, our customs will take their own time to clear.

But you need not wait, if it has not come to your hand, you may go for dispute. I assure that you will get back your money at least.

You haven’t given the present status report to know where the consignment is lying as on date.

Whatever may be, before the purchase protection ends, we have to open dispute with the seller.

I assume, the assured time is getting over, so first send a letter to the seller that you need a full refund as the same has not been received in wanted time and further, you promise him that the amount will be returned immediately in case you receive the item later.

Most of the sellers will respond and agree. Some seller may extend purchase protection for 15 days more, by making a request to you.

This will create a record and help AE to dispose the dispute at our favor at last.

If the time is very short say 1 or 2 days, proceed straight to dispute. If it is an item with battery or electronic one, our customs will take their own time to clear.

But you need not wait, if it has not come to your hand, you may go for dispute. I assure that you will get back your money at least.

@ GANDHI

You haven’t given the present status report to know where the consignment is lying as on date.

If it is an item with battery or electronic one, our customs will take their own time to clear.

But you need not wait, if it has not come to your hand, you may go for dispute. I assure that you will get back your money at least.

You haven’t given the present status report to know where the consignment is lying as on date.

If it is an item with battery or electronic one, our customs will take their own time to clear.

But you need not wait, if it has not come to your hand, you may go for dispute. I assure that you will get back your money at least.

It's just a net organiser. It is not a battery or electronic item.

As per your suggestion, I have opened dispute.

Hi friends.,

On 15-Apr-2015, I placed an order for HID KIT which costs $19.31. You can see the item here.

The package weighs .45kg and its dimension is 18cm x 8cm x 5cm.

Altogether is that a taxable product?

20-Apr-2015 19:54------Received by Post Office---------523112

23-Apr-2015 13:38------Departure export customs-------BEIJING

02-May-2015 08:44-----Arrival Import customs------------KOLKATA APSO

02-May-2015 10:18-----Held by customs--------------------KOLKATA APSO

Now the problem is, its held by the customs. Now I would like to know whats gonna happen next![Confused [confused] [confused]](https://www.theautomotiveindia.com/forums/images/smilies/Confused.gif) . Some where in TAI I read, generally import duties wont attract for the products upto $20.

. Some where in TAI I read, generally import duties wont attract for the products upto $20.

*Will every products held by the customs attracts duty when it is released to the customers?

*Will I get any call from the customs office? IF yes, what should I say to avoid a hefty tax?

*Somewhere I read, import tax can be a max of 30% of price of the product(Including its shipping cost.). Is it true? WHat can be the max %?

*I paid Rs 1,241.60/- exactly for this product and I think its ok to pay a max tax of Rs 500/- or below for this silly product. What if the tax is much higher than the real worth of this product.?

-Can I refuse to pay? If yes and if I refused, will they ship it back to the seller? So will I get a refund with a deduction of its shipping charge?

These are my doubts.. I request you people to help me by sharing your valuable experiences and knowledge.

Thanks in Advance![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

Regards.,

On 15-Apr-2015, I placed an order for HID KIT which costs $19.31. You can see the item here.

The package weighs .45kg and its dimension is 18cm x 8cm x 5cm.

Altogether is that a taxable product?

20-Apr-2015 19:54------Received by Post Office---------523112

23-Apr-2015 13:38------Departure export customs-------BEIJING

02-May-2015 08:44-----Arrival Import customs------------KOLKATA APSO

02-May-2015 10:18-----Held by customs--------------------KOLKATA APSO

Now the problem is, its held by the customs. Now I would like to know whats gonna happen next

![Confused [confused] [confused]](https://www.theautomotiveindia.com/forums/images/smilies/Confused.gif) . Some where in TAI I read, generally import duties wont attract for the products upto $20.

. Some where in TAI I read, generally import duties wont attract for the products upto $20.*Will every products held by the customs attracts duty when it is released to the customers?

*Will I get any call from the customs office? IF yes, what should I say to avoid a hefty tax?

*Somewhere I read, import tax can be a max of 30% of price of the product(Including its shipping cost.). Is it true? WHat can be the max %?

*I paid Rs 1,241.60/- exactly for this product and I think its ok to pay a max tax of Rs 500/- or below for this silly product. What if the tax is much higher than the real worth of this product.?

-Can I refuse to pay? If yes and if I refused, will they ship it back to the seller? So will I get a refund with a deduction of its shipping charge?

These are my doubts.. I request you people to help me by sharing your valuable experiences and knowledge.

Thanks in Advance

![Smile [:)] [:)]](https://www.theautomotiveindia.com/forums/images/smilies/Smile.gif)

Regards.,