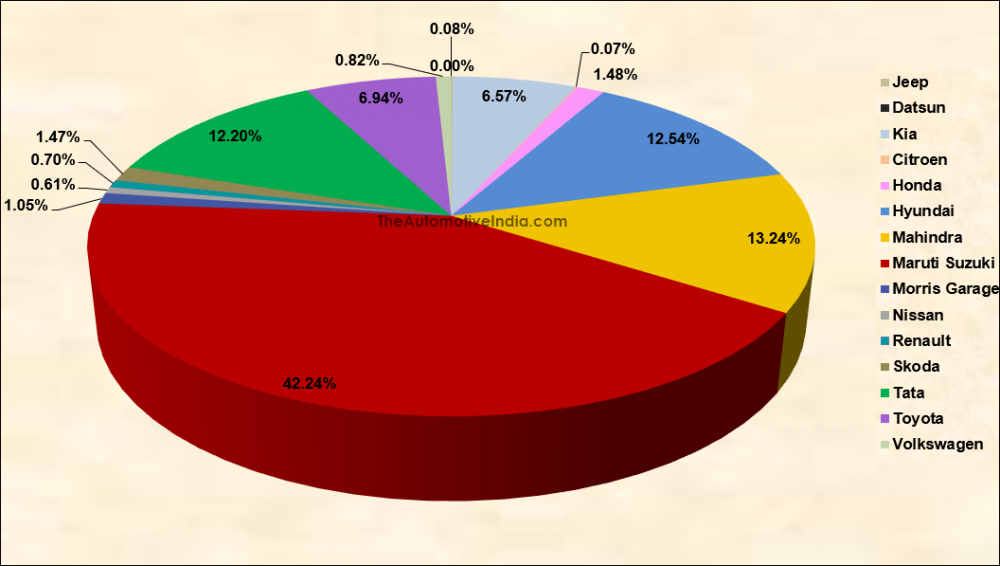

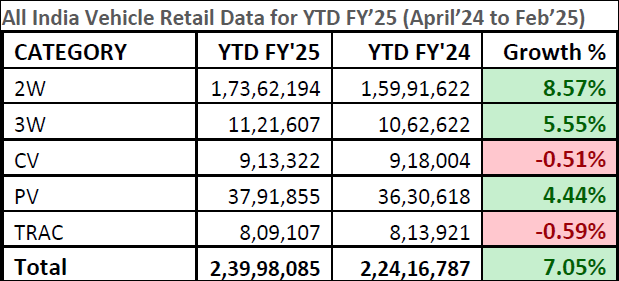

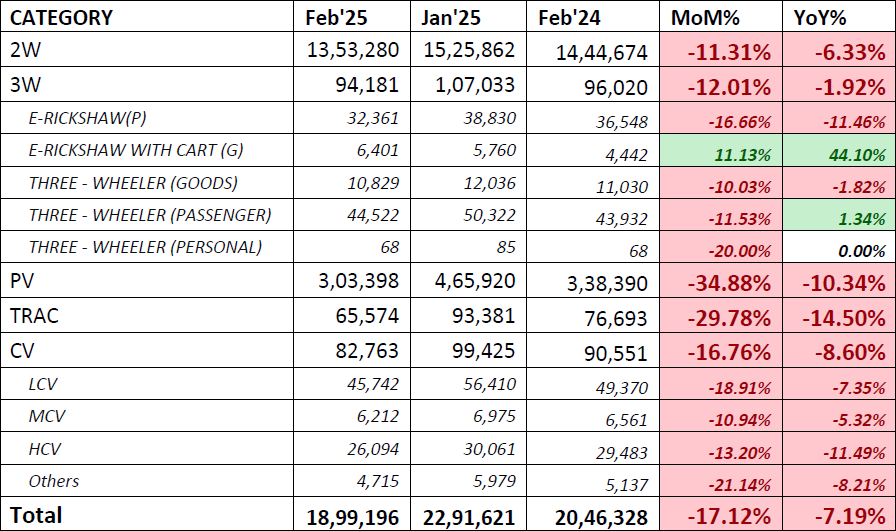

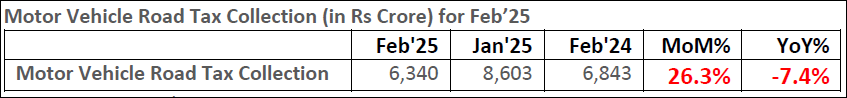

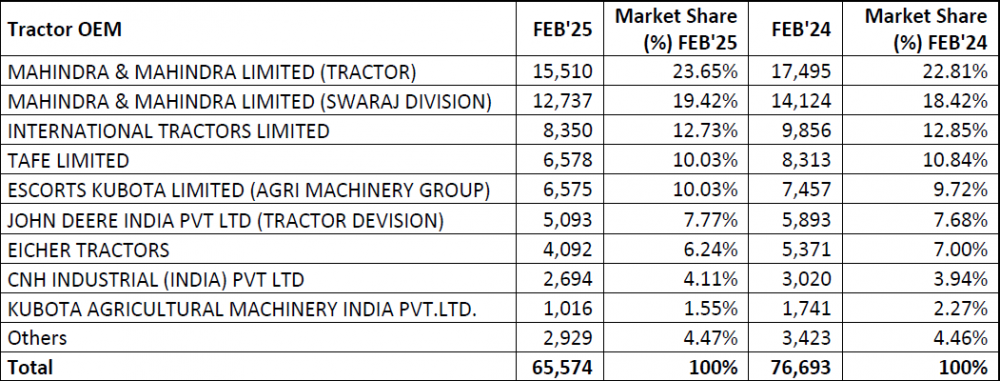

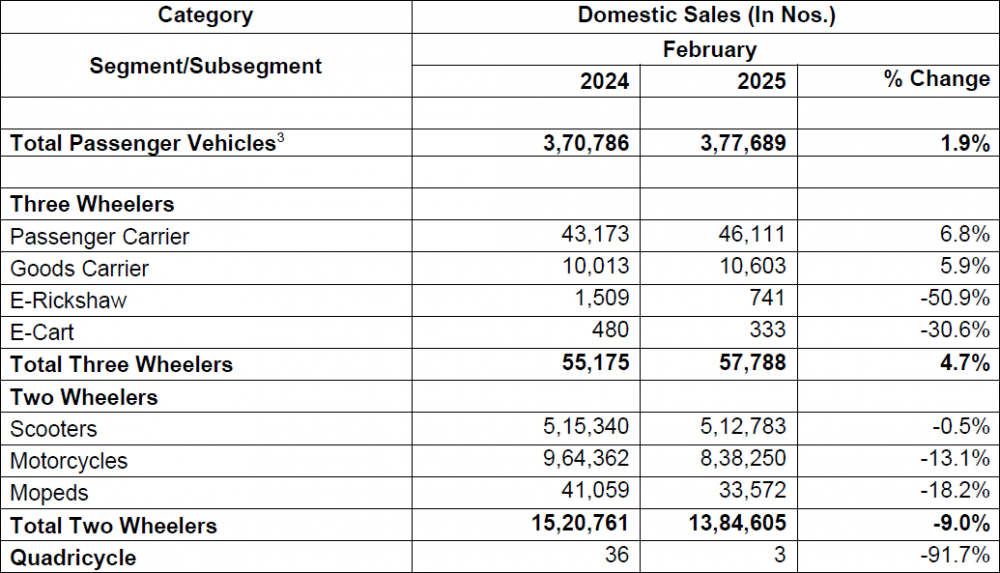

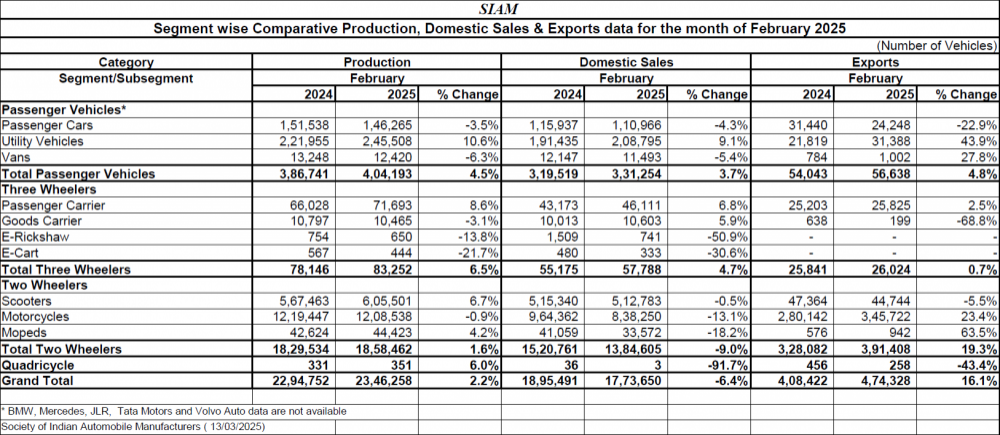

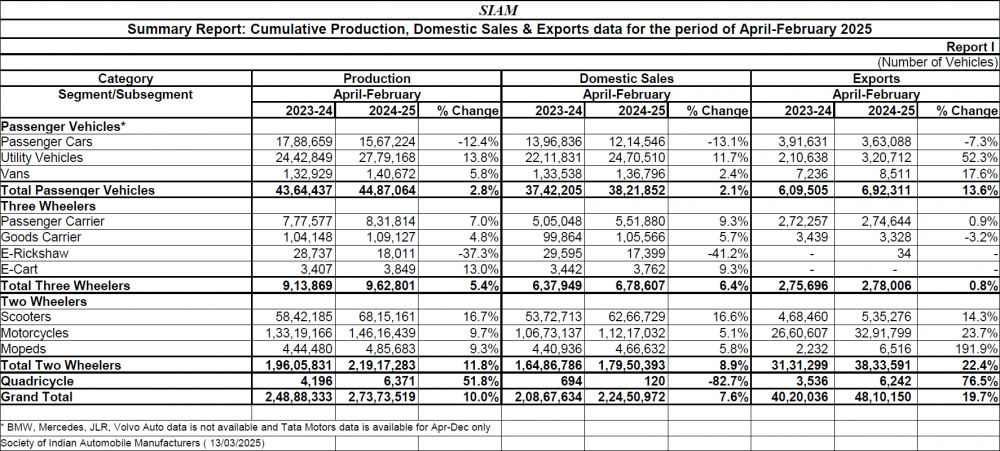

6th March’25, New Delhi, INDIA: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for February'25. February’25 Retails FADA President, Mr. C S Vigneshwar, shared his perspective on the Auto Retail performance for February 2025: “February witnessed a broad-based downturn across all categories, a trend that was anticipated in our previous survey which projected a ‘Flat to De-growth’ sentiment for the month. Overall, the market closed with a -7% YoY decline, with 2W, 3W, PV, Trac and CV falling by 6%, 2%, 10%, 14.5% and 8.6% respectively.

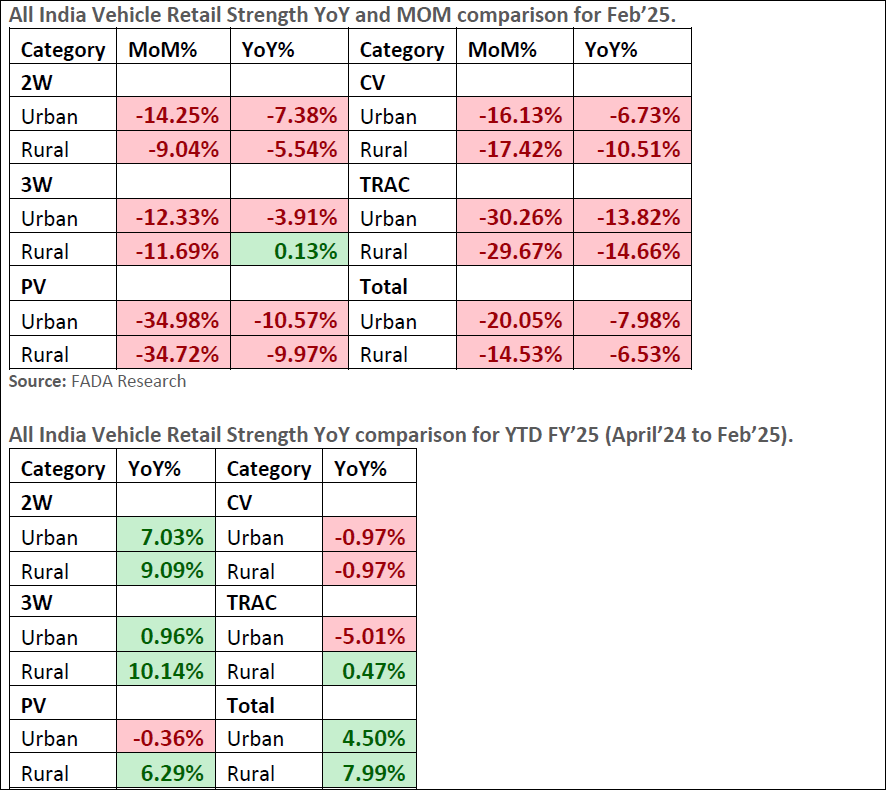

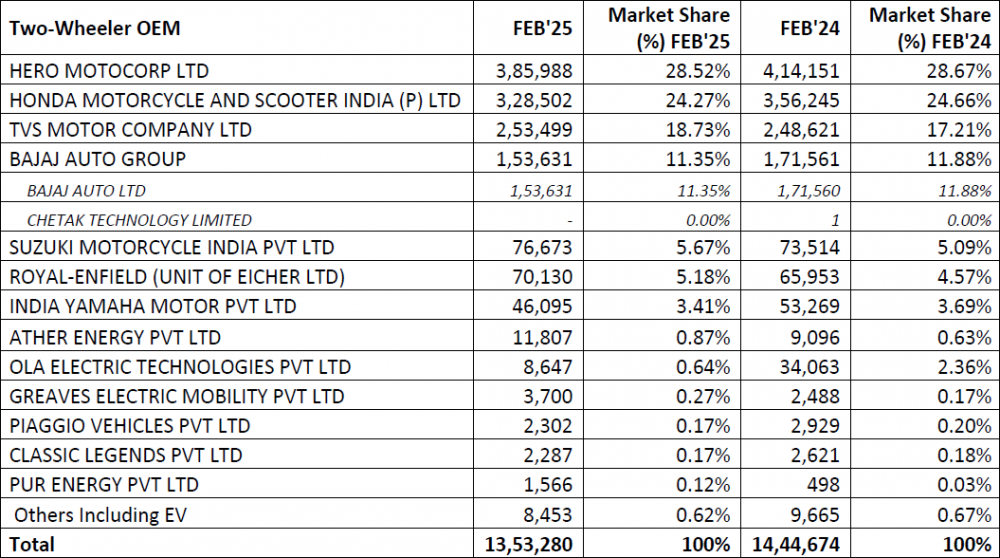

During the month, dealers began expressing concerns about inventory being pushed to them without their consent. While such initiatives may serve broader business objectives, it is critical to align wholesale allocations with genuine demand to protect dealer viability and ensure healthy inventory management. In the 2W segment, despite an 8.57% FY YTD growth, retail sales dipped by 6.33% YoY. Urban areas experienced a sharper decline of 7.38% compared to a 5.5% drop in rural markets. Rural performance was better due to better agricultural sentiments and seasonal marriage demand.

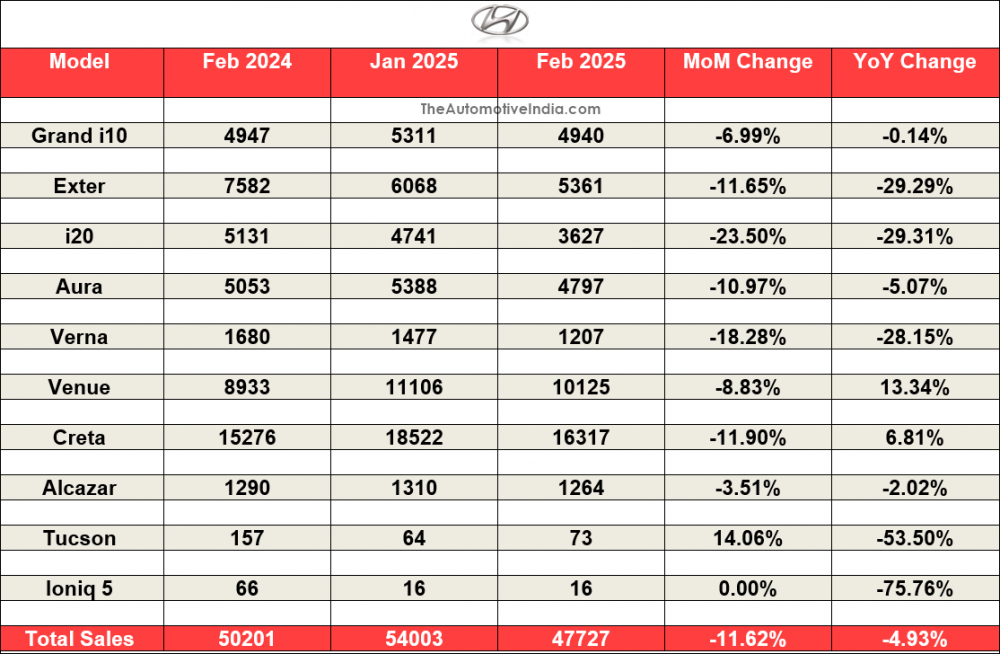

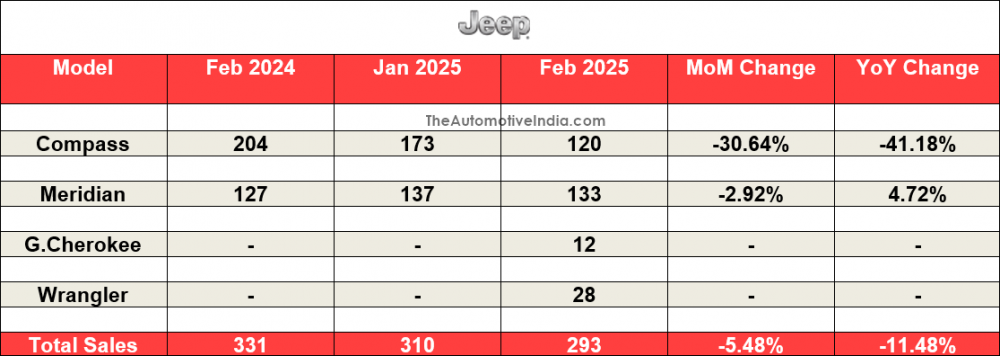

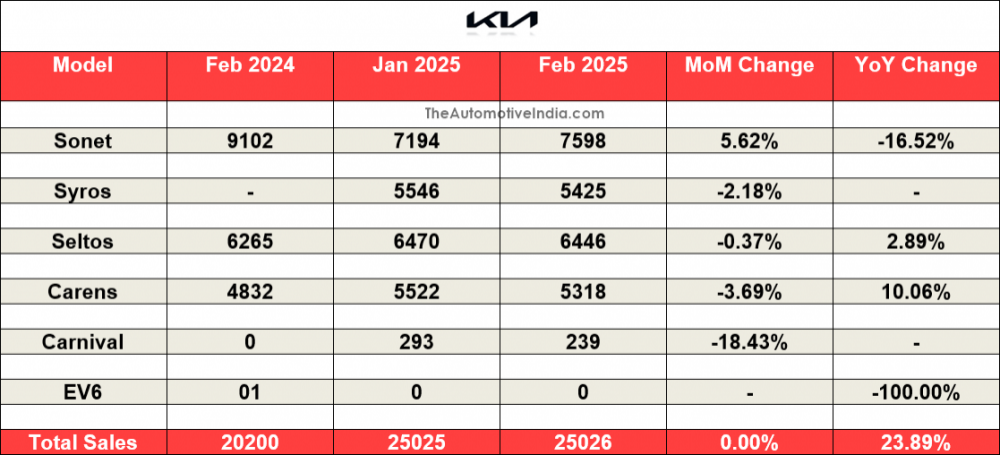

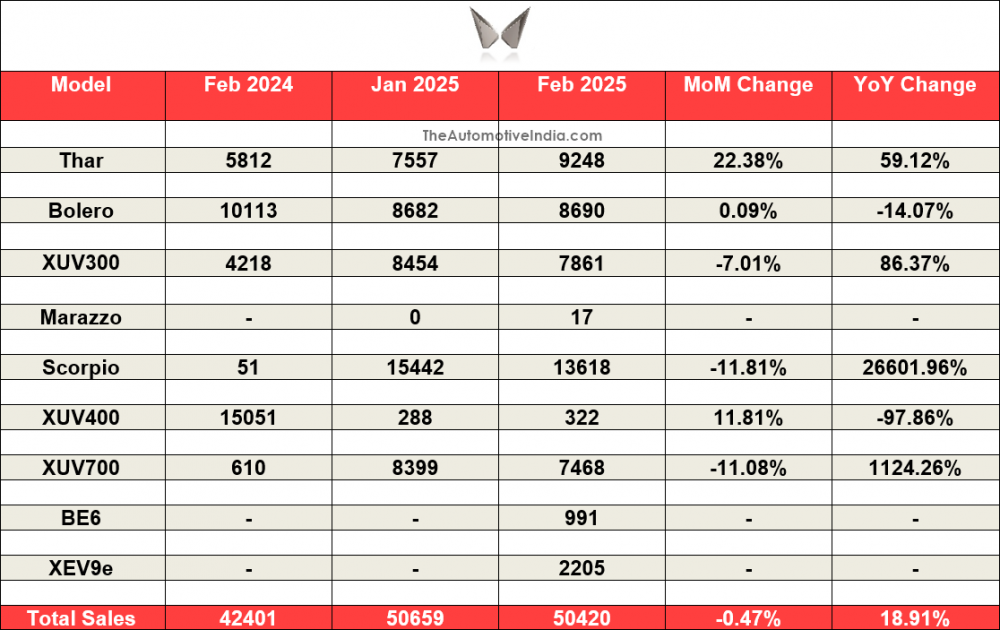

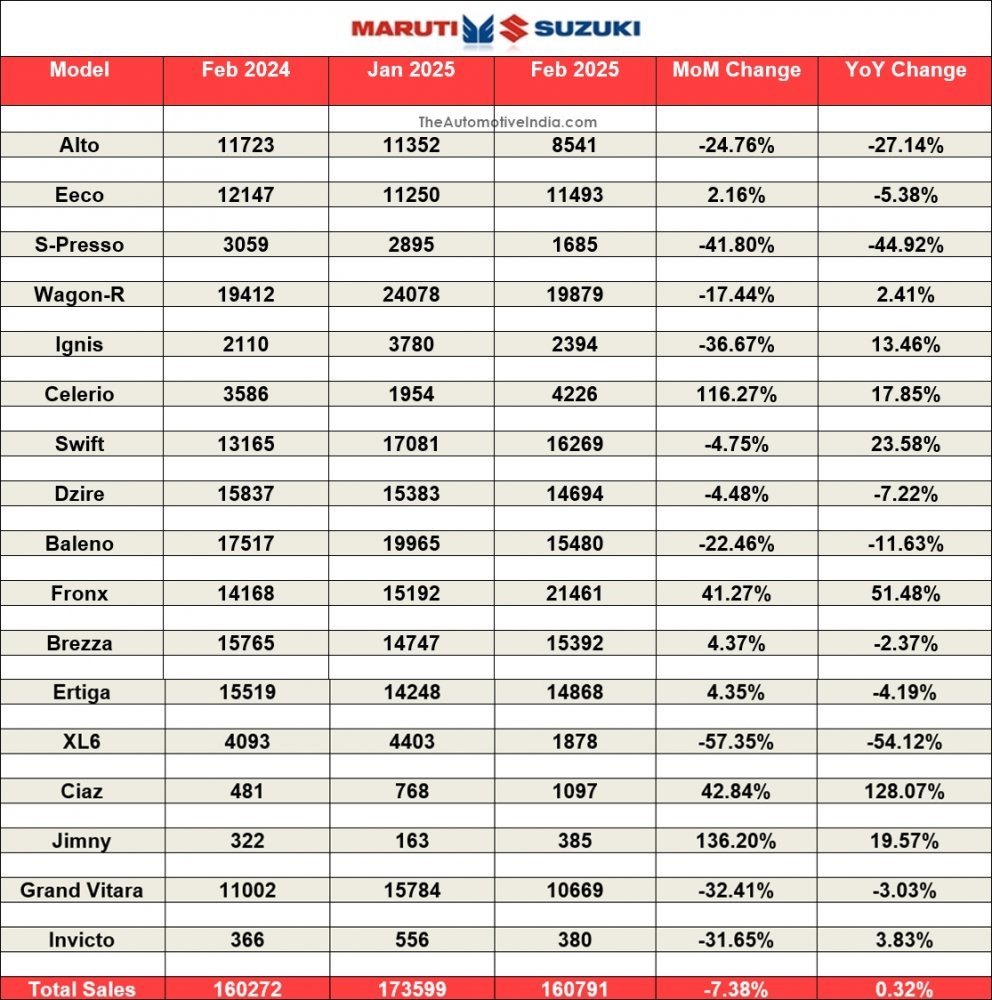

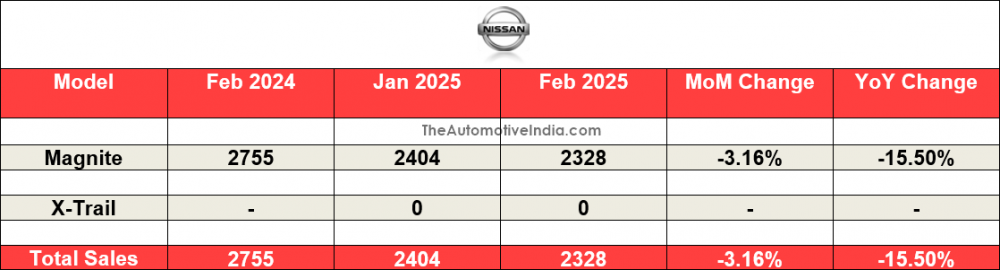

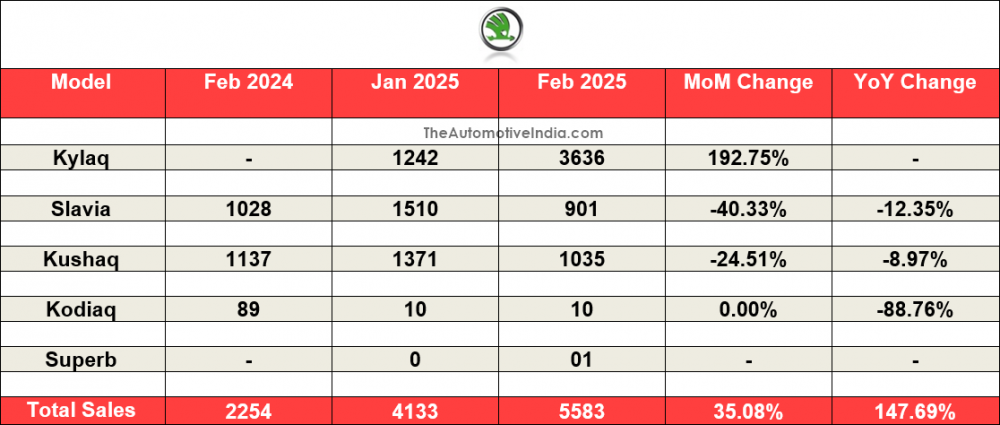

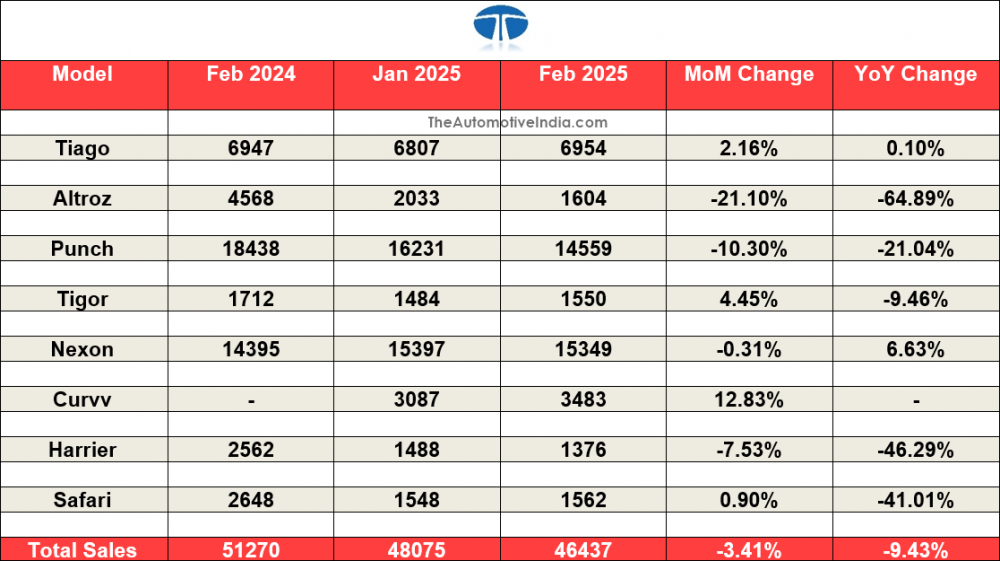

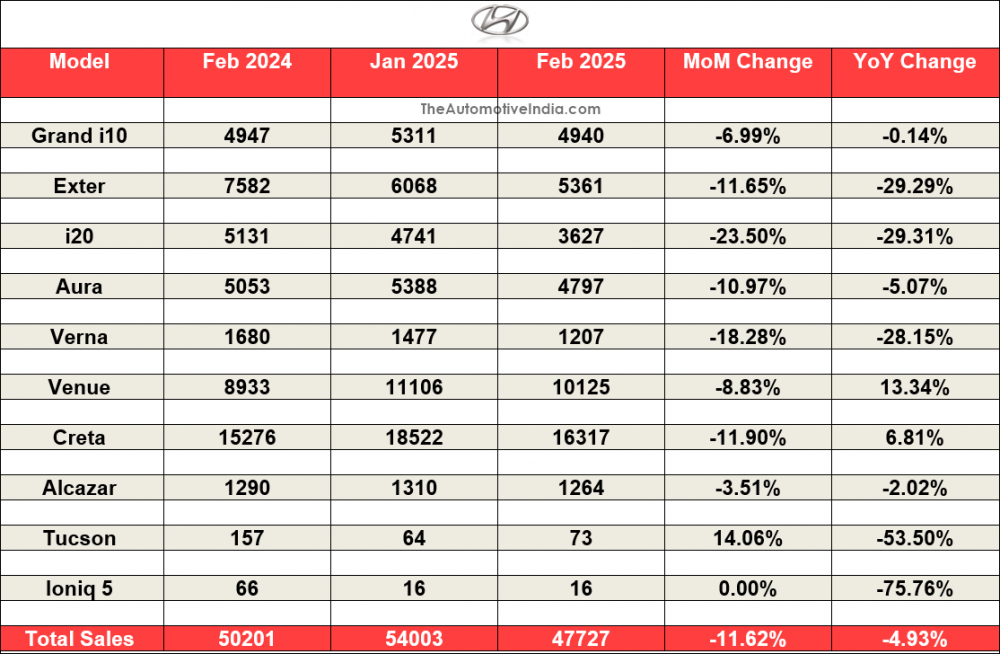

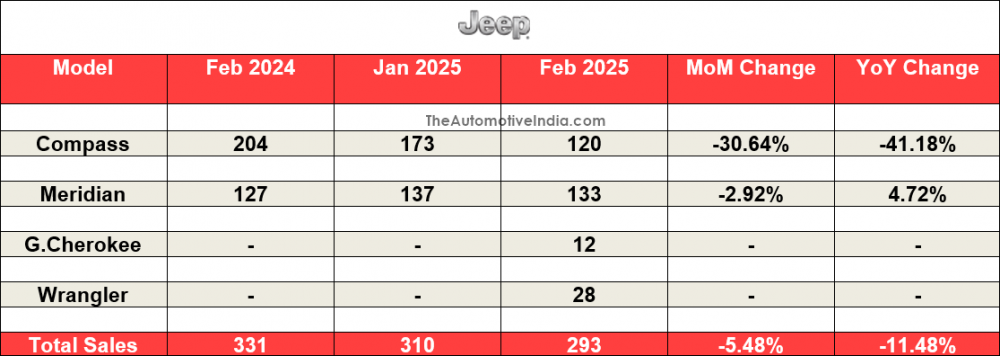

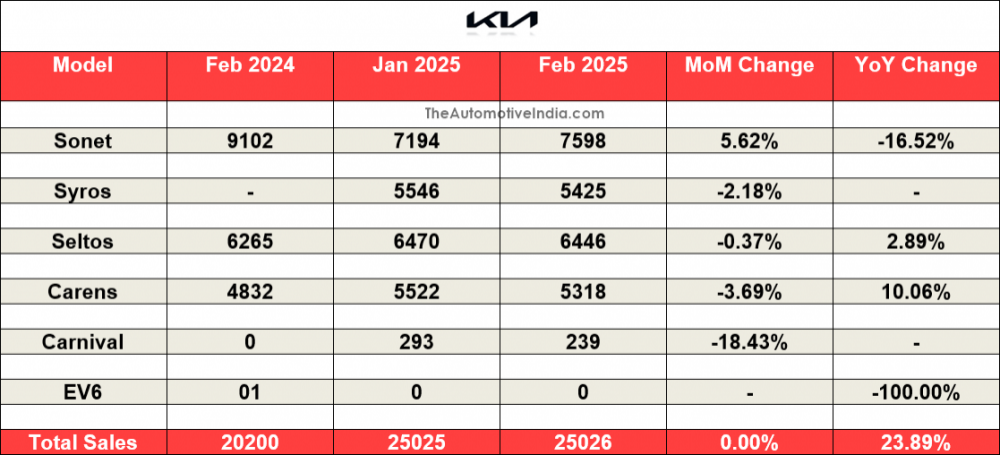

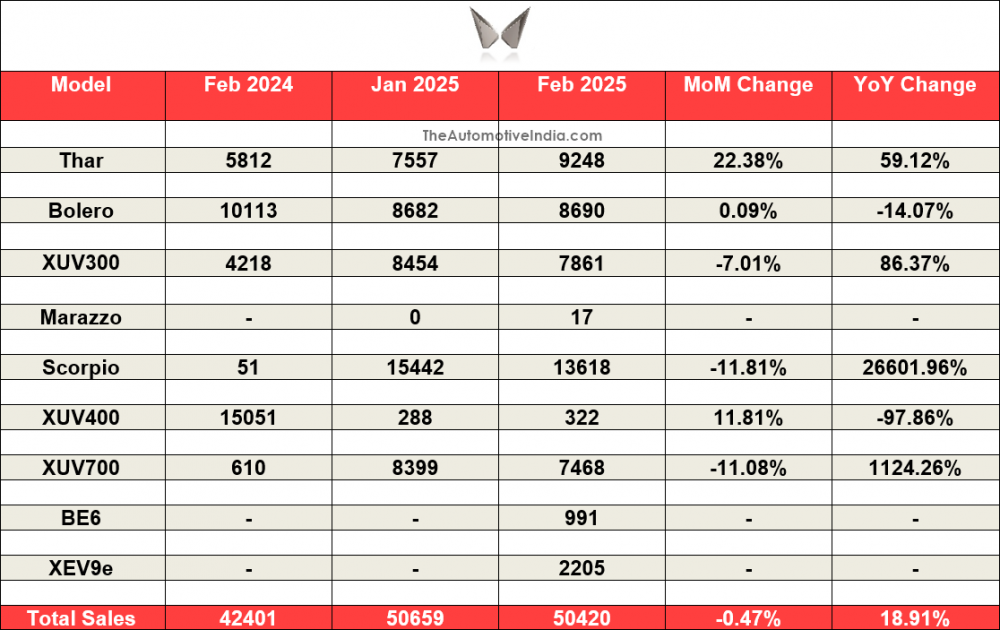

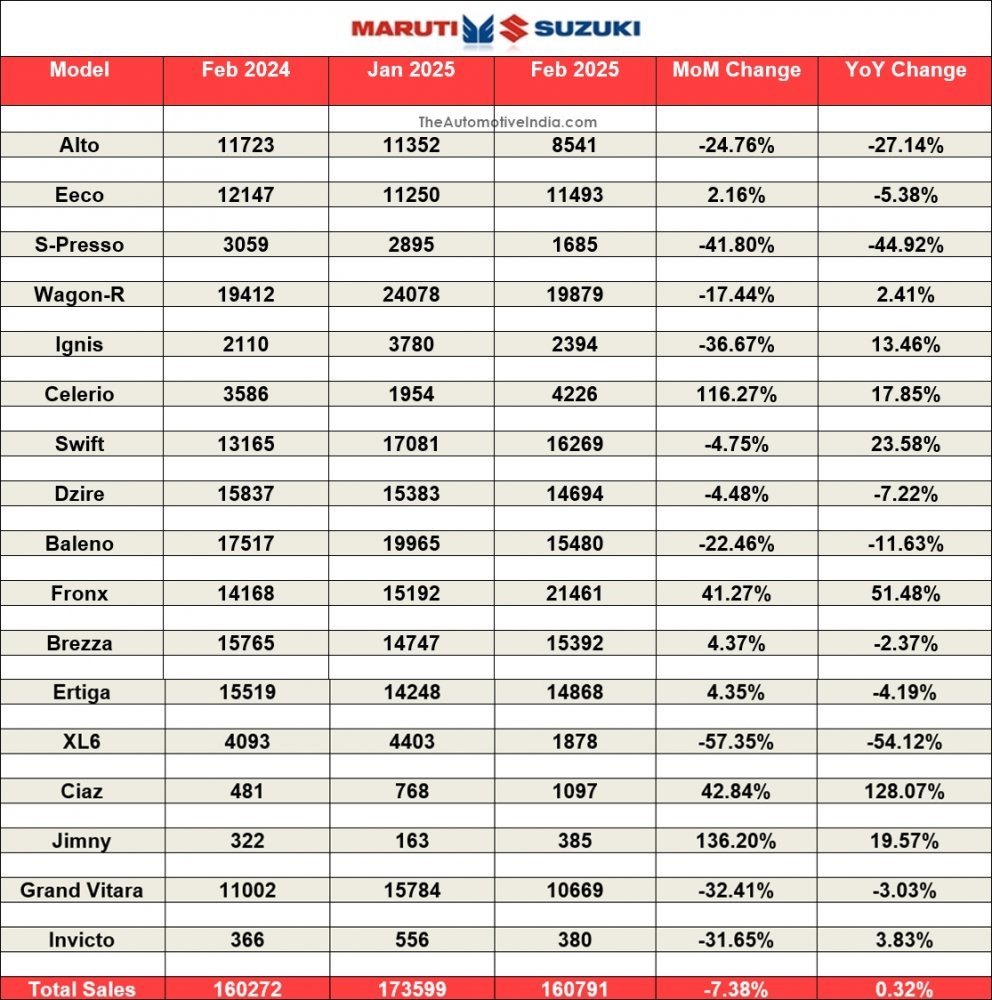

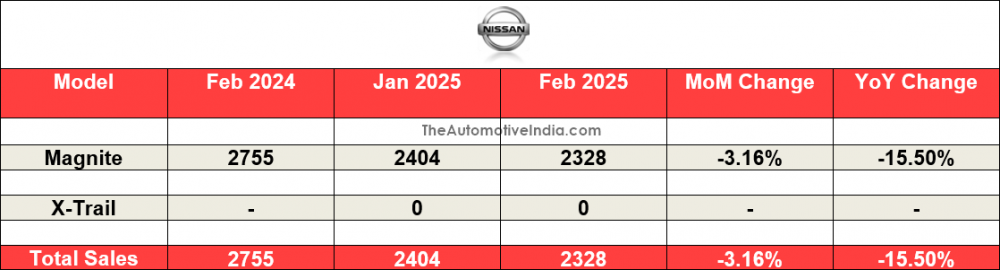

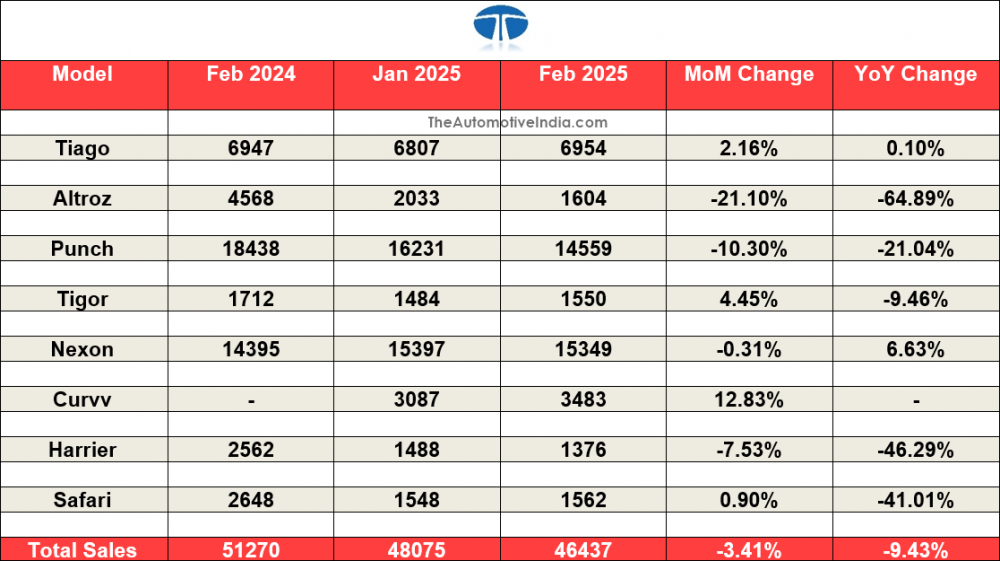

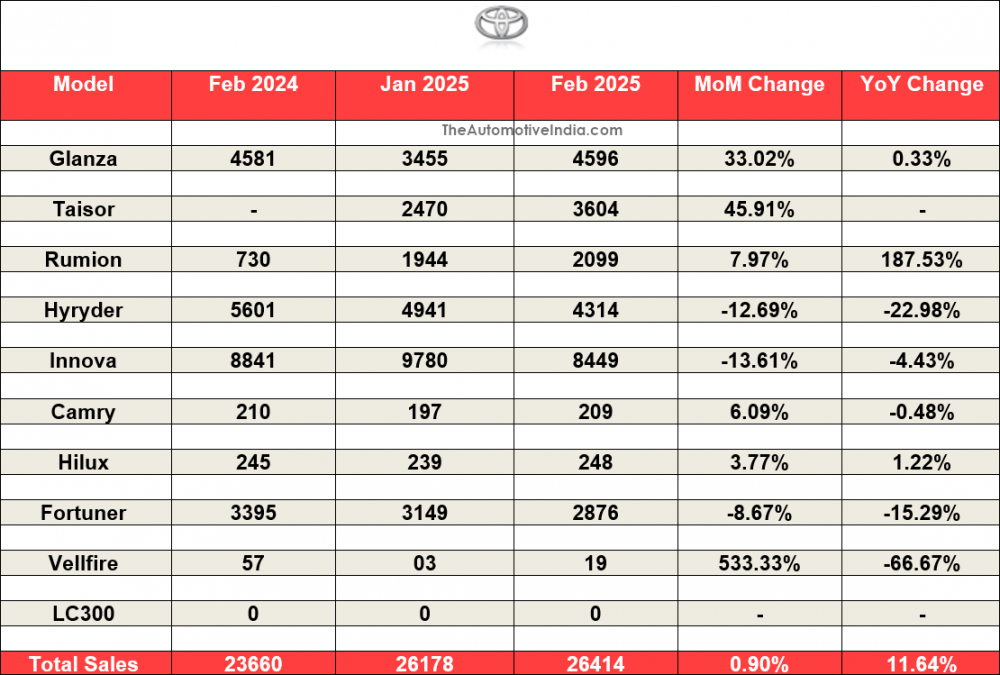

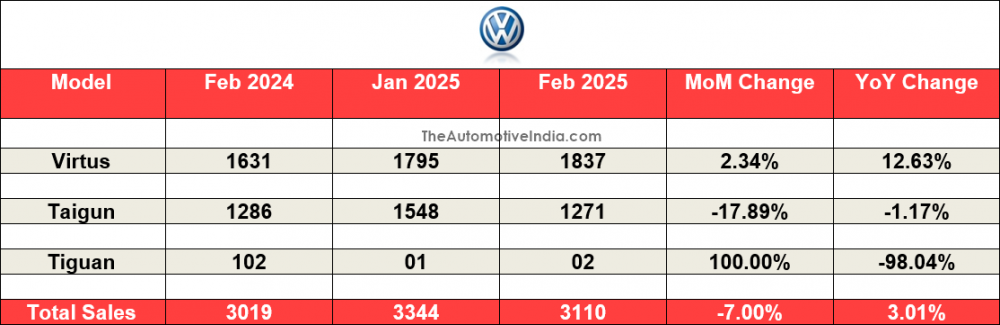

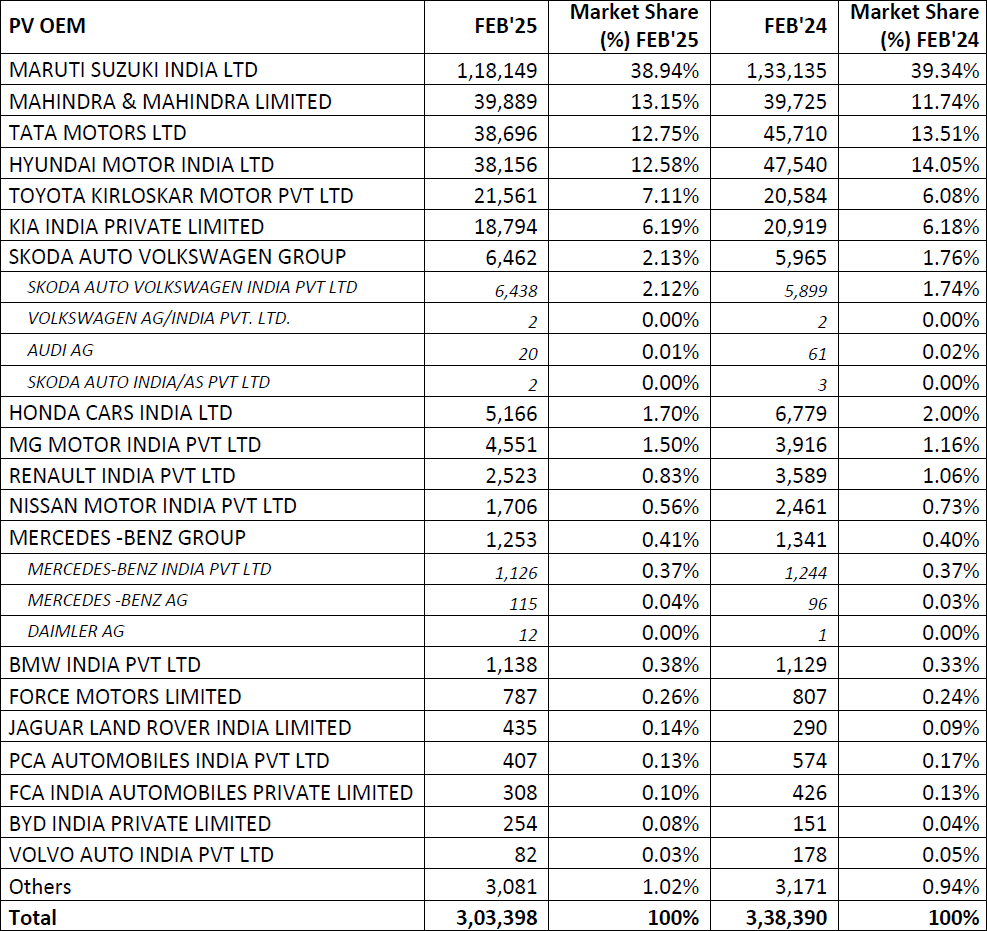

Dealers attributed this to inventory imbalances, aggressive pricing adjustments (notably post-OBD-2B), weak consumer sentiment, lower enquiry volumes and limited finance availability. Concerns over slow-moving models and external economic pressures, such as liquidity constraints and inflation, further intensified these challenges. The PV segment, despite a modest 4% YTD growth, saw retail sales fall sharply by -10.34% YoY. Dealers noted weak market sentiment which specially continues in the entry level category, delayed conversions, challenging targets and stressed that OEMs should avoid overburdening dealers with excessive inventory—a practice that risks unmanageable stock levels given the cyclical nature of the industry. This feedback underscores the need for greater alignment between national strategies and local dealer insights. Inventory levels in this segment remained in the range of 50-52 days.

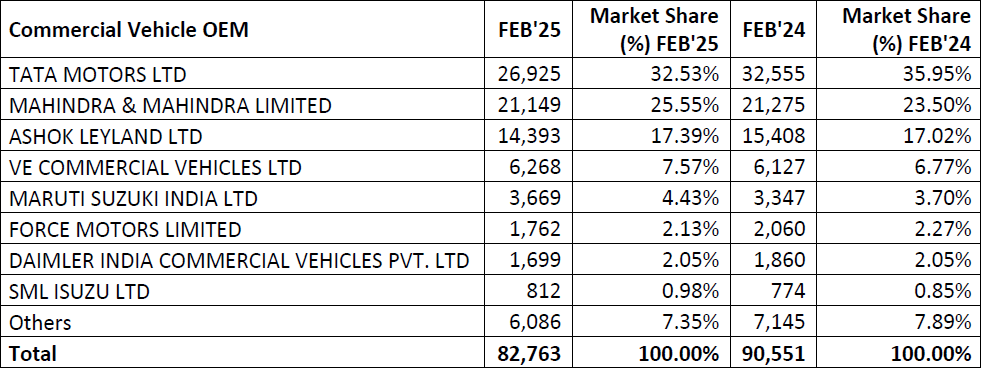

Finally, the CV segment, which saw a modest YTD decline of -0.5%, retail sales dropped by -8.6% YoY. Dealers pointed to a challenging commercial environment, with weak sales in transportation sector, tightening finance norms and pricing pressures delaying customer decisions—particularly in bulk orders and institutional contracts. While robust order bookings, notably in the tipper segment driven by increased government spending and steady supplies offered some relief, the prevailing negative sentiment and structural market shifts call for a more adaptive approach. There is cautious optimism that the market will improve in March as dealers recalibrate their targets to better align with current demand.”

Near-Term Outlook

The near-term outlook for auto retail in March 2025 is cautiously optimistic, with dealer expectations indicating that nearly 45% foresee growth, 40% expect flat performance and only 14% anticipate de-growth. However, challenges remain, as five consecutive months of declining stock markets have dampened consumer confidence—with investors closing more SIPs rather than opening new ones and reduced discretionary spending driven by dented profitability. Despite this, the convergence of multiple festivals—ranging from Holi and Gudi Padwa to the onset of Navratri—and year-end depreciation benefits is expected to provide a much-needed boost to vehicle purchases.

Segment-specific insights also support a more positive outlook. In the 2W segment, positive Agri-output and the festive calendar are seen as catalysts, even though the booking pipeline slowed towards the end of February. The CV space is likely to benefit from increased government spending and a spike in institutional buying, despite some liquidity challenges. Meanwhile, PV space is expected to gain traction, fuelled by attractive schemes, the adaptive market strategy that leverages festive demand and favourable financial incentives is anticipated to

drive a recovery in March.

Key Findings from our Online Members Survey

§ Liquidity

o Neutral 51.89%

o Bad 28.30%

o Good 19.81%

§ Sentiment

o Neutral 44.03%

o Bad 30.82%

o Good 25.16%

§ Expectation from March’25

o Growth 45.28%

o Flat 40.25%

o De-growth 14.47%