The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for CY’24 and December'24.

CY’24 Retails

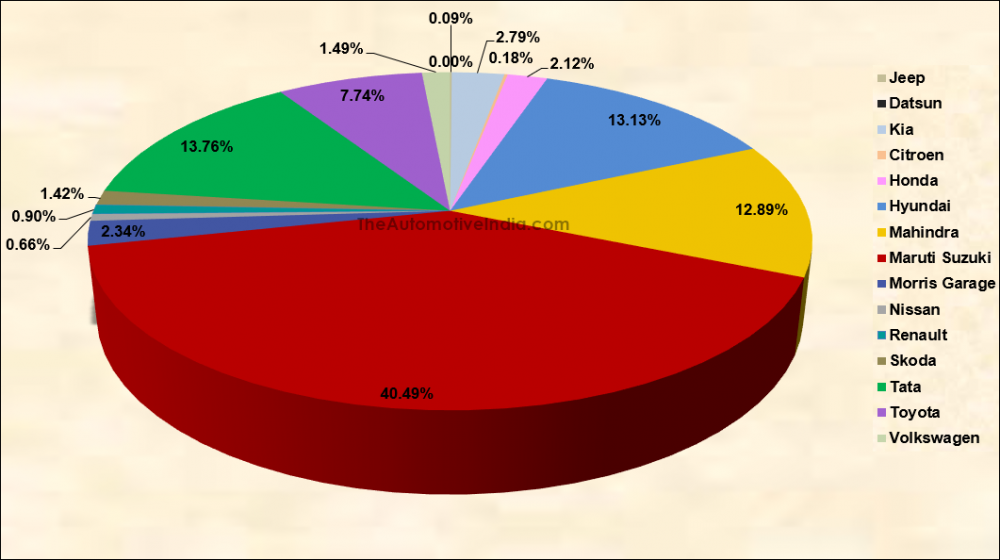

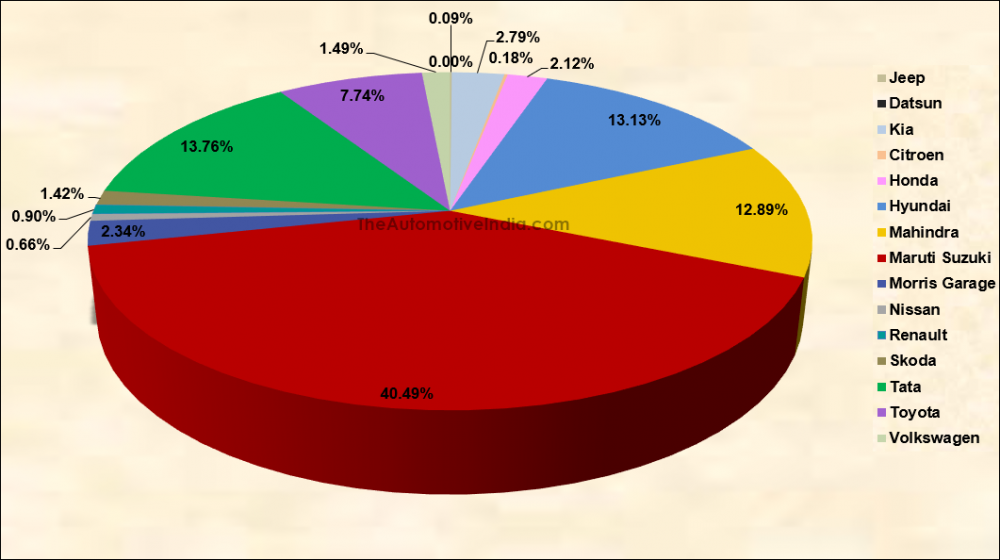

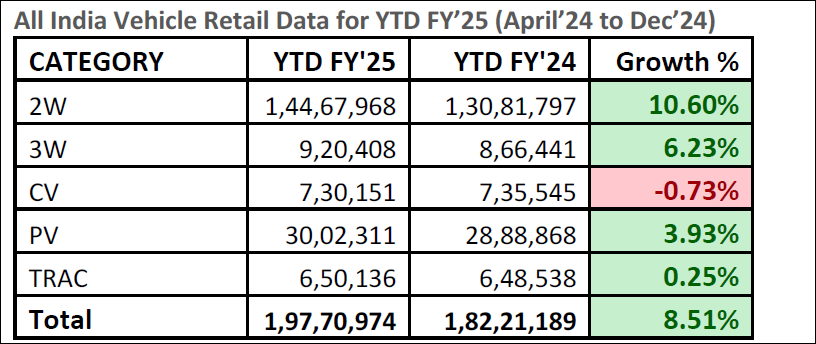

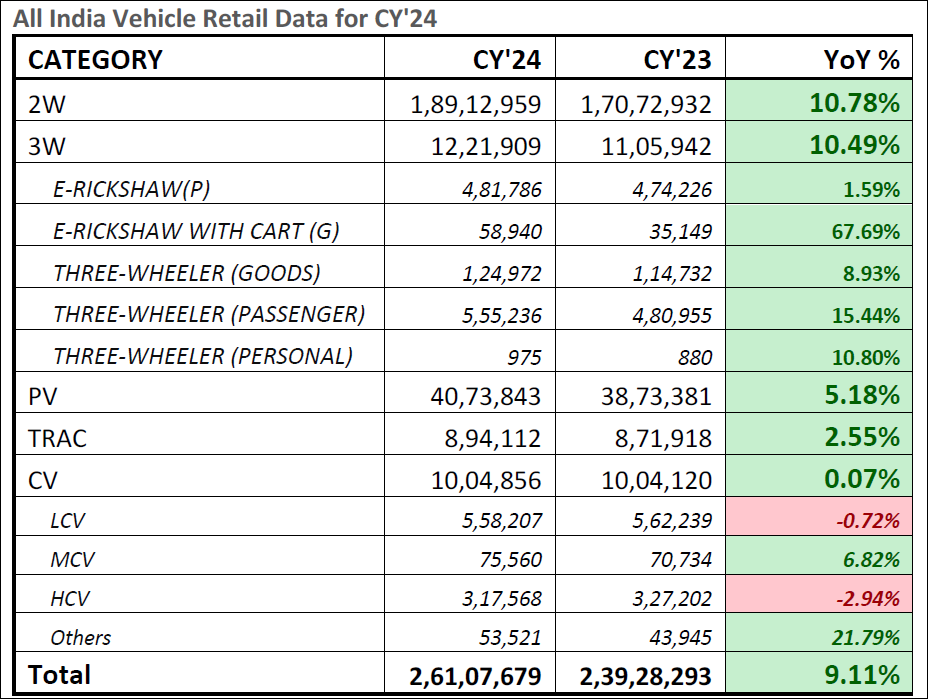

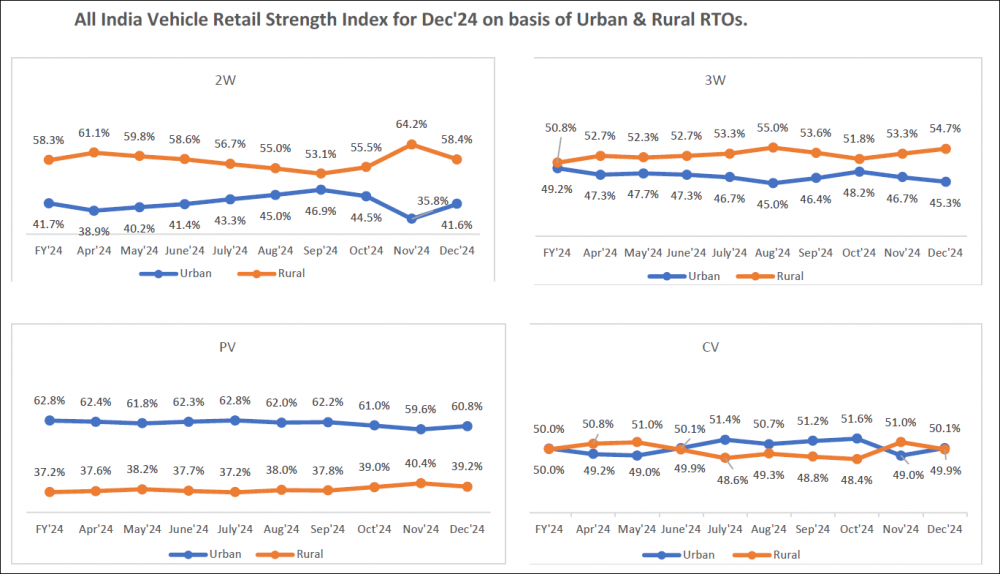

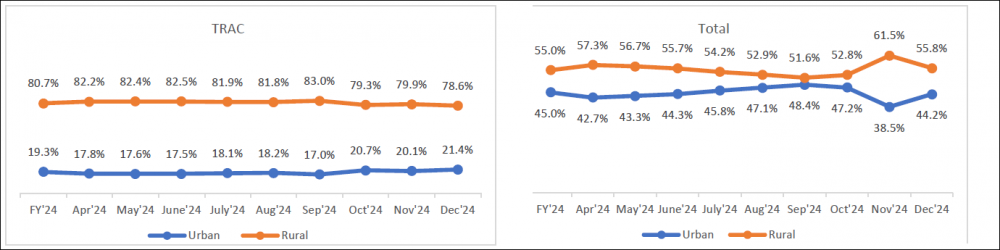

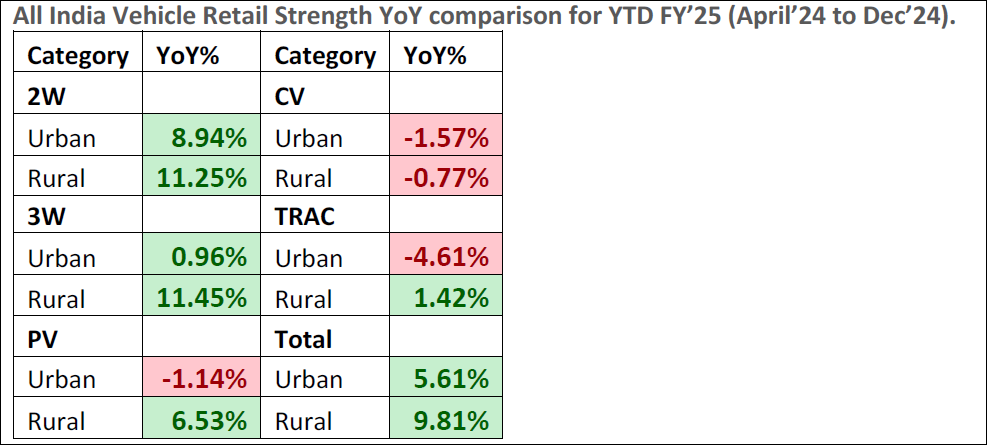

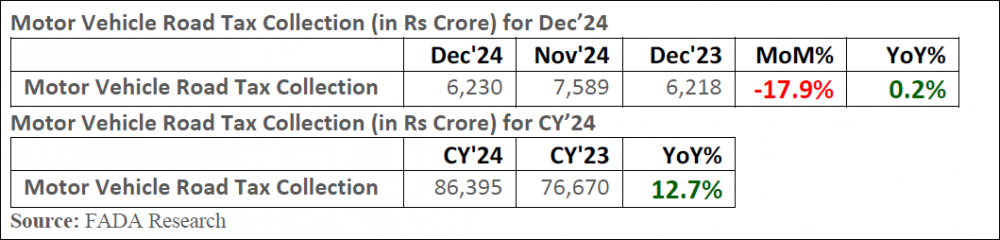

FADA President, Mr. C S Vigneshwar, shared his perspective on the auto retail performance for CY 2024: “Despite multiple headwinds in CY24—including heatwaves, elections at both central and state levels and uneven monsoons—the auto retail industry remained resilient, closing the year with a 9% YoY growth. While 2W, 3W, PV and Tractor segments grew by 10.78%, 10%, 5% and 2.5% YoY respectively, CV retails stayed nearly flat at 0.07% YoY. Notably, 3W, PV and Tractor segments touched new all-time highs and 2W barely missed surpassing its CY18 peak. CV is also yet to reach its CY18 peak, a year which saw the introduction of axle load norms. In 2W, improved supply, fresh models and strong rural demand propelled growth, though finance constraints and rising EV competition remain challenges. CV performance was subdued amid election-driven uncertainty and reduced infrastructure spending. Meanwhile, PV benefited from robust network expansion and product launches, albeit with margin pressures due to higher inventory thus leading to discount war towards the 2nd half.”

December’24 Retails

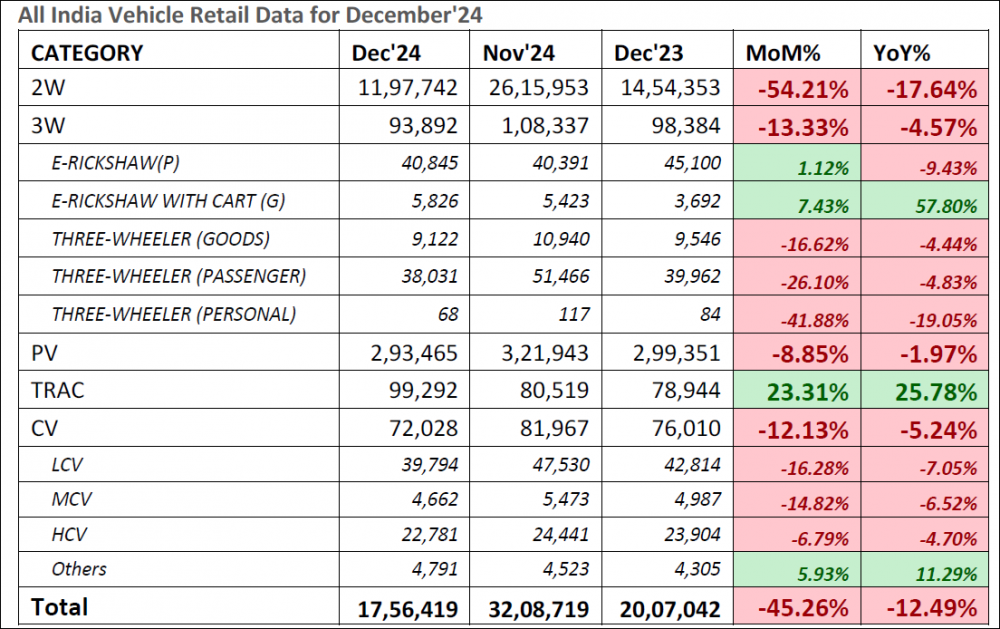

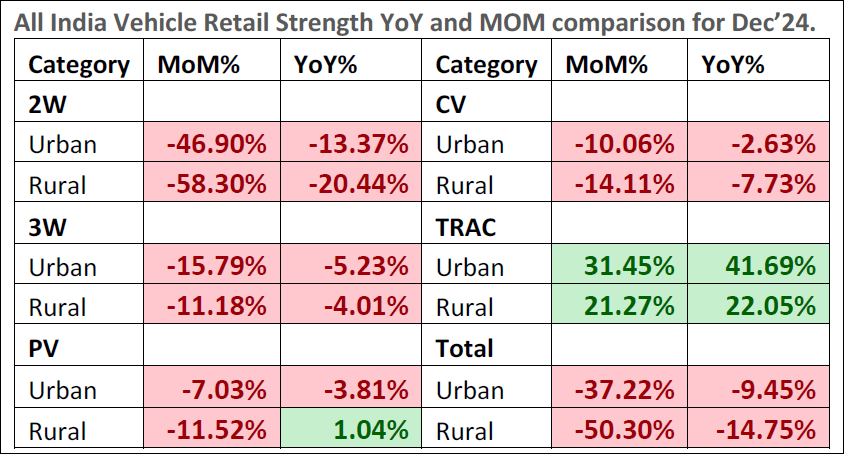

FADA President, Mr. C S Vigneshwar, shared his perspective on the auto retail performance for December 2024: “In our previous release, 60% of dealers expected December to either experience de-growth or remain flat. Reflecting this sentiment, December’s total retails dropped by -12% YoY. All categories except Tractors witnessed de-growth, with 2W, 3W, PV and CV falling by -17.6%, -4.5%, -2%, and -5.2% YoY respectively. Tractors, on the other hand, registered a notably contrasting 25.7% YoY growth. The 2W segment suffered a substantial drop of -17.6% YoY and -54.2% MoM. Dealers cited low cash flow and poor market sentiment—exacerbated by delayed crop payments, halted government disbursements and typical year-end factors—as the main reasons.

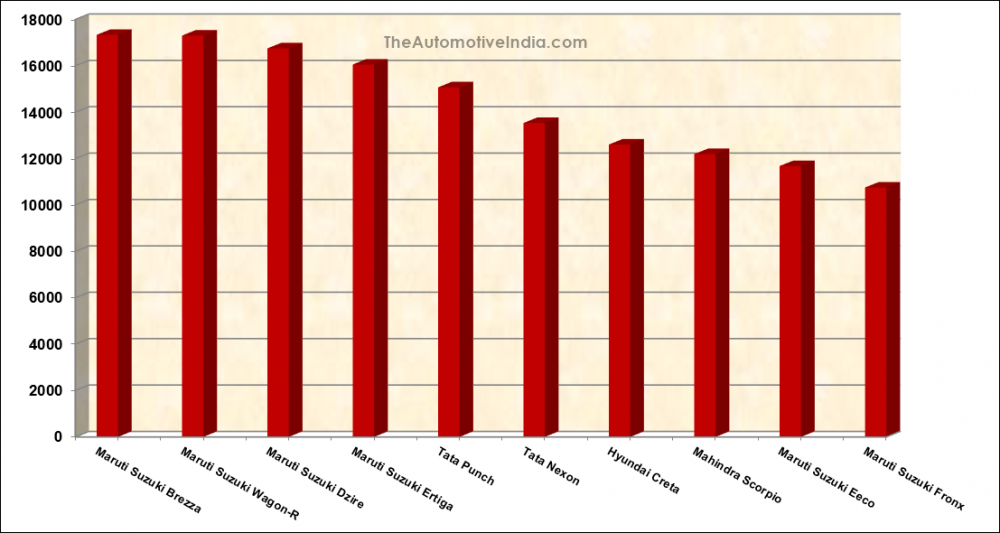

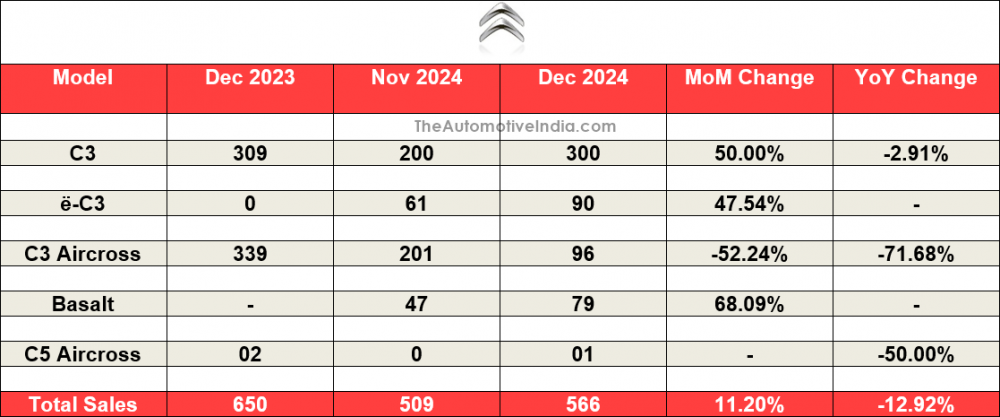

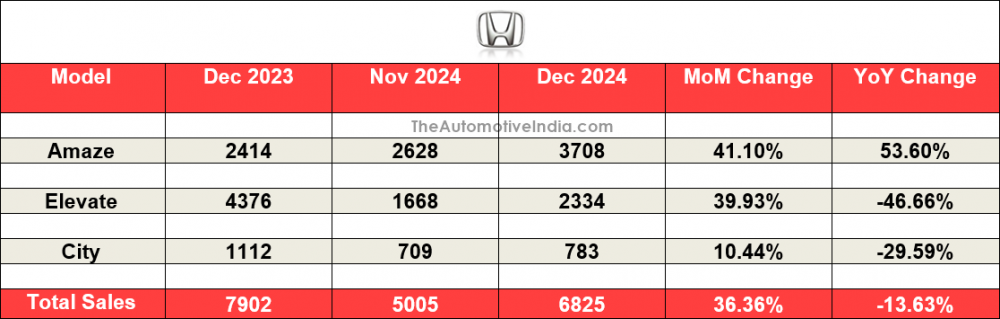

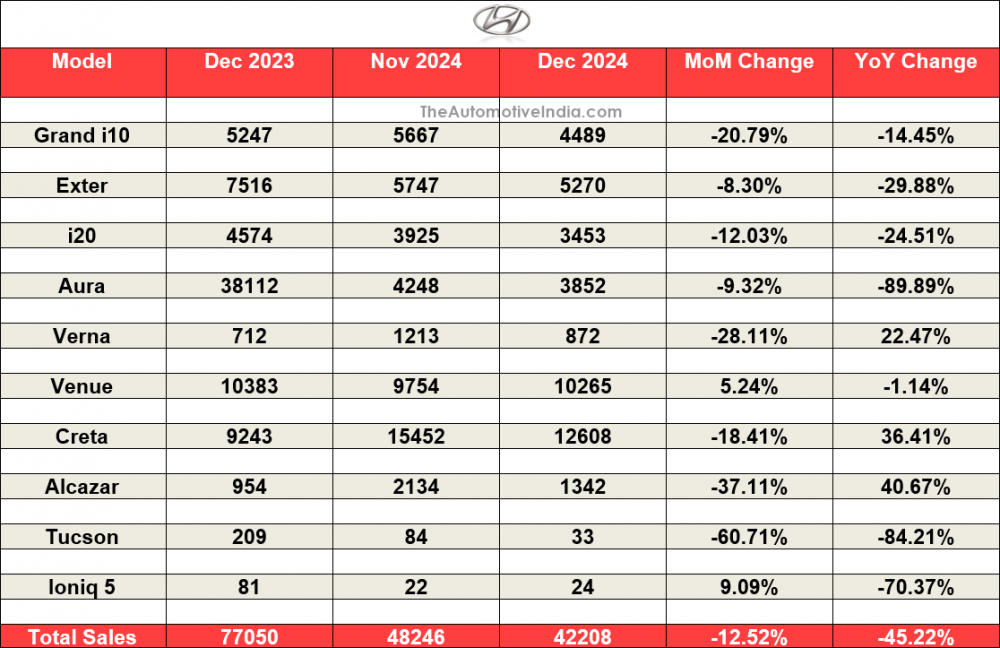

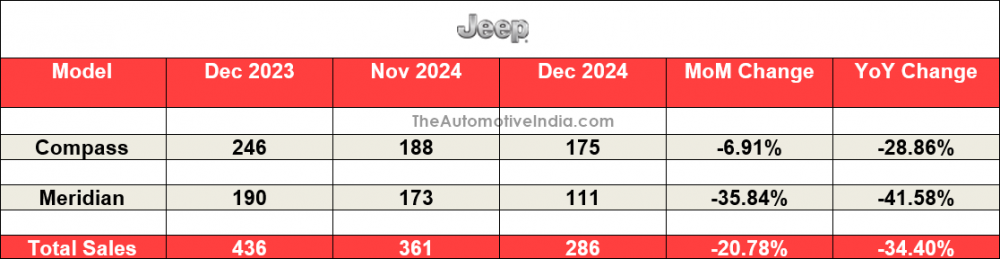

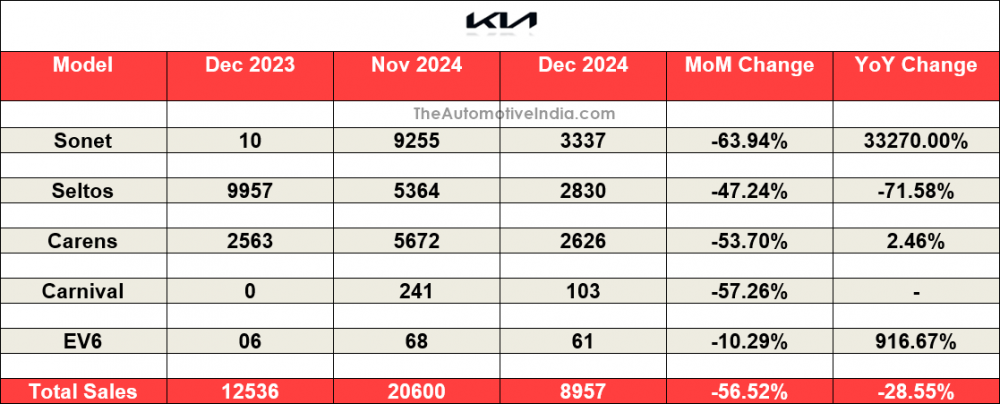

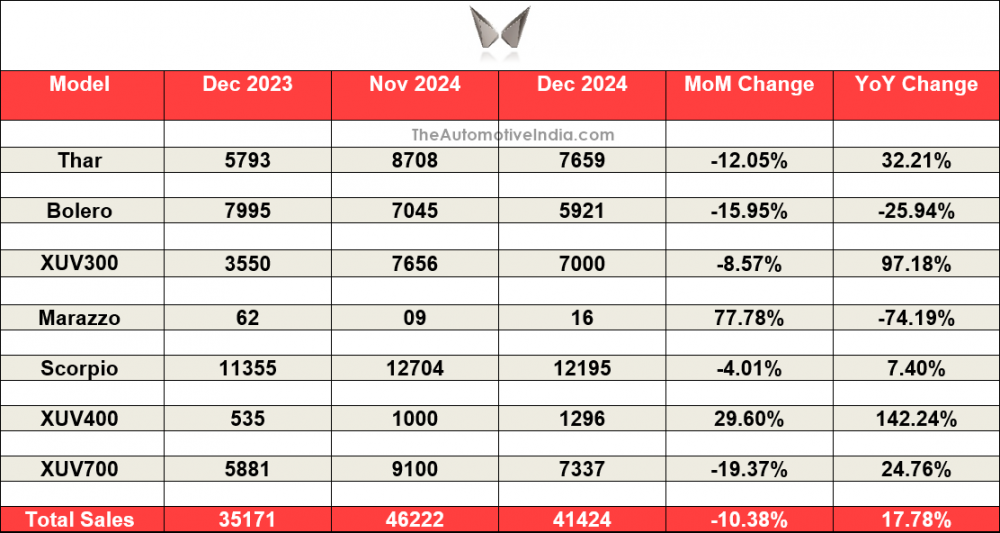

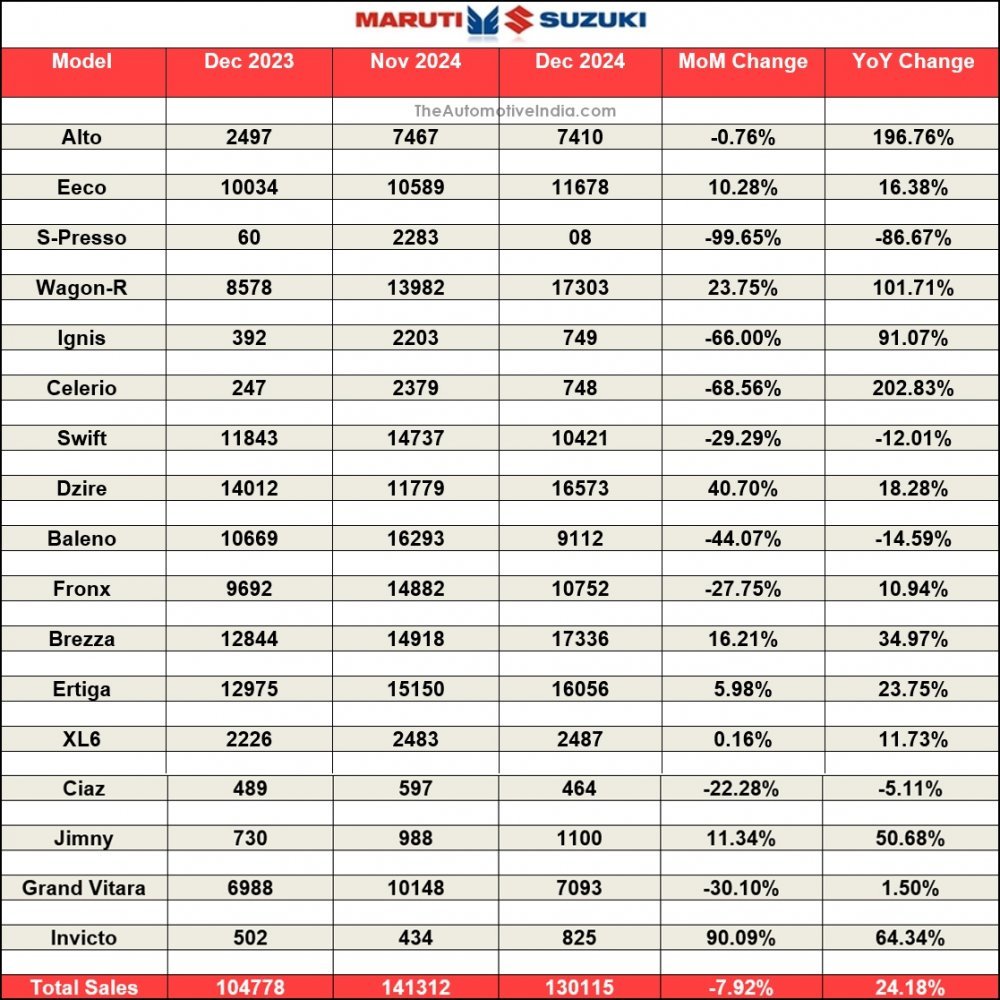

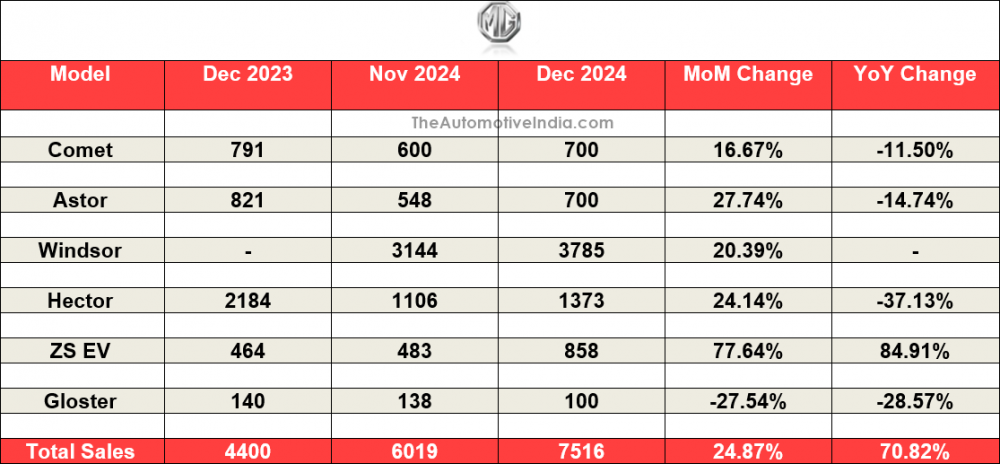

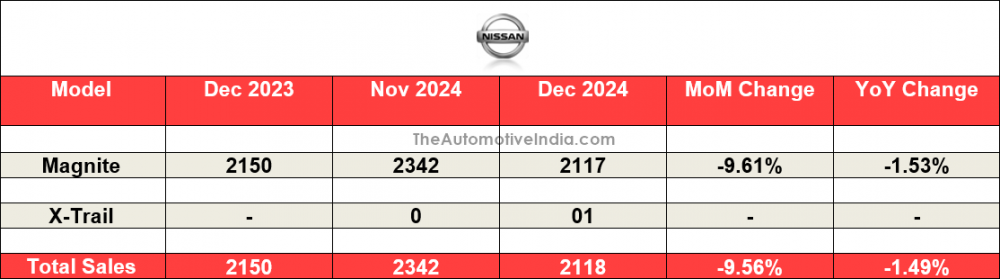

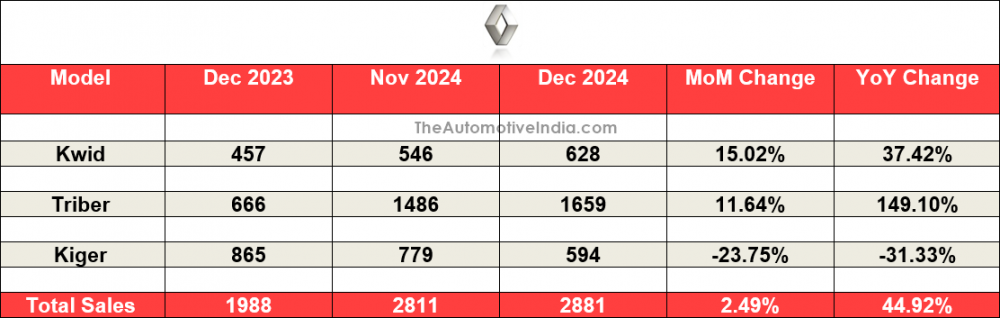

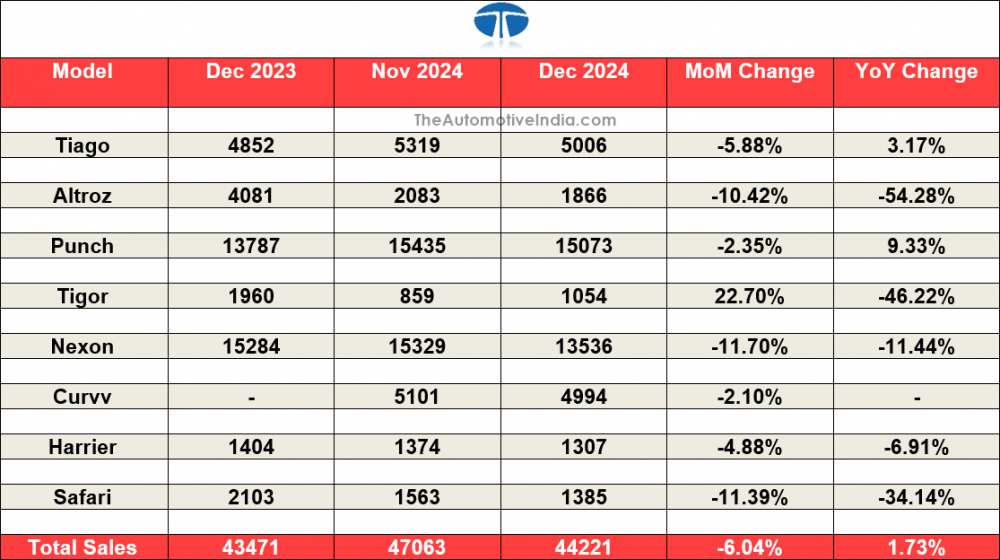

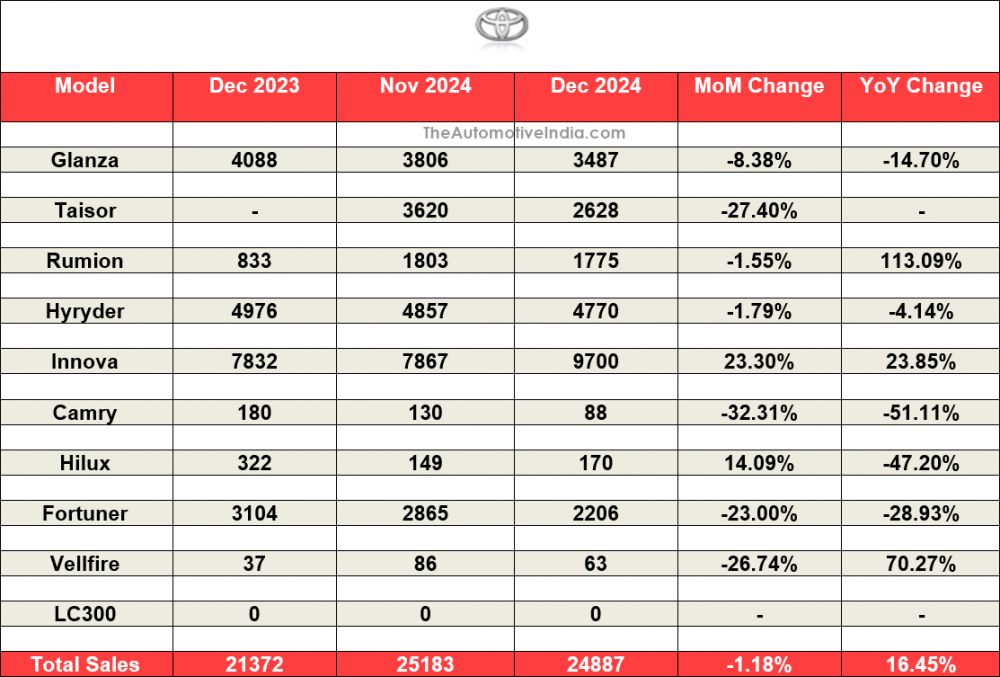

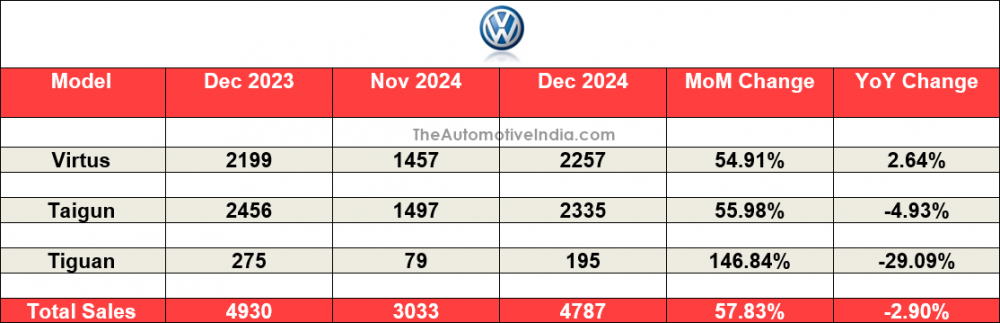

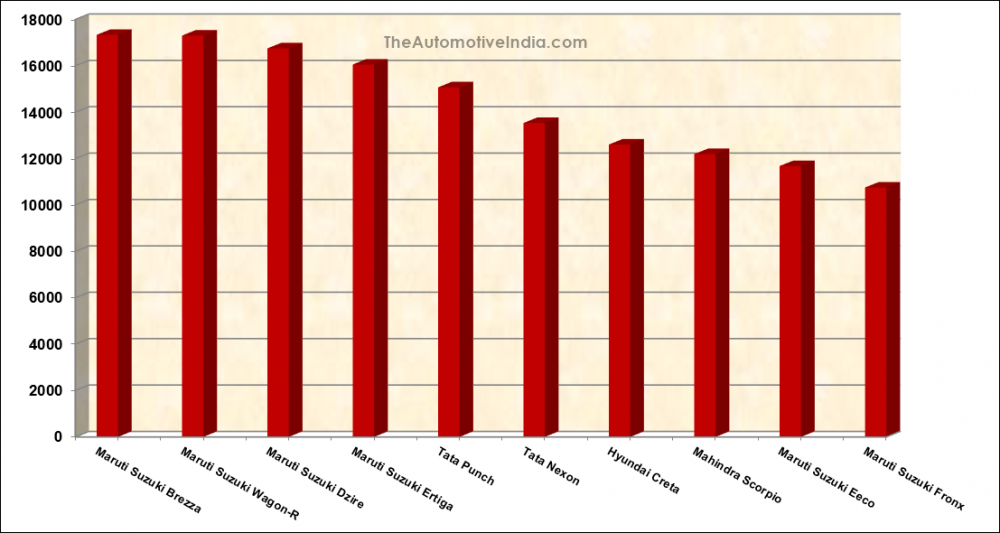

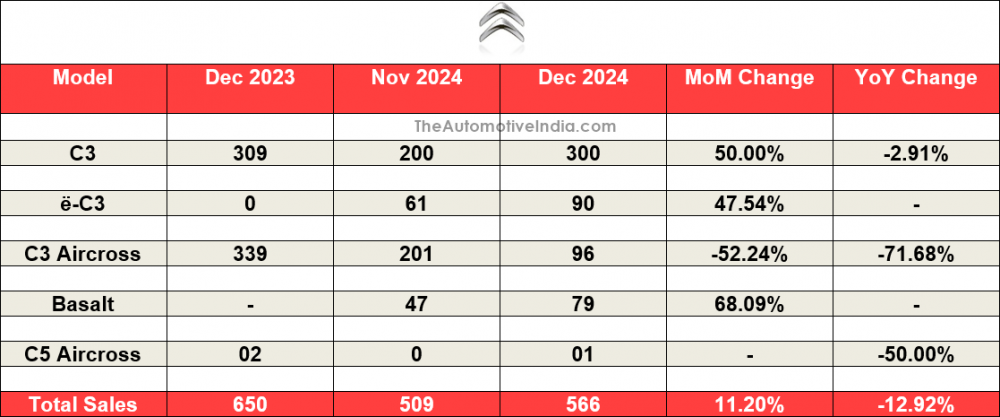

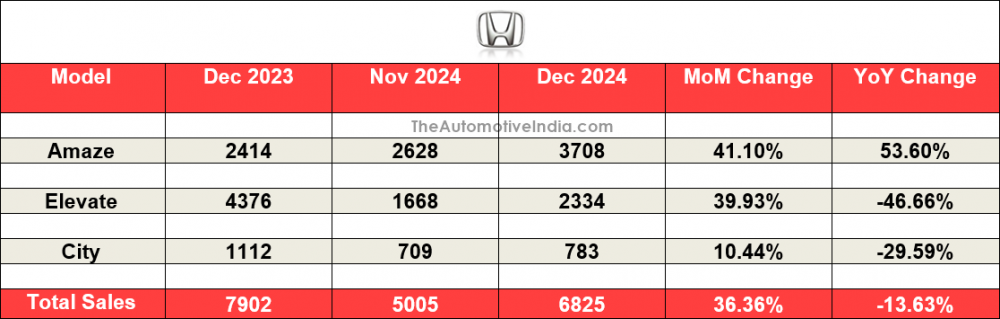

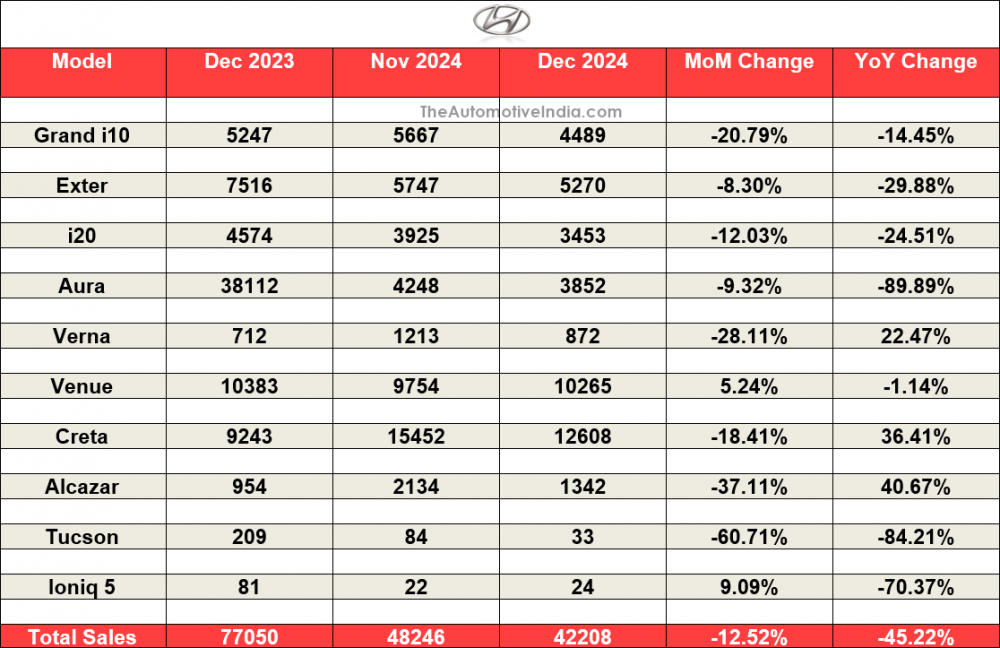

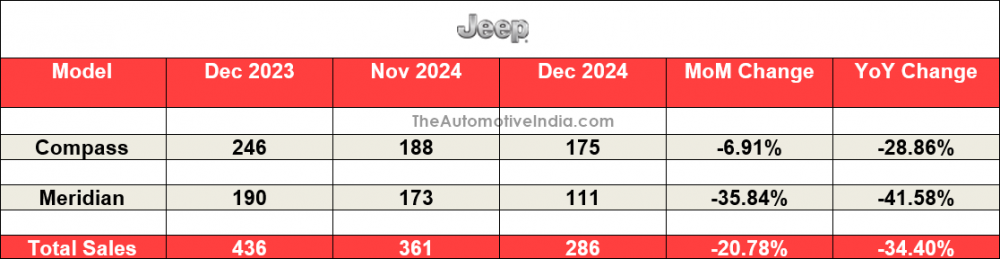

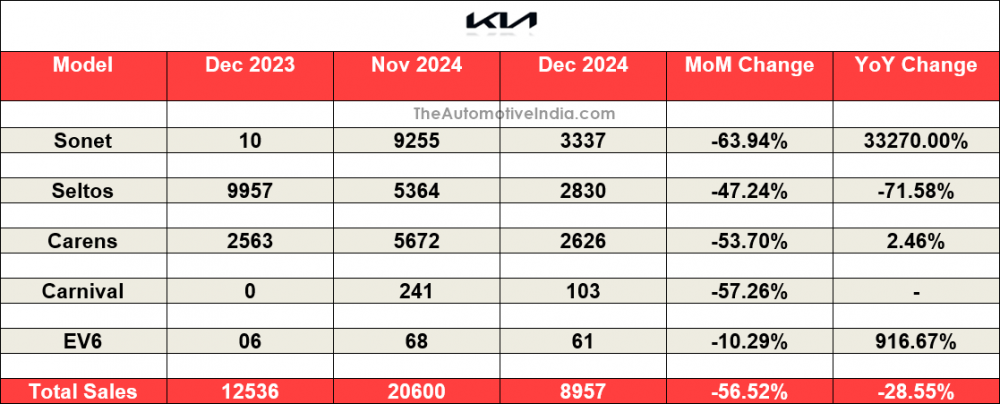

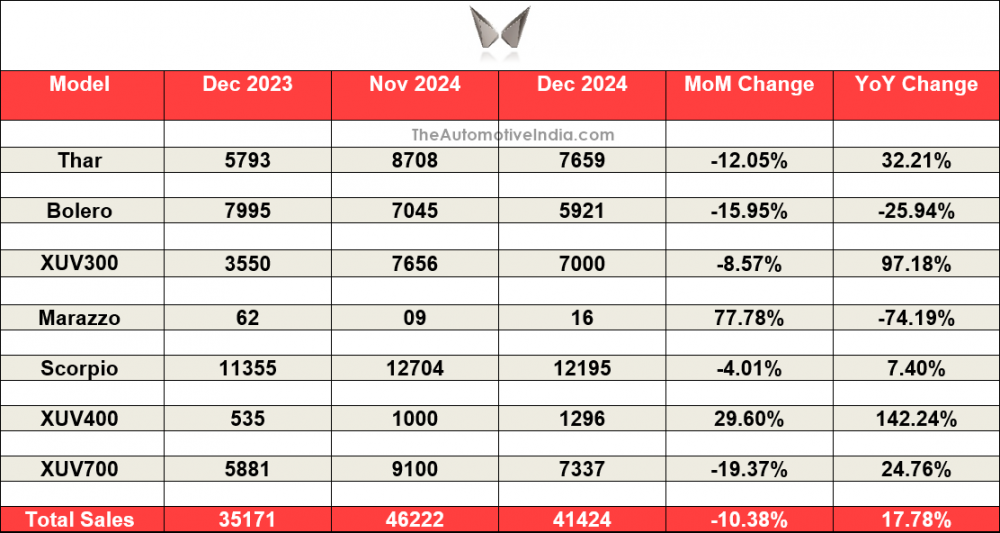

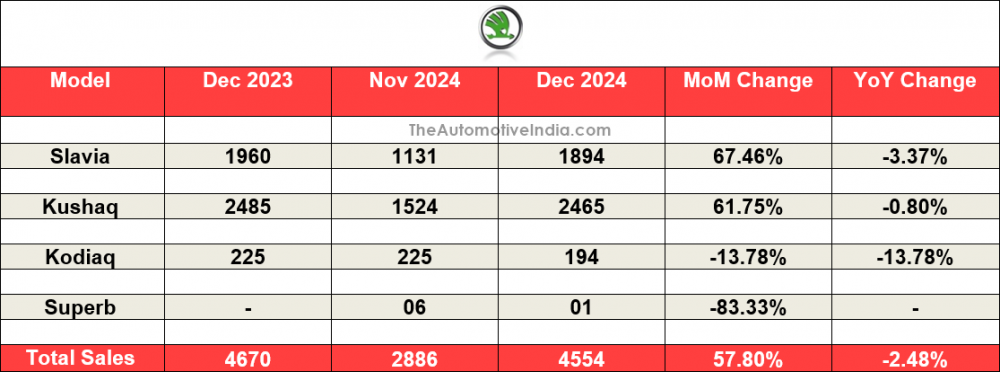

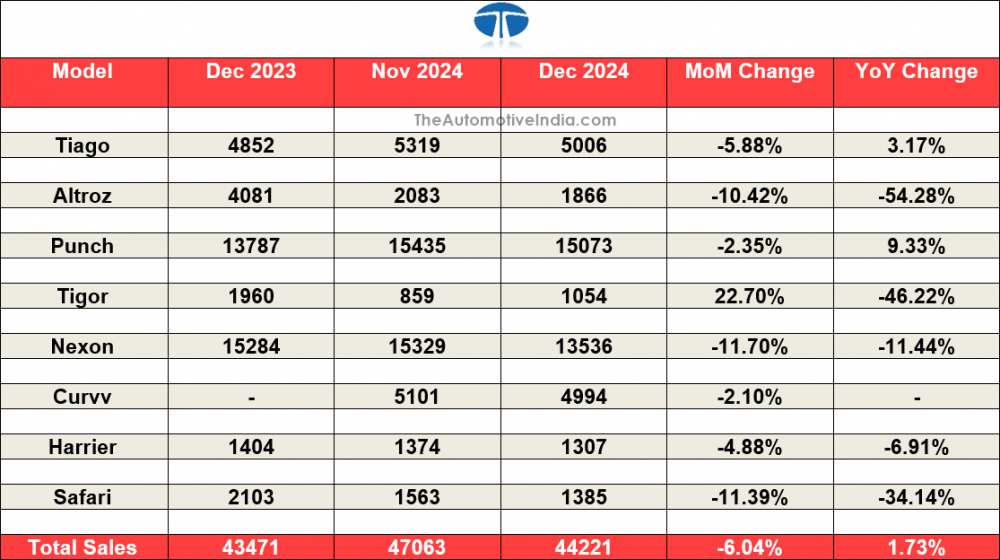

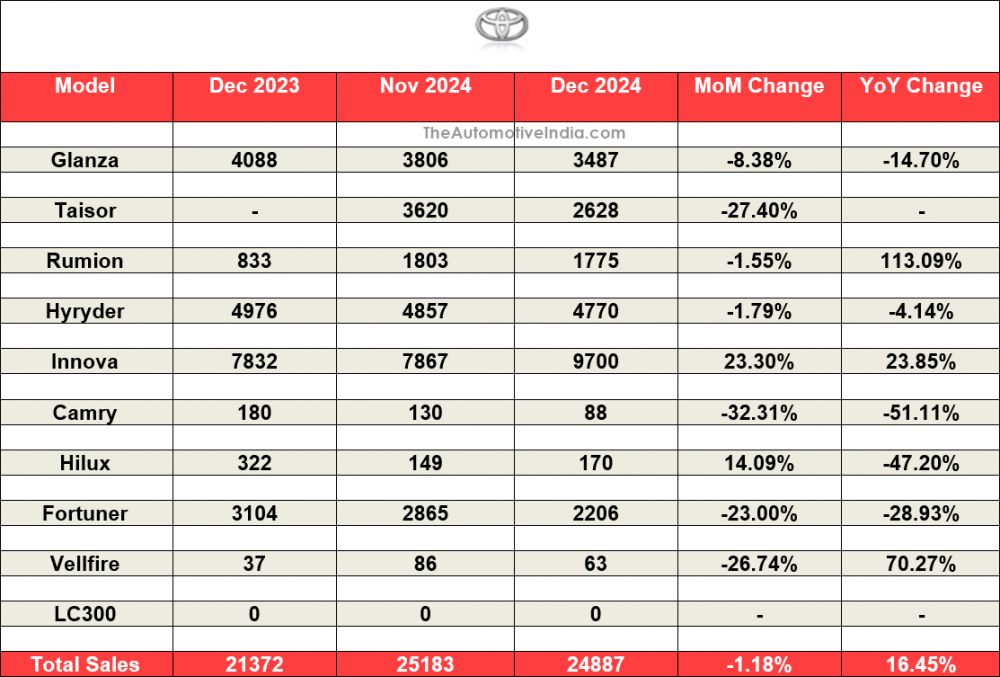

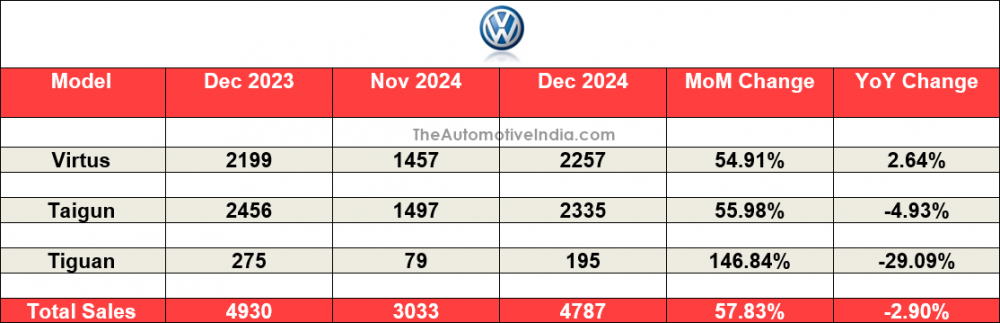

Supply challenges for popular models and the growing push toward EVs further weighed on volumes. Many dealers also mentioned that heightened discounts and limited financing options failed to offset weak demand. PV retails declined by -1.9% YoY and -8.8% MoM, primarily due to high inventory levels following the festive season and aggressive discounting aimed at clearing stock. Poor market sentiment, limited new model launches and intense price competition among co-dealers further impacted sales. While some dealers benefited from year-end schemes and expanded product ranges, overall demand remained subdued, with many customers deferring purchases to January for anticipated benefits.

Inventory levels ranged between 55 and 60 days. CV retails declined by -5.2% YoY and -12.1% MoM due to low market sentiment, delayed government fund releases and slow financing approvals. Many customers postponed purchases, preferring 2025 models. While some segments, such as tippers, demonstrated resilience, ongoing LCV degrowth and unseasonal rains further dampened demand. Although year-end schemes and inquiries offered limited relief, overall sales remained under pressure.”

Near-Term Outlook

Looking ahead, Auto Dealer sentiment for January remains cautiously optimistic, with nearly half (48.09%) of surveyed dealers anticipating growth, 41.22% expecting stable demand and only 10.69% foreseeing a decline. In 2W, improved MSP and rural fund inflows could bolster sales, although financing challenges persist. The rise of EVs in this segment will also begin to impact entry-level 2W market share. The CV segment may see a mild uptick—Q4 is traditionally stronger—but progress will hinge on the pace of infrastructure projects and easier credit approvals. For PV, upcoming new launches, wedding-season demand, and year-start promotions should drive footfall, though potential price hikes could moderate gains. Overall, despite certain headwinds, Auto Dealers remain hopeful that steady product availability, strategic marketing and supportive government measures will sustain momentum in the near term. However, PV OEMs must carefully manage their supplies in line with market demand.

Long-Term Outlook

With 66.41% of Auto Dealers anticipating growth, 26.72% expecting stability and only 6.87% foreseeing a slowdown in CY’25, the automotive retail sector appears poised for a significant rebound. Dealers across categories sense a resurgence in market confidence, fuelled by improved rural liquidity, evolving government policies and a wave of new product launches across multiple powertrain. Despite financing headwinds and heightened competition, many retailers believe that focused marketing strategies, robust supply chains and better alignment with customer preferences will create a foundation for sustained expansion. In the 2W segment, rising rural incomes, fresh model introductions and an eventual plateau in EV disruption could revitalize growth after years of sluggish demand. The CV sector, traditionally strong in Q4, is looking for momentum from infrastructure investments, stable credit availability and government incentives— factors that could spark a healthy uptick in fleet renewals and expansions. Meanwhile, PV Dealers anticipate strong consumer pull from new SUV launches, feature-rich EVs and its maturing EV ecosystem, though pricesensitive buyers and interest rate fluctuations remain watchpoints. Overall, FADA remains optimistic that market recovery, coupled with strategic OEM support and policy-level clarity, will enable the automotive retail industry to end CY’25 on a robust note.

Key Findings from our Online Members Survey

§ Liquidity

o Neutral 53.05%

o Good 25.19%

o Bad 21.76%

§ Sentiment

o Neutral 51.15%

o Good 29.01%

o Bad 19.85%

§ Expectation from January’25

o Growth 48.09%

o Flat 41.22%

o De-growth 10.69%

Expectation from CY’25

o Growth 66.41%

o Flat 26.72%

o De-growth 06.87%