Thread Starter

#1

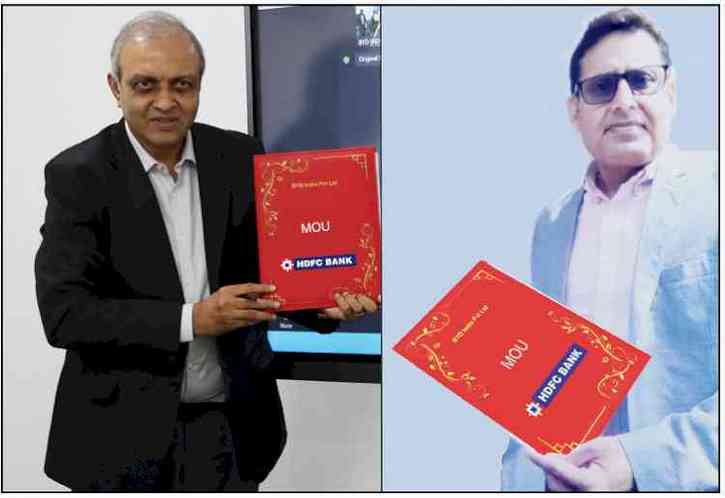

BYD India inks MOU with HDFC Bank for dealer finance

BYD India, a new energy vehicle manufacturer, signed an MOU with the HDFC Bank towards a stock financing solution to its pan India dealer network. The strategic tie-up will provide BYD’s dealers access to inventory finance for the electric cars.

BYD India, a new energy vehicle manufacturer, signed an MOU with the HDFC Bank towards a stock financing solution to its pan India dealer network. The strategic tie-up will provide BYD’s dealers access to inventory finance for the electric cars.

HDFC Bank’s dealer finance solution provides a bouquet of customised products offering tailored solutions for electric car dealers and BYD’s end customers.

BYD now has four industries including auto, electronics, new energy and rail transit. Since its foundation in 1995, the company quickly developed solid expertise in rechargeable batteries and became a relentless advocate of sustainable development, successfully expanding its renewable energy solutions globally with operations in over 70 countries and regions and over 400 Cities.

Commenting on the strategic tie-up with BYD India, Vikas Pandey, Business Manager, Auto Loan, HDFC Bank, said, “We believe in creating an ecosystem that brings OEMs, dealers and financiers together thus enabling customers to purchase their Electric Vehicle. ”

HDFC Bank has committed to becoming carbon neutral by FY2032. This tie-up is a step towards that.

Sanjay Gopalakrishnan, Sr Vice President – Electric Passenger Vehicle Business – BYD India, added, “The strategic tie up with India’s largest private bank gives our dealers access to Inventory funding and cash credit. This will also help them manage other expenses. Dealers are the frontrunners for our electric car sales and we are happy to support them through this tie-up.”

With the goal to achieve net-zero emissions by 2070 in India, BYD is committed and will constantly work closely with its partners to provide low-carbon products for the local market.

Financial Express

BYD now has four industries including auto, electronics, new energy and rail transit. Since its foundation in 1995, the company quickly developed solid expertise in rechargeable batteries and became a relentless advocate of sustainable development, successfully expanding its renewable energy solutions globally with operations in over 70 countries and regions and over 400 Cities.

Commenting on the strategic tie-up with BYD India, Vikas Pandey, Business Manager, Auto Loan, HDFC Bank, said, “We believe in creating an ecosystem that brings OEMs, dealers and financiers together thus enabling customers to purchase their Electric Vehicle. ”

HDFC Bank has committed to becoming carbon neutral by FY2032. This tie-up is a step towards that.

Sanjay Gopalakrishnan, Sr Vice President – Electric Passenger Vehicle Business – BYD India, added, “The strategic tie up with India’s largest private bank gives our dealers access to Inventory funding and cash credit. This will also help them manage other expenses. Dealers are the frontrunners for our electric car sales and we are happy to support them through this tie-up.”

With the goal to achieve net-zero emissions by 2070 in India, BYD is committed and will constantly work closely with its partners to provide low-carbon products for the local market.

Financial Express