5th September’24, New Delhi, INDIA: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for Aug'24.

Aug’24 Retails

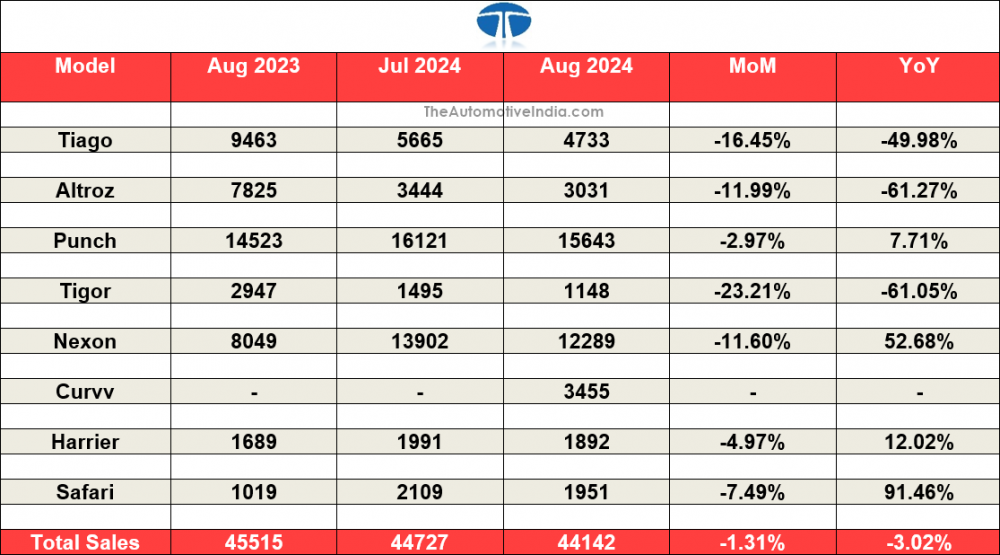

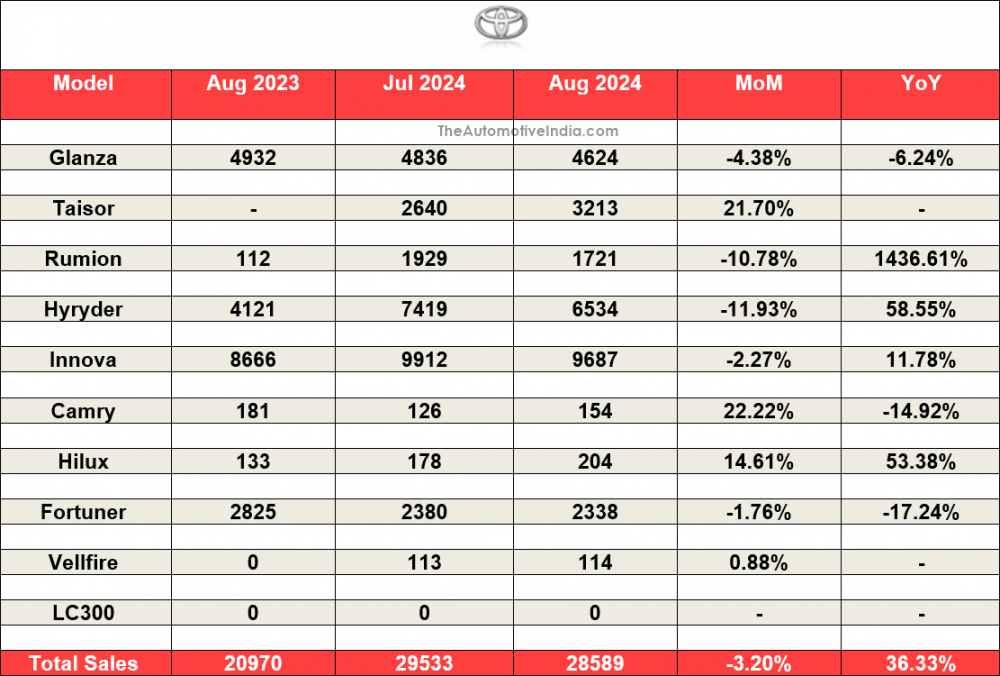

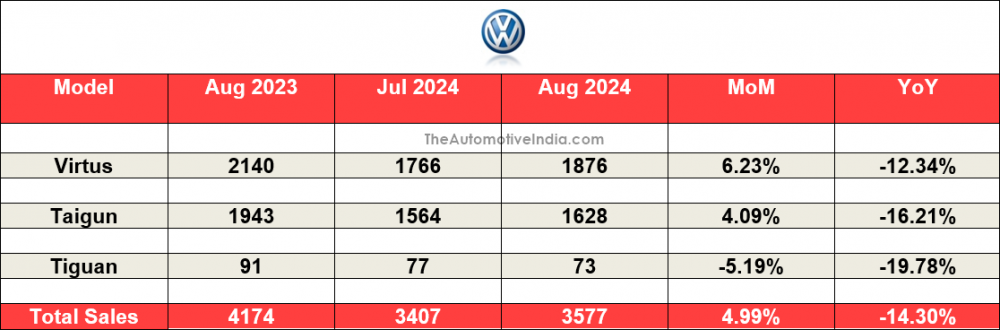

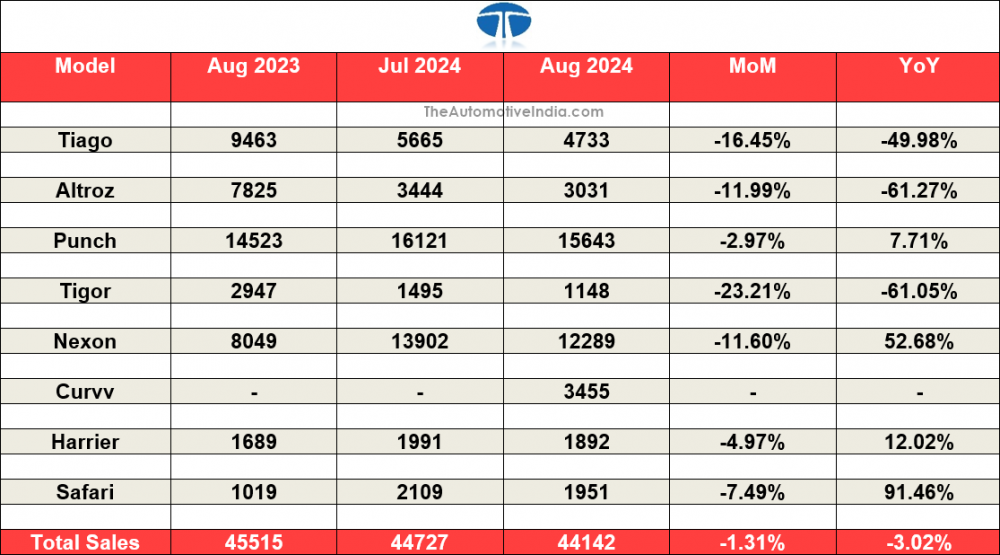

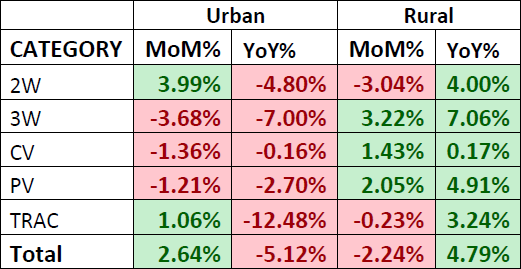

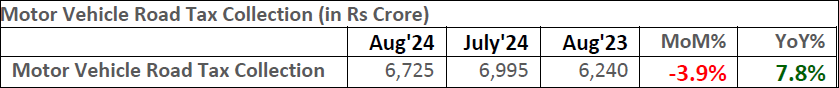

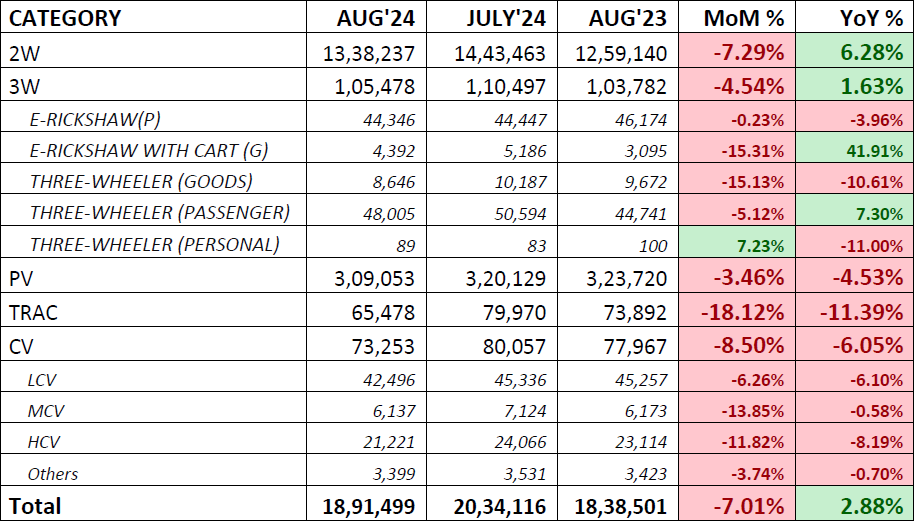

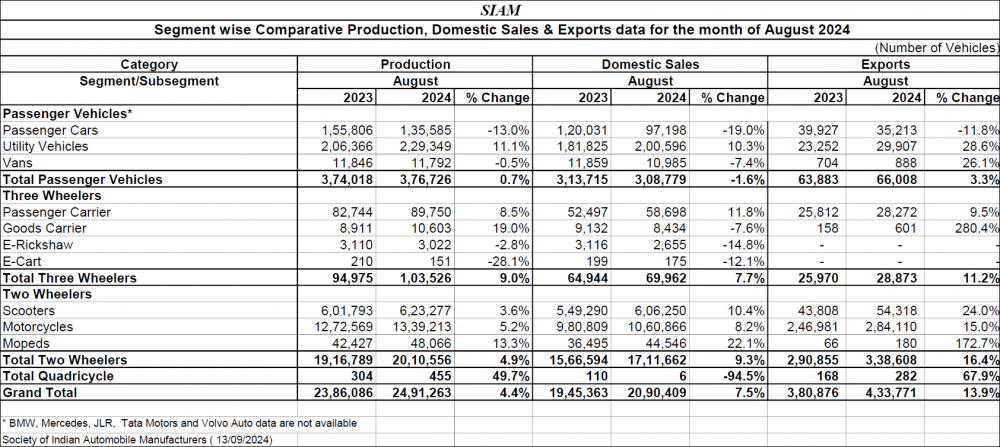

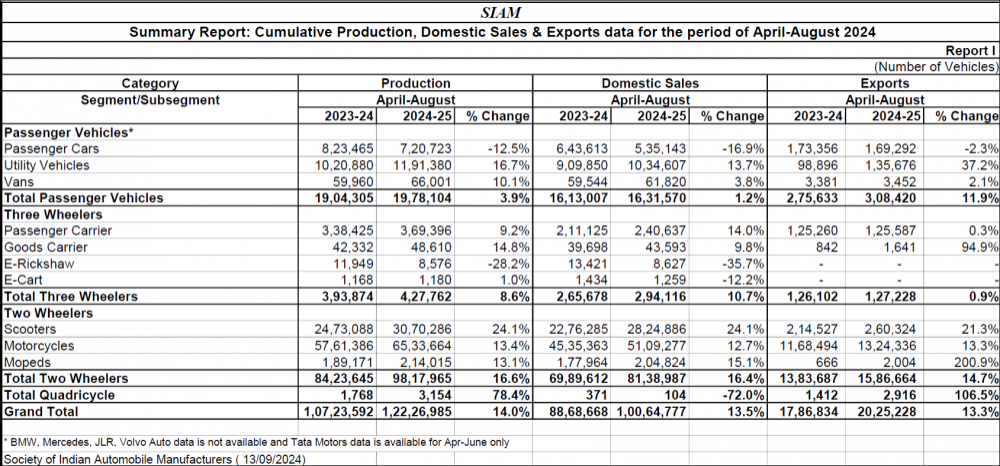

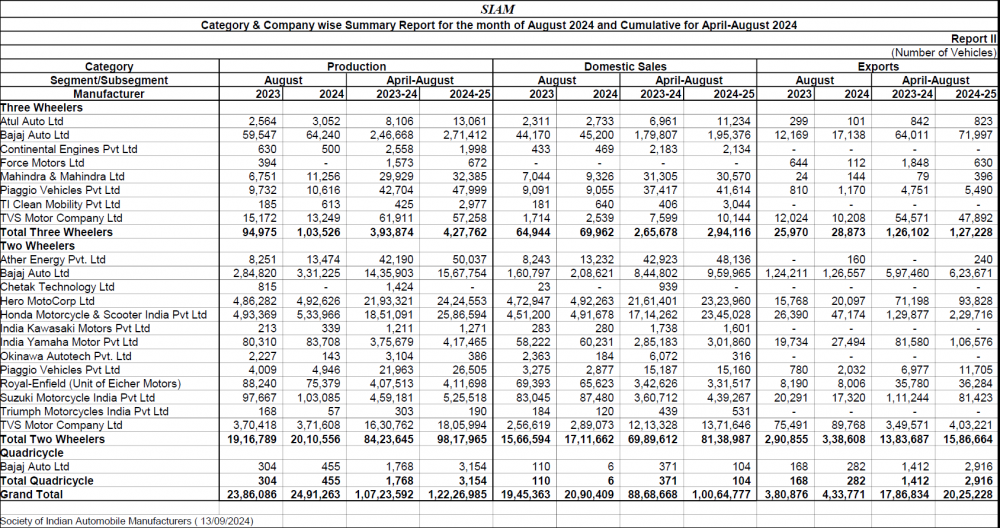

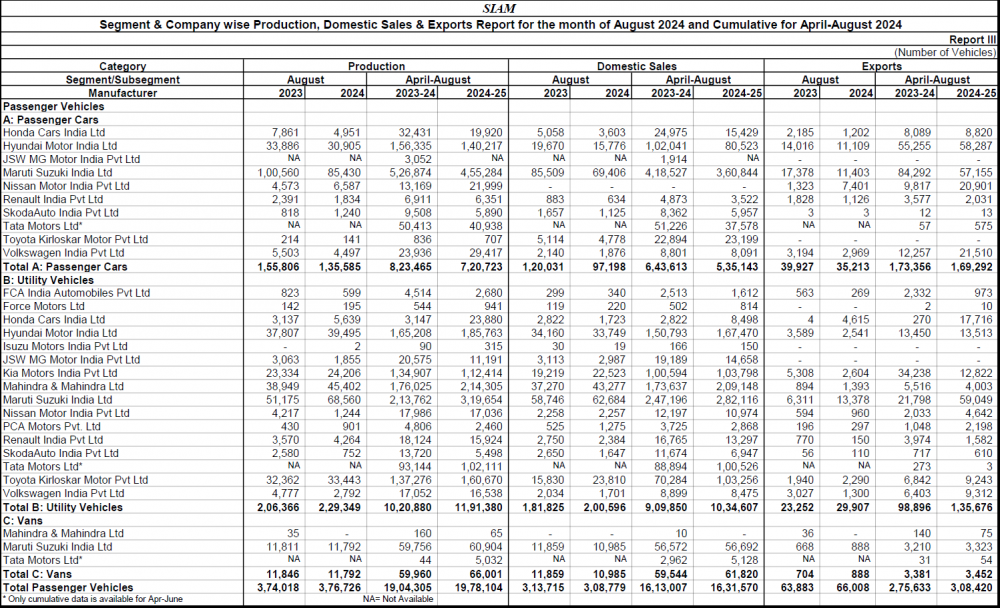

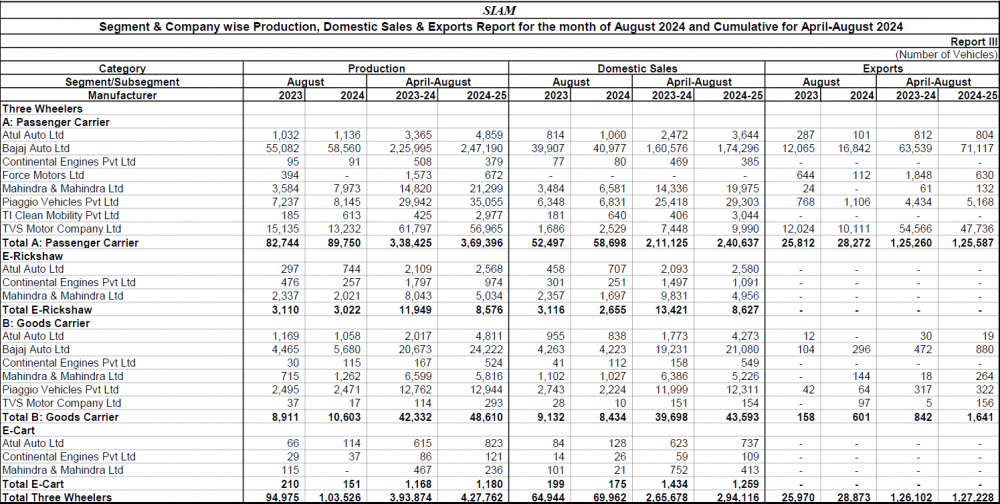

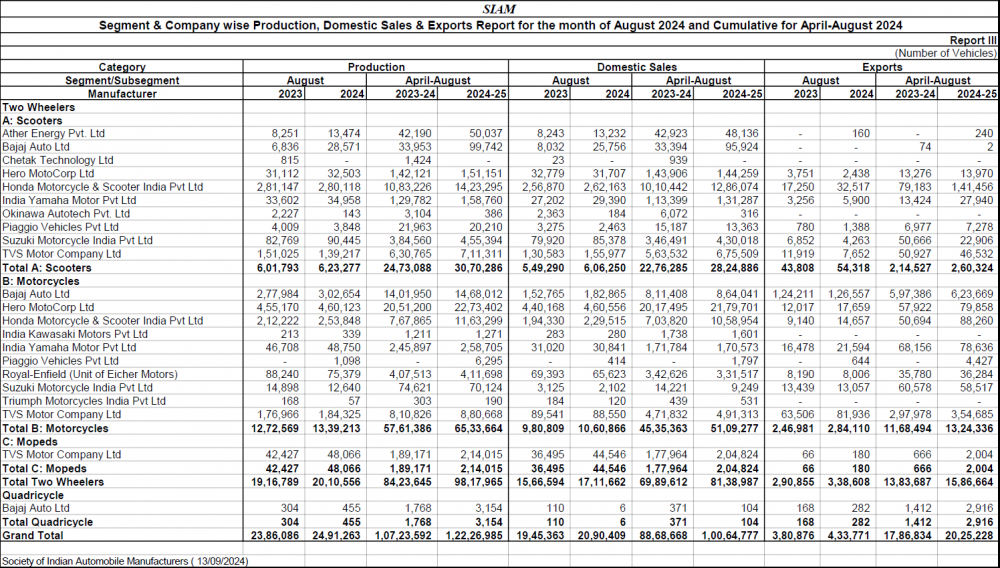

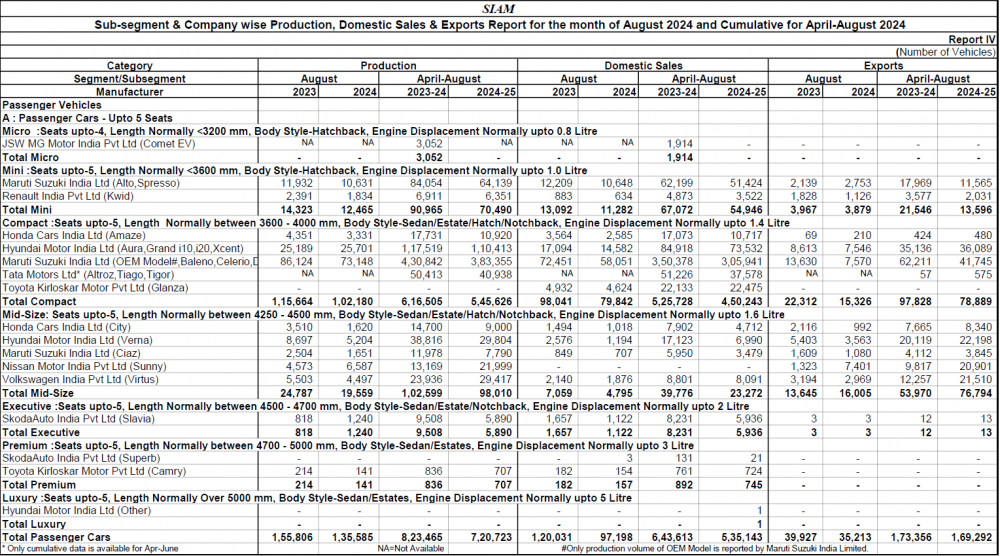

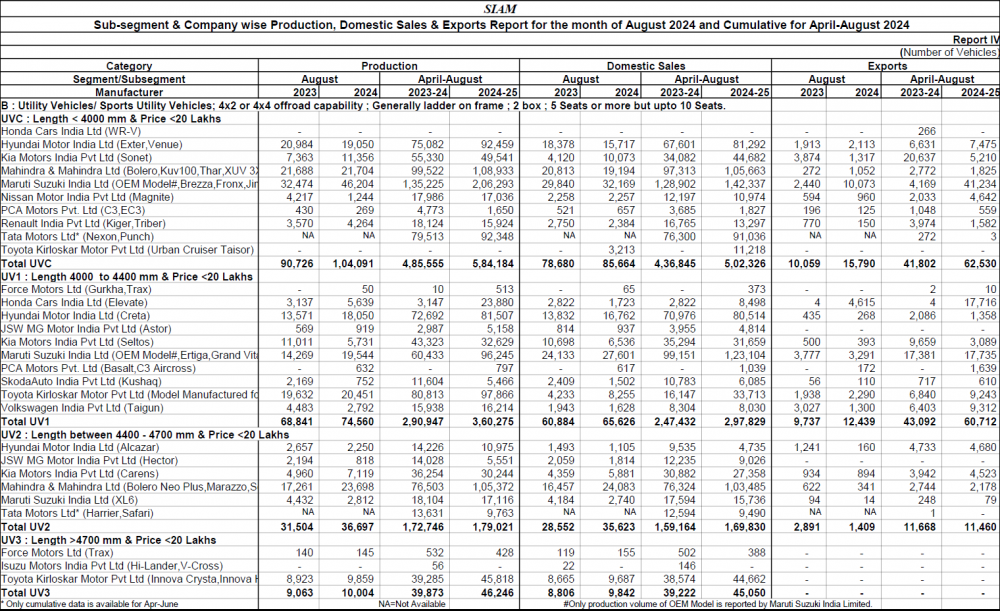

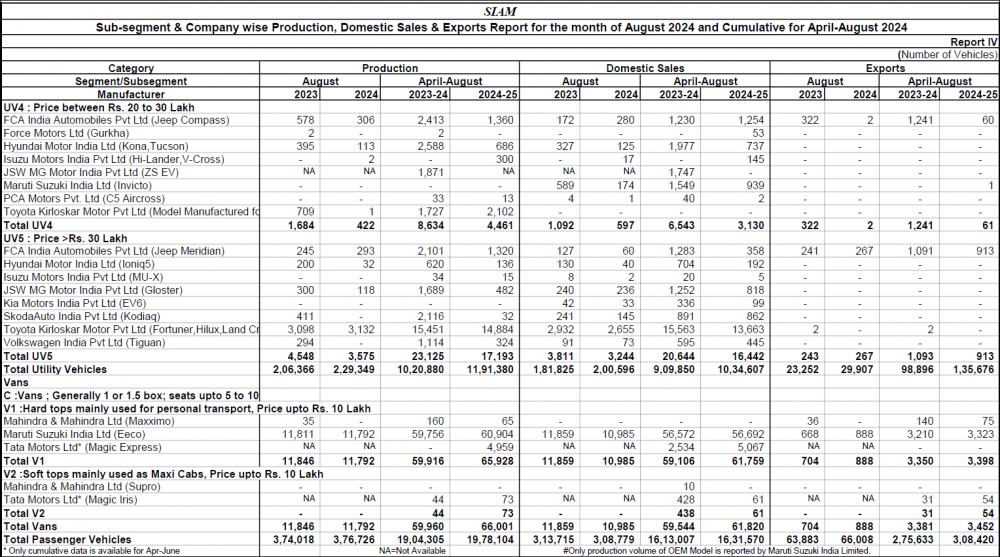

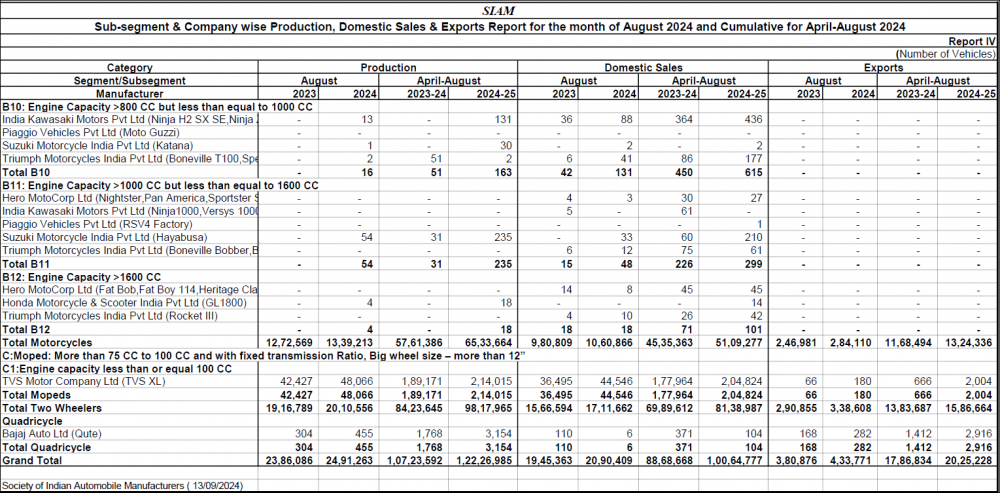

FADA President, Mr. Manish Raj Singhania, commented on the auto retail performance for August 2024, stating, “In August, India witnessed 15.9% excess rainfall across the country, with northwest India seeing a surplus of 31.4%, 7.2% in the east and northeast, 17.2% in central India and a minor deficiency of 1.3% in the peninsular region. This monsoon season brought unpredictable weather, starting with extreme heat waves which delayed monsoon and transitioned into heavy rainfall, leading to flood-like conditions in several areas. These weather anomalies have had a direct impact on India's auto retail market, which registered a modest YoY growth of just 2.88% in August. While the two-wheeler (2W) and three-wheeler (3W) segments managed to post growth at 6.28% and 1.63%, respectively, other categories faced significant setbacks. Passenger vehicle (PV) sales declined by 4.53%, tractor sales dropped by 11.39% and commercial vehicles (CV) saw a 6.05% drop, underscoring the challenges the industry is grappling with, due to these volatile conditions.

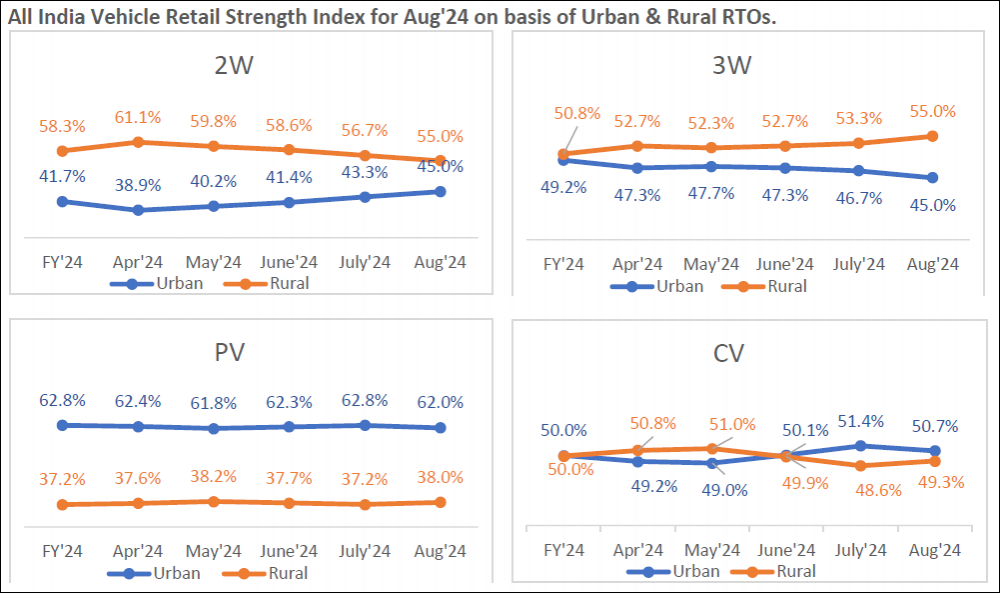

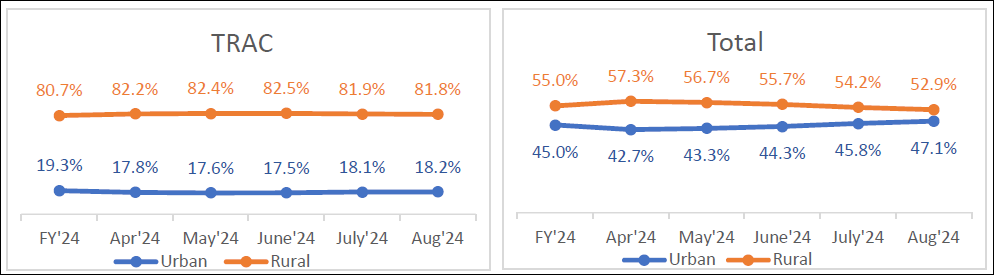

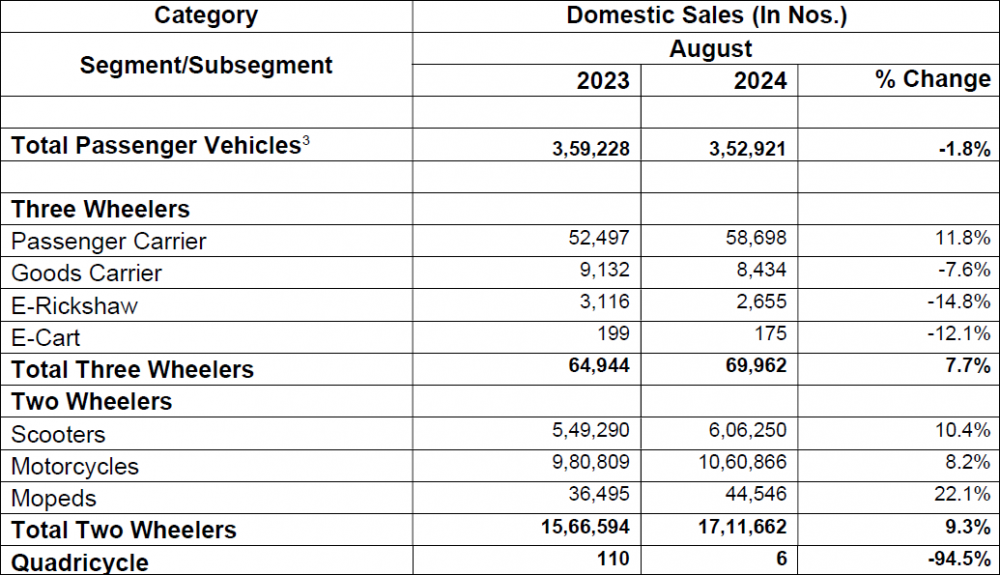

The 2W market saw a MoM decline of 7.29%, largely due to excessive rains and flooding, which disrupted demand across various regions. Many customers postponed their purchases, anticipating new product launches, while others deferred due to market saturation and changing preferences. Limited marketing efforts from OEMs and subdued market sentiment further impacted sales. Despite these headwinds, the 2W segment grew by 6.28% YoY, thanks to improved stock availability and the onset of the festive season. Our retail strength index also indicates that rural sentiments remained strong on a YoY basis. FADA is raising SOS signals as PV sales fell by 3.46% MoM and 4.53% YoY.

Even with the arrival of the festive season, the market remains under significant strain due to delayed customer purchases, poor consumer sentiment and persistent heavy rains. Inventory levels have reached alarming levels, with stock days now stretching to 70-75 days and inventory totalling 7.8 lakh vehicles, valued at an alarming Rs.77,800 crore. Rather than responding to the situation, PV OEMs continue to increase dispatches to dealers on a MoM basis, further exacerbating the issue. FADA urgently calls upon all Banks and NBFCs to intervene and immediately control funding to dealers with excessive inventory. Dealers must also act swiftly to stop taking on additional stock to protect their financial health. OEMs, too, must recalibrate their supply strategies without delay, or the industry faces a potential crisis from this inventory overload.

If this aggressive push of excess stock continues unchecked, the auto retail ecosystem could face severe disruption. Commercial vehicle sales experienced a sharp drop, with an 8.5% MoM decline and a 6.05% YoY fall. Members have pointed to key challenges, such as heavy rains, floods and landslides, which have severely impacted market activity. Additionally, reduced construction activity and sluggish demand in industrial sectors have further strained sales. The CV segment continues to struggle, facing pressure from steep discounting by competitors, which has only intensified the decline. Weak sentiment, coupled with inventory and cash flow challenges, continues to affect the industry overall.”

Near-Term Outlook

As we approach the festive season, there are several challenges that could impact auto sales in the near term. India experienced 16% above-normal rainfall in August, with additional rainfall forecasted for September, according to the IMD. This excessive rainfall poses a significant risk to crops nearing harvest, particularly those planted in late June with a 75 to 90 days maturity cycle. Continued heavy rains could negatively affect rural sales, as reduced agricultural output may lead to diminished purchasing power. Additionally, the Shraddh period in September, regarded as an inauspicious time for purchases, is expected to pause sales for some time.

In the CV segment, sluggish construction activity, liquidity issues and weather-related disruptions are likely to suppress demand further. Aggressive discounting practices continue to pressure dealers, leading to reduced profitability and a generally cautious market sentiment. On the positive side, the upcoming festivals, such as Ganesh Chaturthi, Onam and Navratri, are expected to boost consumer sentiment, especially in urban areas. Moreover, favourable rainfall in certain regions has improved agricultural prospects, which could enhance purchasing power in rural areas as the monsoon subsides.

In the CV segment, increasing demand for iron ore, steel transport, and tippers offers a potential lift, supported by new model launches and marketing efforts from OEMs. Given these factors, FADA remains cautiously optimistic about the near-term outlook. While the festive season and improved rural demand present promising opportunities for growth, ongoing weather uncertainties and high inventory levels may temper the overall recovery. To navigate these challenges, strategic inventory management and targeted marketing initiatives will be crucial in maximizing festive sales and mitigating risks from adverse weather conditions.

Key Findings from our Online Members Survey

§ Liquidity

o Neutral 51.60%

o Bad 27.20%

o Good 21.20%

§ Sentiment

o Neutral 49.60%

o Good 25.60%

o Bad 24.80%

§ Expectation from September’24

o Growth 50.00%

o Flat 31.60%

o De-growth 18.40%