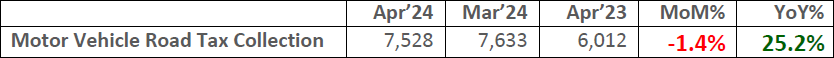

The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for April'24.

April’24 Retails

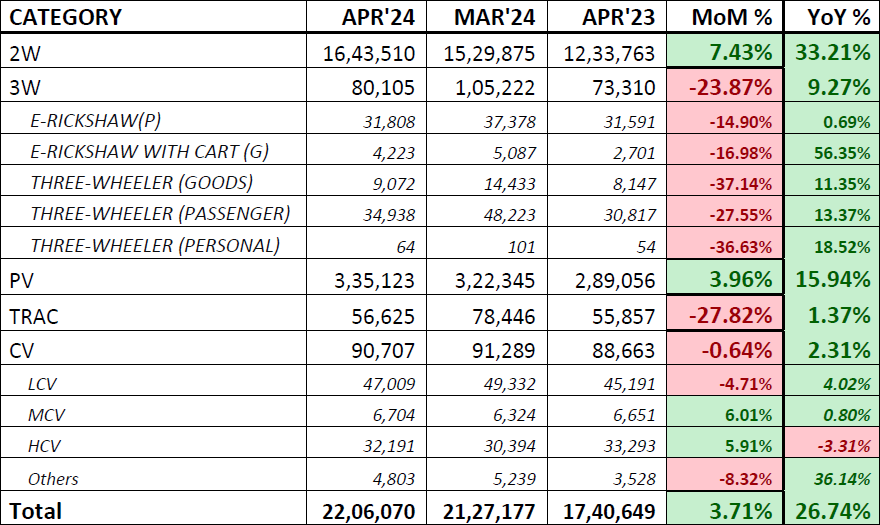

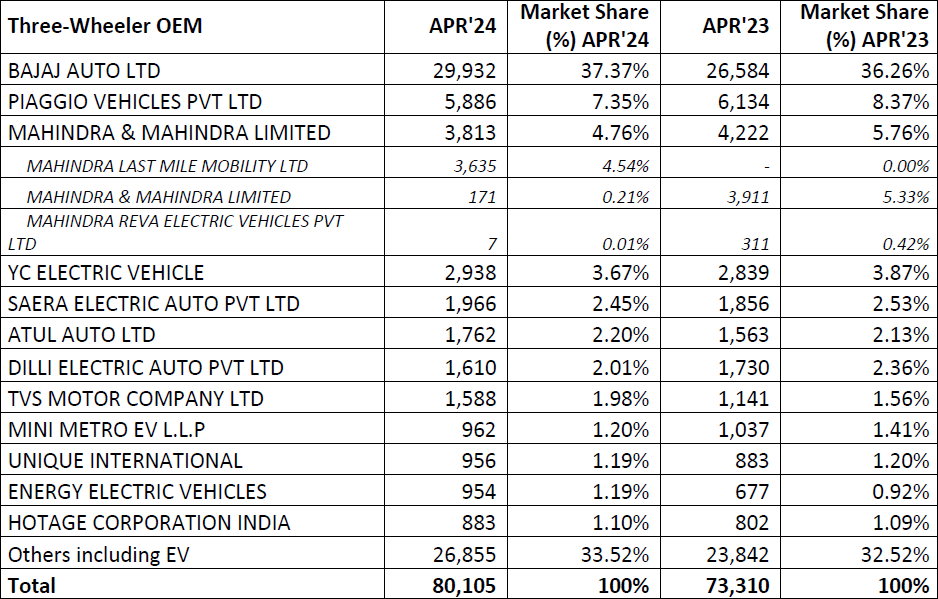

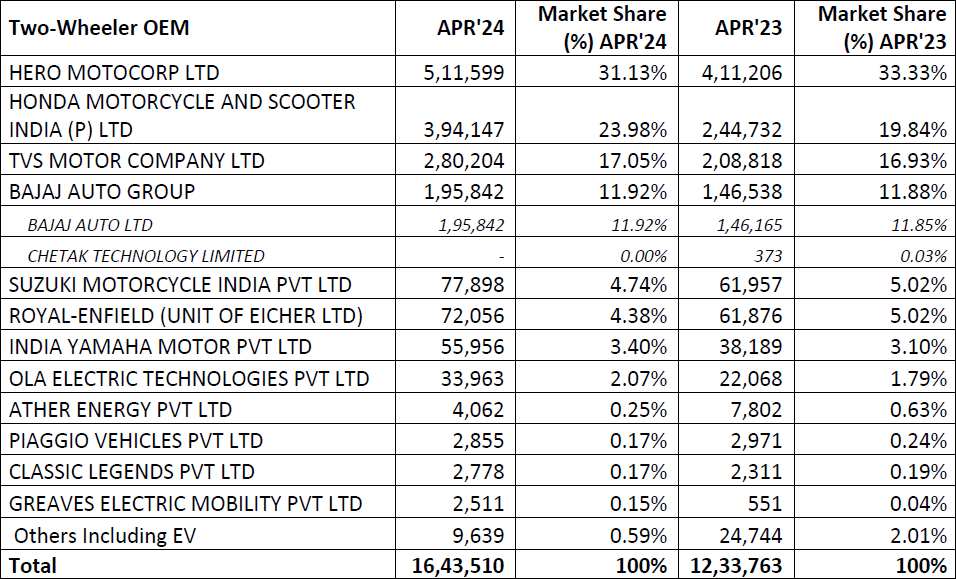

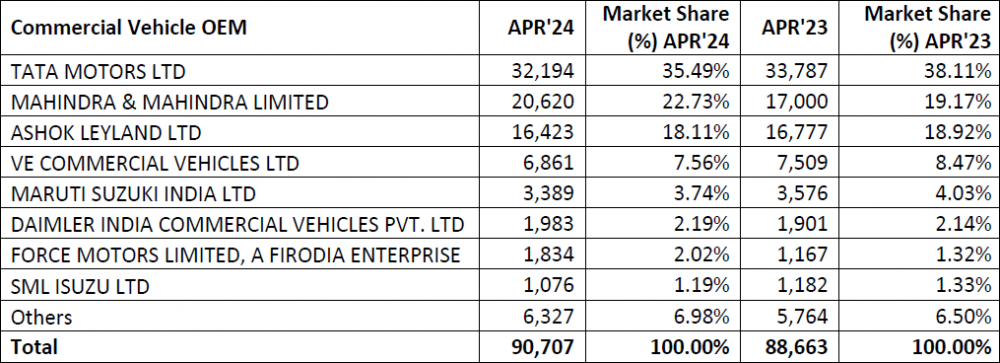

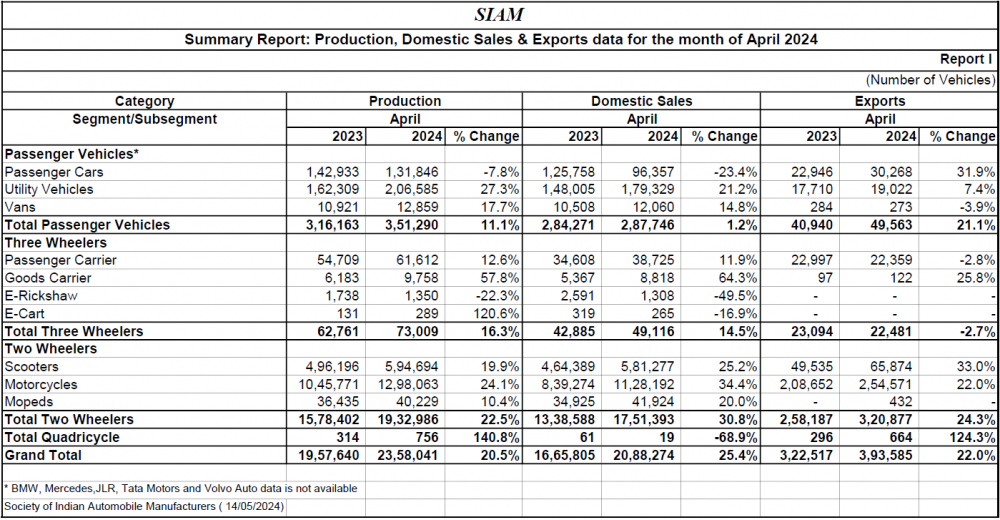

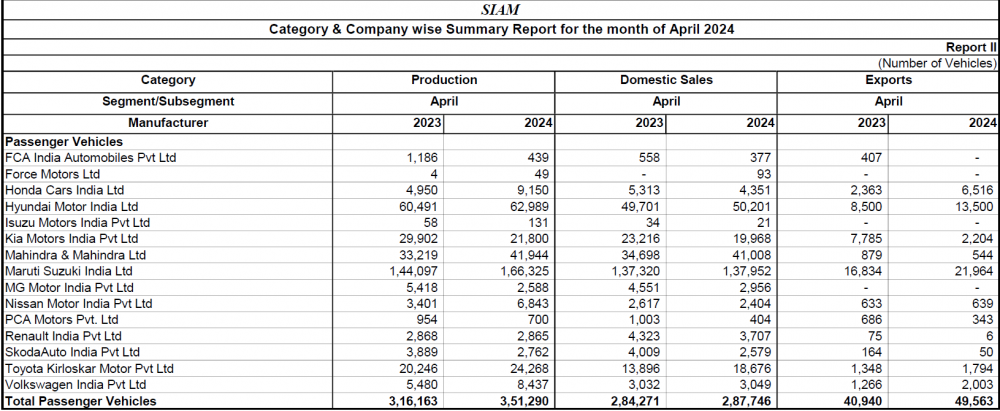

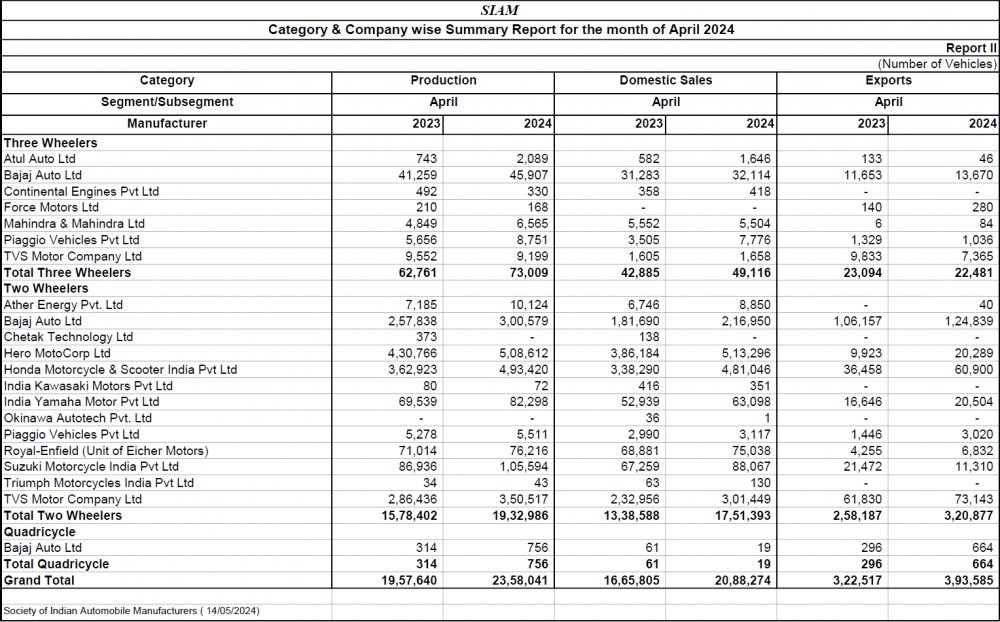

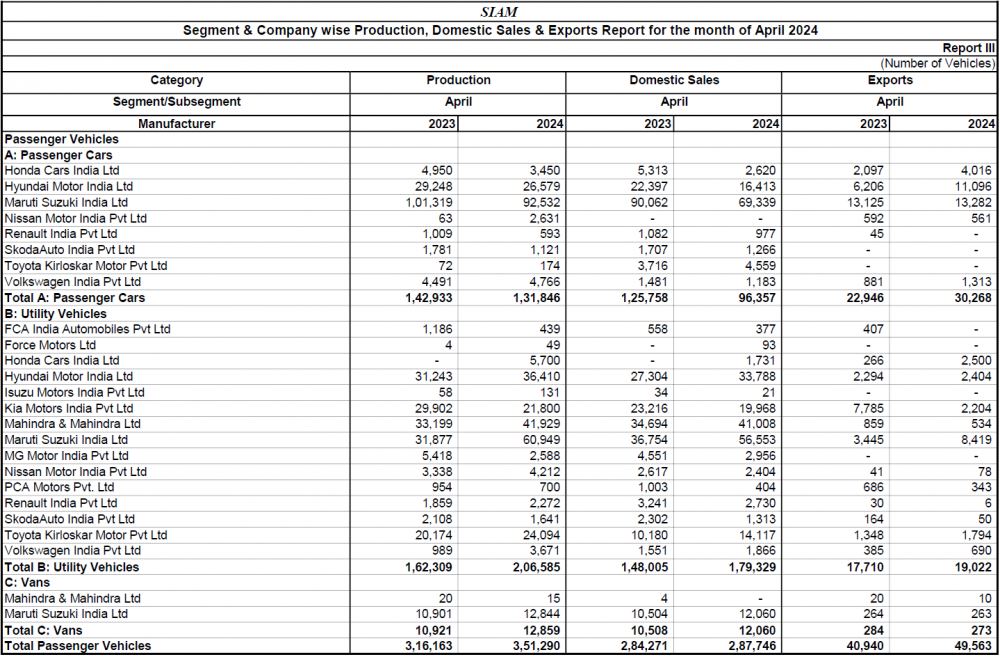

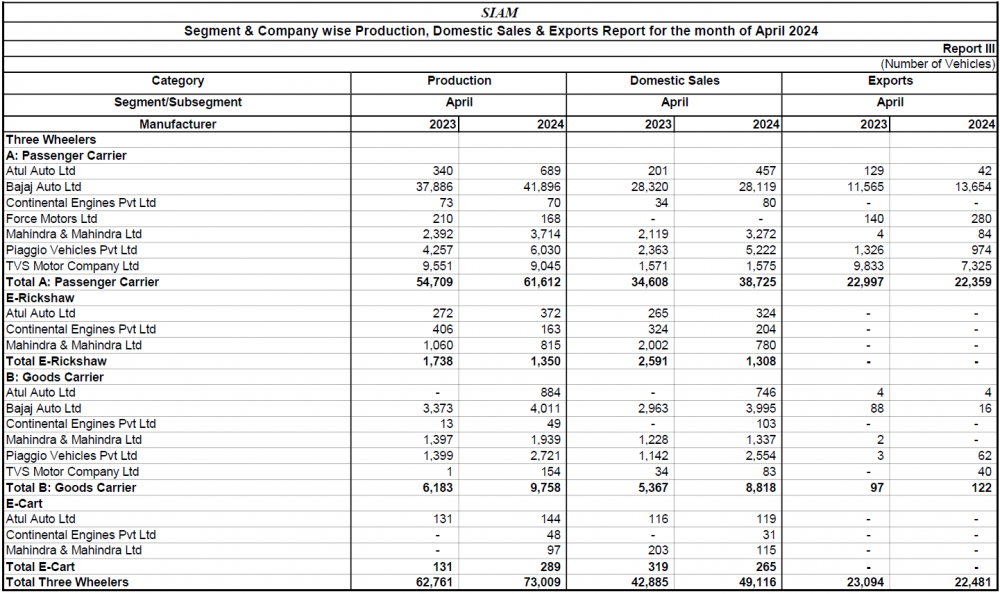

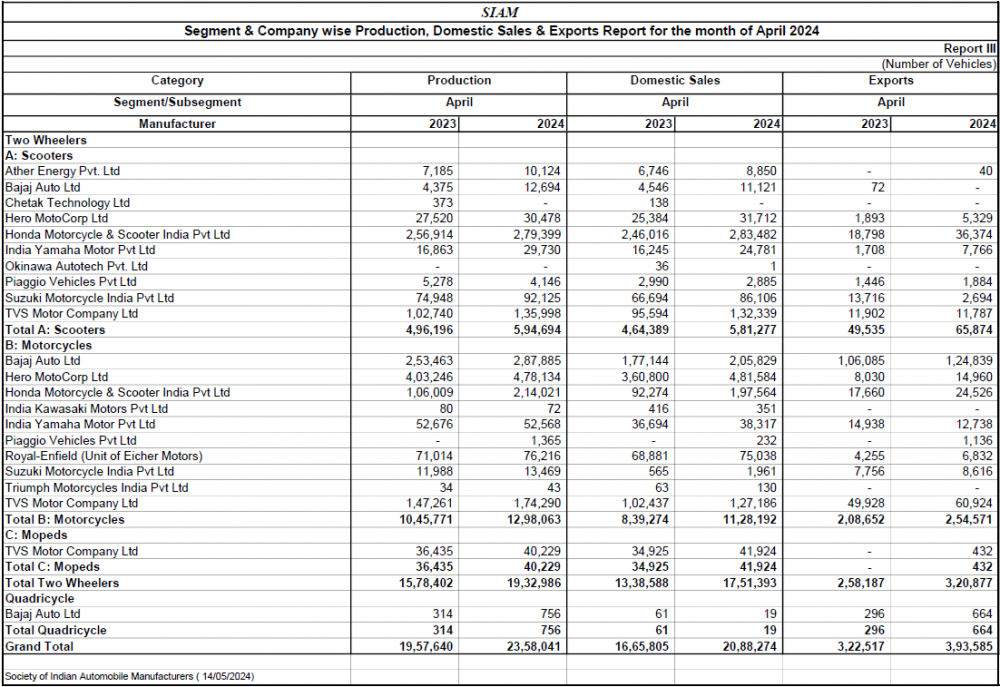

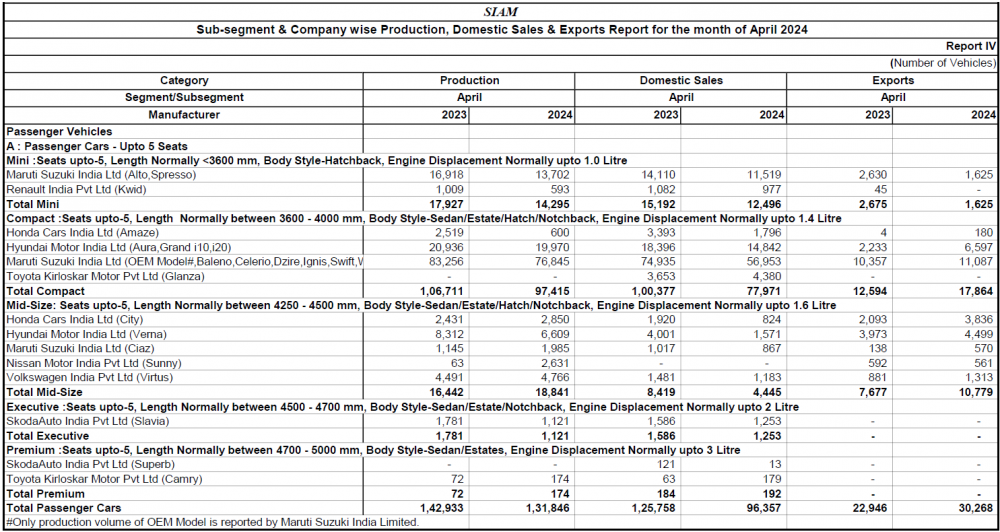

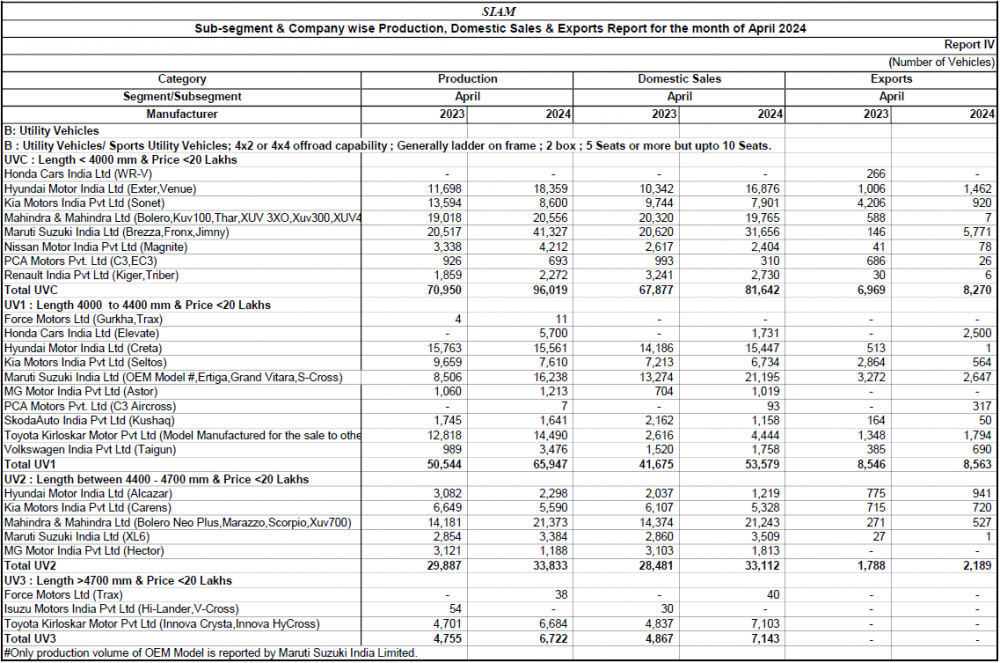

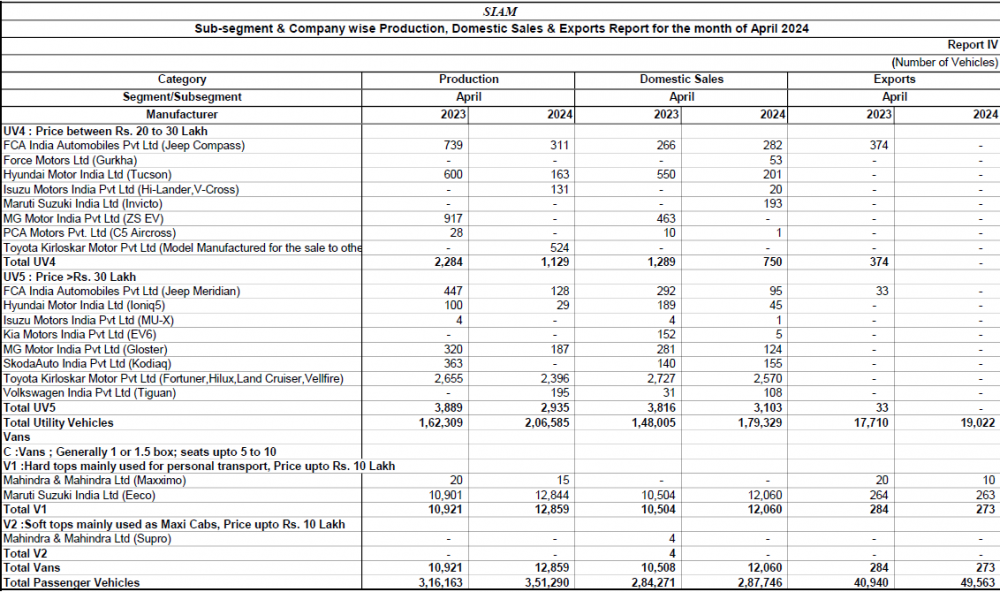

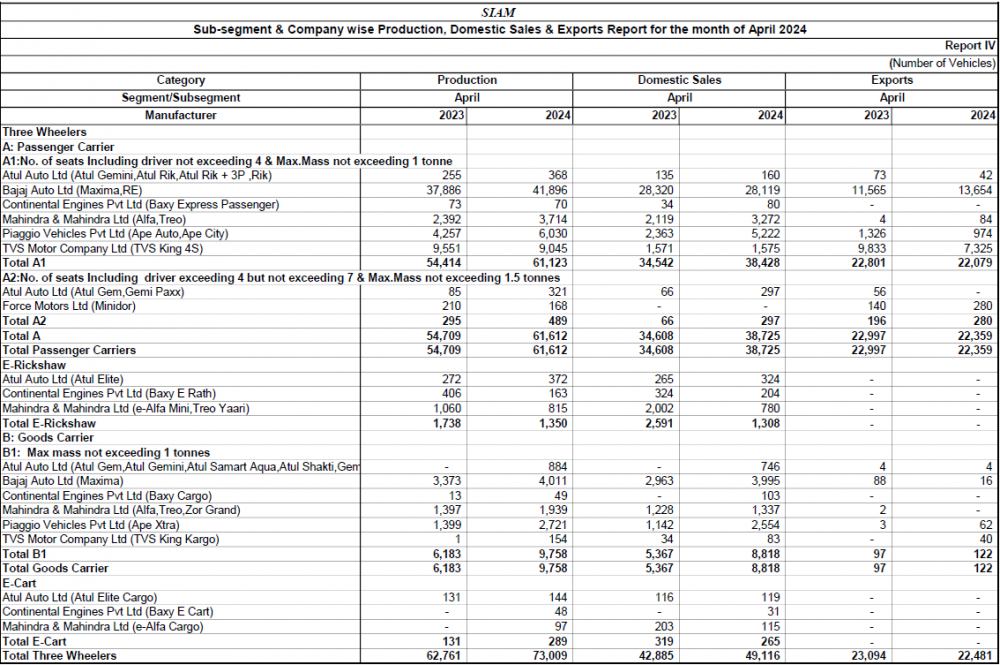

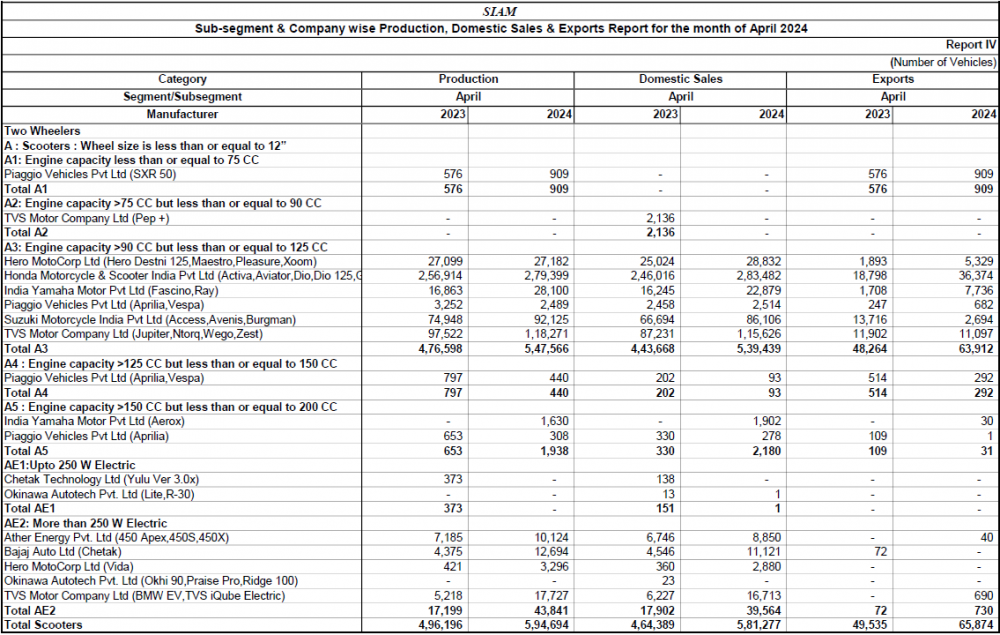

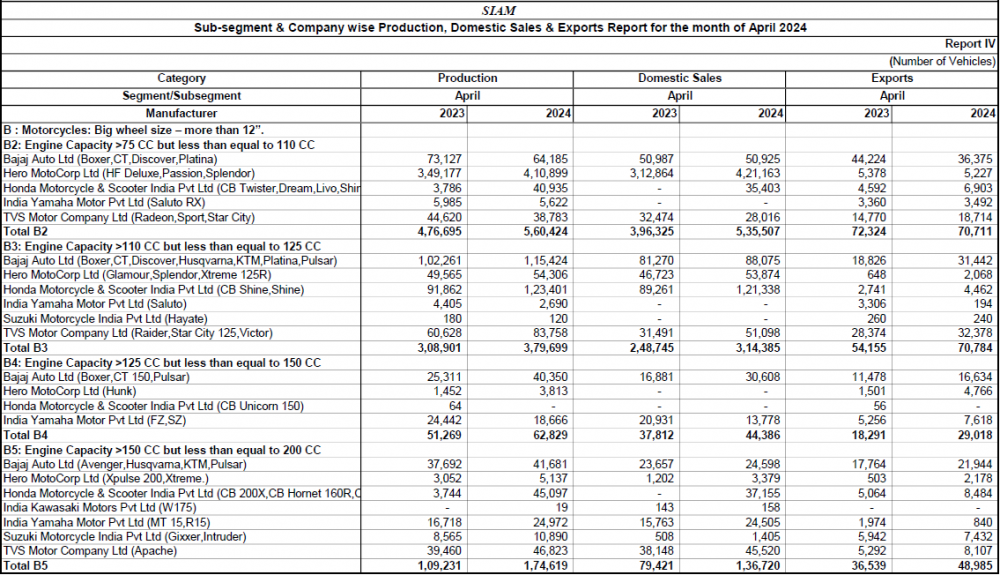

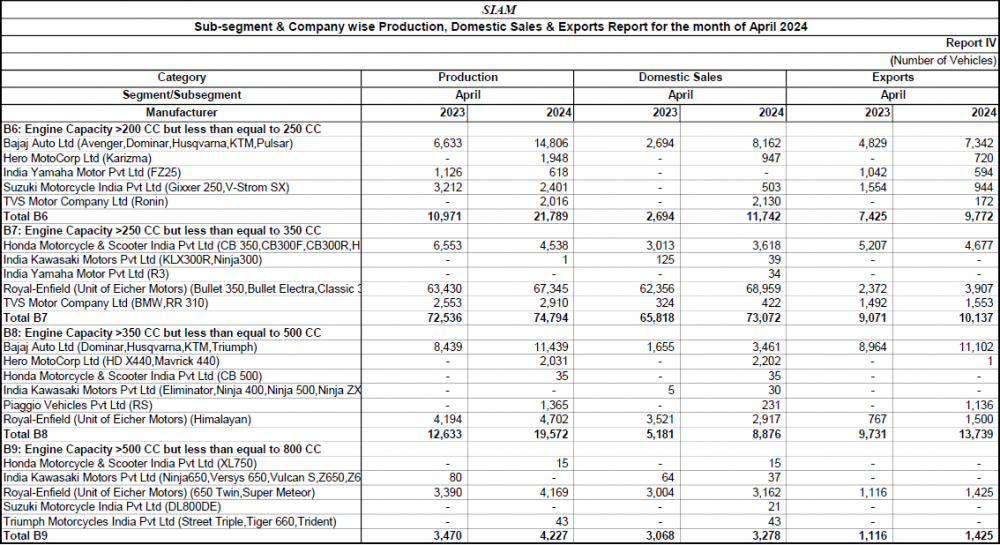

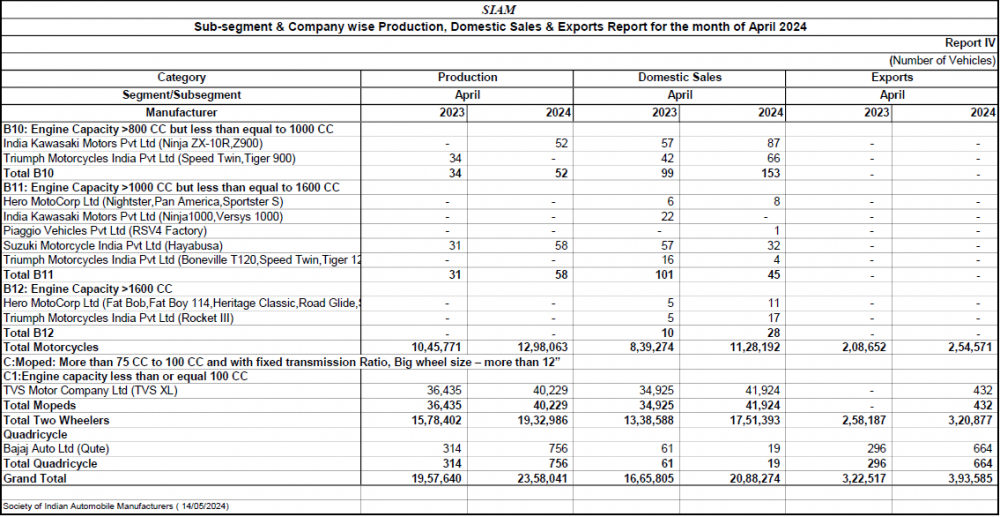

FADA President Mr. Manish Raj Singhania commented on April 2024's auto retail performance, stating, “In April 2024, the Indian Auto Retail sector achieved a robust 27% YoY growth. The two-wheeler (2W), threewheeler (3W), passenger vehicle (PV), tractor (Trac) and commercial vehicle (CV) segments grew by 33%, 9%, 16%, 1%, and 2%, respectively. While some attribute this growth to the shift in Navratri to April instead of March last year, the overall increase was significant. Comparing combined March and April 2024 with the same period last year shows a 14% YoY growth for the entire industry.

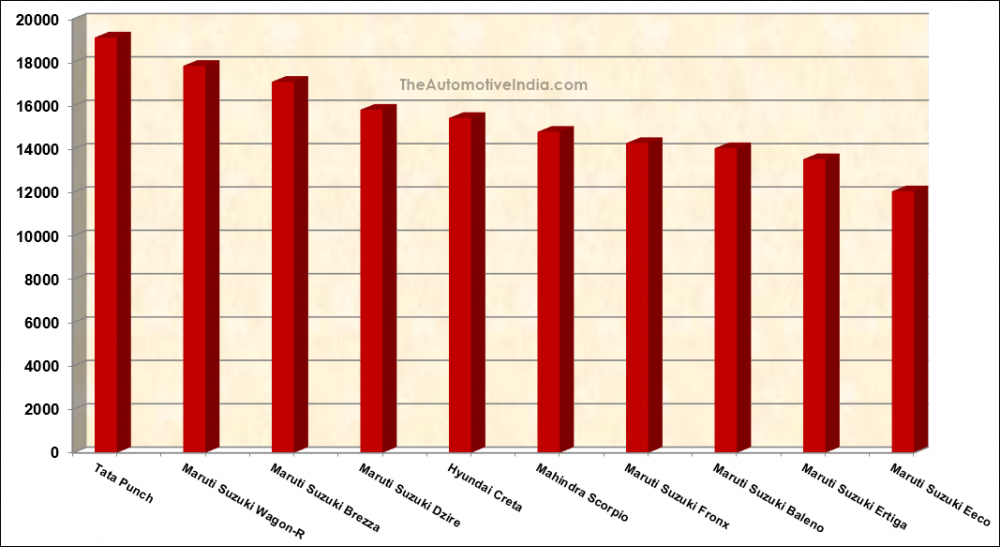

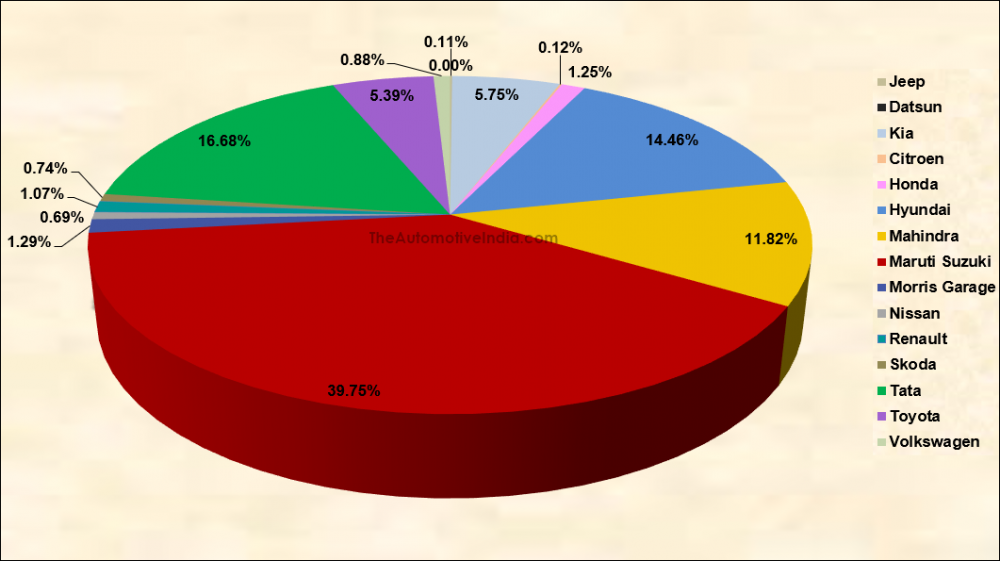

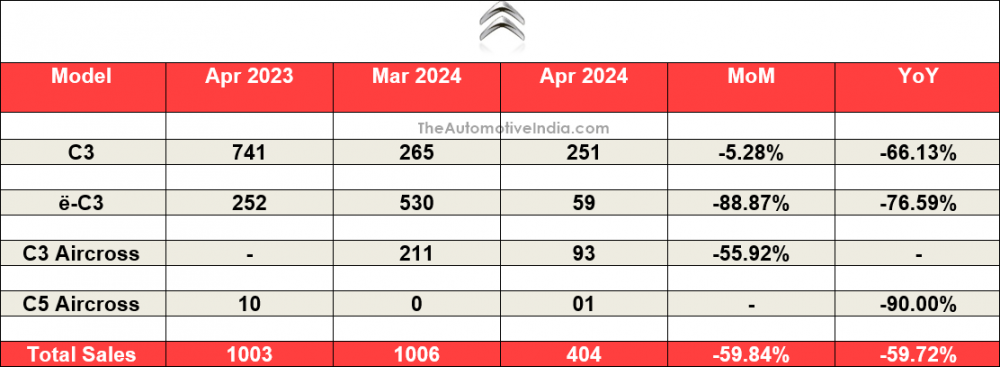

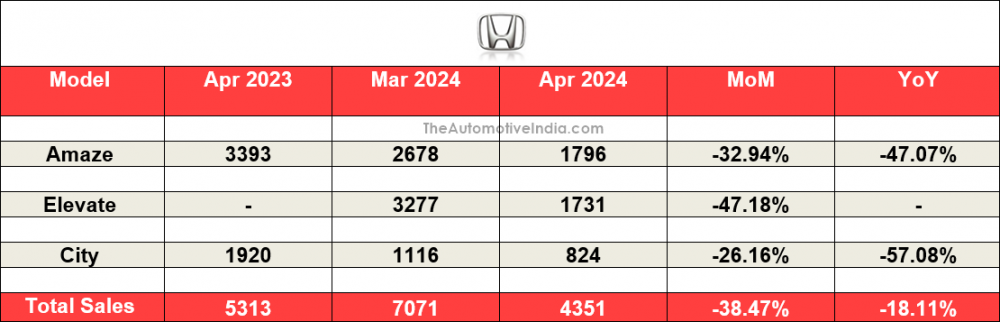

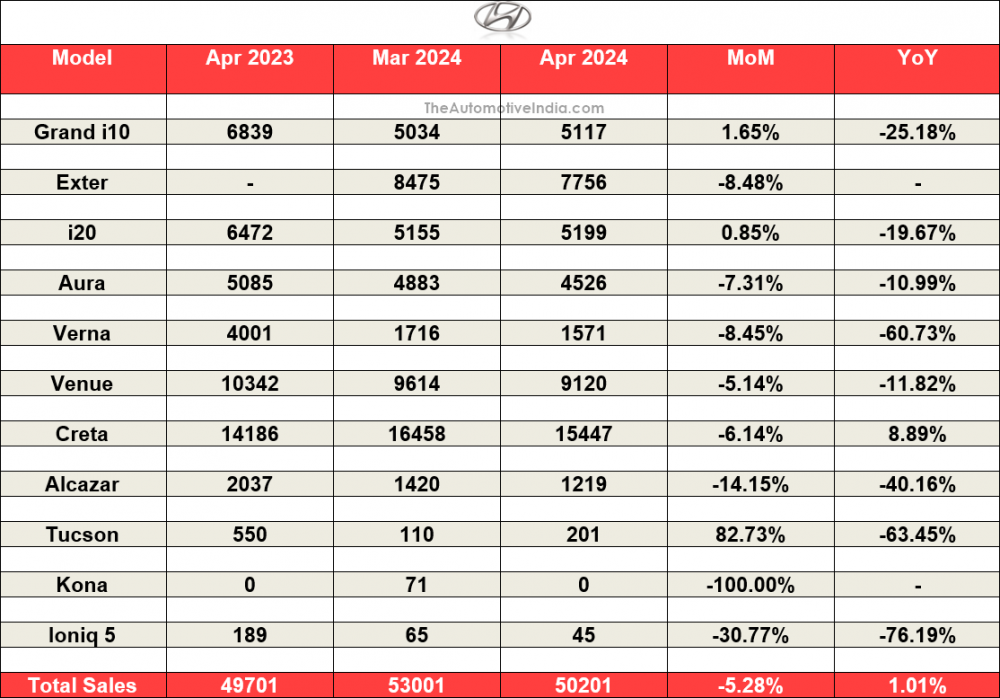

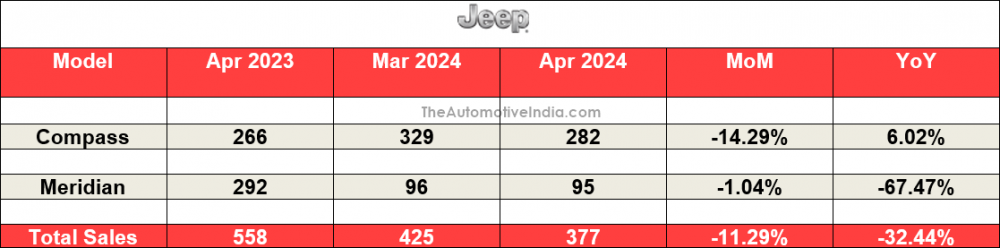

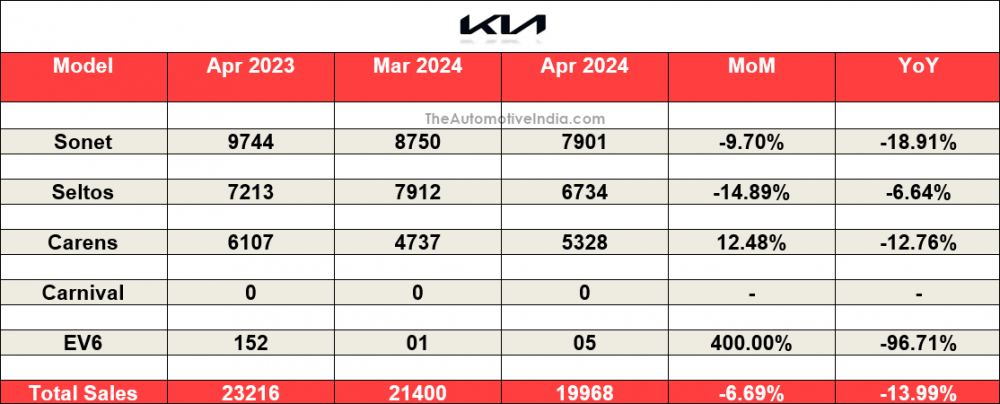

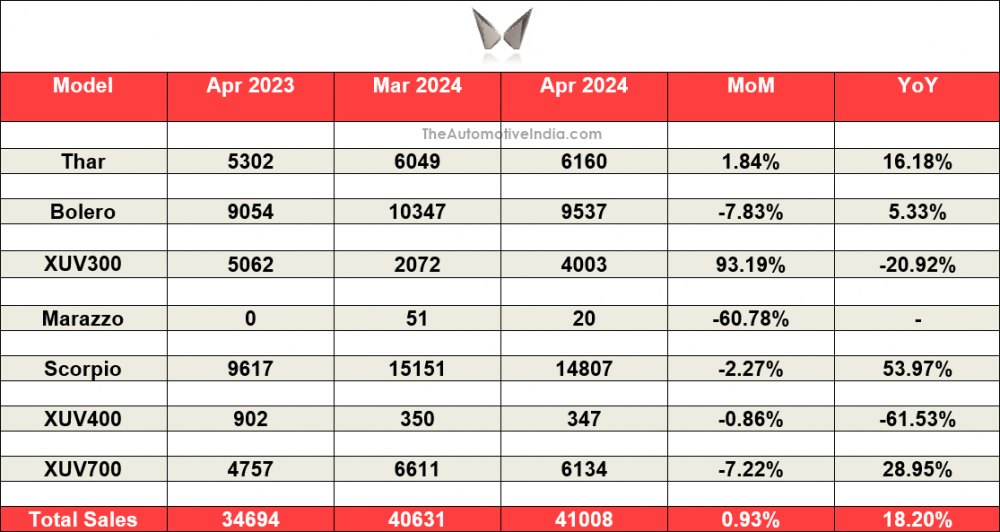

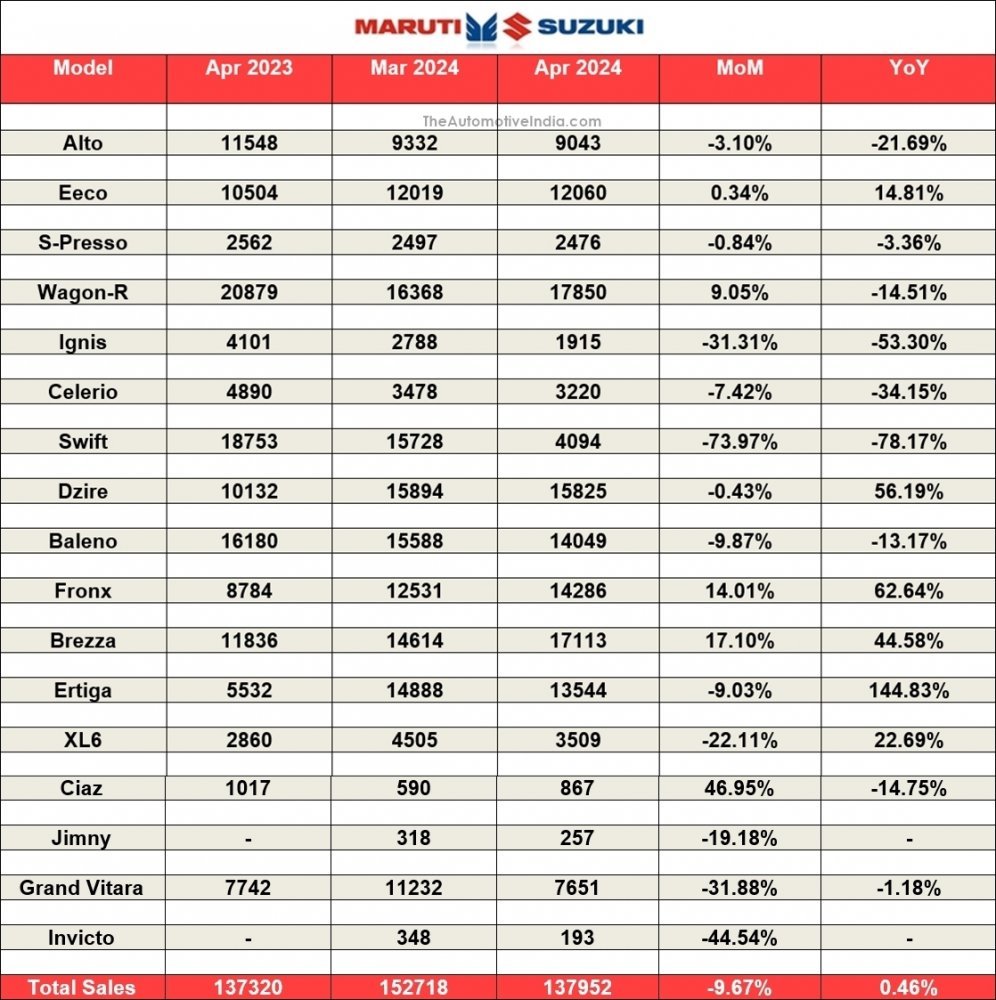

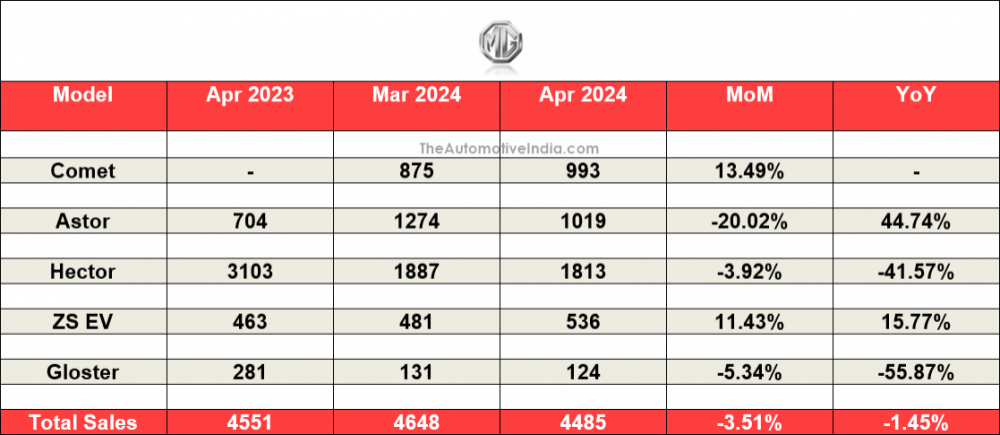

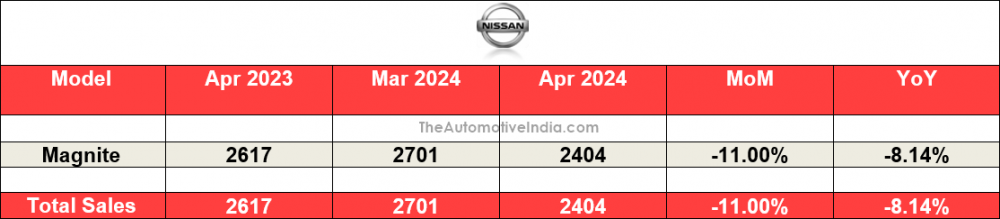

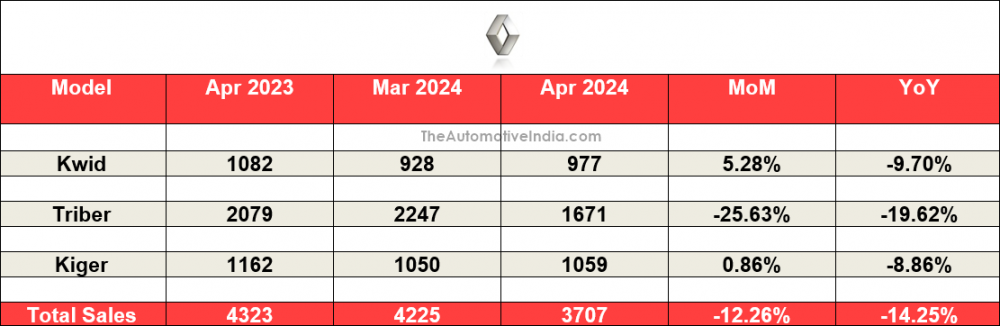

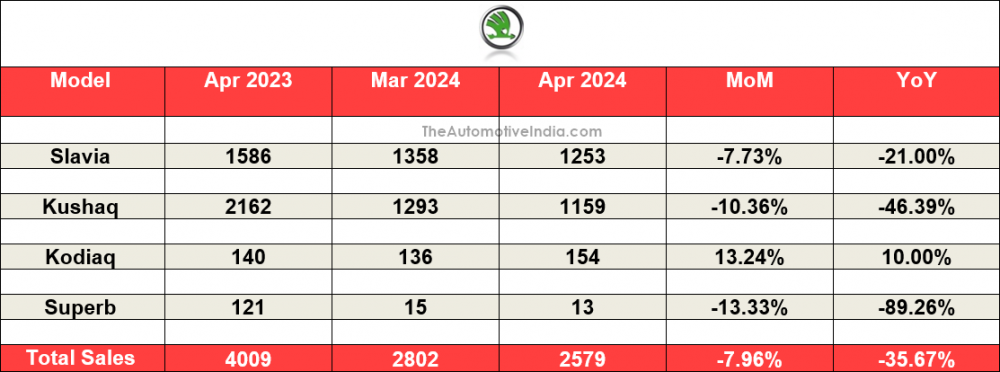

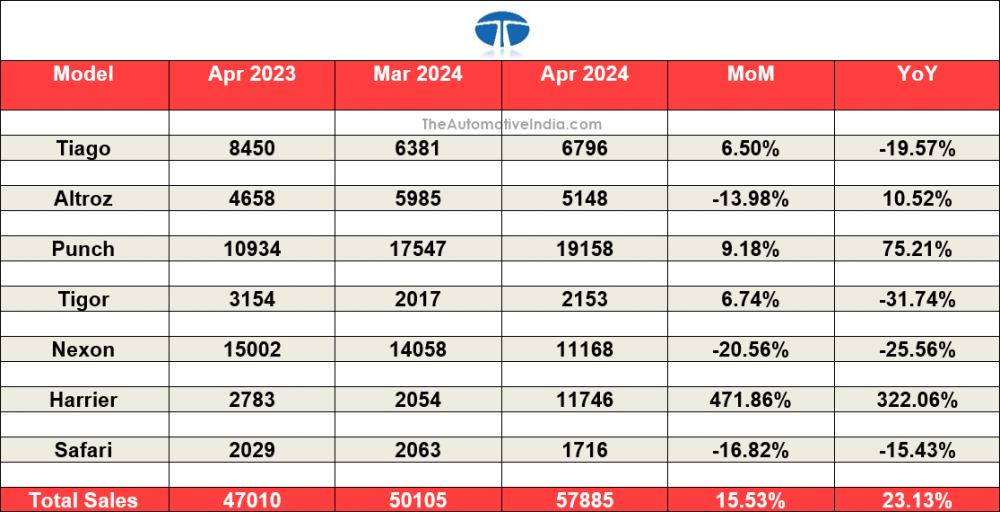

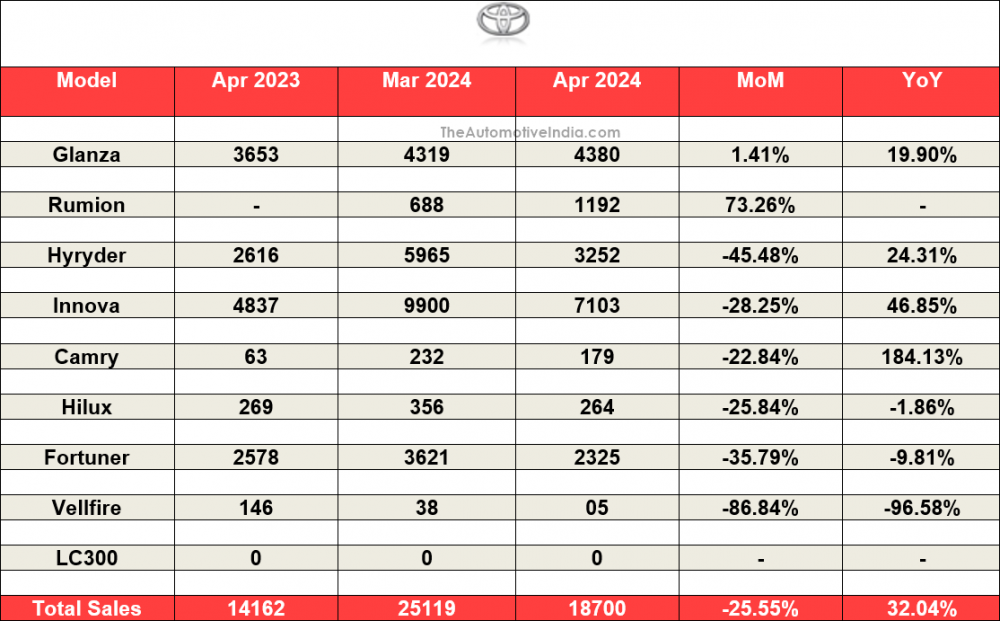

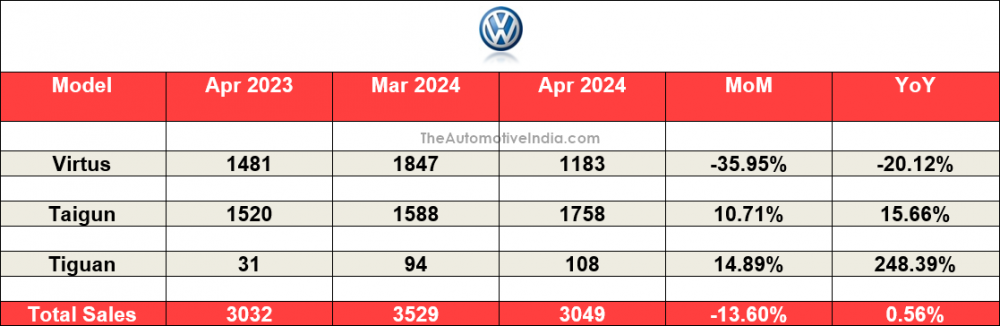

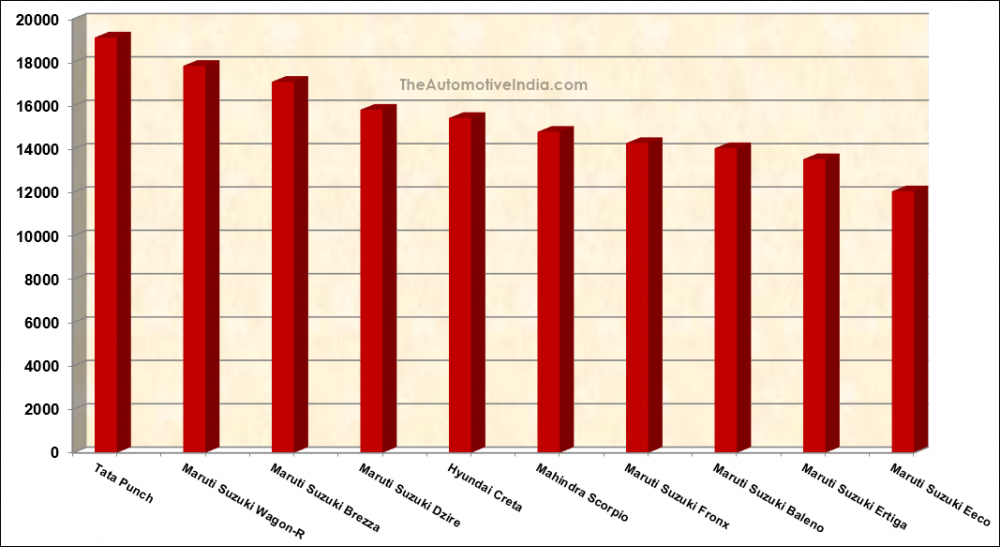

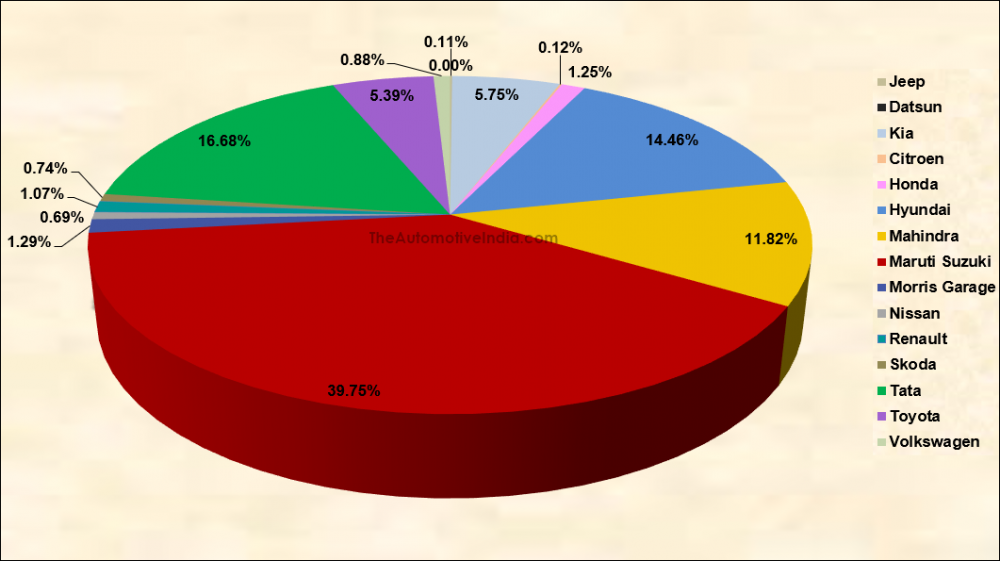

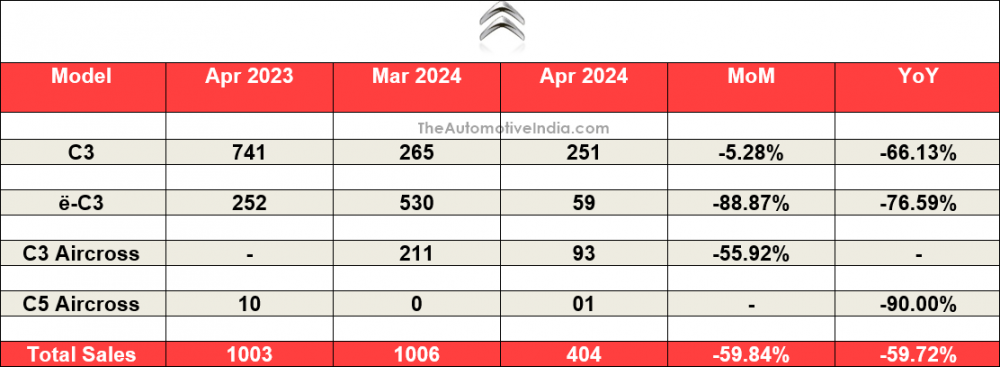

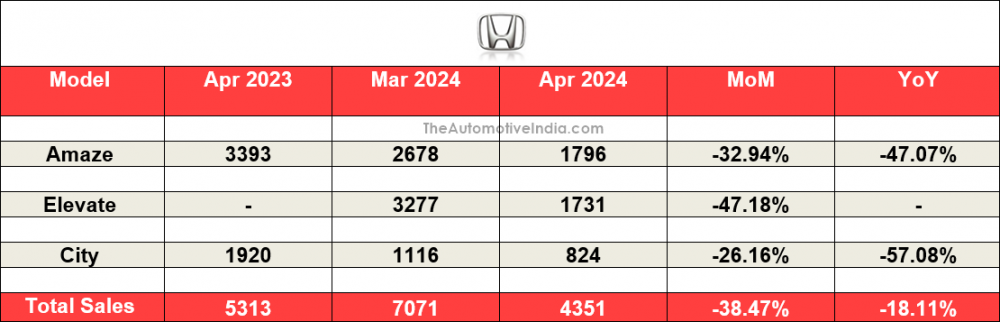

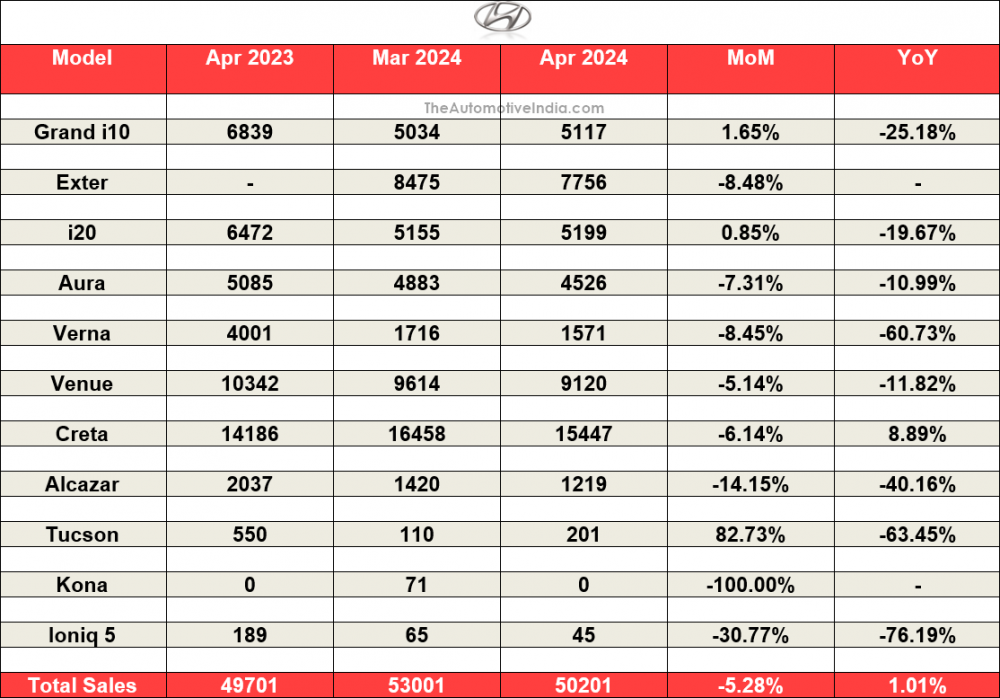

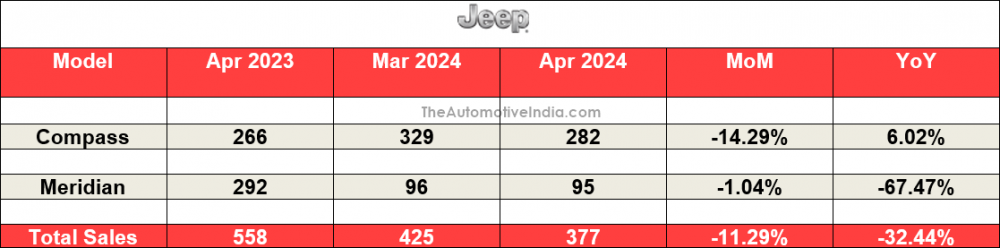

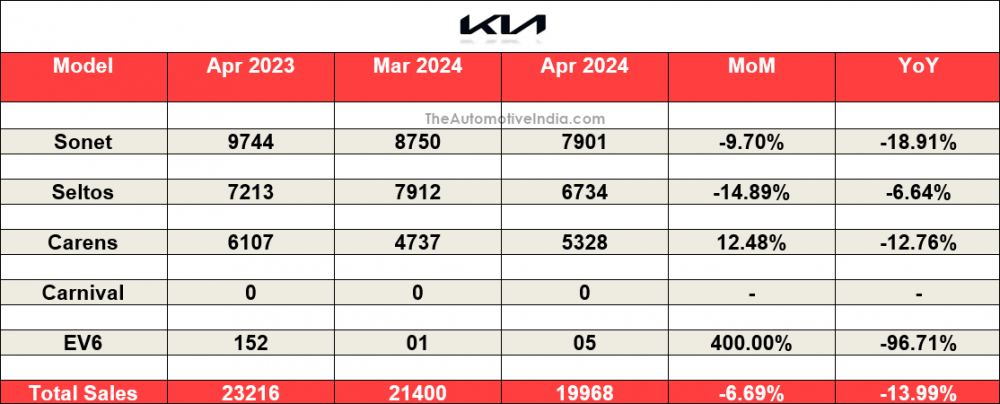

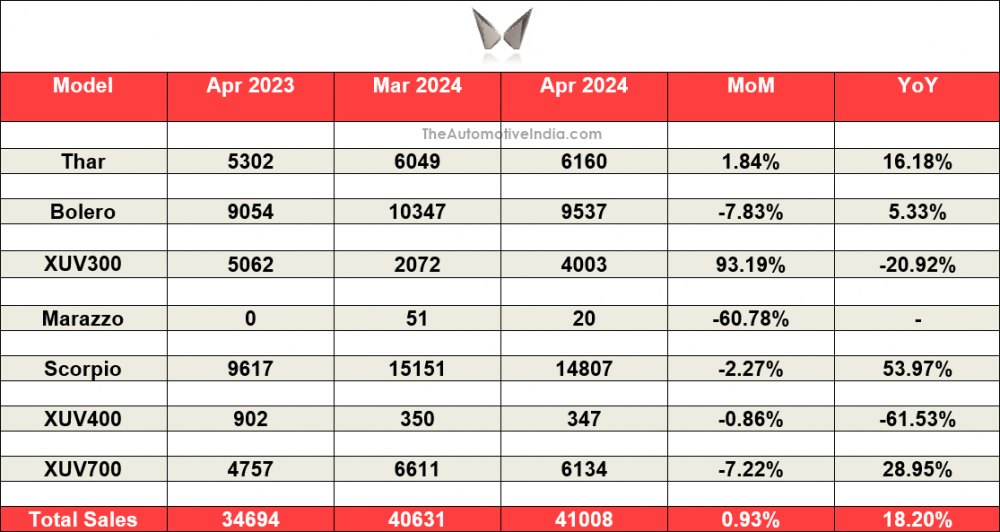

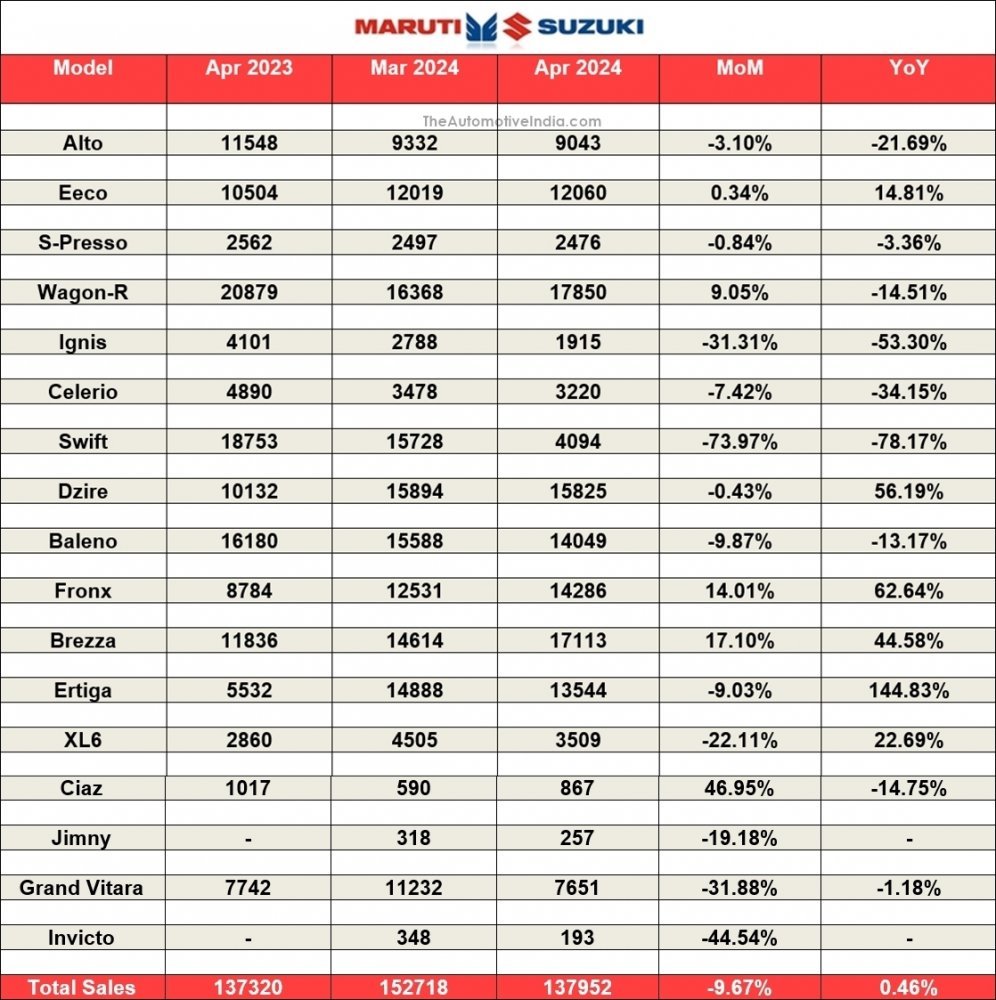

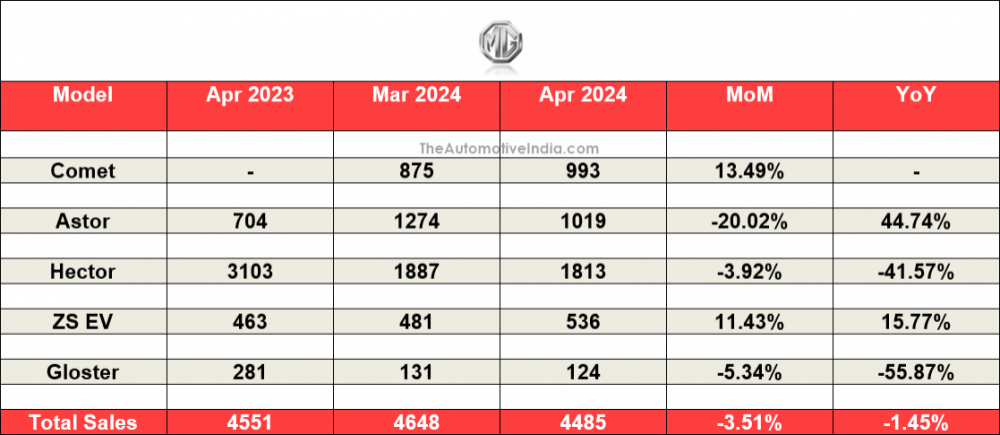

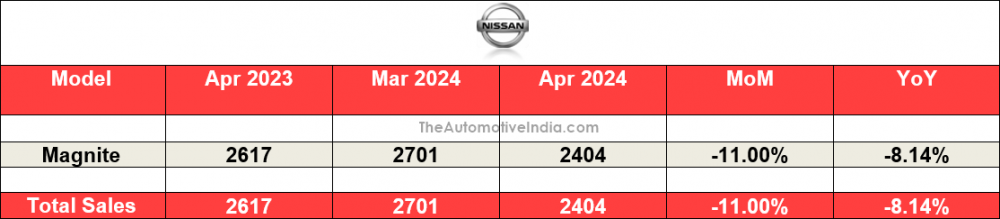

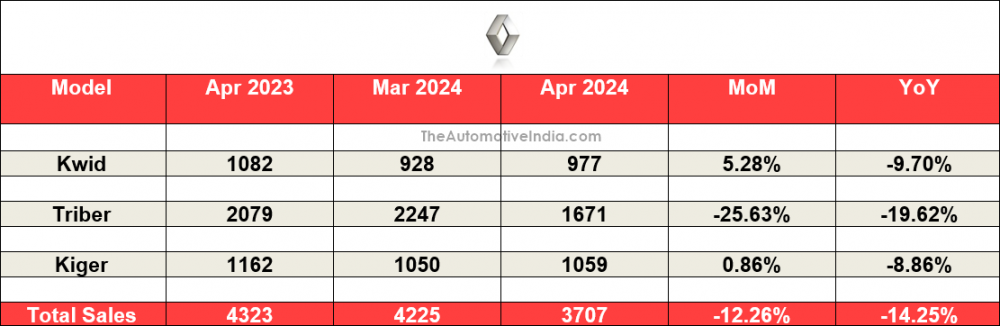

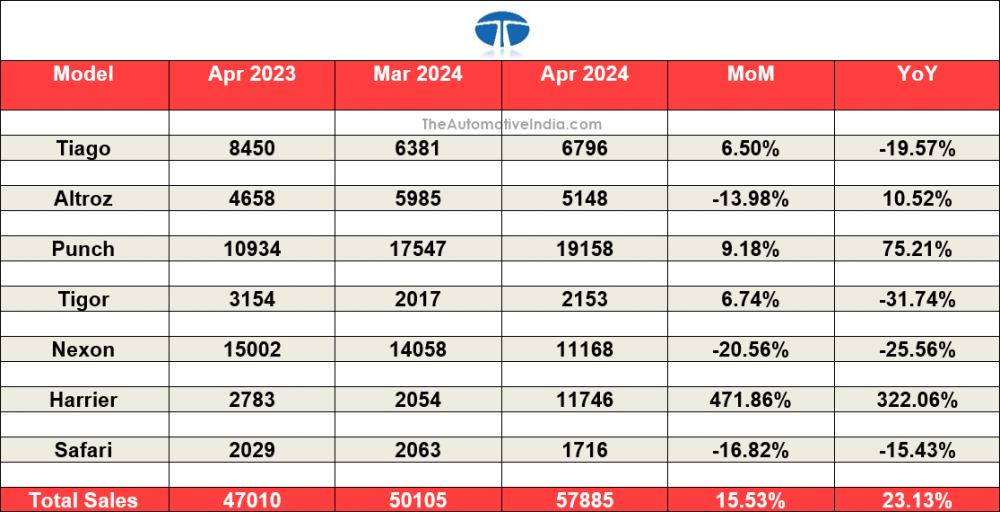

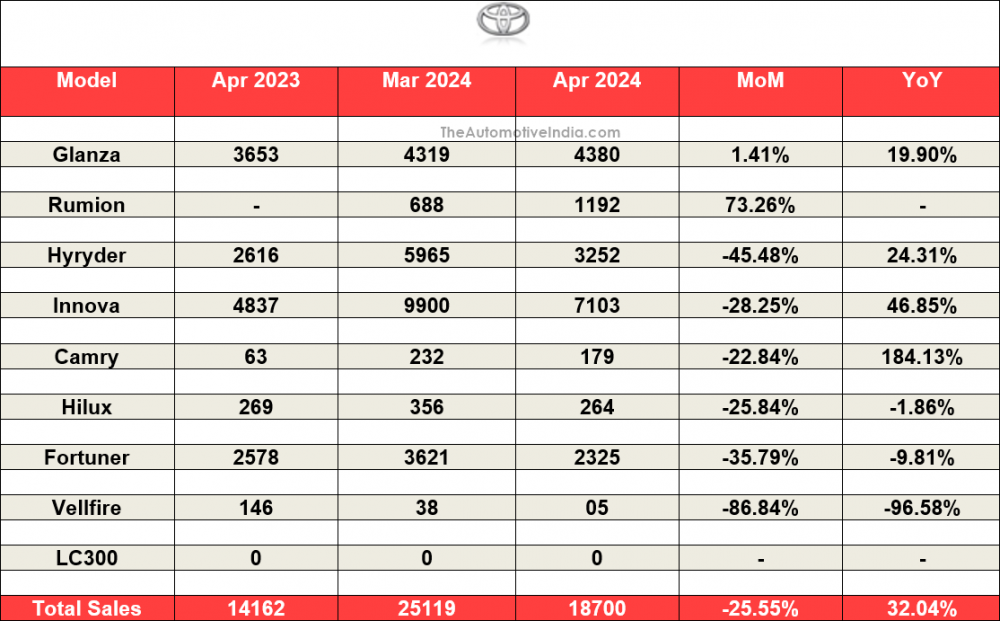

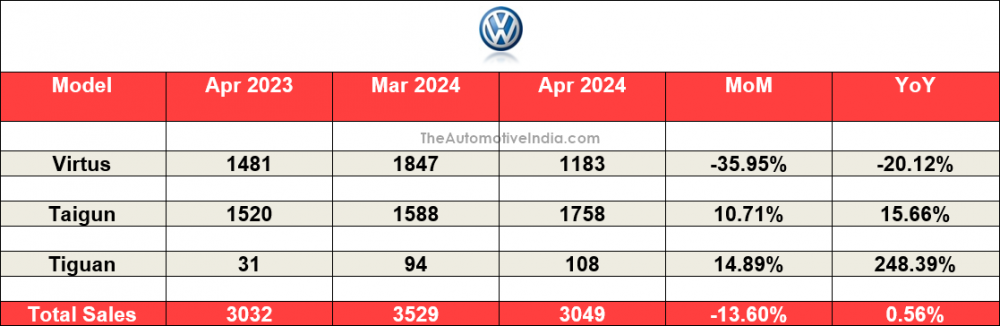

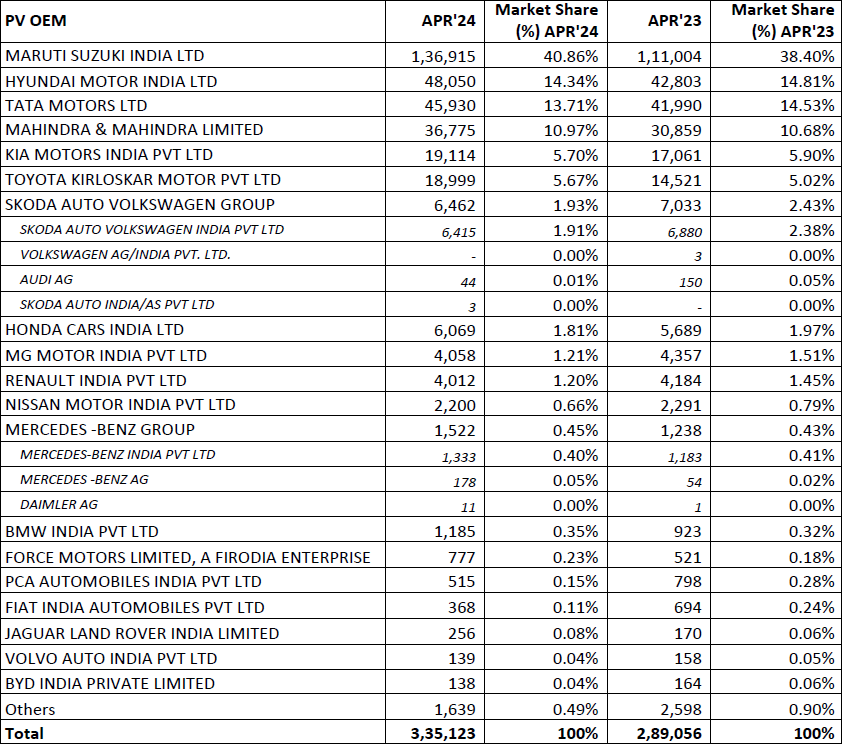

The 2W segment saw notable growth due to improved supply and the increasing demand for 125cc models. Positive market sentiments, bolstered by stable fuel prices, a favourable monsoon outlook, festive demand and the marriage season, contributed to this rise. New model launches also helped drive growth, despite some delays in supply. The PV category experienced double-digit YoY growth, supported by enhanced model availability and favourable market sentiments, particularly around festive events like Navratri and Gudi Padwa. Despite strong bookings and customer flow, high competition, excess supply and discounting presented challenges for sustained growth.

Additionally, the lack of new models in some portfolios impacted market traction. The CV segment showed modest 2% YoY growth and a 0.6% MoM decline, indicating varied market conditions. Positive momentum was found in bulk and corporate deals and school bus demand, though elections dampened sentiment, with customers delaying expansion plans. Limited finance options and regional challenges such as water scarcity further impacted performance.”

Near-Term Outlook

The outlook for May 2024 is shaped by several positive indicators. Improved vehicle supply and strategic planning in the 2W segment have led to rising customer bookings and better market sentiment, driven by favourable crop yields. In the PV segment, new model launches and favourable monsoon forecasts are set to stimulate customer interest, while bulk deals in the CV segment should bolster demand in sectors like iron ore, steel, and cement. The appeal of new electric models and sustained demand for conventional vehicles are likely to provide further momentum.

Despite these positive trends, challenges remain. Election uncertainty continues to affect market sentiment, delaying customer conversions and stalling purchasing decisions. Financial constraints, extreme temperatures, and overcapacity in the CV segment could slow growth, while heavy discounting in the PV segment could impact profitability. Seasonal factors such as no marriage dates and a lack of major festive events may also influence demand. The auto industry remains cautiously optimistic about its near-term outlook. Market opportunities exist with rising customer interest in new models. However, election-related uncertainty and financial constraints remain key challenges that the industry will need to monitor closely to navigate this evolving landscape effectively.

Key Findings from our Online Members Survey

§ Liquidity

o Neutral 46.46%

o Good 35.84%

o Bad 17.70%

§ Sentiment

o Neutral 45.58%

o Good 34.07%

o Bad 20.35%

§ Expectation from May’24

o Growth 50.00%

o Flat 33.63%

o De-growth 16.37%