Thread Starter

#1

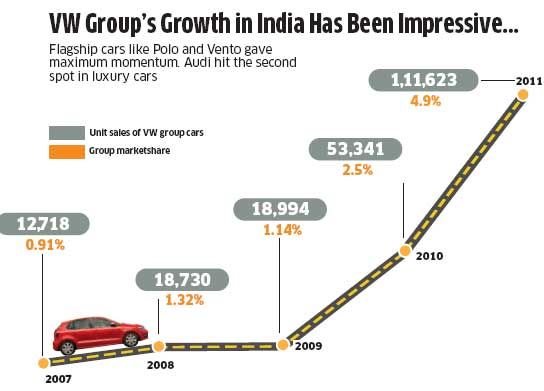

Volkswagen may still struggle to compete with fierce price-warriors like Hyundai & Maruti Suzuki he rear-view mirror frames a blur. For Volkswagen India has floored the accelerator. In just four years its brand recognition has zoomed from 8% to 54%, sales have soared from 13,000-odd to 1.1 lakh cars and the market share needle has inched up from 0.91% to 4.9%.

Even when the roads were treacherous - in 2011-12 the automobile industry grew by 5% - Volkswagen was burning rubber: its unit sales grew at over 50%. And last month, its luxury brand, Audi, unseated Mercedes to become the second-largest luxury car seller in India.

Nobody's on Volkswagen's tail. Once fellow road warriors, Ford and GM have been left behind. But the road ahead is not empty. Maruti and Hyundai are speeding away, and suddenly it seems the superfast VW is still playing catch up. Or worse, even slowing down.

Month-on-month sales of its flagship brands (with few exceptions like Audi) seem to have lost their sizzle (see graph next page). But Maruti and Hyundai are kicking up a storm. Monthly sales of Maruti Swift have grown from 12,114 cars in March 2011 to 20,521 cars in March 2012.

Sales of Polo have hovered around 4,000 in those months. Similarly, its sedan sold around 4,000 in March 2011 and March 2012. But Hyundai's Verna is flying off the shelves - from 489 in March 2011 to 4,132 in March 2012.

A bad patch on the road, some would say. A proud John Chacko, chief representative, Volkswagen Group India, prefers to look at the bigger picture: "We changed the game." That's because in four years Volkswagen has become the sixth-biggest car company in India beating much older Ford and GM who have been here since the 1990s.

But that's not a place VW is content with. It is perhaps the most audacious, aggressive and ambitions car company in the world today.

With VW, Audi and Skoda and many other brands under its umbrella, it is many companies rolled in one. Selling 8 million cars in 2011 on a E159.3 billion revenue makes VW the second-largest car company (after GM) and more importantly, among the most profitable car companies in the world. By 2018, it hopes to snatch away the No. 1 title from GM. By 2015, it hopes to beat BMW to become No. 1 in luxury cars.

In this grand plan, India is the next battlefield. Already the No. 1 car company in China, VW wants 10% market share in India by 2018. This is why it can't afford to stumble now. This is why the weakening buzz about its cars maybe bigger trouble than just a rough patch.

So far, the group's sharp rise in India has been on the back of VW's global strength - big investments, great products and smart brand building for big-bang launches. That stage of market entry is over. Now VW must prove that it is agile and sensitive about handling Indian roads and its fussy Indian customers. Here, its report card is not encouraging.

"VW has done a tremendous job of launching the brand in India. Now the battle has to be won inside showrooms - with customers," says VG Ramakrishnan, vice-president (automotive & transportation) at consulting firm Frost & Sullivan. The critical last mile - of dealers, sales, customers and service - is a problem area. "This is the most difficult market we know of," says Chacko.

To understand what's going on, let's go straight to the battlefield - the showroom - where the brands are slugging it out.

Last Mile Problem

Something is refreshingly different about the VW's dealership in Noida. On a sunny April Sunday, parking is surprisingly easy with many vacant slots. There is an unusual orderliness inside the spacious, relatively plush showroom - a welcoming reception, comfortable lounge sofas, both planning and investments show.

Starting with the Beetle at the entrance, cars are well laid out for you to see and sit inside. The only exception is perhaps the three-four odd car buyers who have come in with children and add some chatter and disarray to the setting.

Barely half a kilometre away, the Hyundai showroom is a different world. Parking outside is chaotic with cars choc-a-bloc, many spilling over to the road. Inside, the showroom is big - but feels small. It looks chaotic and messy - display cars are cramped in, reception is tucked in a corner, tables and chairs are packed in to optimally utilise the space. But all this really does not matter.

The business looks good. Sales agents are busy. And the place is buzzing with customers. The two showrooms reflect the reality well. In 2011, VW sold 75,000-odd Polos and Ventos - its flagship cars in India. In contrast, Hyundai sold 1,20,000-odd i20s and Vernas - the comparable models that compete with the two VW cars.

Partly this has got to do with VW's lower dealer penetration (103 dealers) compared with Hyundai's (544 dealers). But there are other issues VW is grappling with - starting with price. VW cars carry a price premium. Take i20 and Polo. Their top end model (1200 cc, petrol, on-road Delhi price) costs Rs 6.89 lakh and Rs 7.2 lakh, respectively.

Article source: Economic Times

Even when the roads were treacherous - in 2011-12 the automobile industry grew by 5% - Volkswagen was burning rubber: its unit sales grew at over 50%. And last month, its luxury brand, Audi, unseated Mercedes to become the second-largest luxury car seller in India.

Nobody's on Volkswagen's tail. Once fellow road warriors, Ford and GM have been left behind. But the road ahead is not empty. Maruti and Hyundai are speeding away, and suddenly it seems the superfast VW is still playing catch up. Or worse, even slowing down.

Month-on-month sales of its flagship brands (with few exceptions like Audi) seem to have lost their sizzle (see graph next page). But Maruti and Hyundai are kicking up a storm. Monthly sales of Maruti Swift have grown from 12,114 cars in March 2011 to 20,521 cars in March 2012.

Sales of Polo have hovered around 4,000 in those months. Similarly, its sedan sold around 4,000 in March 2011 and March 2012. But Hyundai's Verna is flying off the shelves - from 489 in March 2011 to 4,132 in March 2012.

A bad patch on the road, some would say. A proud John Chacko, chief representative, Volkswagen Group India, prefers to look at the bigger picture: "We changed the game." That's because in four years Volkswagen has become the sixth-biggest car company in India beating much older Ford and GM who have been here since the 1990s.

But that's not a place VW is content with. It is perhaps the most audacious, aggressive and ambitions car company in the world today.

With VW, Audi and Skoda and many other brands under its umbrella, it is many companies rolled in one. Selling 8 million cars in 2011 on a E159.3 billion revenue makes VW the second-largest car company (after GM) and more importantly, among the most profitable car companies in the world. By 2018, it hopes to snatch away the No. 1 title from GM. By 2015, it hopes to beat BMW to become No. 1 in luxury cars.

In this grand plan, India is the next battlefield. Already the No. 1 car company in China, VW wants 10% market share in India by 2018. This is why it can't afford to stumble now. This is why the weakening buzz about its cars maybe bigger trouble than just a rough patch.

So far, the group's sharp rise in India has been on the back of VW's global strength - big investments, great products and smart brand building for big-bang launches. That stage of market entry is over. Now VW must prove that it is agile and sensitive about handling Indian roads and its fussy Indian customers. Here, its report card is not encouraging.

"VW has done a tremendous job of launching the brand in India. Now the battle has to be won inside showrooms - with customers," says VG Ramakrishnan, vice-president (automotive & transportation) at consulting firm Frost & Sullivan. The critical last mile - of dealers, sales, customers and service - is a problem area. "This is the most difficult market we know of," says Chacko.

To understand what's going on, let's go straight to the battlefield - the showroom - where the brands are slugging it out.

Last Mile Problem

Something is refreshingly different about the VW's dealership in Noida. On a sunny April Sunday, parking is surprisingly easy with many vacant slots. There is an unusual orderliness inside the spacious, relatively plush showroom - a welcoming reception, comfortable lounge sofas, both planning and investments show.

Starting with the Beetle at the entrance, cars are well laid out for you to see and sit inside. The only exception is perhaps the three-four odd car buyers who have come in with children and add some chatter and disarray to the setting.

Barely half a kilometre away, the Hyundai showroom is a different world. Parking outside is chaotic with cars choc-a-bloc, many spilling over to the road. Inside, the showroom is big - but feels small. It looks chaotic and messy - display cars are cramped in, reception is tucked in a corner, tables and chairs are packed in to optimally utilise the space. But all this really does not matter.

The business looks good. Sales agents are busy. And the place is buzzing with customers. The two showrooms reflect the reality well. In 2011, VW sold 75,000-odd Polos and Ventos - its flagship cars in India. In contrast, Hyundai sold 1,20,000-odd i20s and Vernas - the comparable models that compete with the two VW cars.

Partly this has got to do with VW's lower dealer penetration (103 dealers) compared with Hyundai's (544 dealers). But there are other issues VW is grappling with - starting with price. VW cars carry a price premium. Take i20 and Polo. Their top end model (1200 cc, petrol, on-road Delhi price) costs Rs 6.89 lakh and Rs 7.2 lakh, respectively.

Article source: Economic Times

![Confused [confused] [confused]](https://www.theautomotiveindia.com/forums/images/smilies/Confused.gif)