Thread Starter

#1

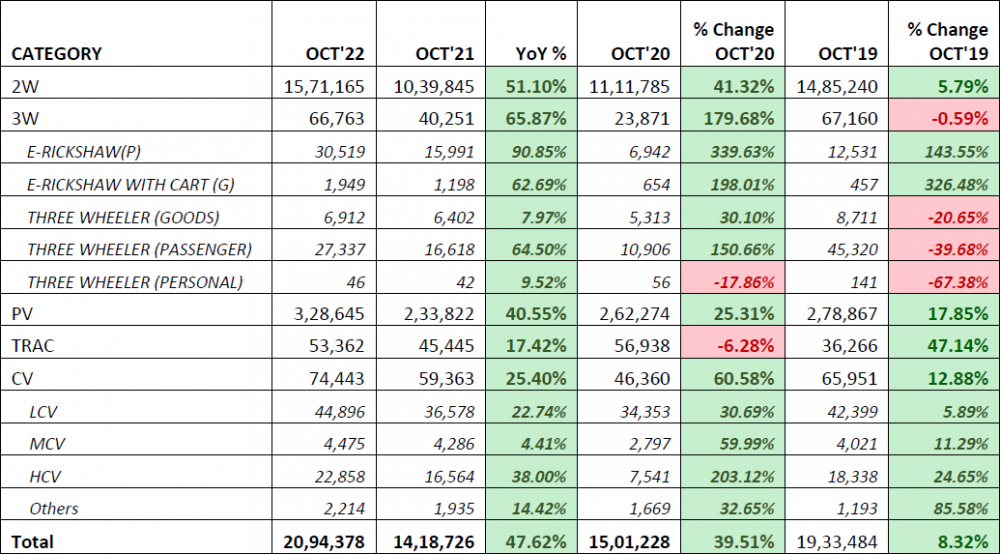

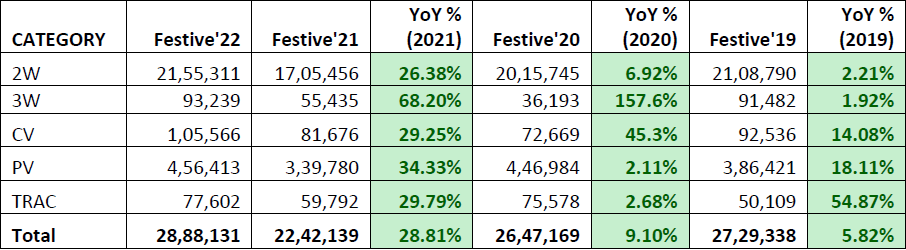

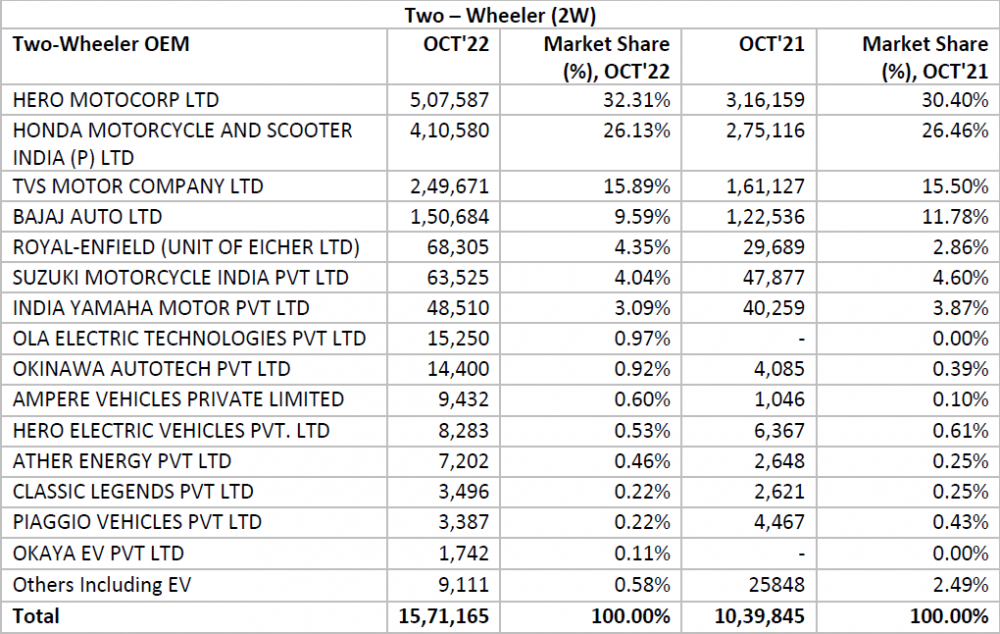

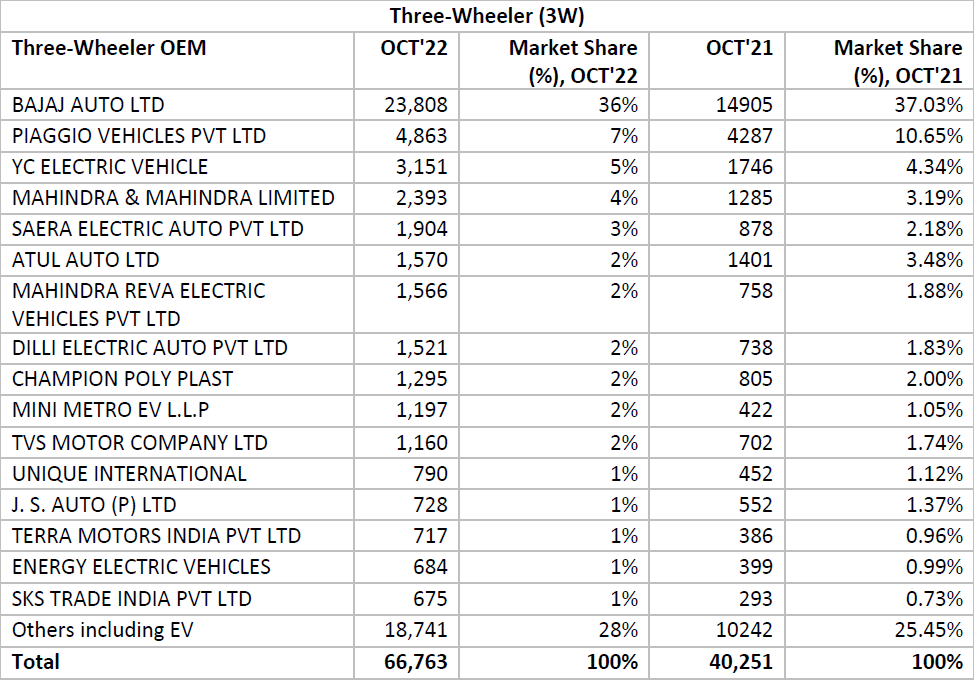

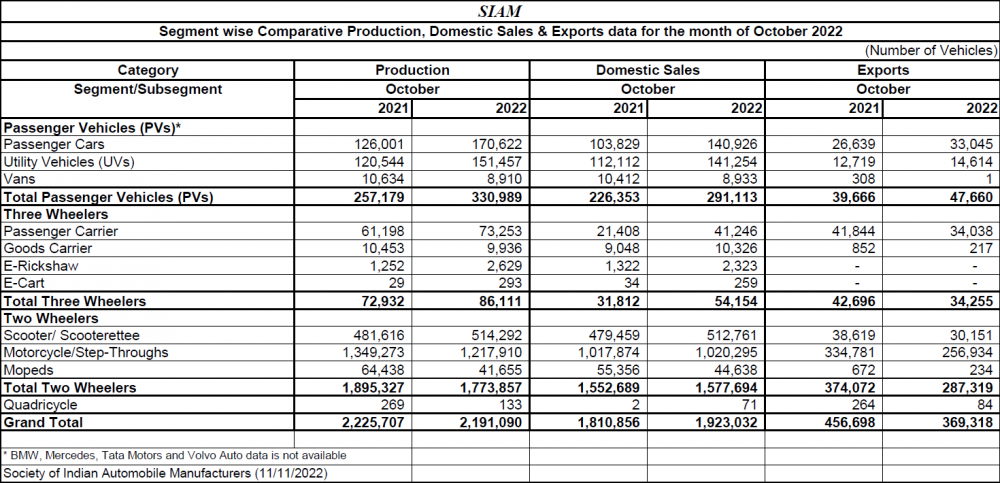

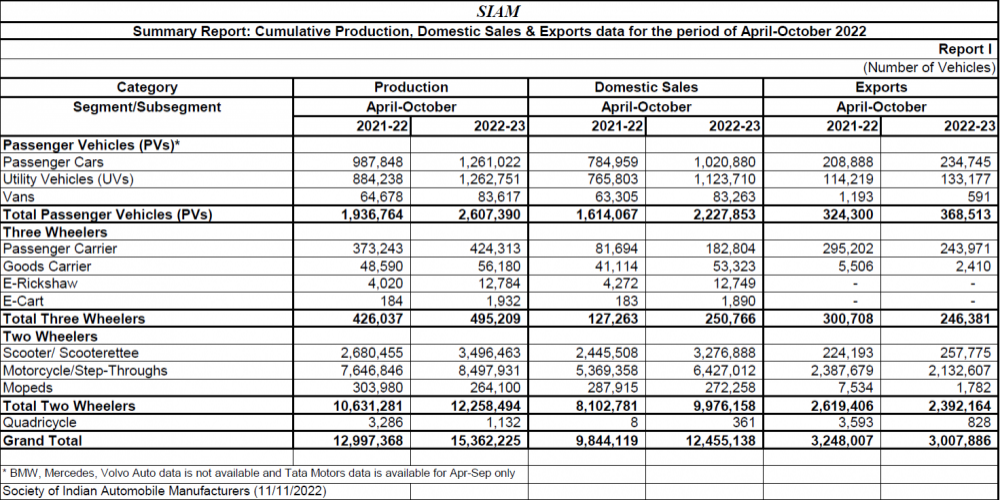

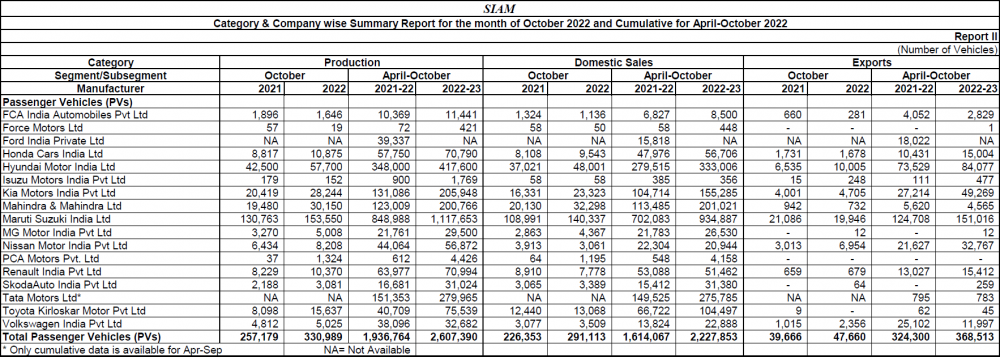

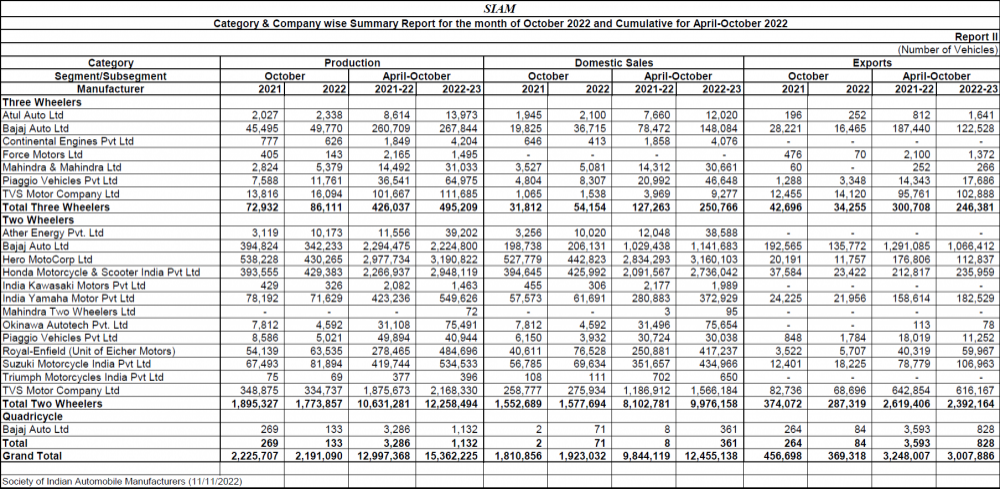

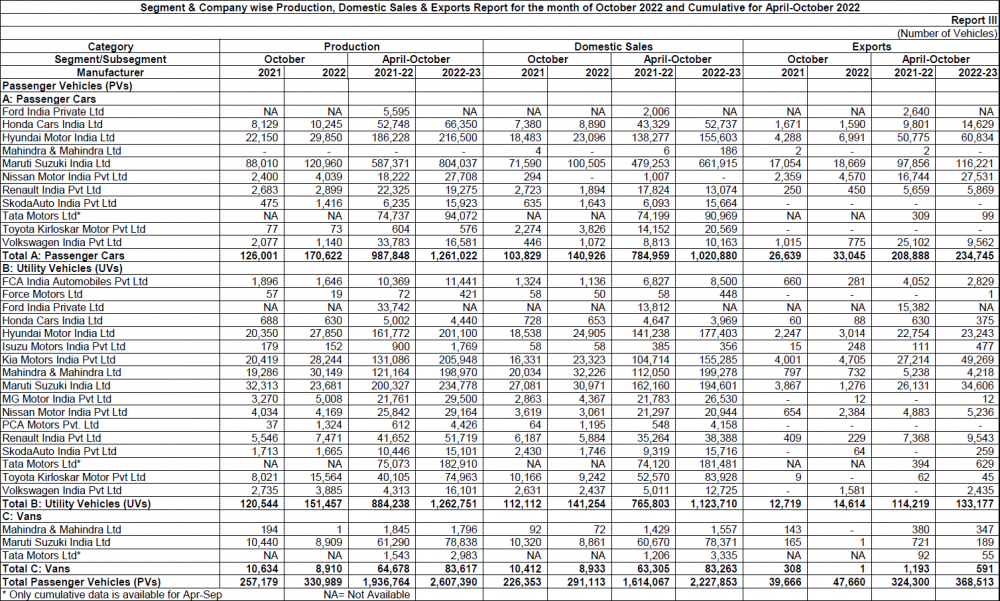

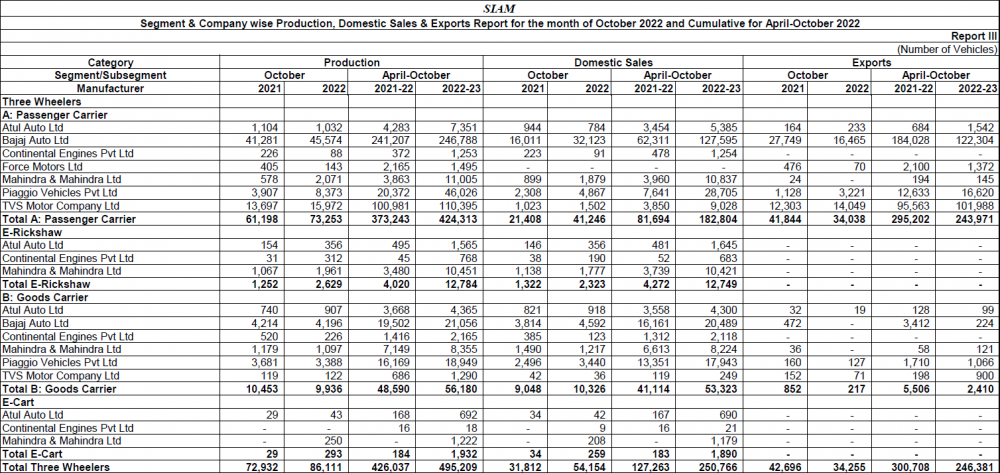

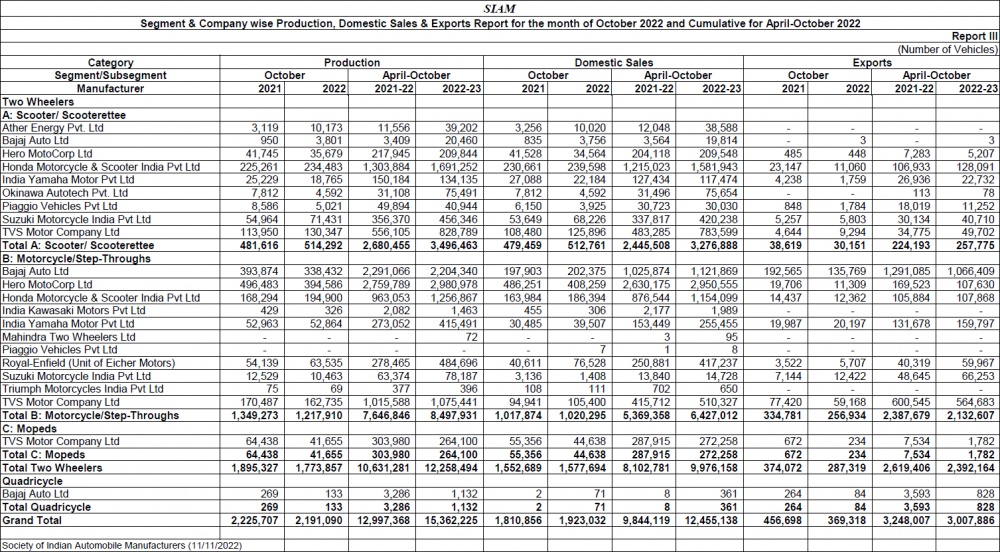

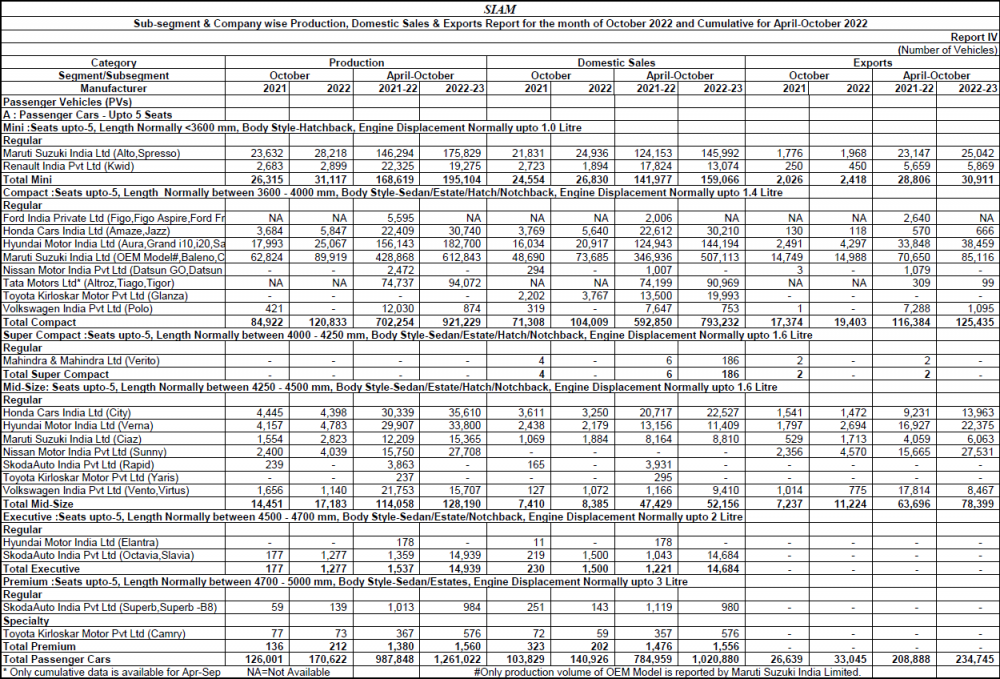

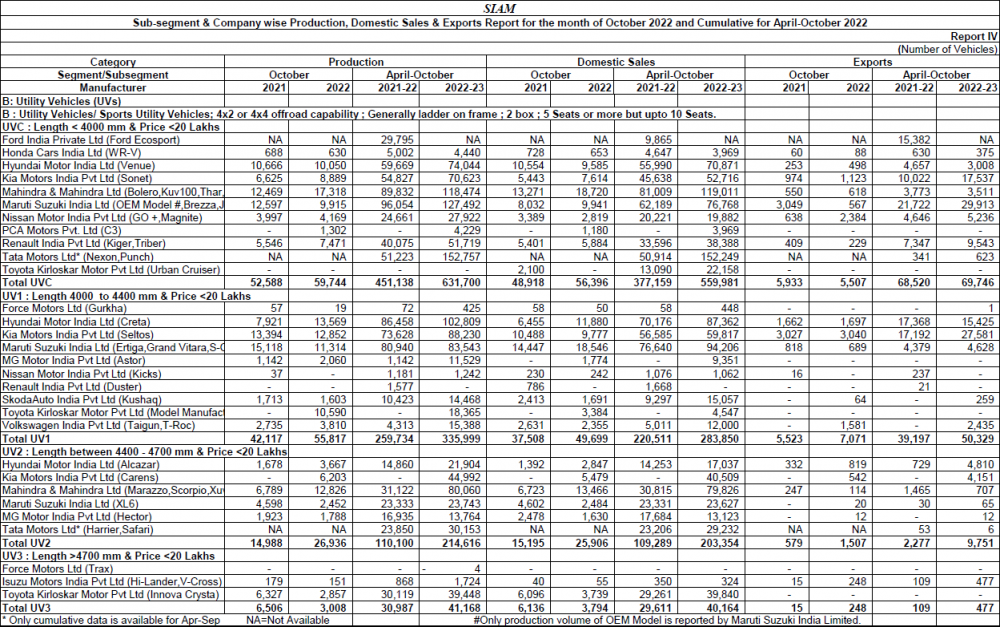

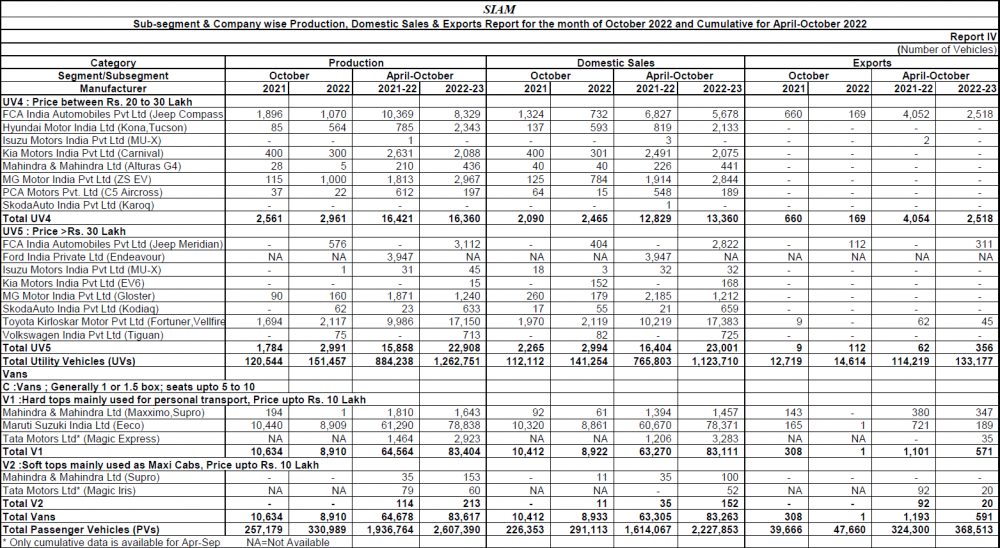

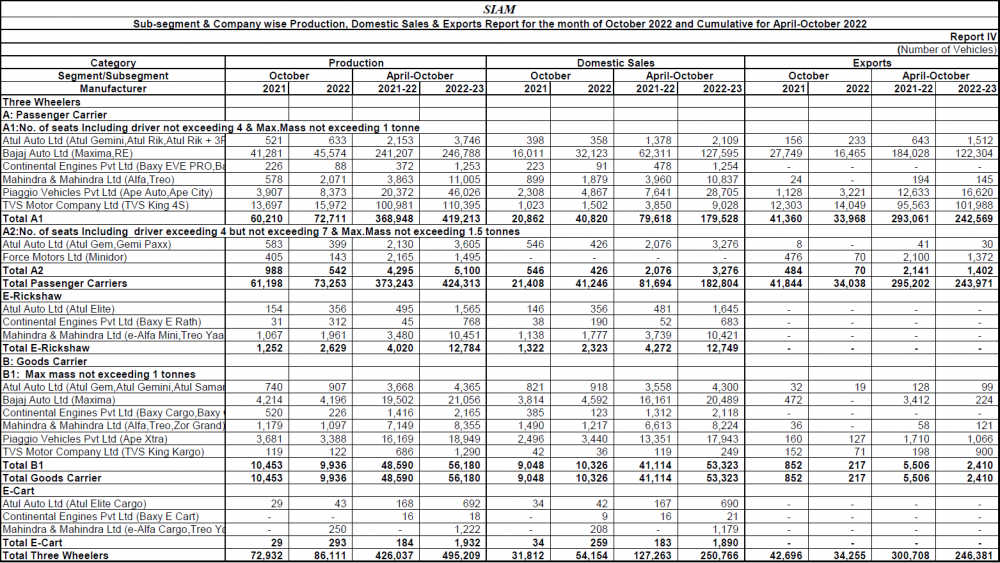

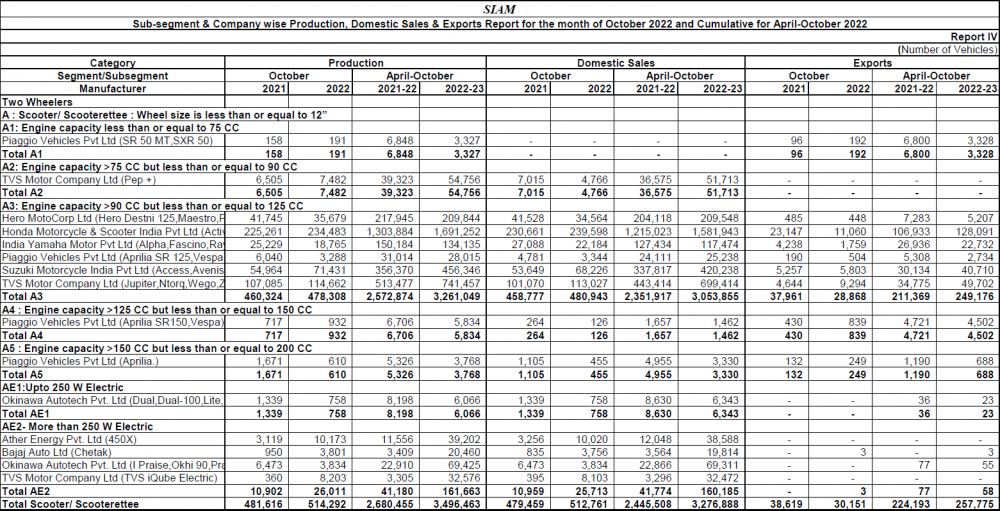

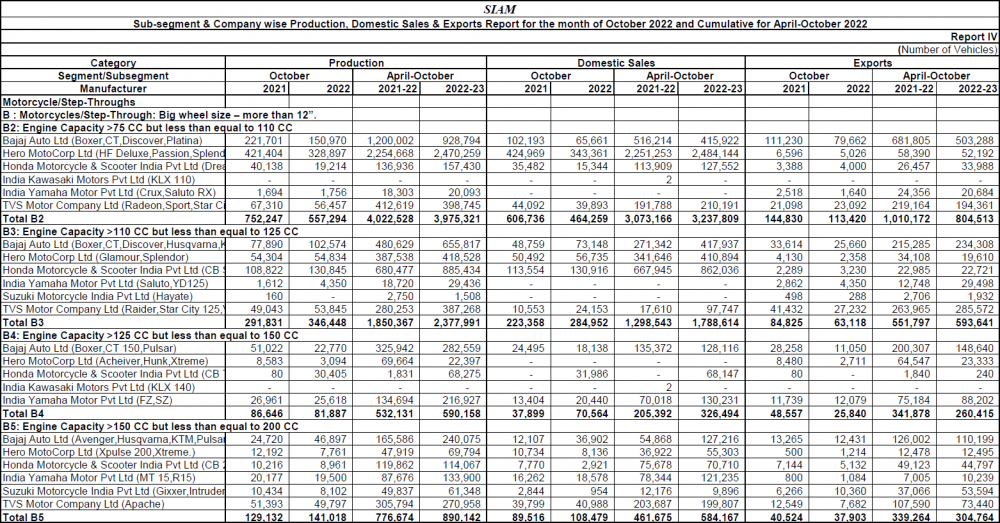

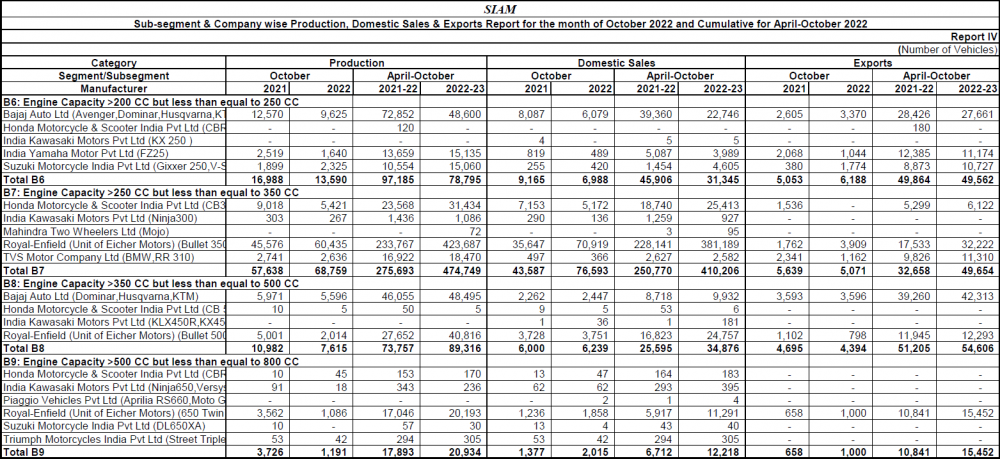

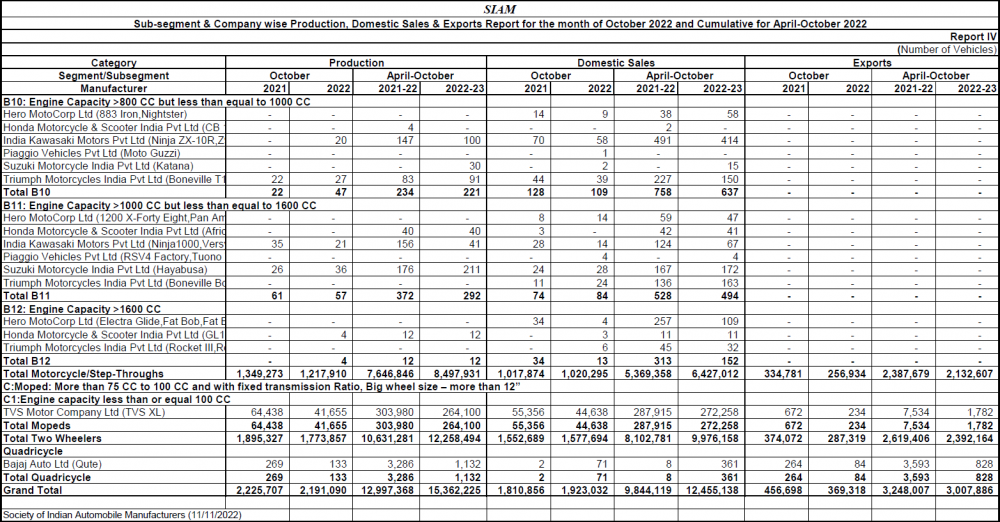

October 2022 Indian Car Sales

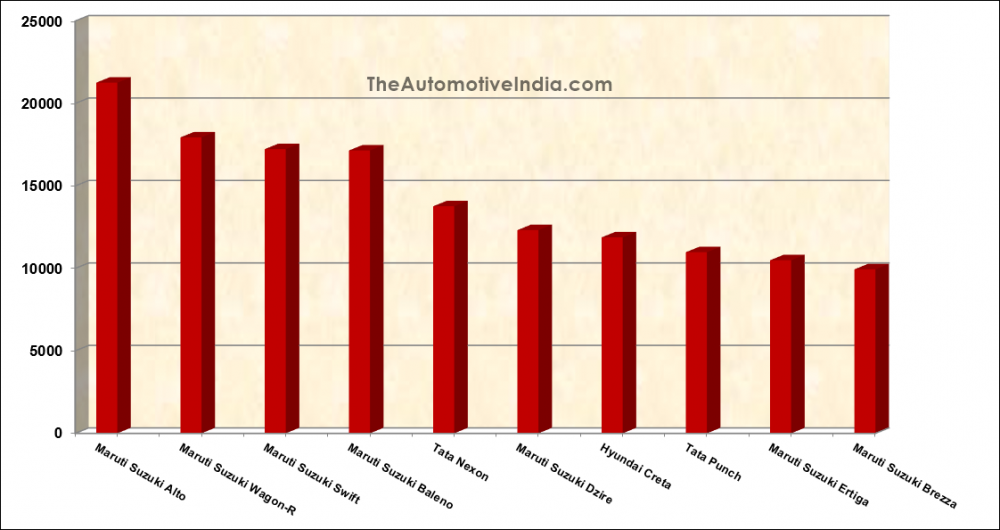

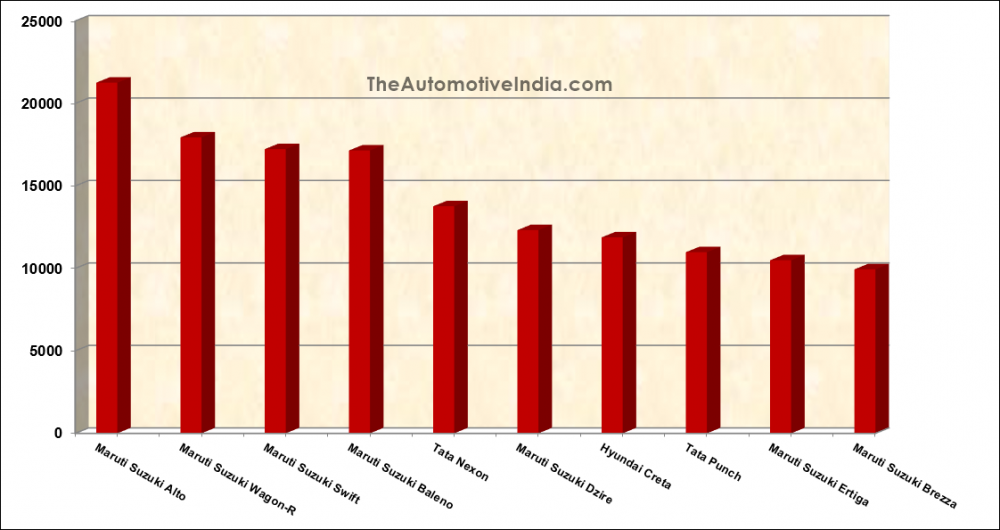

Top 10 Best Selling Cars: October 2022

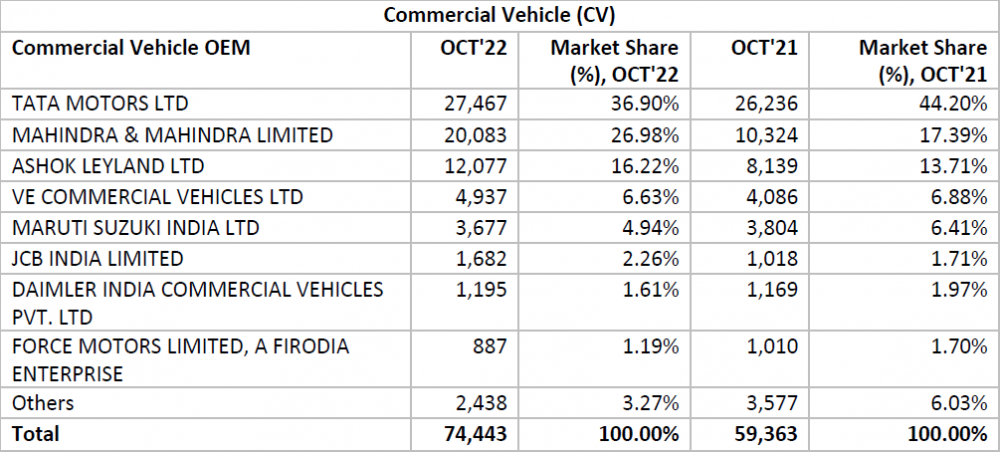

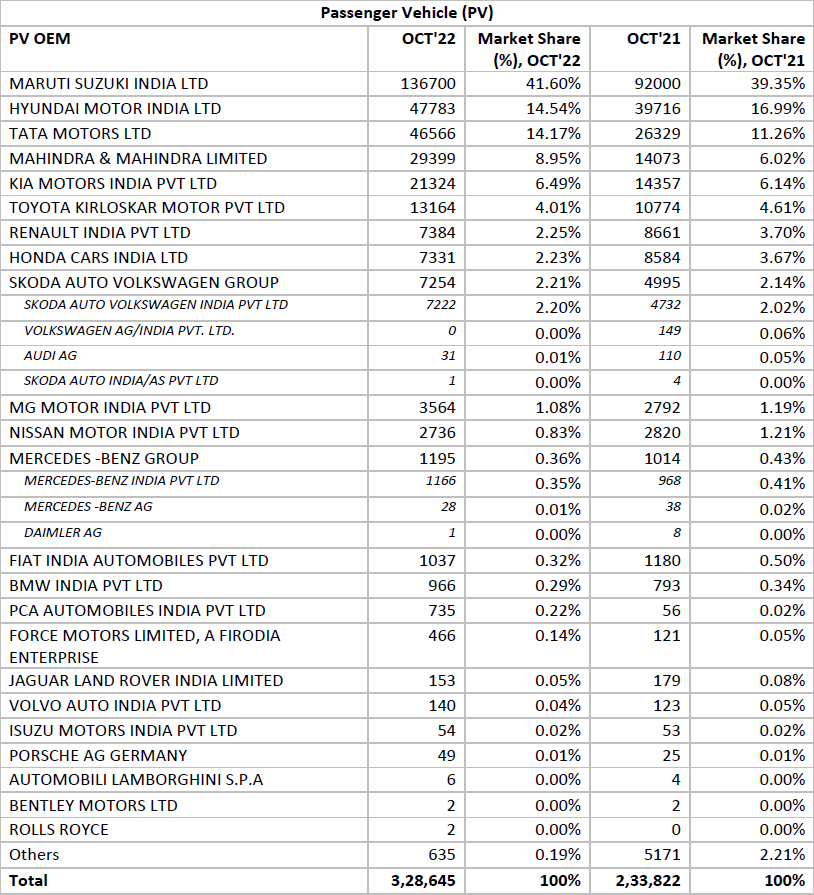

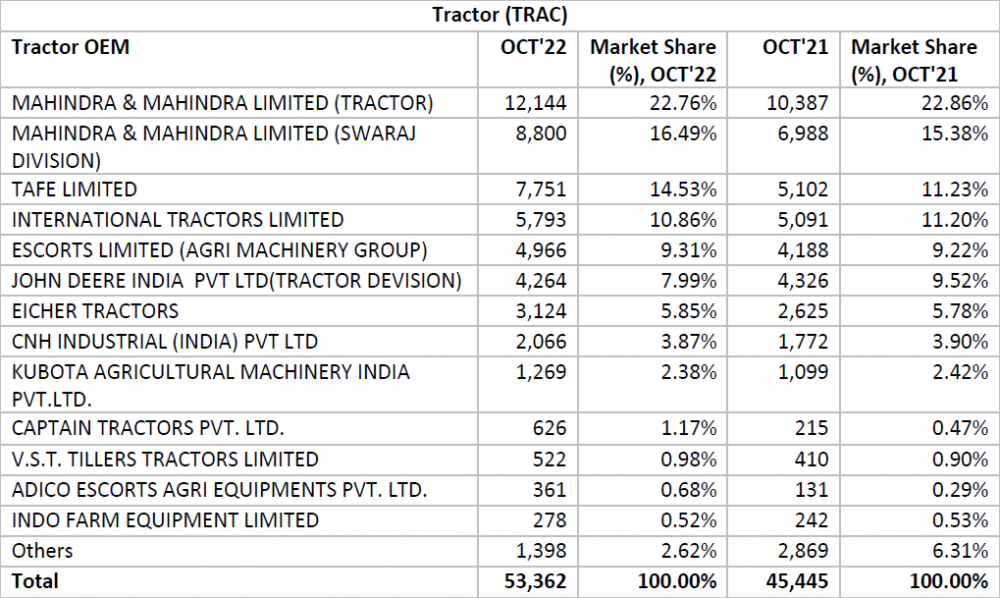

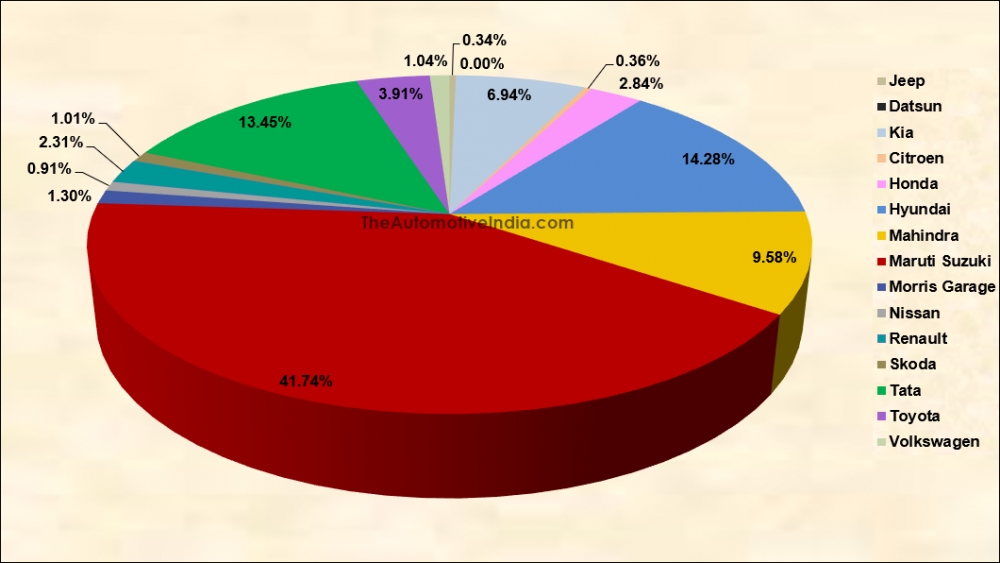

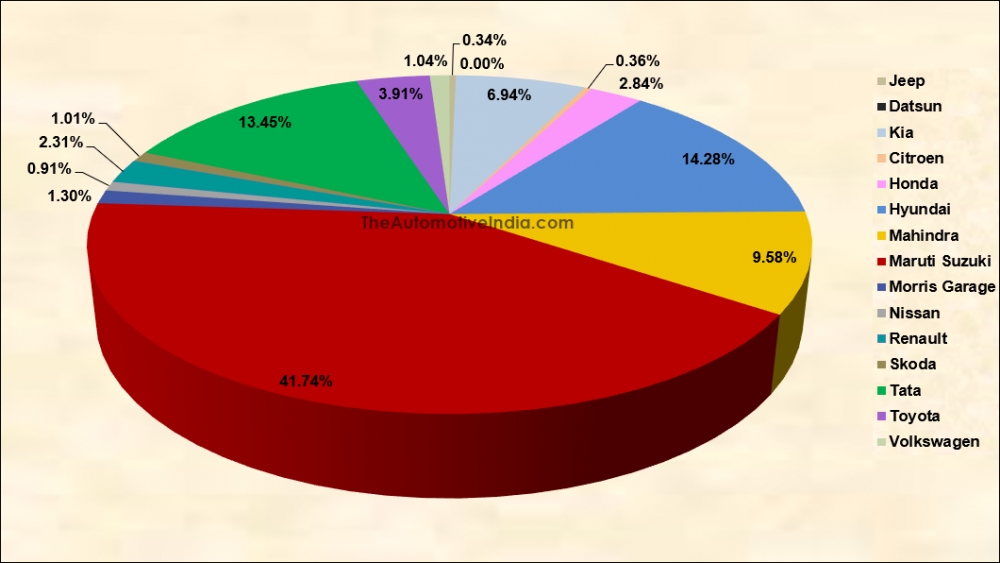

Manufacturer's Market Share: October 2022

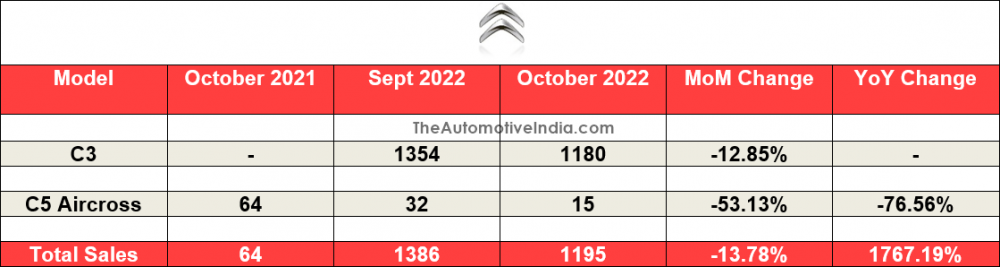

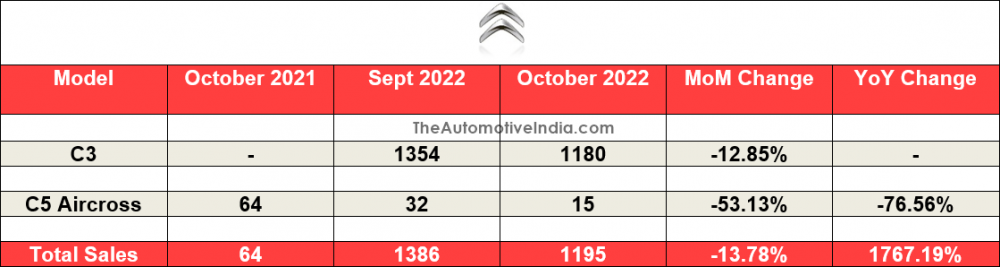

Citroën October 2022 Indian Car Sales

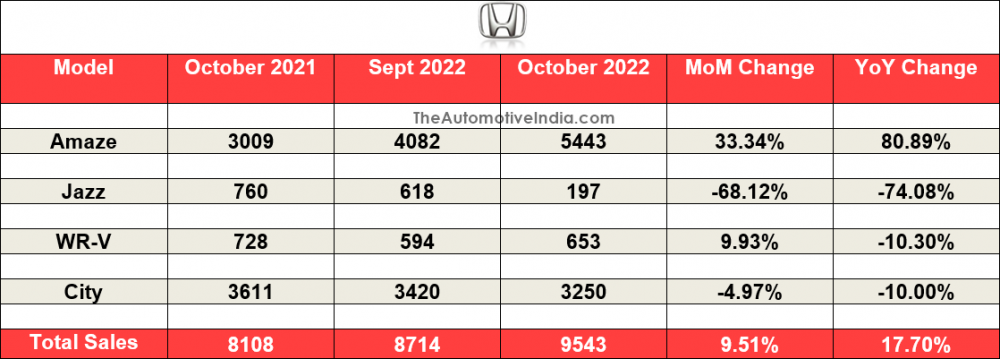

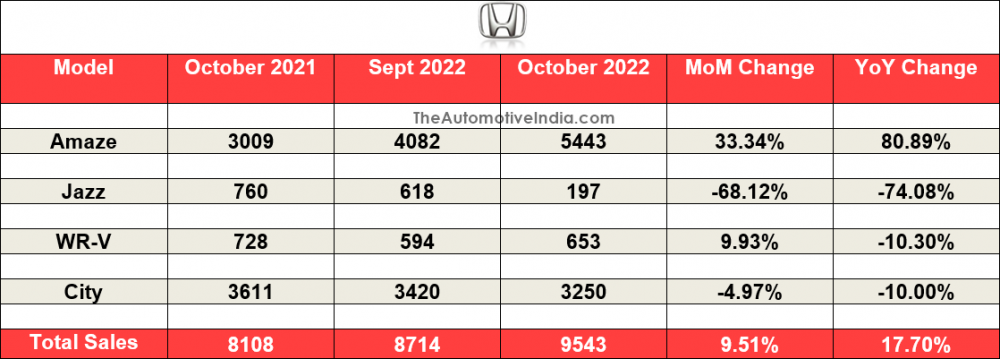

Honda October 2022 Indian Car Sales

Hyundai October 2022 Indian Car Sales

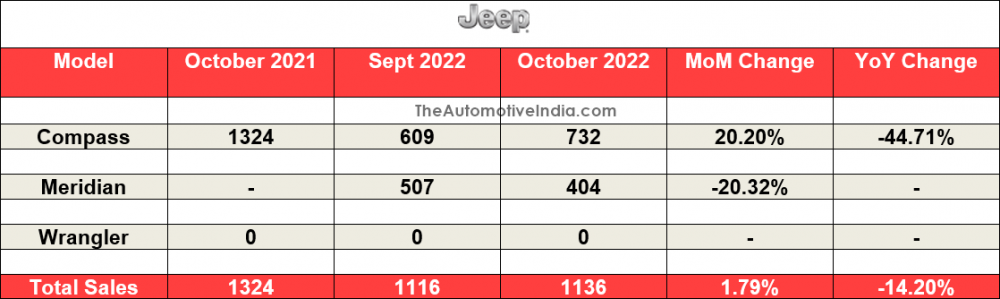

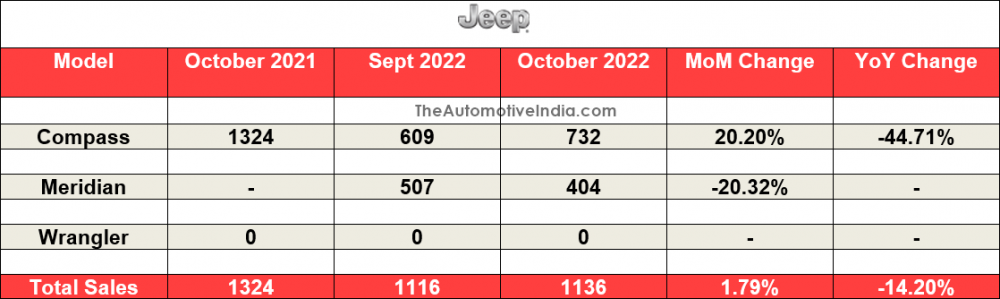

Jeep October 2022 Indian Car Sales

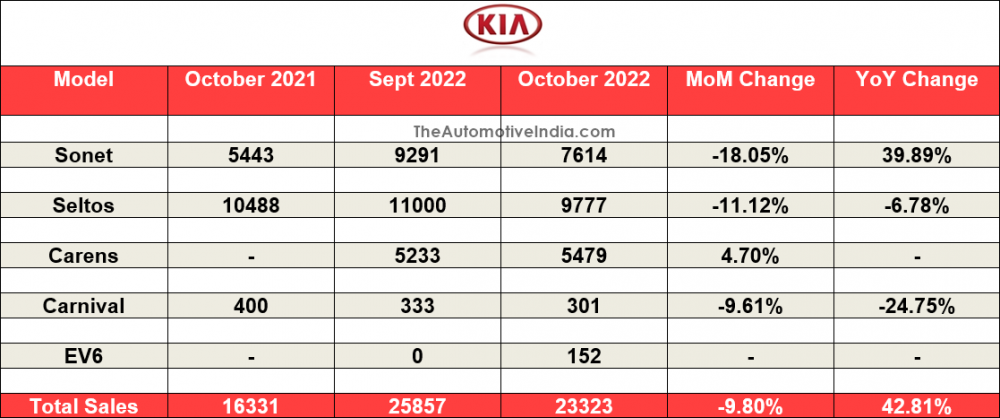

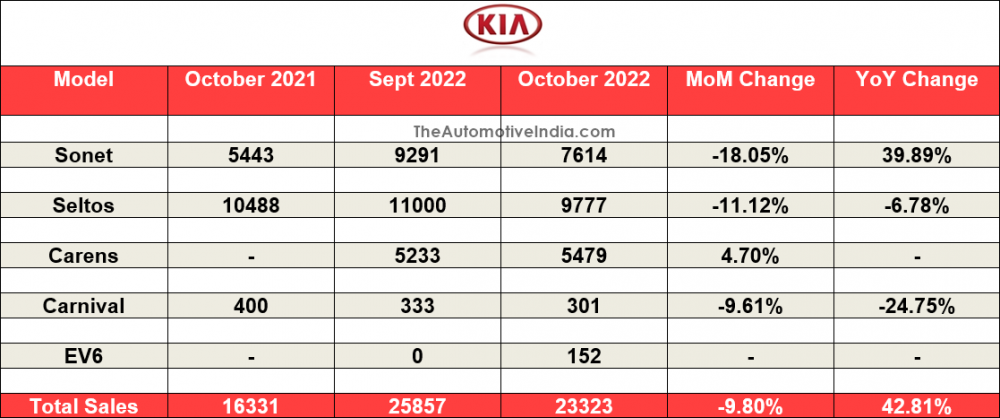

Kia October 2022 Indian Car Sales

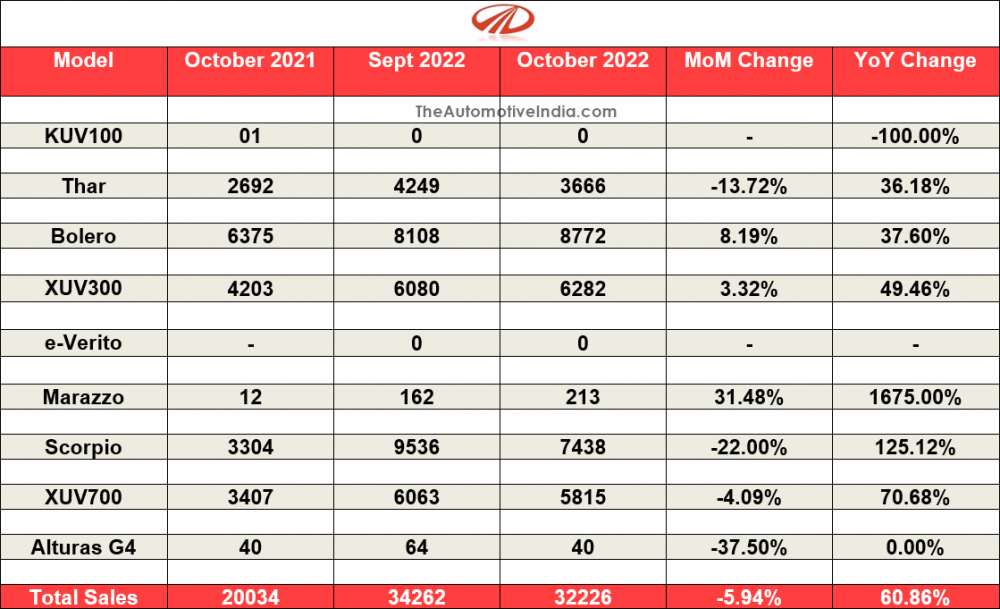

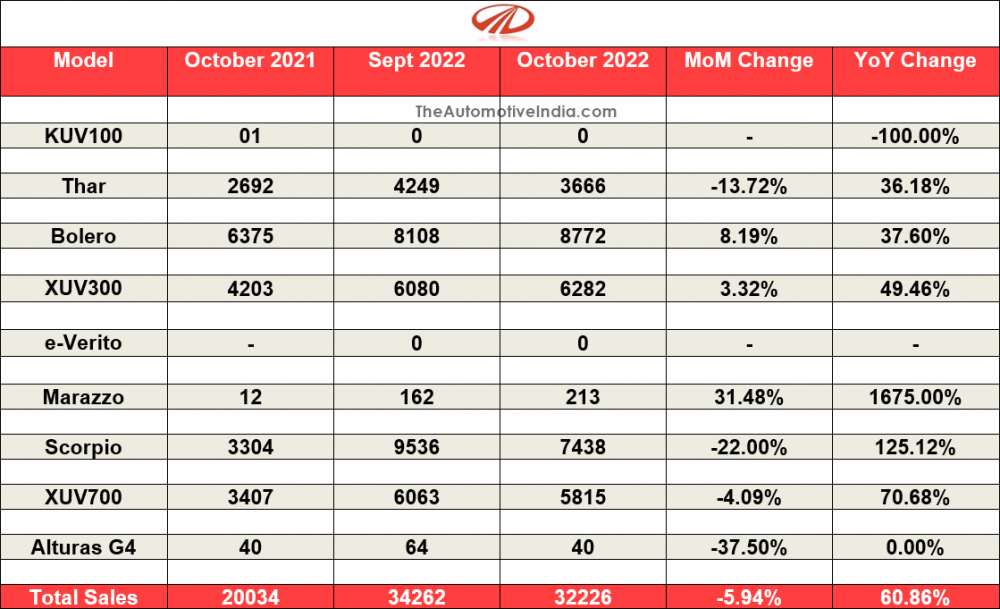

Mahindra October 2022 Indian Car Sales

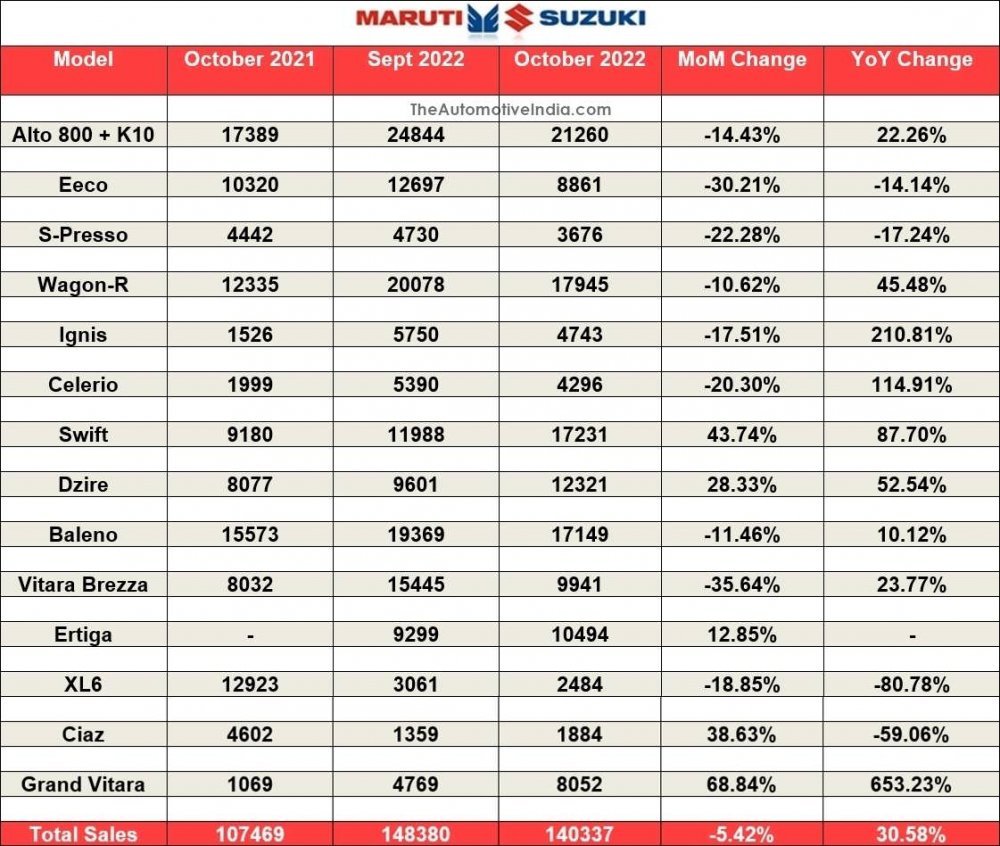

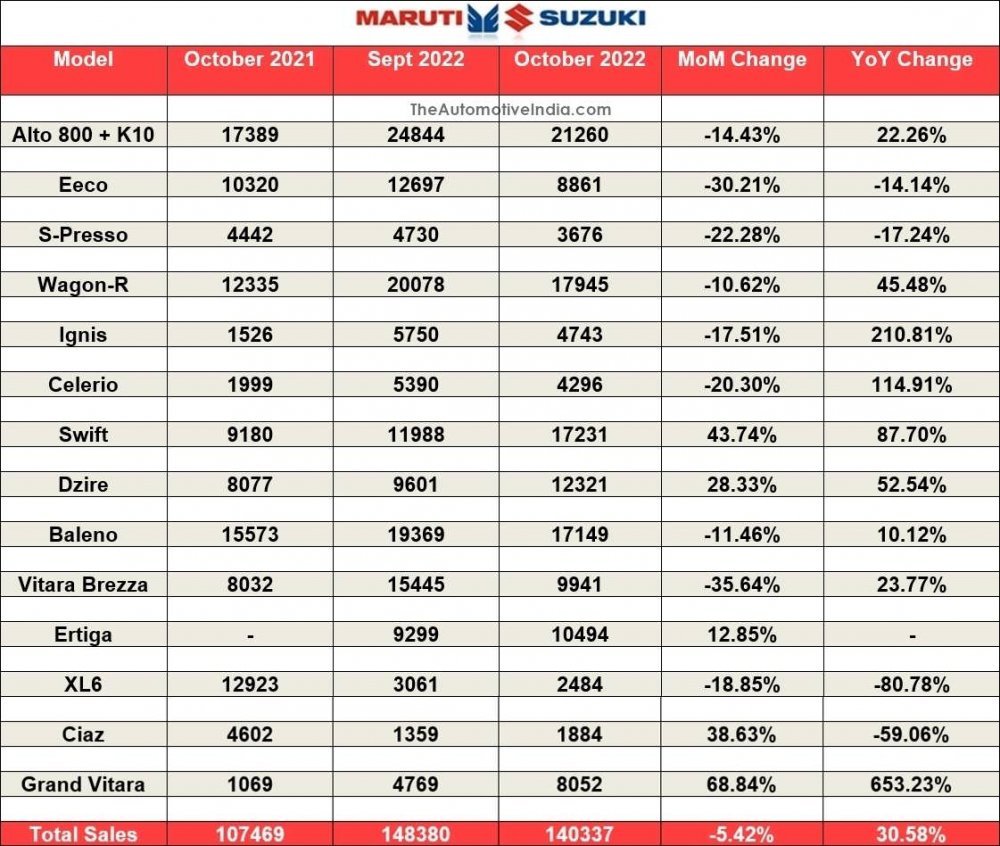

Maruti Suzuki October 2022 Indian Car Sales

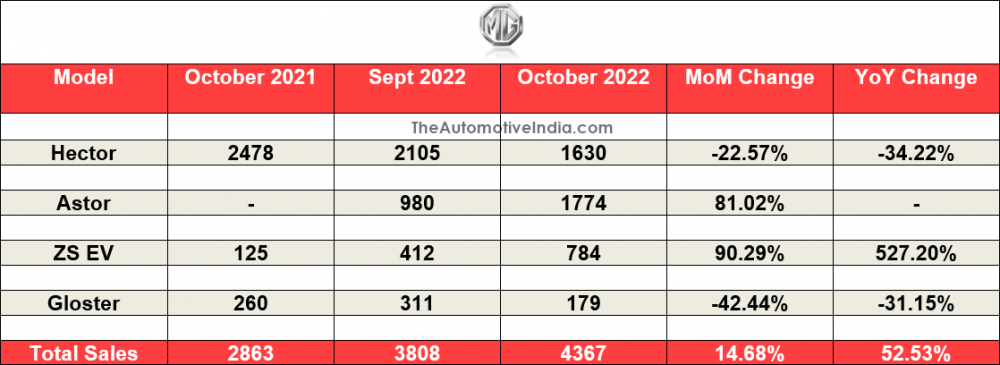

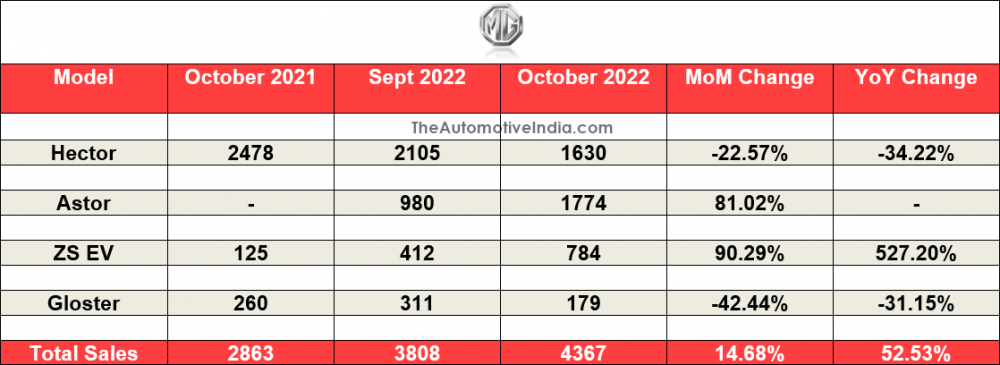

Morris Garages October 2022 Indian Car Sales

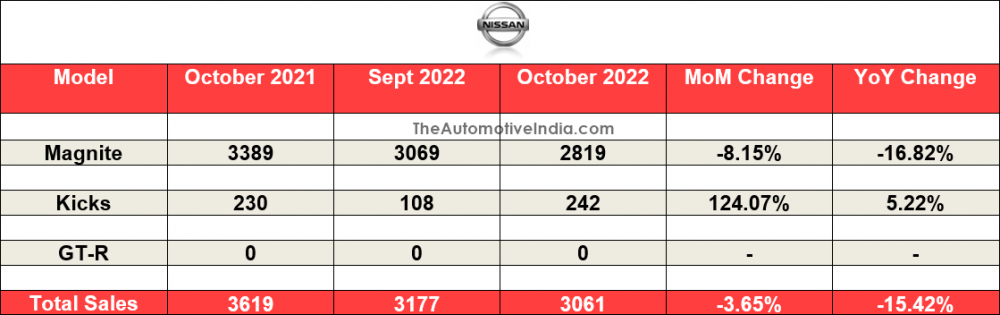

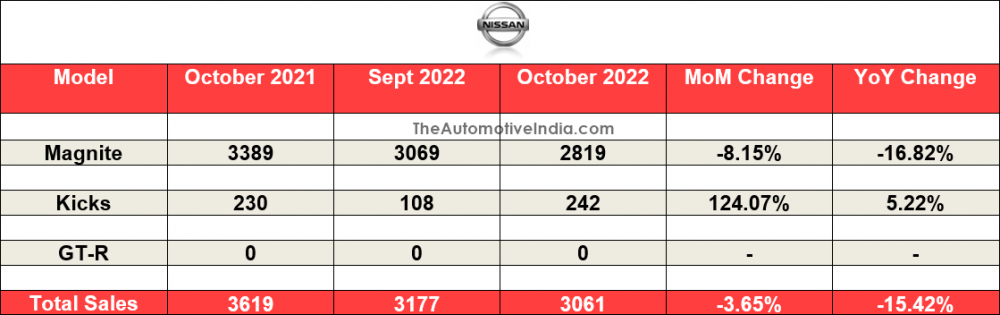

Nissan October 2022 Indian Car Sales

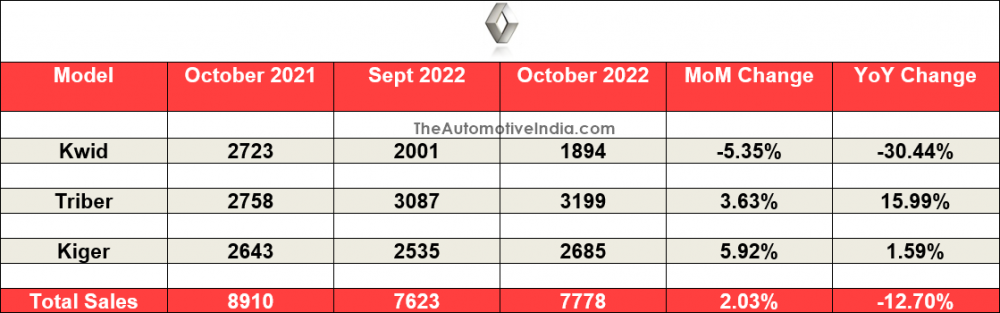

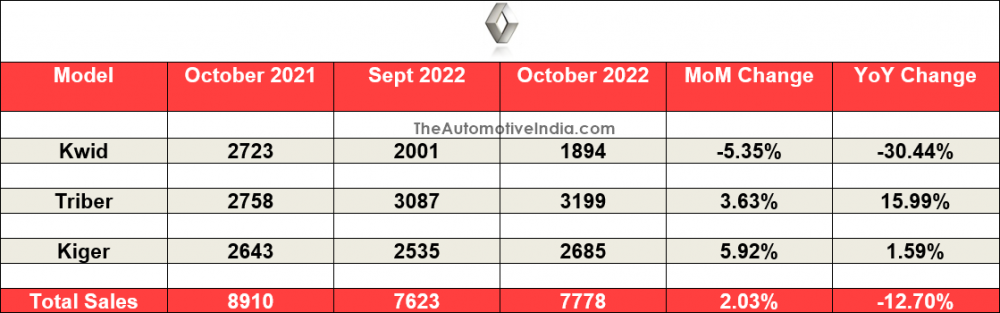

Renault October 2022 Indian Car Sales

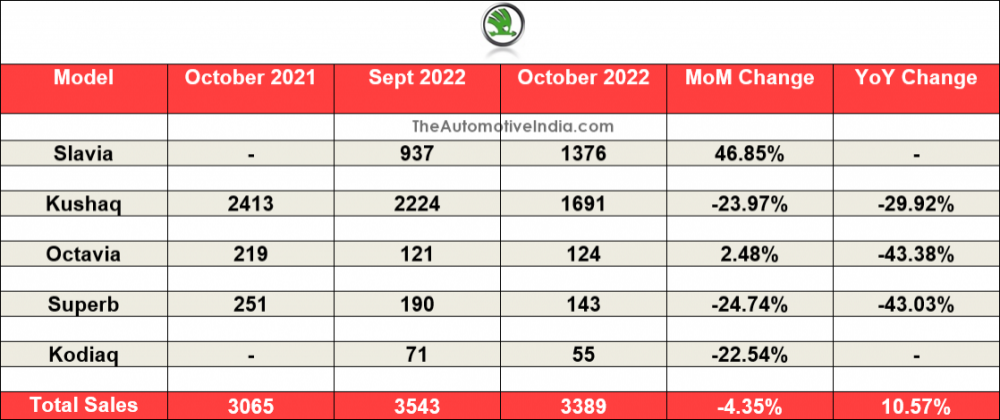

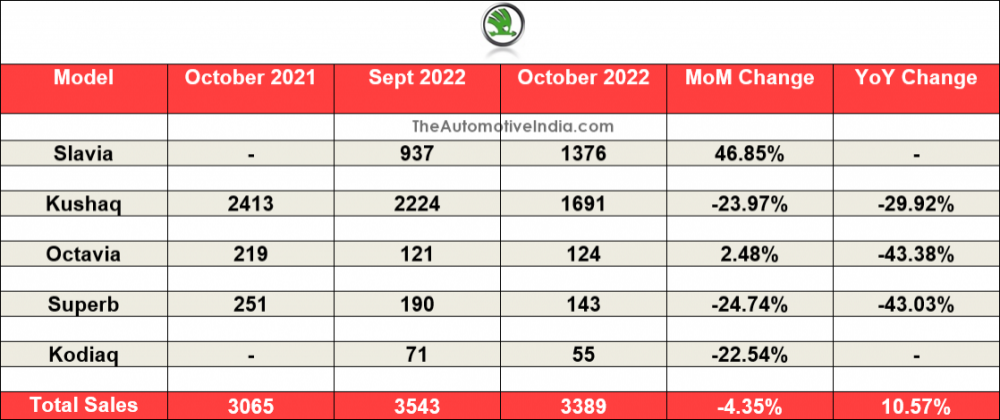

Skoda October 2022 Indian Car Sales

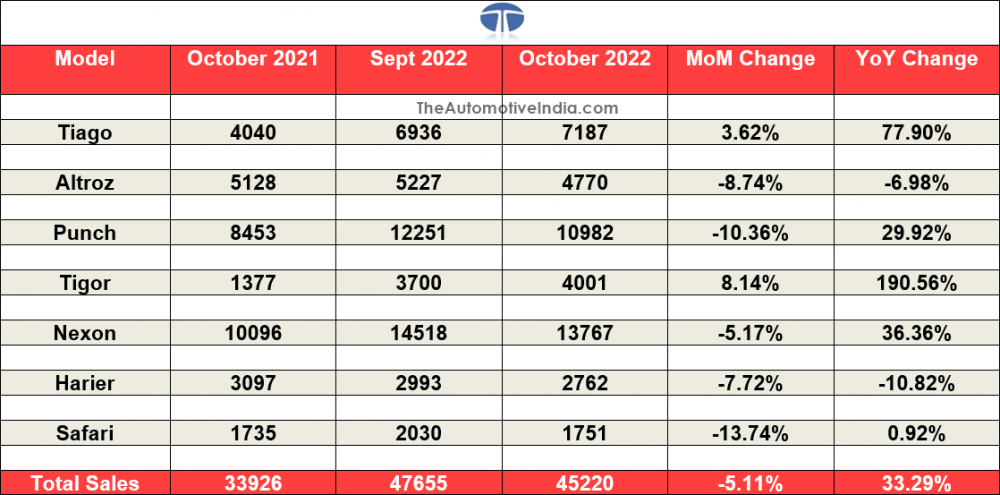

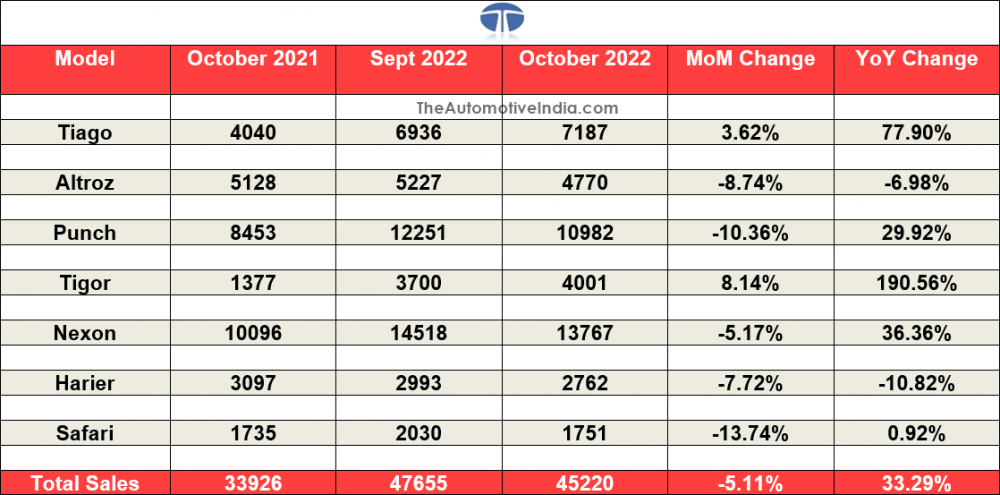

Tata Motors October 2022 Indian Car Sales

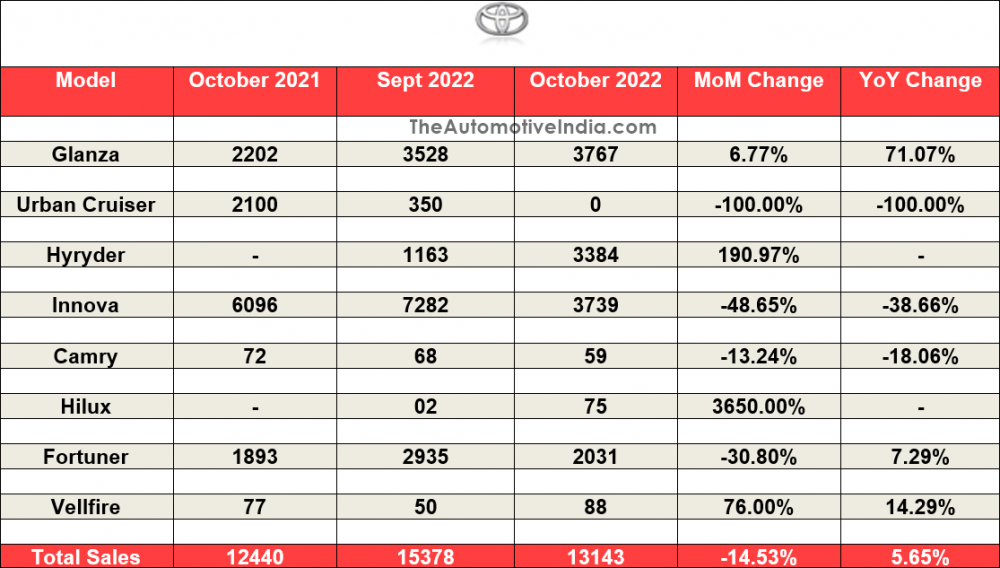

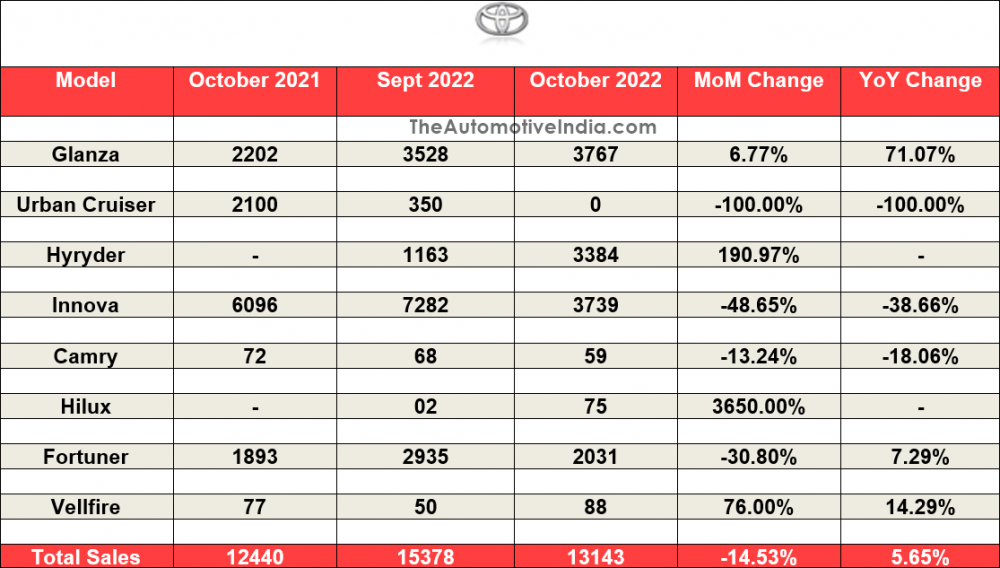

Toyota October 2022 Indian Car Sales

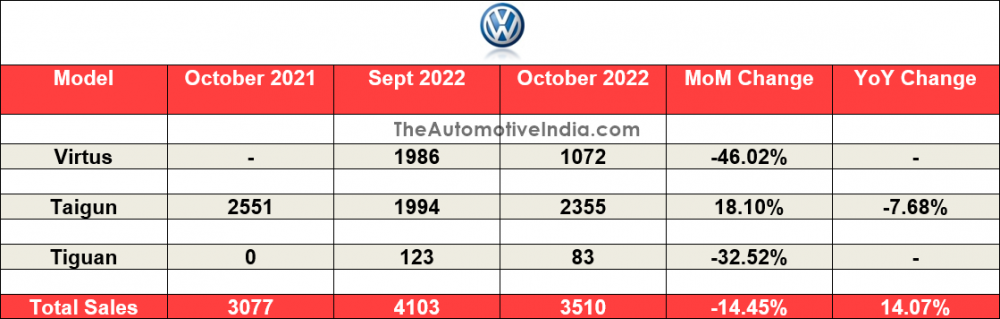

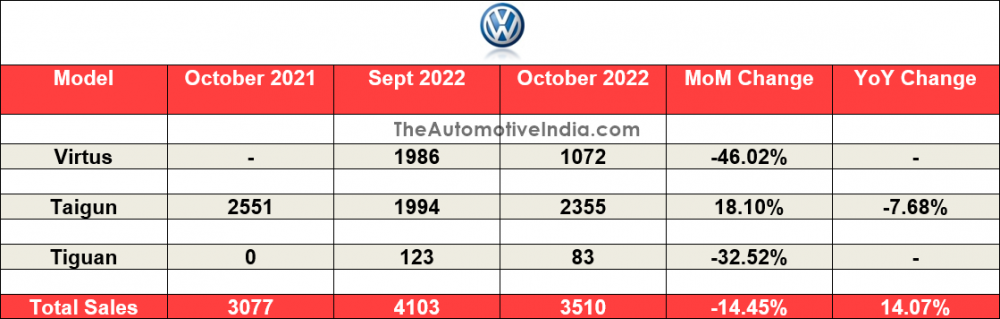

Volkswagen October 2022 Indian Car Sales

Top 10 Best Selling Cars: October 2022

Manufacturer's Market Share: October 2022

Citroën October 2022 Indian Car Sales

Honda October 2022 Indian Car Sales

Hyundai October 2022 Indian Car Sales

Jeep October 2022 Indian Car Sales

Kia October 2022 Indian Car Sales

Mahindra October 2022 Indian Car Sales

Maruti Suzuki October 2022 Indian Car Sales

Morris Garages October 2022 Indian Car Sales

Nissan October 2022 Indian Car Sales

Renault October 2022 Indian Car Sales

Skoda October 2022 Indian Car Sales

Tata Motors October 2022 Indian Car Sales

Toyota October 2022 Indian Car Sales

Volkswagen October 2022 Indian Car Sales

Drive Safe,

350Z