The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for March'24 and FY’24.

March’24 Retails

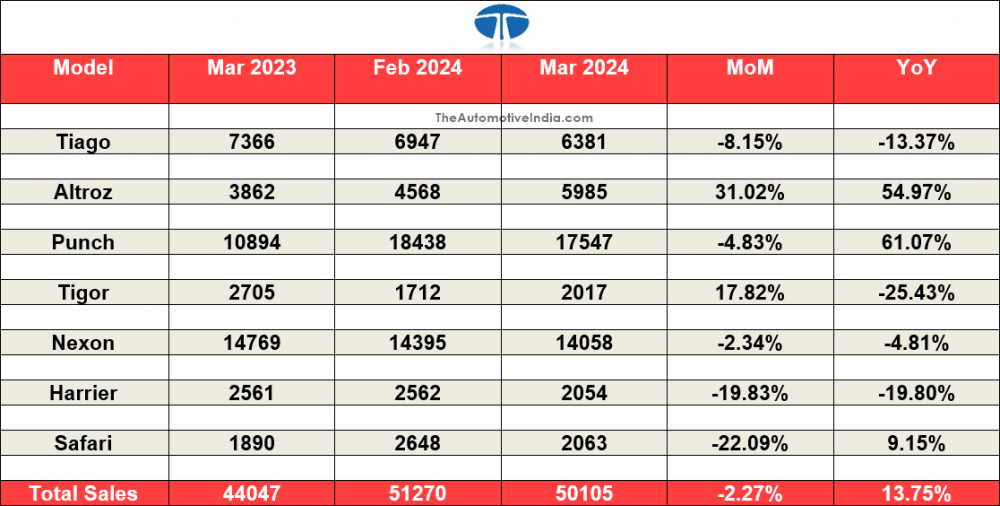

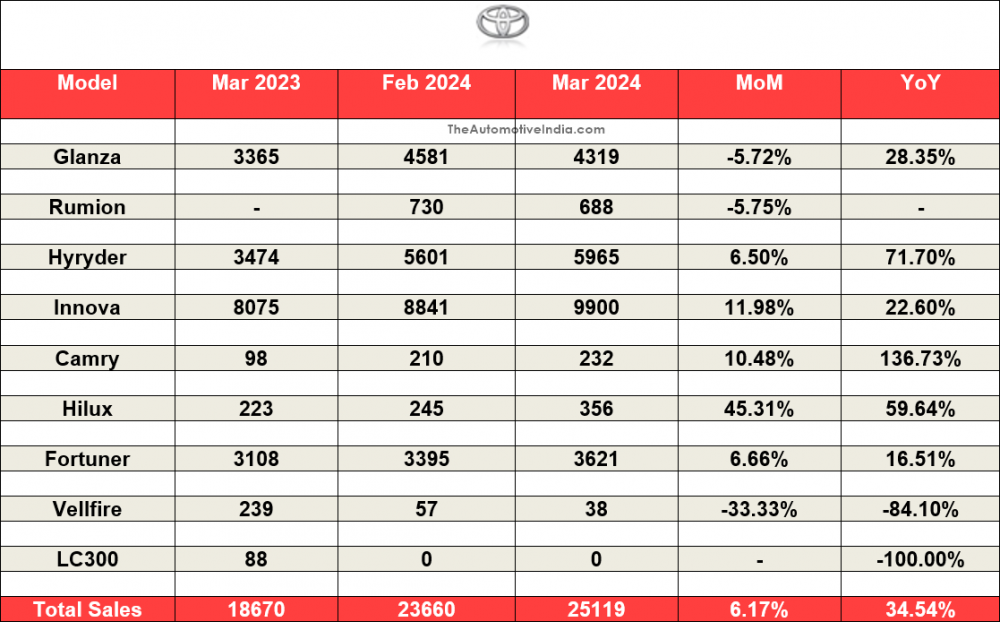

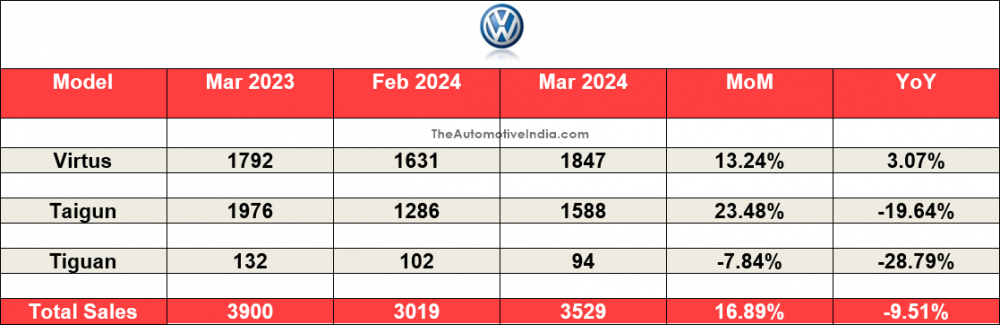

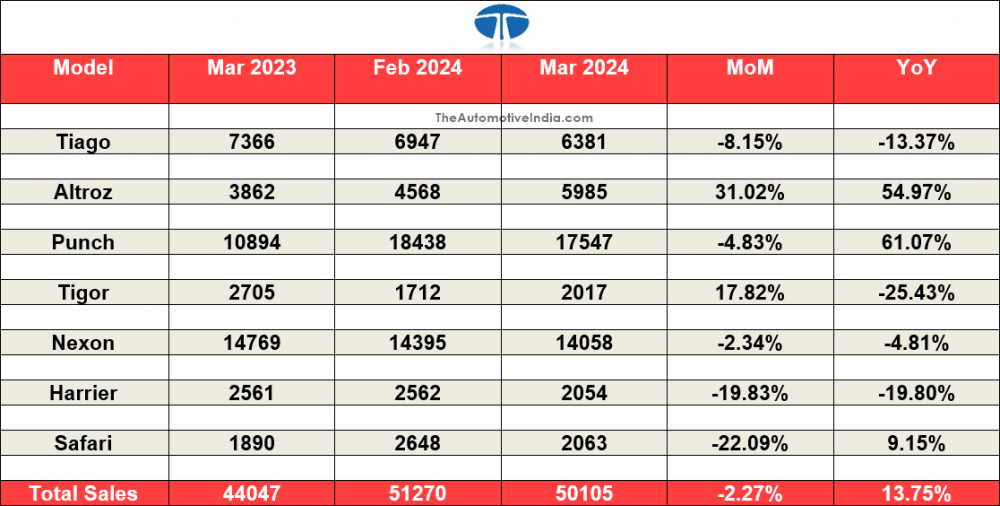

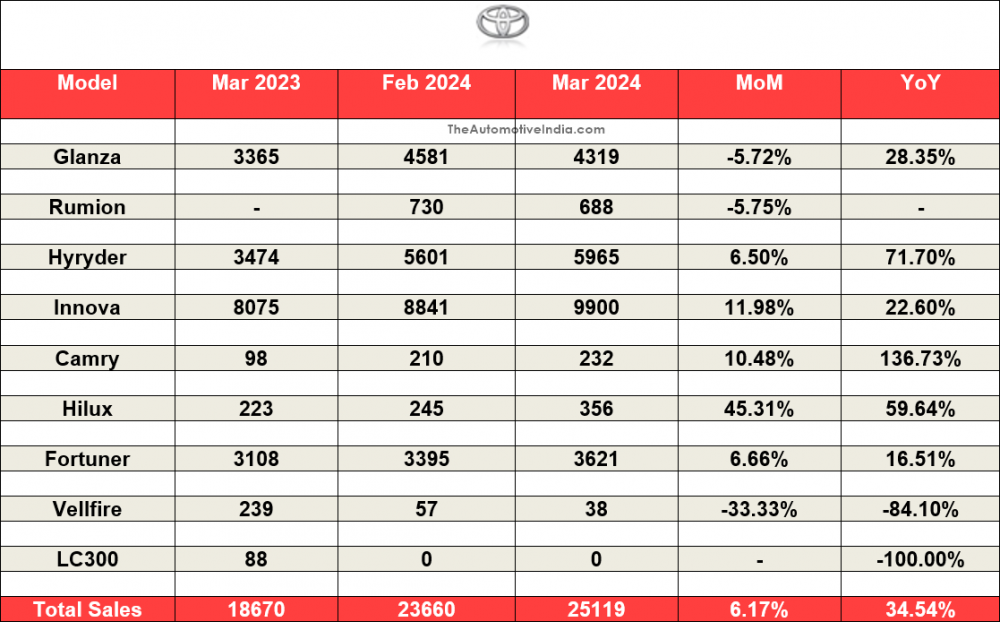

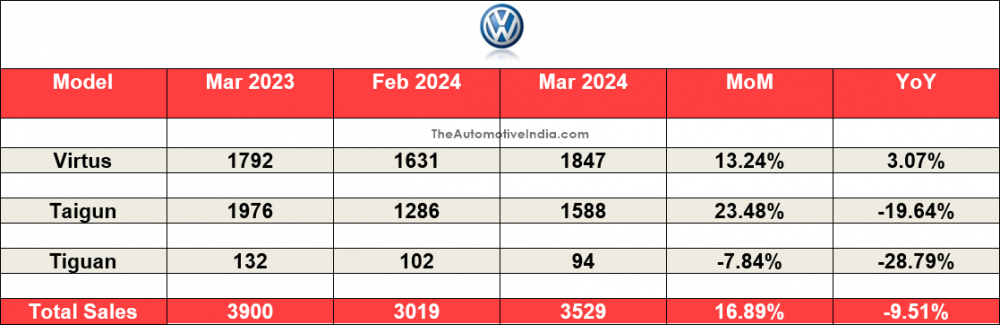

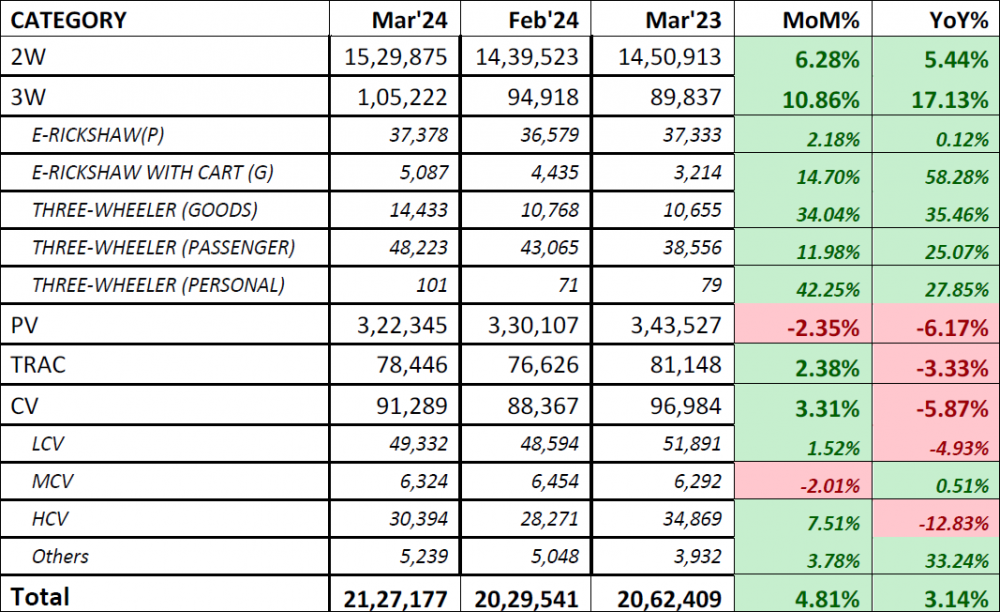

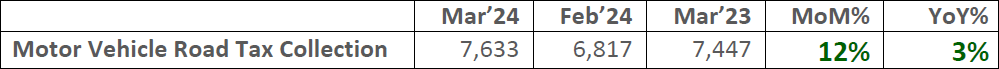

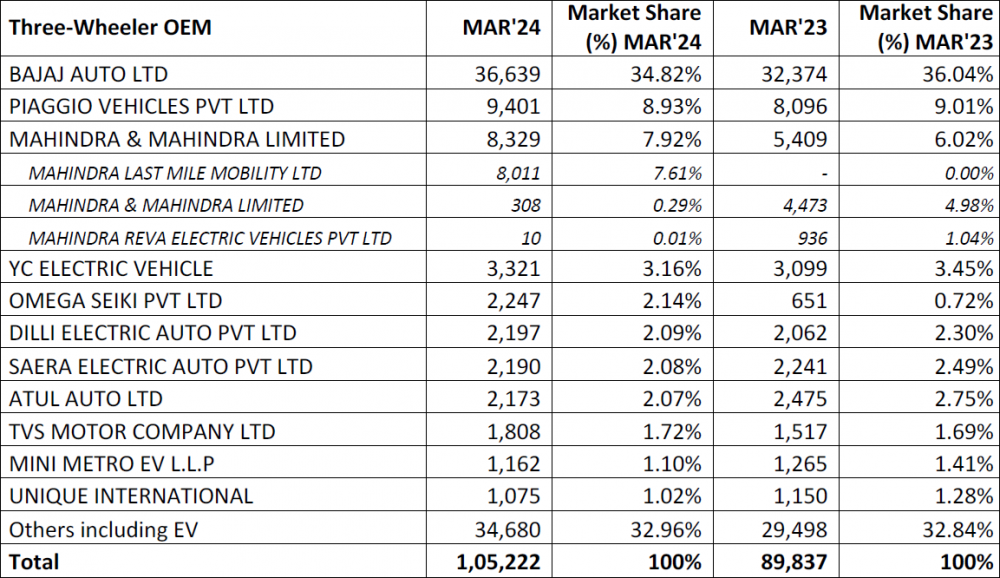

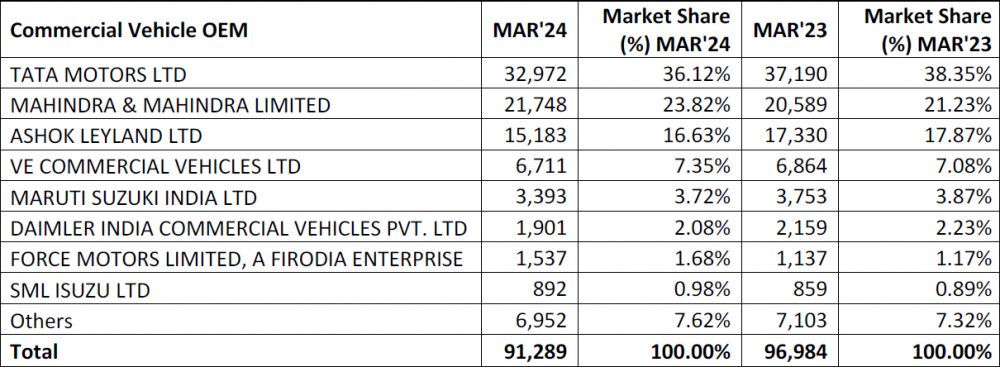

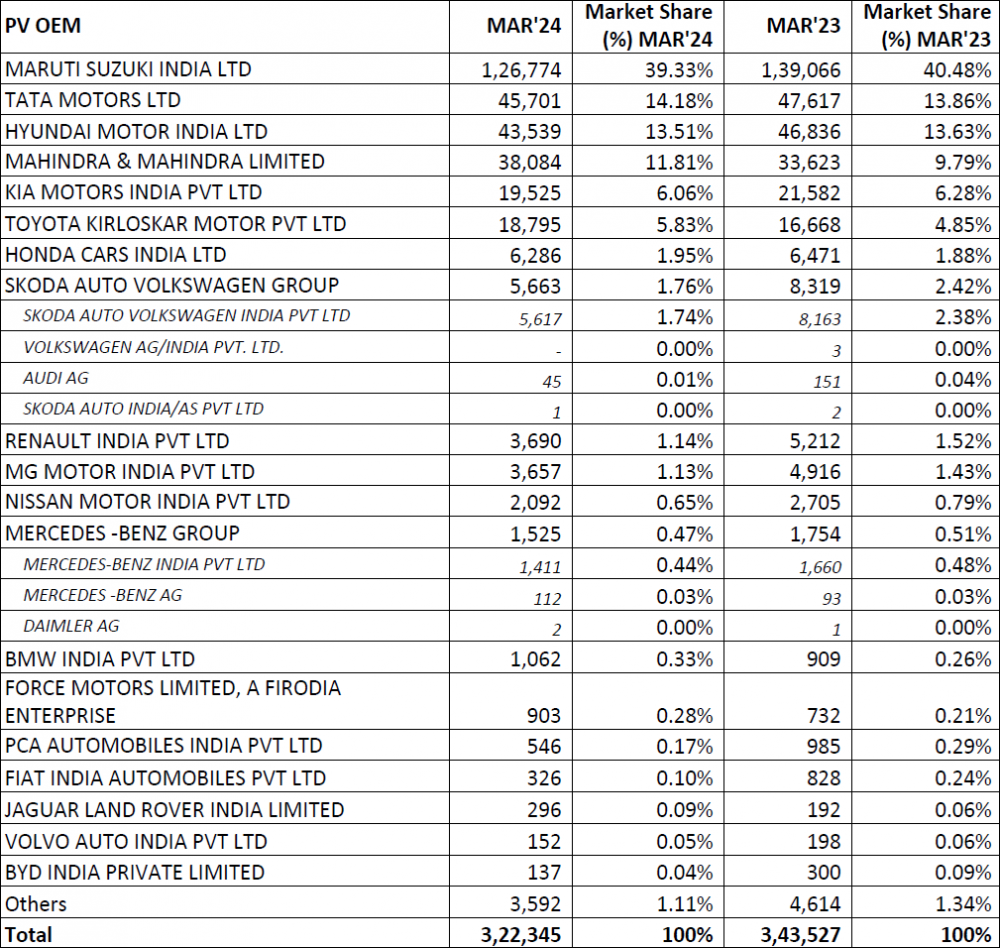

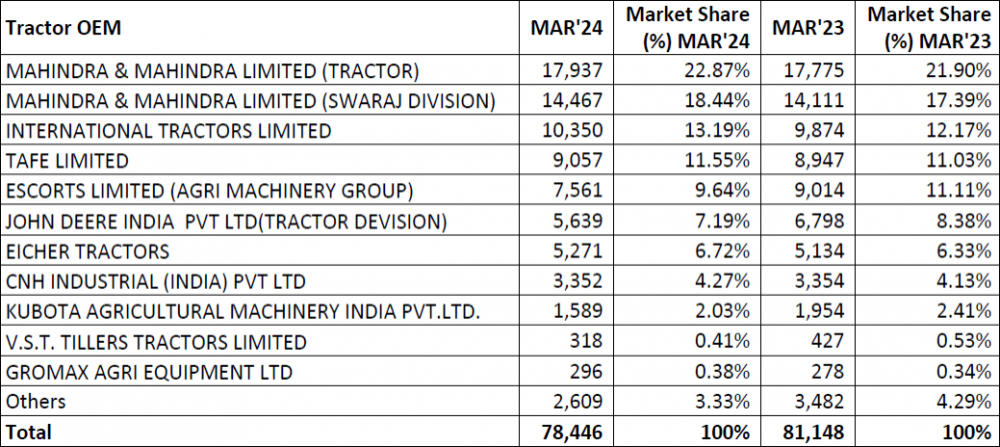

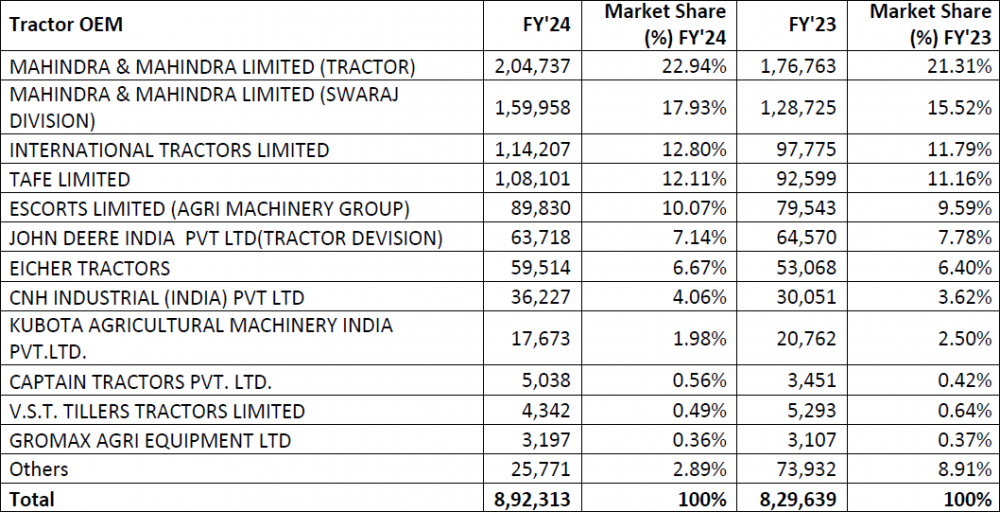

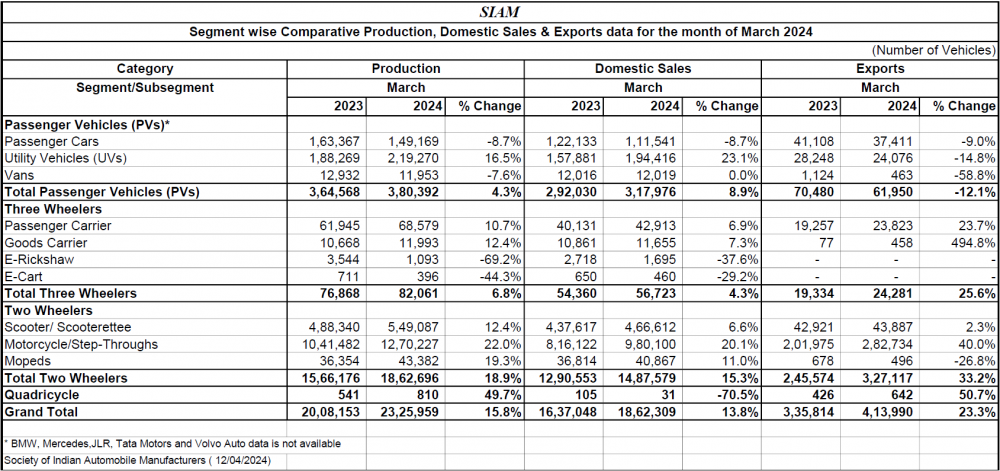

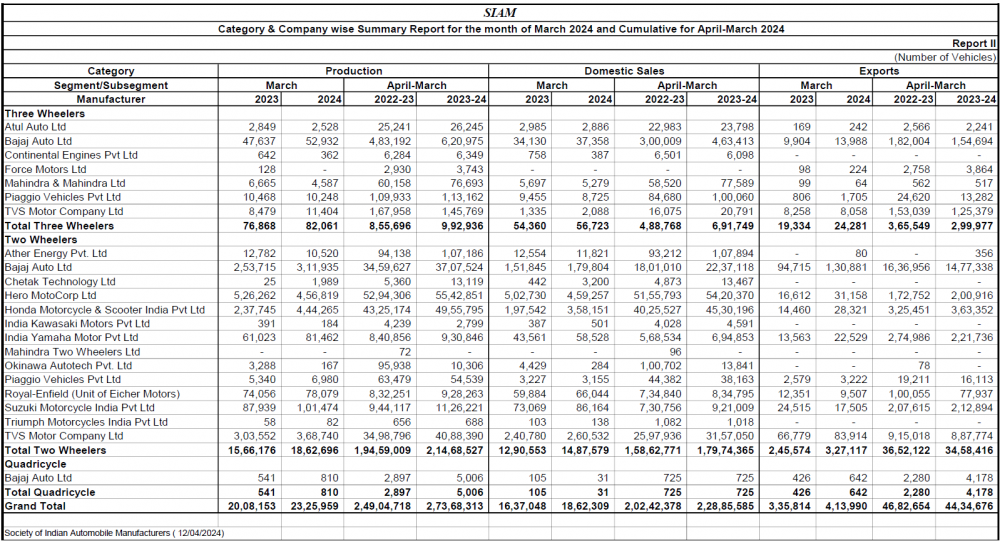

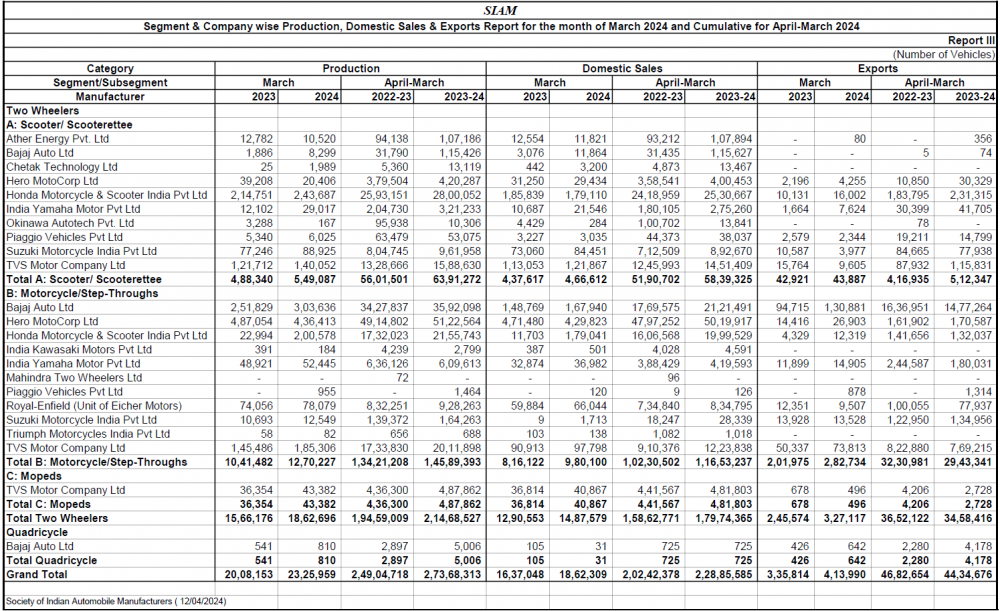

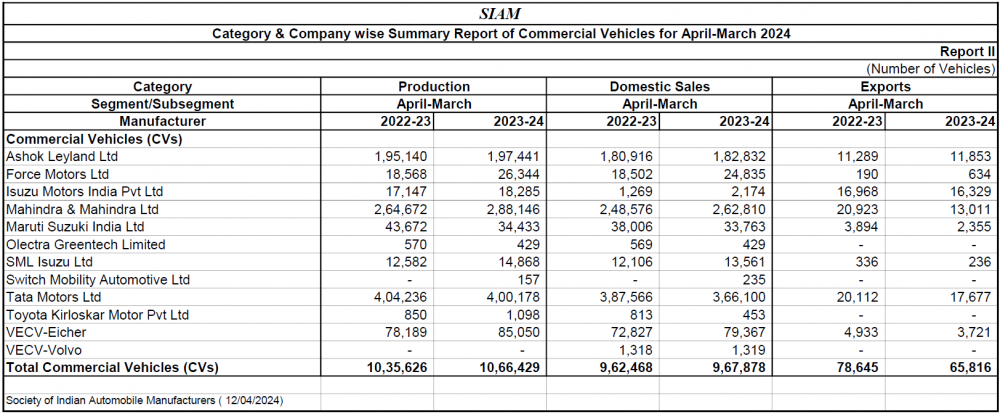

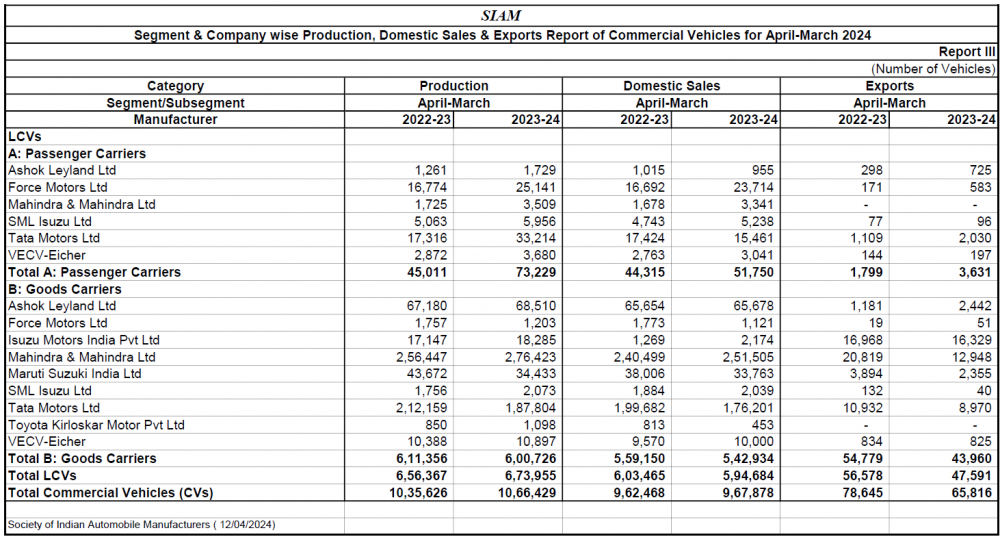

In March 2024, the Indian Auto Retail sector experienced modest growth of 3.14% YoY, as reported by FADA President, Mr. Manish Raj Singhania. The two-wheeler (2W) and three-wheeler (3W) segments saw increases of 5% and 17% respectively, while passenger vehicles (PV), tractors (Trac) and commercial vehicles (CV) faced declines of 6%, 3%, and 6% respectively.

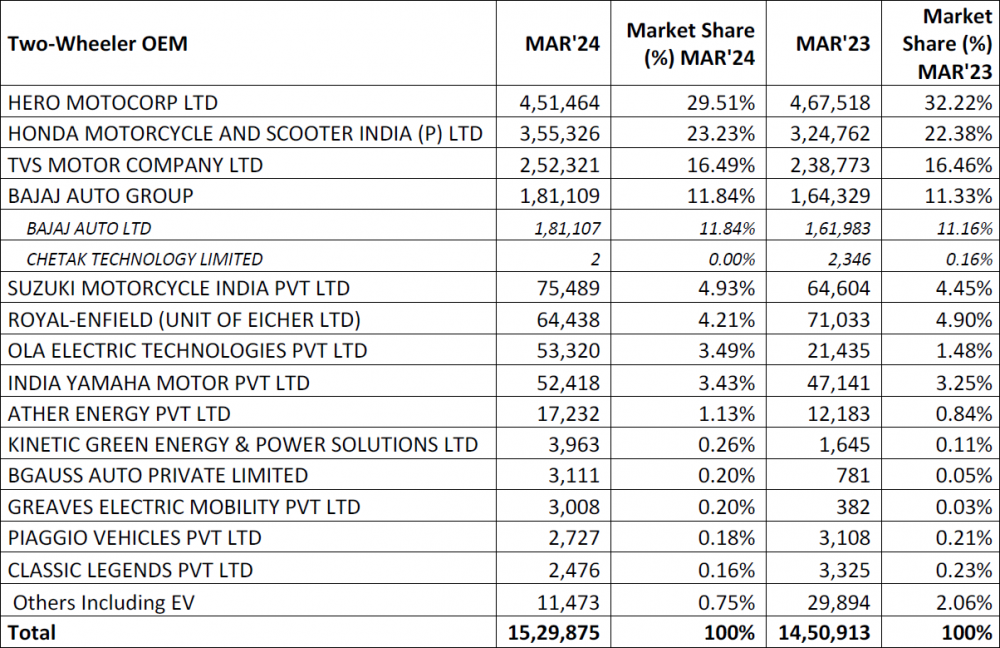

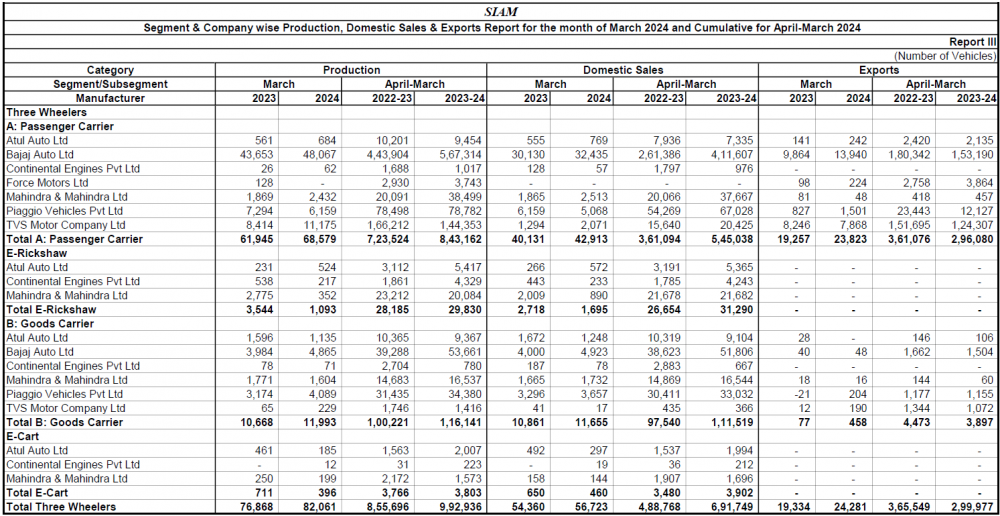

Mr. Singhania highlighted that “the 2W segment demonstrated resilience and adaptability, with electric vehicle (EV) sales surging due to the expiration of the FAME 2 subsidy on March 31st. This led to a notable boost in the 2W-EV market share to 9.12%. Positive market sentiment was supported by seasonal events, improved vehicle supply, and financial incentives. Despite facing market volatility and intense competition, the industry is strategically evolving, particularly in the premium and EV categories, signalling a bright future. The 3W segment showed an encouraging sales trend hitting an all-time high retail, driven by the growing acceptance of EVs. The introduction of EV autos and loaders positively impacted the retail environment. Although faced with election-related uncertainties and concerns over policy changes, such as free bus travel for women, the overall outlook for the sector remains upbeat, supported by the quality of vehicles and strong market demand.

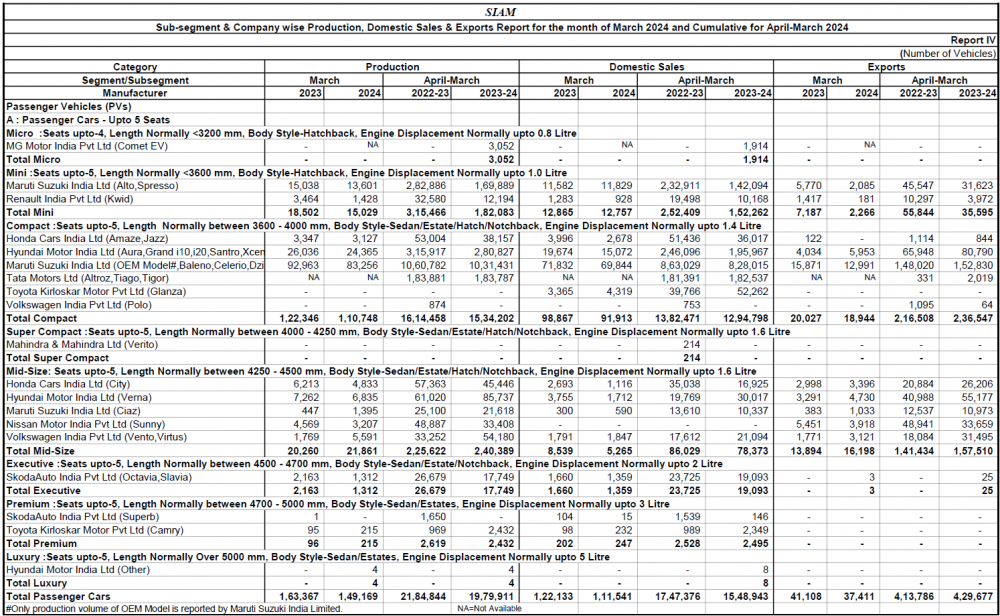

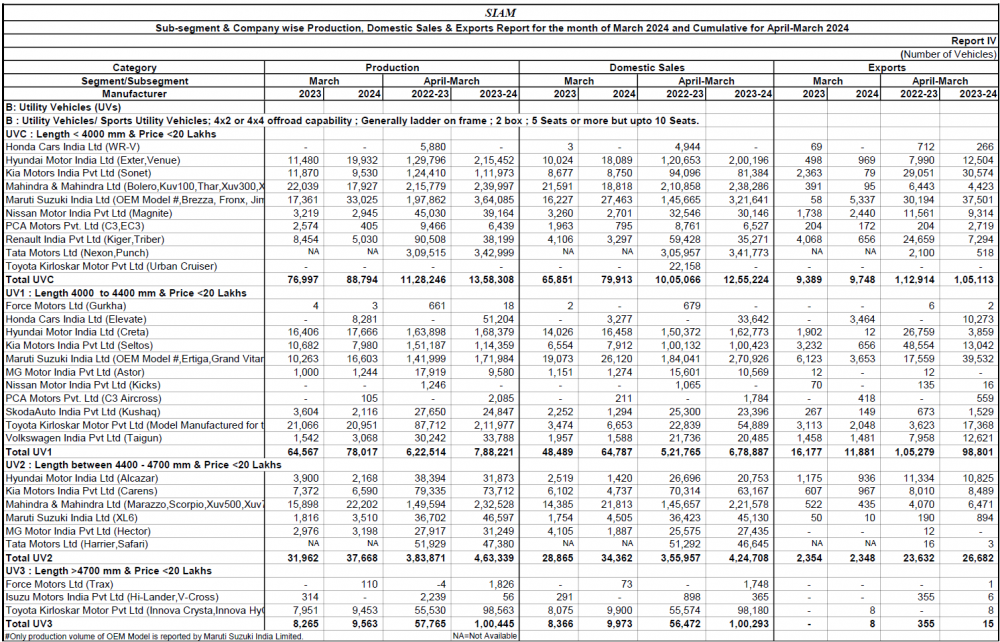

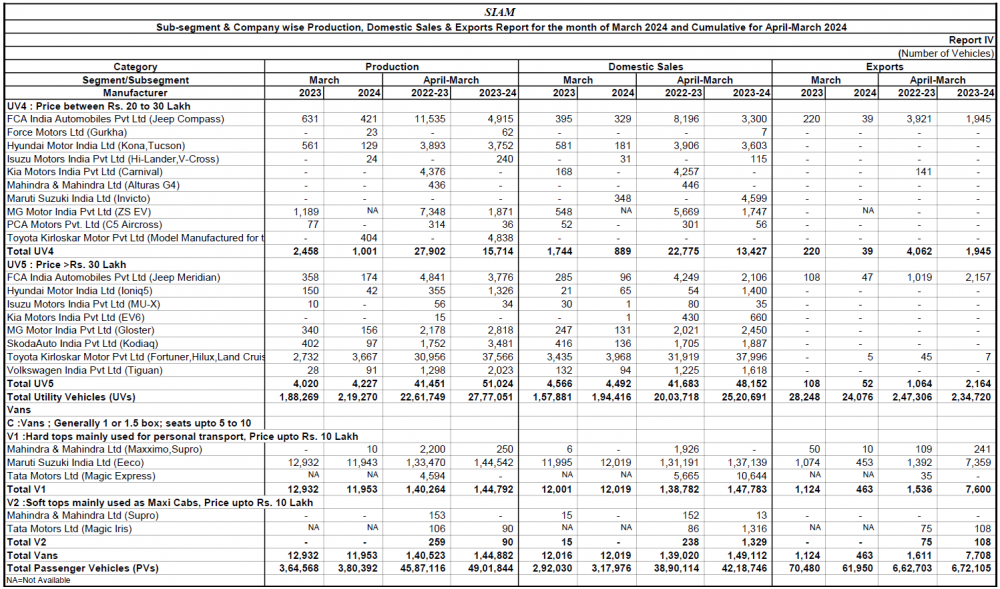

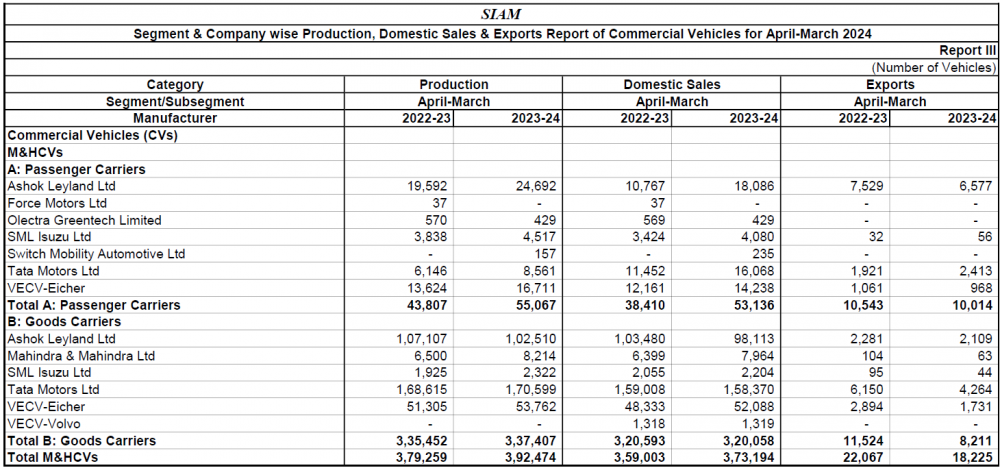

The PV sector encountered challenges, with a MoM decrease of 2% and a YoY fall of 6%. The downturn was influenced by heavy discounting and selective financing further affected by economic worries and the electoral climate. Nonetheless, positives such as improved vehicle availability, increased stock levels and new model launches did stimulate demand in certain areas. The impact of election activities and changes in festival dates also played a role in sales dynamics. For the CV sector, March presented a complex scenario. The election announcement resulted in a temporary reduction in purchases, though there is an expectation of a recovery post-election, with decreasing concerns about the forthcoming monsoon. The sector grappled with issues like recent declines, poor agricultural outcomes, discount pressures and financing difficulties. On the upside, there was strong demand in specific areas such as coal and cement transportation, bolstered by bulk orders and vehicle upgrades, which enhanced customer engagement.”

FY’24 Retails

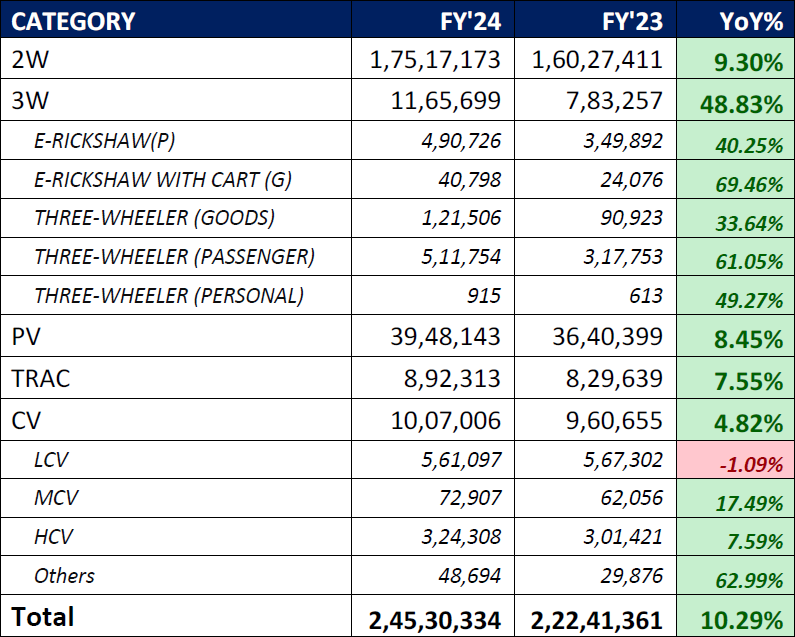

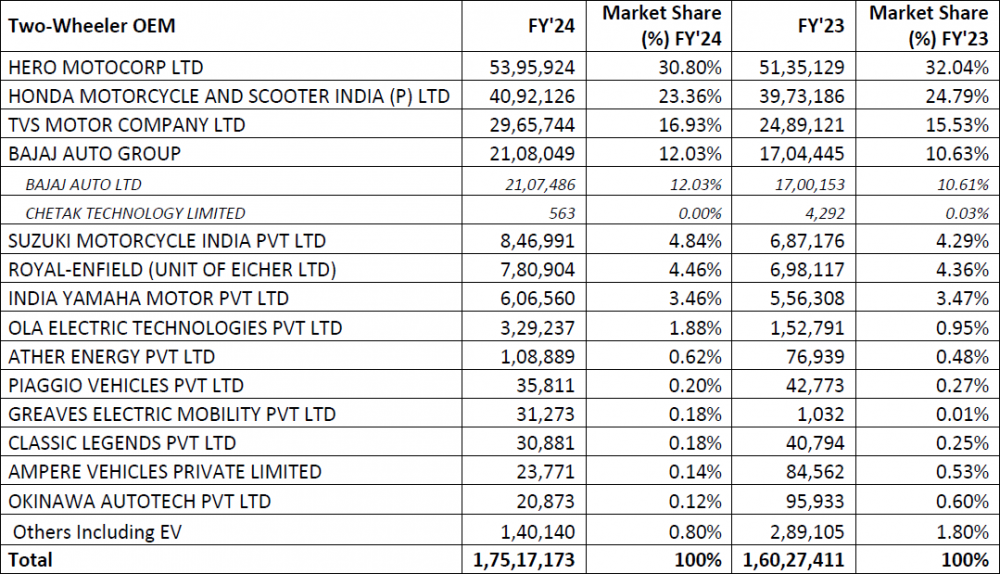

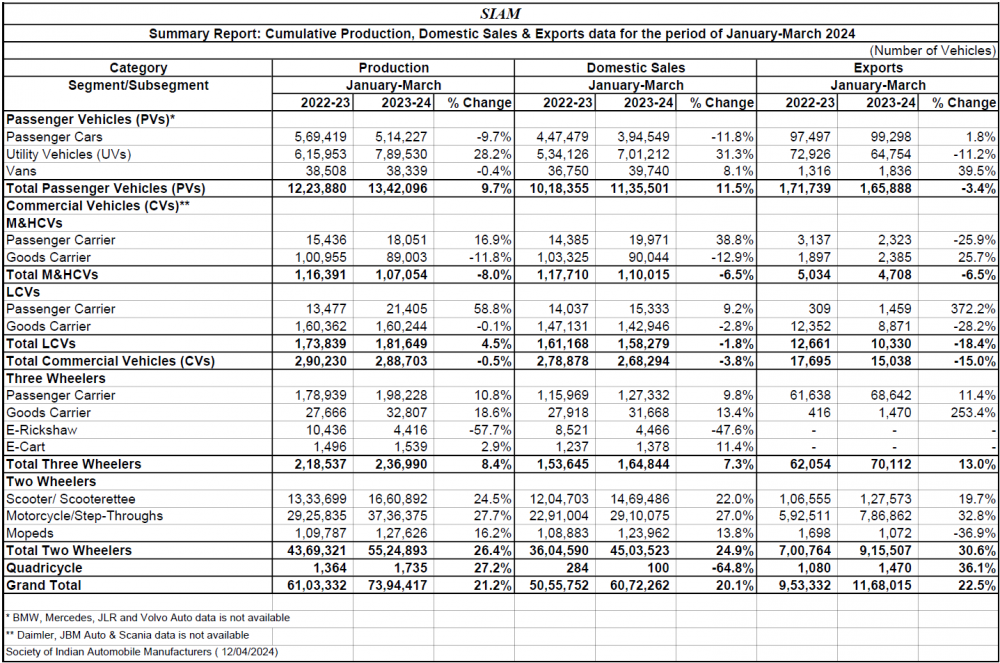

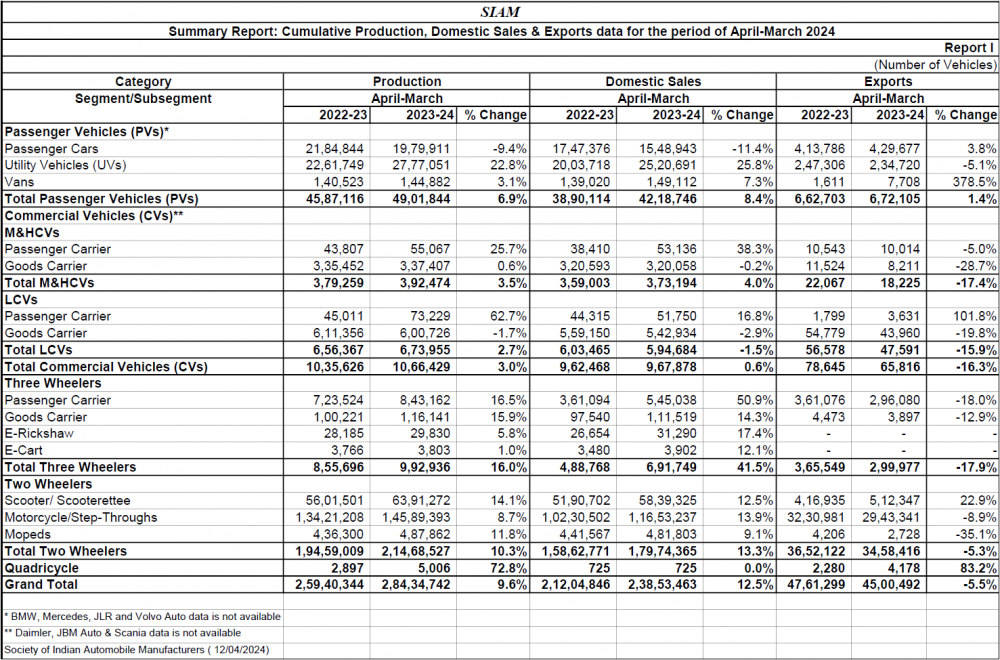

Reflecting on FY’23, FADA President Mr. Manish Raj Singhania commented, "The Indian Auto Retail sector achieved a commendable double-digit growth of 10% YoY across all categories, with 2W, 3W, PV, Trac and CV registering increases of 9%, 49%, 8.45%, 8% and 5% respectively. Notably, the 3W, PV and Trac segments set new record highs, surpassing previous years' performances. In FY24, the 2W segment saw a 9% growth, driven by a rich mix of factors including enhanced model availability, new product introductions, and positive market sentiment, further augmented by special schemes and the rural market's recovery from COVID. The growth in EVs and strategic launches in premium segments also played a critical role, overcoming challenges such as supply constraints and heightened competition.

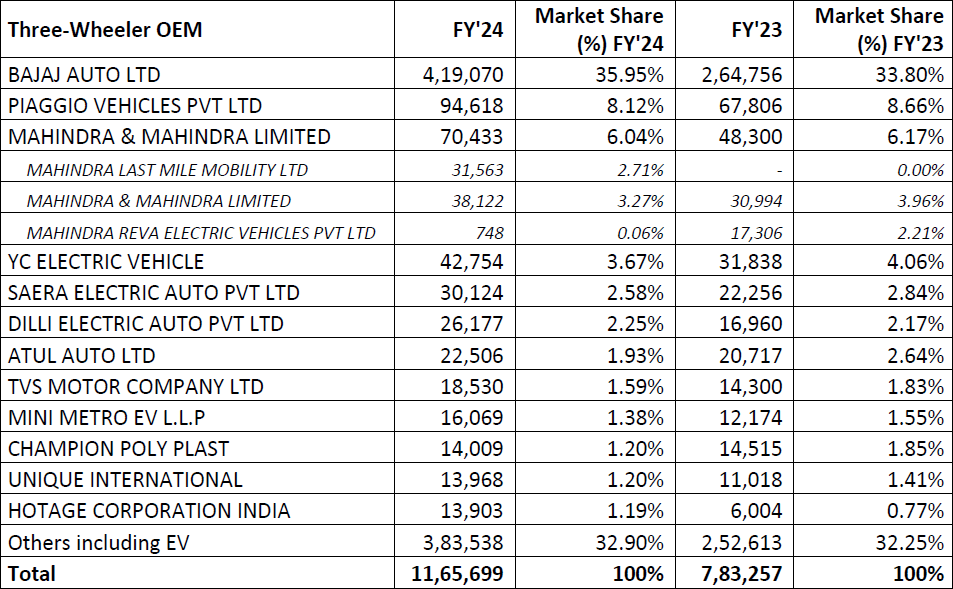

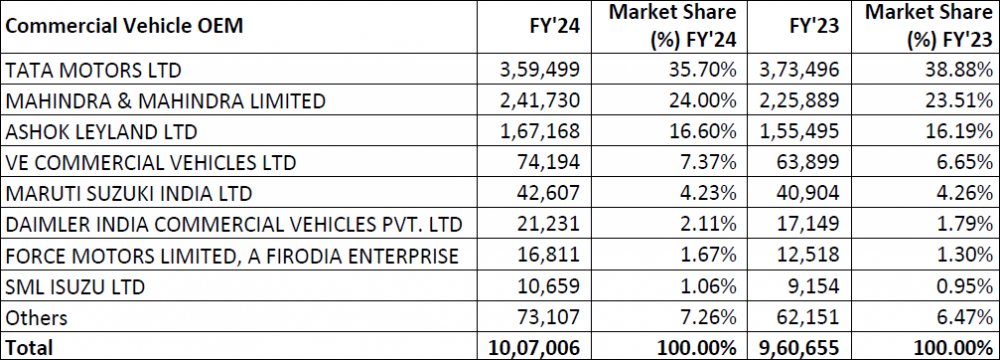

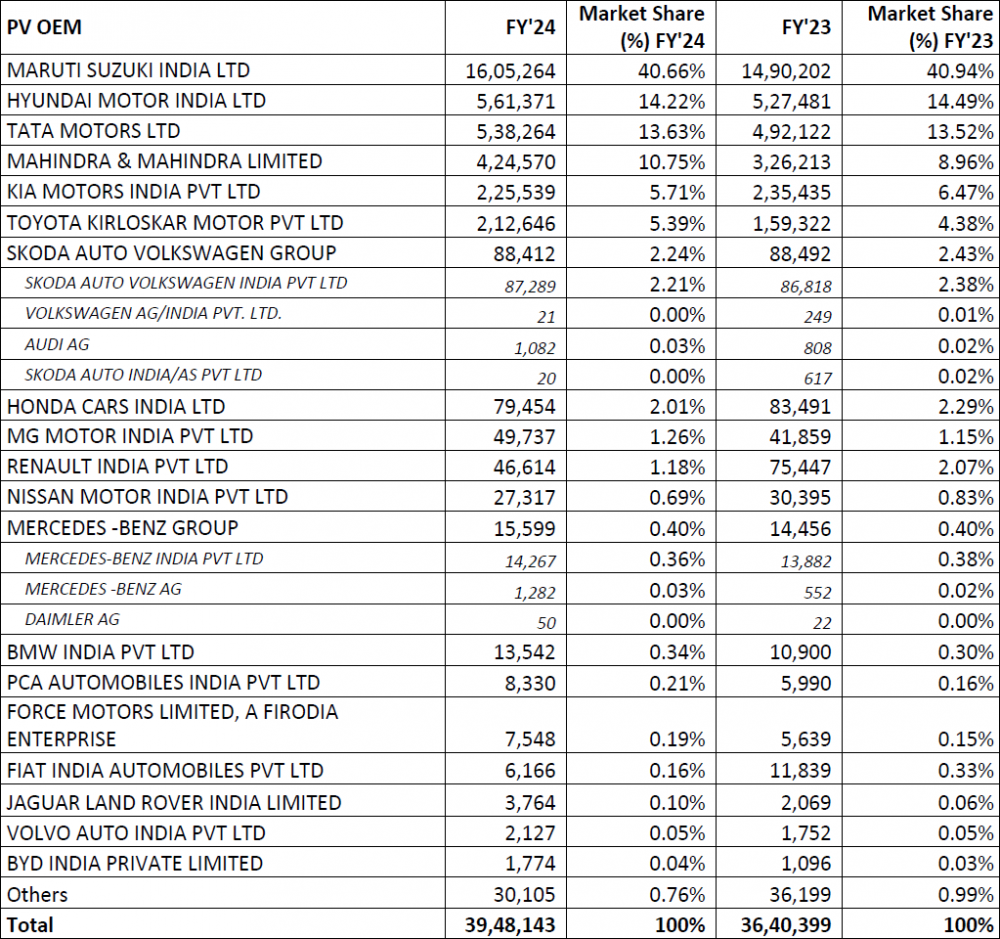

The 3W segment's growth soared to 49% YoY, setting a new benchmark. This remarkable achievement was fuelled by the introduction of cost-effective CNG fuel options and new EV models, alongside strong market sentiment and the seamless integration of high-quality after-sales service. These elements, combined with the sector's innovative approach, catapulted the 3W segment to new heights. For the PV segment, FY24 was a milestone year, achieving an 8.45% YoY growth and reaching an all-time high. Factors such as improved vehicle availability, a compelling model mix and the launch of new models played pivotal roles. Enhanced supply dynamics, strategic marketing efforts, ever expanding quality road infrastructure and strong demand in the SUV segment, now holding a 50% market share, significantly contributed to this success. The CV segment experienced a 5% growth in FY24, demonstrating the sector's strategic response to diverse market dynamics. Improved vehicle supply, effective planning, and increased freight movement drove significant replacement purchases. Additionally, the segment capitalized on government tenders, better road connectivity and bulk deals, showcasing its adaptability and strategic market positioning."

Near-Term Outlook

With a notable decline in consumer sentiment among urban Indians, as reported by the Centre for Monitoring Indian Economy (CMIE), the automotive sector faces a nuanced challenge. This downturn, characterized by a restraint in discretionary spending within urban income brackets, adds a layer of complexity to the industry's landscape. In this scenario, the decision of the MPC of the RBI to keep lending rates unchanged at 6.5% would continue to badly impact the retail sales of all vehicles, especially entry level vehicles as these buyers are extremely price sensitive. Given the continued inflationary trend without any relief in finance rates, these prospective buyers may continue to hesitate. Coupled with the forthcoming elections, these challenges will influence the Industry, potentially curbing vehicle sales across all segments. Despite this, opportunities for rebound and growth linger, bolstered by festive occasions and strategic product unveilings aimed at reviving consumer interest.

The industry's adaptability is further tested by improved supply dynamics and an increasing bend towards electric mobility, alongside enticing financing options, all poised to mitigate the effects of the current economic sentiment and electoral caution. The automotive sector's resilience is thus spotlighted, with concerted efforts to tackle these challenges through innovation and strategic market engagement. As it navigates through a period marked by careful optimism, the sector is positioned for a cautious yet hopeful trajectory towards recovery. The strategic foresight and adaptability demonstrated by the industry promise a pathway to resilience and sustained growth, even as it confronts evolving market conditions.

Long-Term Outlook

Heading into FY’25, the Indian Auto Industry is poised for growth amidst a mix of optimism and challenges. The excitement around new product launches, particularly electric vehicles, sets a forward-looking tone. Manufacturers are gearing up with better supply chains and an array of models to meet diverse consumer demands. Economic growth, favourable government policies and an anticipated good monsoon are expected to fuel demand, especially in rural areas and the commercial vehicle sector, which is closely linked to infrastructure projects and economic activity. Market sentiment is cautiously optimistic, with the industry banking on improved customer engagement and financing schemes to boost sales. However, it faces challenges like high base in PV segment and intense competition. The focus is on overcoming these hurdles with innovation and strategic market engagement, aiming for a balanced growth across all the segments. As FY’25 unfolds, the Indian Auto Industry is navigating through evolving market demands and economic conditions, leveraging its strengths for sustainable growth and a wider reach.

Key Findings from our Online Members Survey

§ Liquidity

o Neutral 48.93%

o Good 39.64%

o Bad 11.43%

§ Sentiment

o Neutral 45.71%

o Good 39.29%

o Bad 15.00%

§ Expectation from Apr’24

o Growth 56.43%

o Flat 32.50%

o De-growth 11.07%

§ Expectation from FY’25

o Growth 72.14%

o Flat 20.36%

o De-growth 07.50%